Summary:

- Coupang reports strong Q1 2024 with continued growth outpacing the broader South Korean e-commerce industry.

- The South Korean e-commerce market continues to expand, benefiting Coupang, but faces competition from Chinese companies.

- Operational risk remains with the Farfetch turnaround and integration, which could result in continued losses for the company.

Michael Vi

Investment Thesis

Coupang (NYSE:CPNG) reported a strong Q1 2024 with guidance that points to continued growth and profitability. The overall South Korean e-commerce market continues to grow, despite the already high penetration, benefiting Coupang. Furthermore, Coupang is growing faster than the overall industry, implying that management is doing a good job of delighting customers and adding market share.

Unfortunately, the company is trading at a high valuation and competitive threats from China could hinder profitability. Coupang needs its new offerings to be successful, particularly its Farfetch acquisition, to materially impact valuation.

Coupang had a Solid Q1 2024

Coupang’s business appears to be growing at a healthy rate, despite the muted response from investors. The company’s Net Revenues of $7.1 billion were up 23% compared to last year (up 28% excluding the effect of currency conversion). Carving out the recent Farfetch acquisition, revenue showed a healthy annual organic growth at 18% as reported and 23% adjusted for foreign exchange fluctuations.

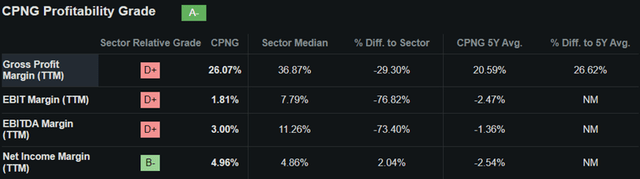

The company reported Gross Profit in Q1 2024 of $1.9 billion, with Gross Profit margins of 27.1%. This was an improvement year-over-year. Farfetch’s gross profit was $122 million, showing a 27% growth compared to last year and a similar gross profit margin of 26.5%.

Coupang reported Q1 2024 Net Income of $5 million, which is down $86 million from a year ago. The main driver of this income miss was the inclusion of losses incurred at Farfetch. Excluding this, Net Income would have been $98 million, an increase of 7.7% compared to the $91 million reported the same time last year. This translates to a Q1 EPS of $0.05, which missed Wall Street analysts’ estimates by $0.01.

Opportunities and Threats in the South Korean e-Commerce Market

Despite Coupang’s size and market leadership in South Korean e-commerce, the company is far from dominant. The industry remains highly fragmented and thus competition is fierce. According to management, Coupang has “just a single-digit share of a massive and highly fragmented $560 billion commerce opportunity.” Note that management in the call is probably talking about the wider commerce opportunity available to Coupang.

Looking more narrowly at e-commerce, the opportunity is still quite large and growing. According to research firm GlobalData, the South Korean e-commerce sector hit $115.1 billion in sales in 2023. The industry is poised to grow by 9.1% in 2024 to $125.6 billion. This would place South Korea’s e-commerce market the third-largest in Asia, behind only China and Japan. The primary drivers of this growth are a tech-savvy population, high internet and smartphone penetration, and digital retail innovations. According to the same article, roughly 81% of South Korean consumers have shopped online within the past six months.

This overall industry growth is highly beneficial for Coupang. Even more impressively, despite its size Coupang’s e-commerce revenues are growing faster than the overall industry, indicating that the company may be gaining market share.

A key risk though for Coupang is the possible entrants of Chinese e-commerce company’s into the market. In particular, AliExpress, Temu, and Shein have rapidly grown their market share in Korea by utilizing an “ultra-low pricing strategy.” These Chinese companies are able to run such loss-leading strategies due to their enormous amount of capital. According to market tracker Wiseapp Retail Goods, in March 2024, AliExpress had 8.8 million monthly active users. This is still a far cry from Coupang, which had 30.8 million monthly active users during the same time period. However, this does highlight the growing threat they represent and a key risk for Coupang. According to management;

New China commerce entrants remind us that barriers to entry are low and consumers can switch shopping options faster in retail than in almost any other industry, within seconds and with a swipe of the finger. Customers cast a new vote with every purchase they make and will not hesitate to spend their money at another venue they deem to be better. We have to win their vote each and every time by offering them the best selection, price and service. And we strive relentlessly to make that value proposition better every day.

