Summary:

- Coupang’s core business, Product Commerce, continues to show strong growth, increasing market share, and margin expansion.

- The Developing Offerings segment, including Farfetch, Coupang Eats, Coupang Play, and Taiwan, offers attractive opportunities for growth but weighs on EBITDA due to heavy investments.

- The valuation of CPNG is reasonable and attractive, with the core business alone potentially worth more than the current market cap.

Michael Vi

Coupang’s (NYSE:CPNG) shares have underperformed significantly since their IPO, still down over 60%. However, despite this initial poor performance, I believe the underlying business is attractive and worth an investment at current levels. The core business is a compounding machine, continuing to show strong growth, increasing market share, and margin expansion. Meanwhile, the Developing Offerings are rapidly growing and at an earlier stage of their life cycles. I believe the current valuation barely reflects the value of the core business, while growth in other segments can offer more optionality.

Strong Fundamentals and Competitive Advantages

As South Korea’s largest e-commerce player, Product Commerce is Coupang’s core business, responsible for more than all of its EBITDA (given the losses in Developing Offerings). This segment continues to grow at healthy rates while driving margin expansion. In Q1 2024, the segment’s revenue grew by nearly 15% (almost 8x the 2% growth in retail spending in South Korea), driving a 62% increase in adjusted EBITDA, which translates to an adjusted EBITDA margin expansion of nearly 220 basis points from 5% in Q1 2023 to approximately 7.2% in Q1 2024.

Coupang’s core business is self-strengthened as it grows by a combination of mutually reinforcing competitive advantages. The company’s dominant position in South Korea, coupled with an extensive end-to-end logistics network, allows it to adopt a customer-centric approach, including fast delivery (Rocket Delivery), free delivery above a minimum spend ($11), easy returns, and excellent customer service. Along with a wide product selection, these factors create happy and engaged customers who return for more shopping. This growth generates economies of scale, further boosting profitability over time. Such dynamics are rare.

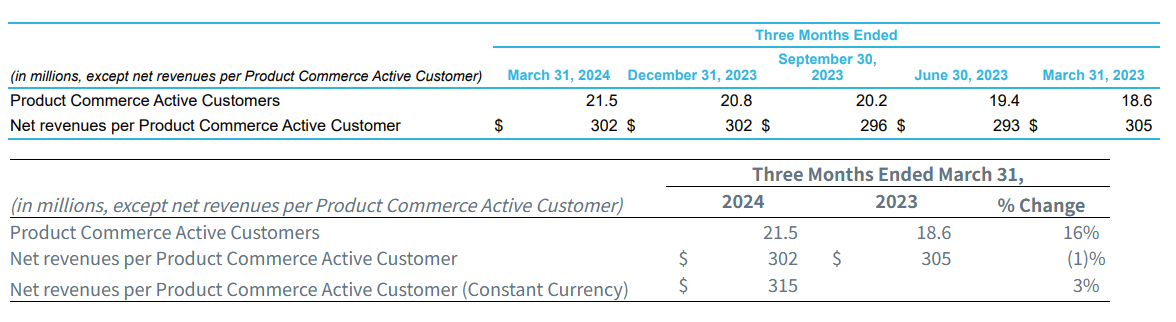

Coupang recently began disclosing a metric that helps investors track customer engagement in terms of average spending within the Product Commerce segment. As of March 31, 2024, Coupang provides quarterly Product Commerce Active Customers and Total net revenues per Product Commerce Active Customer metrics instead of Active Customers and Total net revenues per Active Customer.

While these figures appear flat in dollar terms, net revenues per product commerce active customers are still growing year-over-year (+3% in Q1 2024) from already high levels, demonstrating a very engaged customer base. Notably, as revealed during the Q1 2024 earnings call, all cohorts, even the oldest ones, continue to show revenue growth.

