Summary:

- Coupang is a dominant South Korean e-commerce retailer, but it faces decelerating growth as most households are already customers.

- The company’s core business remains strong, but its new ventures, like food delivery and Farfetch, are currently loss-making and still uncertain.

- Coupang’s valuation appears fair, trading at ~22X three-year forward earnings, with potential growth driven by increasing market share and improving margins.

- Given the uncertainties in new initiatives and decelerating market growth, we are staying on the sidelines while closely monitoring the company’s progress.

fotoVoyager

Executive Summary

Coupang (NYSE:CPNG) is a South Korean e-commerce market champion and is often dubbed the Amazon (AMZN) of Korea. The company owns its logistics network, offers next-day delivery for its loyalty scheme members and has a growing third-party marketplace.

Almost all Korean households are already active shoppers of Coupang and most of them are Rocket WOW members. Future active customer growth is limited going forward, however, per-customer sales should continue increasing, albeit at a slower pace than before. Korea already has some of the highest e-commerce penetration in the world.

Coupang is a good quality business and will maintain a strong position in Korea. The main controversy when valuing Coupang comes from their future growth prospects. The company has been investing to grow in tangential business areas such as food delivery, and Taiwanese retail and most recently has bought a British luxury fashion retailer.

These growth initiatives are still loss-making and operate in quite challenging markets. It is questionable if the company can generate attractive profits from these.

We do like the core Korean Product Commerce business, but we are not intrigued about the new growth initiatives or the valuation.

Merchant or a platform?

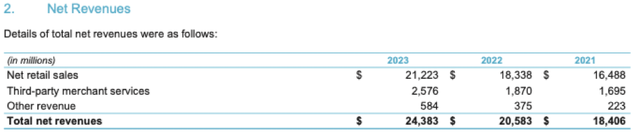

When valuing an e-commerce retailer it is important to establish whether it is a merchant or a platform. The merchants record revenues on a gross merchandise value basis and often generate single-digit profit margins, the platforms, on the other hand, charge a net fee on the GMV and often generate 20-30% profit margins.

Coupang generates 87% of revenues from its own inventory sales. Assuming that merchanting is capable of generating a 5% operating margin while 3P has 20% potential, the retail operations should be capable of generating ~$1.5 billion in operating profits.

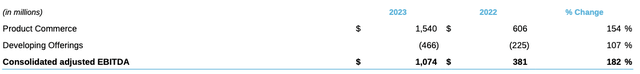

Last year, the Product Commerce division of Coupang generated $1.5 billion of EBITDA, in line with our expectations, for an overall 6.3% margin. The third-party business is growing faster than the merchanting operation; therefore, we can expect the operating margin of the business to trend up over time.

Product Commerce profit (Coupang)

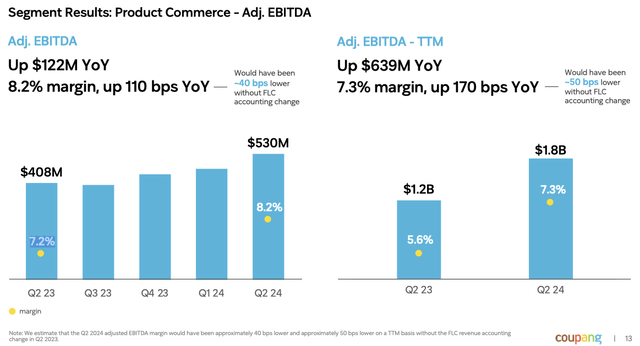

Assuming that the trends of the past three years continue, by 2026 the margin of the commerce division could grow to about 6.8-7%.

We have seen many overly optimistic margin assumptions when valuing Coupang. It is important to note that the 1P retail is still the bread and butter of the company, and it often takes years to scale the third-party business, just like we have seen with Amazon or JD. Coupang’s Product Commerce division is unlikely to reach double-digit margins any time soon, even though the profitability is likely to continue trending up over time.

In the second quarter of 2024, Coupang reported a pick-up in Commerce operating margins to about 7.3% from 5.6% last year. This level of profitability is now trending above our prior expectations, though accounting change seems to have contributed to the acceleration.