Coupang’s Core E-Commerce Business Continues to Thrive

The company has two reporting segments, its core e-commerce segment under “Product Commerce” as well as its new business lines under “Developing Offerings.”

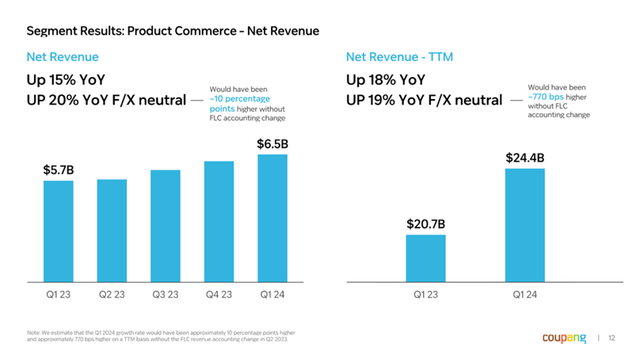

Coupang’s core business continues to do well and expands at a healthy and profitable rate. Remember that the company’s core Product Commerce makes up 91.3% of the company’s revenue this quarter at $6.5 billion, compared to Developing Offerings revenue of $620 million. The Product Commerce segment supports the company’s new development initiatives. The former with a $467 million EBITDA while the Developing Offerings has a negative EBITDA of $186 million, the bulk of which is due to losses from Farfetch.

Revenue growth for the Product Commerce segment is surprisingly solid at 15% year over year. The underlying metrics underpinning this growth look solid as well. The company’s number of active customers increased by 2.9 million reaching 21.5 million in the quarter, a growth of 16% year over year. According to management, the segment revenue growth was primarily driven by current active customers. This is important because we can expect revenue from these new customer acquisitions to only increase as time goes on. Remember that new customers initially spend less on an ecommerce platform, but that level of spend grows over time. Therefore, I am confident in Coupang’s ability to maintain this level of growth as the company is able to expand its Active customer base.

Within the Product Commerce segment, the key growth divisions highlighted by management are the company’s Rocket Fresh groceries offering and its Fulfillment and Logistics. The Fresh offering grew by 70% year over year in Q1 2024 while Fulfillment and Logistics saw a 130% increase in units sold.

Coupang’s e-commerce business has a main competitive advantage of a large extensive end-to-end logistics network. Using this network, the company is able to deliver products at extremely fast speeds and at low cost. For instance, the company’s fresh grocery delivery service only has a free-shipping threshold of $11 and a guarantee that an order placed by midnight will be in the front door by 7:00 am in the morning. Such customer-centric offerings deliver the “wow” factor as stated by the company’s operating tenets. The combination of an efficient logistics platform as well as a variety of innovative consumer offerings gives Coupang a solid moat in the competitive South Korean market.

Farfetch could be a drag

Apart from Coupang’s core E-commerce business, the company is venturing into new lines of service that could be potential growth opportunities. These services include things like Food Delivery, Streaming services, FinTech, International expansion into Taiwan, and Farfetch. Excluding the latter, Developing Offerings saw its revenue more than double this quarter, from $142 million to $332 million. Total Developing Offerings revenue was $620 million for the quarter, while Farfetch had revenues of $288 million.

Looking at these figures, it’s clear that Farfetch is the most significant, as the revenues of this business eclipse the other segments individually. Therefore, it is important that Coupang gets this business right, as it can end up being a significant drag on profits. In Q1 2024 Farfetch’s total Net losses were $93 million with an EBITDA loss of $31 million. This EBITDA loss is particularly significant as it shows that Farfetch is not profitable at the operations level despite having a decent gross margin.

Luckily, from what I gather, Coupang’s management specialty is in operations and running a tight efficient business. Prior to being bought up, Farfetch had revenues of $2.4 billion in 2023. This indicates that there is demand for e-commerce luxury fashion. The collapse of Farfetch could be due to overspending for growth. Coupang Management is re-structuring Farfetch, and taking its insights and knowledge on operations could be key to turning the business around. Management expects Farfetch to continue to lose money for the year, adding $100 million in adjusted EBITDA losses but expects to break even by year-end.