Coupang Filings

Despite being an eCommerce leader in South Korea, management disclosed that Coupang is still at a single digit share of a commerce TAM of $560 billion in South Korea. New offerings further contribute to expanding the TAM and Coupang’s potential share of the South Korean total retail market.

-

For instance, Coupang Fresh, launched four years ago, is growing units sold at a rate of 70% YoY in Q1’24.

- FLC (Fulfilment and Logistics by Coupang) is another powerful driver of market share growth. Thanks to FLC growing 130% YoY, the assortment of products available for overnight, same-day or next day delivery is also expanding, further strengthening the attractiveness of the service compared to in-store shopping or other eCommerce options. The value proposition to sellers (mostly SMEs) is clear, as it’s reported that on average they more than double sales within 90 days of converting to FLC.

- Coupang is further investing to expand free delivery to even the most remote areas of South Korea, including secluded areas and mountain settlements.

Growth Optionality but Developing Offerings Weighing on EBITDA

Besides the healthy trends in Product Commerce, I see growth optionality in growth ventures included in the Developing Offerings segment. Coupang’s diversification into sectors like meal delivery through Coupang Eats, entertainment through Coupang Play, and financial technology services has opened up new opportunities for the company to expand and increase its income. Currently, revenues from Developing Offerings are primarily generated from luxury fashion marketplace Farfetch, online restaurant ordering and delivery services in Korea and retail operations in Taiwan.

Revenues in this segment expanded from $142m in Q1’23 to $620m in Q1’24 mainly due to the $288m added by the acquisition of Farfetch. Even excluding that, the rest of the Developing Offerings expanded revenue by ~134% thanks to the growth of retail operations in Taiwan and Coupang Eats.

These segments offer attractive opportunities for growth. While not disclosed precisely, Coupang’s market share of the Taiwan retail TAM is significantly lower than its share in South Korea, in an economy that is nearly half the size of South Korea. Coupang is already helping 21,000 Korean suppliers export their products to Taiwan.

Profitability in the segment is still negative, as it’s mainly affected by heavy investments and the early-stage nature of these ventures. The segment generated -$186m AEBITDA in Q1’24 compared to -$47m in Q1’23. Without the $31m AEBITDA loss added by Farfetch, AEBITDA in the Developing Offerings segment would have been -$155m. The segment might take a while to turn any profits, as it’s likely going to be affected by ongoing investments. Coupang has already stated that the segment will continue to focus on newer offerings and entrance into new geographies, as well as overall expansion of fulfillment, logistics, and technology capabilities.

2024 AEBITDA guidance for the segment is a negative $750m (up from $650m because of Farfetch losses), but I believe it could start to turn less negative from next year. Although a minor driver, Farfetch is expected to be close to breaking even on run-rate EBITDA by the end of the calendar year, which alone would lift AEBITDA in the segment by up to $31m.

Despite losses in Developing Offerings driven by high investments, the group’s growth accelerated to 23% in Q1’24 in FX-neutral terms (33% excluding the impact from FLC accounting change).

Margin expansion is occurring at the gross margin level, which went from 24.5% in Q1’23 to 26.5% in Q1’24. While AEBITDA margin has been under pressure, going from ~4.2% in Q1’23 to ~3.9% in Q1’24, it is expected to expand for the full year compared to 2023.

Valuation appears reasonable and attractive for a long-term position

Valuing Coupang can be challenging due to its diverse portfolio of businesses at different stages and with varying fundamentals. Investments in Coupang Eats, Taiwan retail, and the consolidation of Farfetch have created complexity at the group level. Free cash flow (FCF) has been volatile and relatively weak in Q1 2024 ($105 million) due to a significant net working capital drain of -$184 million. However, excluding this impact, the business would have generated a healthier FCF of $289 million. Overall, Coupang’s business typically generates positive free cash flow, amounting to $1.5 billion over the past twelve months. Even without further adjustments, this translates into a reasonable 3.7% FCF yield, considering the business’s 23%+ growth rate.

