Summary:

- Coupang, Inc.’s multibillion dollar investments in vertical integration and technology, paired with its customer-centric approach, have driven consistent margin improvements and profitability since 2023.

- The recent martial law declaration in South Korea underscores political uncertainty but is viewed as a short-term concern without significant long-term impact unless escalation occurs. The Farfetch acquisition has pressured margins and led to EPS revisions. Excluding Farfetch, Coupang’s core business continues to thrive with improving profitability and robust operational execution.

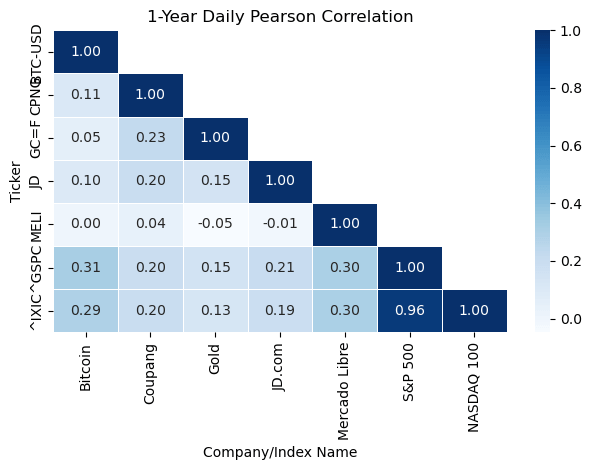

- Coupang offers exposure to the South Korean and Taiwanese markets with a low correlation to U.S. equities, Bitcoin, and gold, enhancing portfolio diversification.

- Coupang’s ecosystem expansion through Coupang Play, Coupang Eats, and Coupang Pay has delivered exceptional growth, leveraging a loyal customer base to diversify revenue streams. Nearly half of South Korea’s population are active Coupang customers, reinforcing its dominant position in one of the world’s most digitally advanced markets.

- A discounted cash flow valuation highlights an 88% upside for CPNG stock, making it an attractive opportunity for long-term investors seeking growth.

Sundry Photography

Coupang, Inc. (NYSE:CPNG) stock, termed “the Amazon of South Korea,” dropped today along with most South Korean stocks. The declaration of martial law (now in doubt) by South Korean President Yoon Suk Yeol, even if overturned by the National Assembly, highlights escalating political instability in Coupang’s core market.

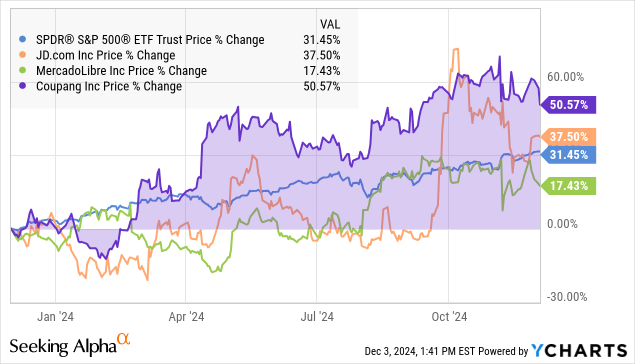

However, Coupang is poised for a strong performance even amidst heightened uncertainty. CPNG stock performed well over the past year, outperforming its peers and the S&P 500 (SP500) considerably.

CPNG Vs Peers 1Y Price Return (YCharts)

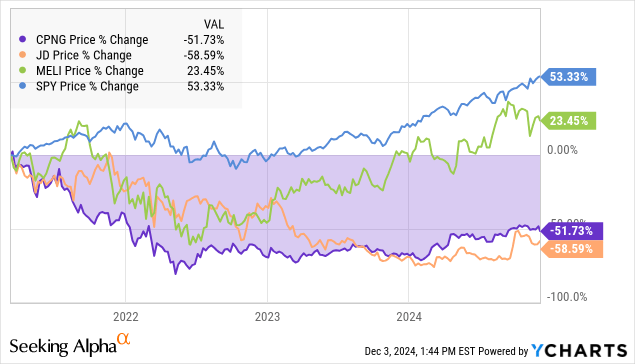

However, zooming out, Coupang stock has failed to exceed its March 2021 IPO price of $63.50 which valued the company at a valuation of $114 billion. With that timeframe in mind, only the badly beaten JD.com (JD) stock underperformed Coupang.

CPNG Vs Peers Price Return Since Coupang IPO (Mar 2021) (YCharts)

Investment Thesis

Coupang’s multibillion dollar investments in vertical integration and technology combined with its customer-centrism are paying off, evidenced by consistent margin improvements and profitability since 2023. The company now dominates the South Korean market, with almost half of South Korea’s population actively shopping from Coupang’s online marketplace.

While some investors are worried about a limited market and growth saturation, Coupang is not showing signs of slowing down. The company is utilizing its growing, loyal customer base and dominant position in e-commerce to convert Coupang shoppers into users of its developing offerings such as Coupang Play (streaming service), Coupang Eats (food delivery) and Coupang Pay (fintech) experiencing stunning growth.

The company also boasts an exceptional and dependable management team which deserves a premium from shareholders, which I discuss with multiple examples. Furthermore, due to the company’s operations lie outside the US, CPNG stock’s role as a diversifying asset is also examined.

On the other hand, the acquisition of Farfetch in 4Q23 has dragged the company’s margins and profitability in 2024 with several downward EPS revisions over the last quarters. With a muted luxury goods market and uncertainty clouding Farfetch, Coupang stock relies on the performance of its recent acquisition in the short to medium term.