Valuation

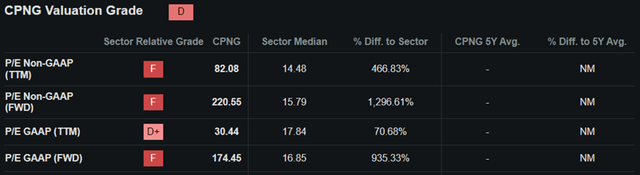

Looking at the valuation of Coupang’s stock, it appears to be trading at an expensive premium. Analysts estimate 2024 year-end EPS to be $0.10, giving the company a one-year forward P/E ratio of 220x. However, as discussed, the bulk of those losses are from the Farfetch acquisition. By 2025 analysts expect the company’s earnings to stabilize to EPS of $0.60, implying a 2025 P/E of 35.8x. Estimates for 2025 EPS range from $0.32 to $0.87, implying a wide P/E range of 66x to 26x 2025 earnings.

A lot of the company’s results are obscured by Farfetch, so I will try to forecast the valuation stripping out those results. In Q1 2024, the company achieved $6.826 billion in Revenue excluding Farfetch. Annualizing this figure and applying the same rate of growth of roughly 20% gives me roughly $32.76 billion in revenue. Using the long-term Net Income margin of comparable companies of roughly 4.8% gives a Net Income of $1.572 billion. Using the company’s diluted shares outstanding of 1.79 billion, this gives me an estimated EPS of $0.88. Assuming a sector median P/E of 18x, this gives me a long-run price target of $15.8 for Coupang’s core business excluding Farfetch.

Quant (Seeking Alpha) Quant (Seeking Alpha)

Assuming that Farfetch is able to achieve a turn-around. It should be noted that at one point in time, Farfetch was the dominant player in luxury e-commerce in the US. At its highs, Farfetch had revenues exceeding $2 billion. Let’s make the assumption that Coupang’s management is able to turn the business around and achieve annual revenues of roughly $1 billion. This is quite a tall order for management, as several prominent potential buyers have refused to purchase Farfetch, implying this is more difficult than it seems. But let’s just go with this scenario. At the same Net Income margin of 4.8%, Farfetch would add roughly $48 million annually to Coupang’s bottom line. This wouldn’t really move the needle unless Farfetch is wildly successful.

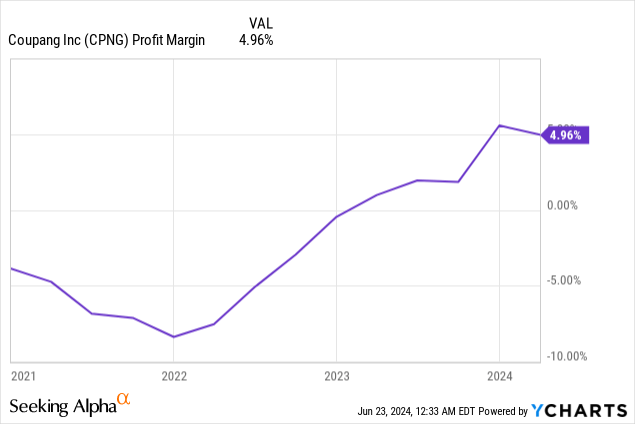

The other issue is that Coupang is quite far from achieving the long-run Net Income margin of 4.8% in my calculations. Looking at the current Q1 2024 Net Income ex-Farfetch of $98 million against e-commerce revenue of $6.5 billion gives me a Net Income margin of 1.5%. In 2023 Coupang was able to achieve a close to 5% Net Income margin; however, that was primarily driven by a one-time non-cash tax benefit of $895 million. Furthermore, as discussed above, the key risk of Chinese competition in South Korean e-commerce could keep margins low for a long time.

In conclusion, I think Coupang is a good company but is trading at a high valuation at these levels. I am bullish on the company’s core offerings, which continue to see steady growth. However, the key risk remains of increasing competition eroding margins. I have CPNG stock as a Neutral.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.