However, recognizing that the core business is more profitable but slower-growing, investors could employ a sum-of-the-parts (SOTP) valuation methodology. In this regard, the value of the core business remains the key aspect. This segment generated $1.7 billion in adjusted EBITDA over the last four quarters. Assuming that capex for this division accounts for 80% of the total capex ($726 million), it would imply nearly $1 billion of adjusted EBITDA minus capex.

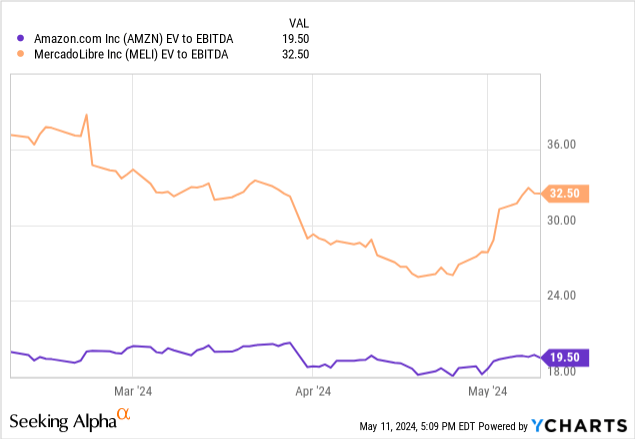

This capex would amount to ~3.0% of revenue in the division, a capital intensity similar to Latin America’s eCommerce giant MercadoLibre’s (MELI) ~3.5% capex/revenue, although much lower than Amazon’s (AMZN) ~10%.

The business grows faster than Amazon’s 12% but more slowly than MercadoLibre’s 36%. While no comparison is perfect and there are certainly other factors to take into account, I think it’s fair to assume Coupang’s fair multiples for AEBITDA would be somewhere between those of Amazon and MercadoLibre, which are, respectively, ~32x and ~20x on a TTM basis.

A multiple of ~26x Coupang’s Product Commerce AEBITDA would amount to ~$44bn EV. Considering that the business has ~$4bn of net cash (~$2bn excluding operating leases), a fair value of ~$44bn for Product Commerce would mean the Product Commerce business alone is worth more than Coupang’s current market cap of $40bn.

With an estimated $750 million in adjusted EBITDA losses in Developing Offerings, Coupang’s net cash could fund similar losses for five years and still retain approximately $250 million for capital expenditures. However, I think the segment is likely to achieve profitability within that timeframe. Since the core business is self-sufficient in financing its growth and arguably doesn’t require the $4 billion cash balance, the Developing Offerings businesses could potentially be seen as an added option with little risk of depleting cash reserves before management identifies any unsuccessful ventures and divests them.

Buying tech leaders with a dominant position in a specific market and growth options that could generate outsized returns is never cheap. Buying them at a price that only reflects the core business at what appears to be a fair valuation is often as good as it gets.

The examples of Meta and Alphabet have shown that buying these businesses when valuation is compressed by losses in new ventures can be a great entry point, and I believe Coupang’s current situation shows clear analogies.

Risks I see with Coupang

Potential risks affect any investment, such as competition entering the market and macroeconomic risk. For Coupang, I see a few key sources of specific risk:

-

The strong reliance on the South Korean economy. Geographical concentration is a key risk, but in this case, also creates more differentiation and idiosyncratic opportunities compared to most eCommerce businesses trading in the US.

-

Geopolitical risks would from potential tensions with North Korea. Moreover, the growing operations in Taiwan are exposed to further geopolitical risk related to a potential aggression by China.

Conclusion

I believe that finding a business with a combination of scale advantage and network effects like Coupang is quite challenging, especially one that grows the core business at 15% while using the cash flow generation to expand via M&A (e.g. Farfetch) and new ventures that offer growth optionality.

Paying for the sole core business (which finances its own growth) while a $4bn net cash balance gives time to new ventures to turn to profitability is probably as good as it gets.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CPNG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.