Retail business is quite seasonal and the performance of a single quarter should not be extrapolated; however, we will continue following the performance of the business to re-evaluate the likely profitability potential.

Active customer growth is decelerating

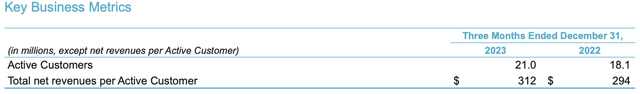

South Korea has a population of about 52 million and there are approximately 24 million households in the country. Single-person households represent ~40% of the total.

Coupang now has about 21 million active customers in the country, 14 million of which are Rocket WOW subscription members.

Coupang by now serves almost all households in Korea, young and old, it is most likely that their growth in the home market will decelerate going forward.

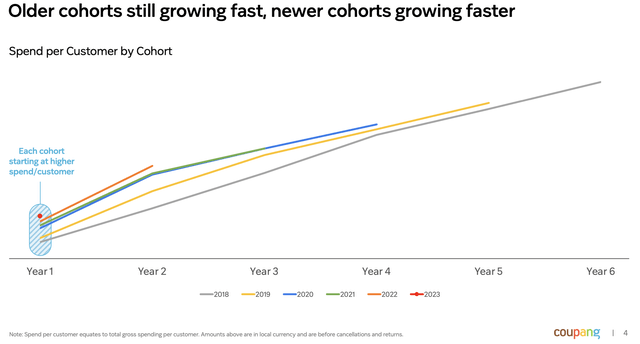

As illustrated by Coupang, every new user cohort has taken a couple of years to get used to the new service and scale up their buying after which growth would settle at an average rate.

As the majority of households seem to be shopping on Coupang already, new Customer cohorts will contribute less and less to sales growth and therefore overall per-customer growth rates will likely settle at slightly above overall e-commerce market growth rates.

Coupang to gain share of the maturing Korean e-commerce market

The e-commerce market itself is already quite mature in Korea, with online accounting for 35% of overall retail sales, some of the highest in the world. Most recently, online grocery retail was the main driving force of the overall e-commerce industry.

Assuming that most of the items that could have been sold online are already being sold by Coupang, going forward the lack of major new categories may result in slower per-customer spending growth rates.

However, it would be reasonable to assume that Coupang will continue gaining market share due to the quality of its service and the value-for-money proposition of its membership bundle.

Korean e-commerce market is quite fragmented with market leader Coupang accounting for only 22% market share. We believe that with increasing loyalty scheme adoption Coupang could continue increasing per-customer spending.

E-commerce market growth In Korea is expected to decelerate to high single digits, therefore Coupang could be expected to continue growing Product Commerce revenues at up to low teens.

In the second quarter of 2024, Coupang reported a strong 24% underlying revenue growth. However, it is expected to decelerate to mid-teens and later to single digits.

Revenue estimates (Seeking Alpha)

The potential threat from Chinese platforms

Retail is a very dynamic market, and it is possible that new formats entirely will drive the e-commerce market growth, and continuing to grow market share will not be that easy.

Lately, the Chinese direct ordering platforms AliExpress (BABA) and Temu (PDD) have started gaining market share in South Korea, having increased their sales by 130% over the last 6 months.

The popularity of the latter two platforms was also exacerbated by the economic issues that many Korean households have been facing recently. The Chinese factory-to-consumer retailers offer value that is often hard to match for local merchants; however, the delivery times are much greater.

Over time, though, the Chinese seem to be willing to invest and enhance their service quality. Alibaba has recently announced its plans to invest $1.1 billion in the market to enhance its logistics capabilities.

It is possible that over time it will become more difficult for Coupang to continue gaining market share.

Coupang is trading at ~22X three-year forward Product Commerce earnings

Coupang’s Product Commerce business is currently still going through a rapid growth phase, as evidenced by the strong recent revenue growth. The margin of the business is also increasing as the third-party business outgrows merchanting services.

Assuming 15% Commerce revenue growth over the next 3 years and a 7% operating margin, we would arrive at ~$2.6 billion 3-year forward EBITDA estimate. After depreciation, interest and taxes, we would arrive at around $1.8 billion of earnings for the commerce division.

The current market capitalisation of Coupang is ~$40 billion, we, therefore, deduct that the business is trading at ~22X three years forward earnings. Given the strong growth and rather dominant position in the Korean market, we would say that this valuation multiple seems reasonable, neither low nor high.

Up to now, we have completely ignored the Developing Offerings division of the business. This part of the business is still loss-making, but if the management could make these businesses work, the value of Coupang could be further enhanced.

The questionable value of the Developing Offerings

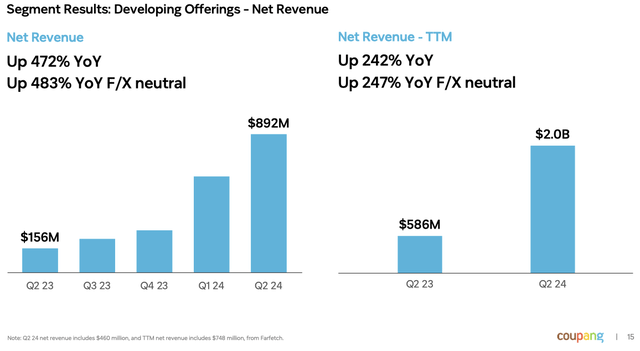

The sales of the Developing Offering division were primarily generated from online restaurant ordering and delivery services in Korea and retail operations in Taiwan, but have picked up considerably with the Farfetch acquisition.

Developing Offerings (Coupang)

Online fashion retail is a very difficult market to compete in, and Coupang has acquired the business out of bankruptcy.

Farfetch operates in a somewhat more promising luxury e-tail segment, as a higher contribution per order helps to offset logistics costs more effectively. On the other hand, driving traffic to the online luxury shop can be quite expensive.

It is not yet clear what exactly is Coupang’s plan for the fashion retailer. The business is quite far from the core Korean commerce operation and synergies are not going to be significant. It would seem that it will be operated as an operationally independent entity

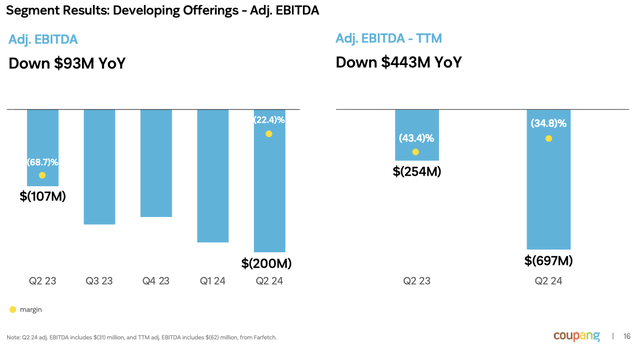

Due to the inclusion of Farfetch, the profitability of Coupang as a whole has declined considerably. If management does not find a way how to turn this business around, the whole group will likely start trading at a discount to the Product Commerce division to reflect the cash drain of Developing Offerings.

Developing Offerings losses (Coupang)

During the last earnings call, management claimed that:

On Farfetch, <…>, our goal is to generate close to positive adjusted EBITDA on a run rate basis by the end of the calendar year. We’re executing to plan and is on track to achieve these goals for the year so far. Though we’re still in the very early stages of our journey.

As it stands today, it would not be reasonable to assign a positive value to the Developing Offerings division. If management is not successful at turning Farfetch around, Coupang could even re-rate to a lower valuation multiple to reflect the losses of the division.

The bottom line

Coupang is a dominant South Korean e-commerce retailer, serving almost all households in their home market. The company has benefited from the rapid e-commerce growth in a market where online retail penetration is some of the highest in the world.

Growth in Korea will likely decelerate going forward, however, Coupang could continue growing as it gains market share due to its logistics advantages and value offered by the membership scheme.

Coupang has also been expanding in tangential industries such as food delivery and online fashion, however, these are still loss-making, and it is uncertain when profits could be expected.

Farfetch in particular was a rather odd acquisition, and we will be watching keenly to see what their plan for the British luxury fashion retailer is.

As it stands today, Coupang seems to be trading at a fair value, given the decelerating Korean market growth and uncertainty concerning Developing Offerings. For the time being, we will stay on the sidelines but will continue following this high-quality business.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.