The martial law dip on December 3rd is considered a short-term opportunity but demonstrates the uncertainty surrounding international stocks and the potential instability coming to the South Korean market over upcoming months.

Coupang Overview: A Solid GARP Story

Coupang’s Strategy: Customer-Centrism, Vertical Integration And Expanding Offerings

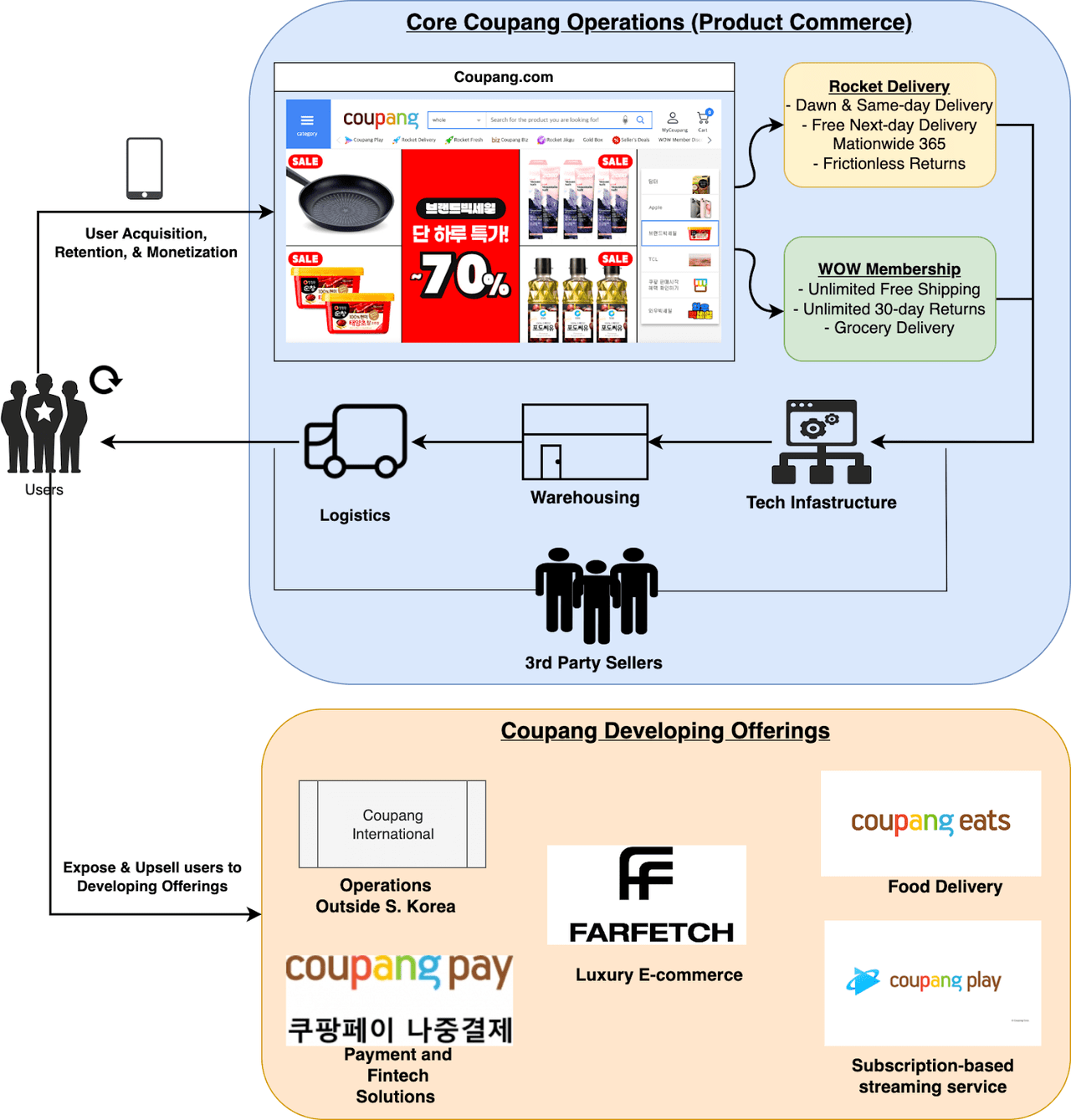

Coupang’s Strategy involves the acquisition and retention of a large market share of the South Korean population (22 active customers out of 52 million population) through discounted services, impressively fast delivery, vast selection and free returns, or as the company calls it, “wowing” their customers.

The loyalty and traffic from Coupang’s core eCommerce services provide the company with significant leverage. Coupang then uses its users to generate revenue through advertising and developing offerings, which include fintech (Coupang Pay), food delivery (Coupang Eats), and streaming services (Coupang Play) among others.

Coupang’s Strategy Visualization (Author’s Figure)

This strategy resembles Amazon’s (AMZN) customer-centrism which invests heavily in cheap, convenient and fast services to provide unmatched value and acquire loyal customers which serve as a high-conversion audience for the company’s subsequent offerings.

Coupang’s Revenue Sources

Product Commerce: Coupang operates primarily as an e-commerce or “next-generation retail” company with an online platform and extensive warehouse and logistics capabilities.

This segment provides the vast majority of revenue for the company (90.3% of total revenue, 3Q24) and includes 1P (owned inventory, fulfilled by Coupang), 3P commissions (third-party merchants selling through the Coupang platform) and Rocket Fresh (grocery delivery).

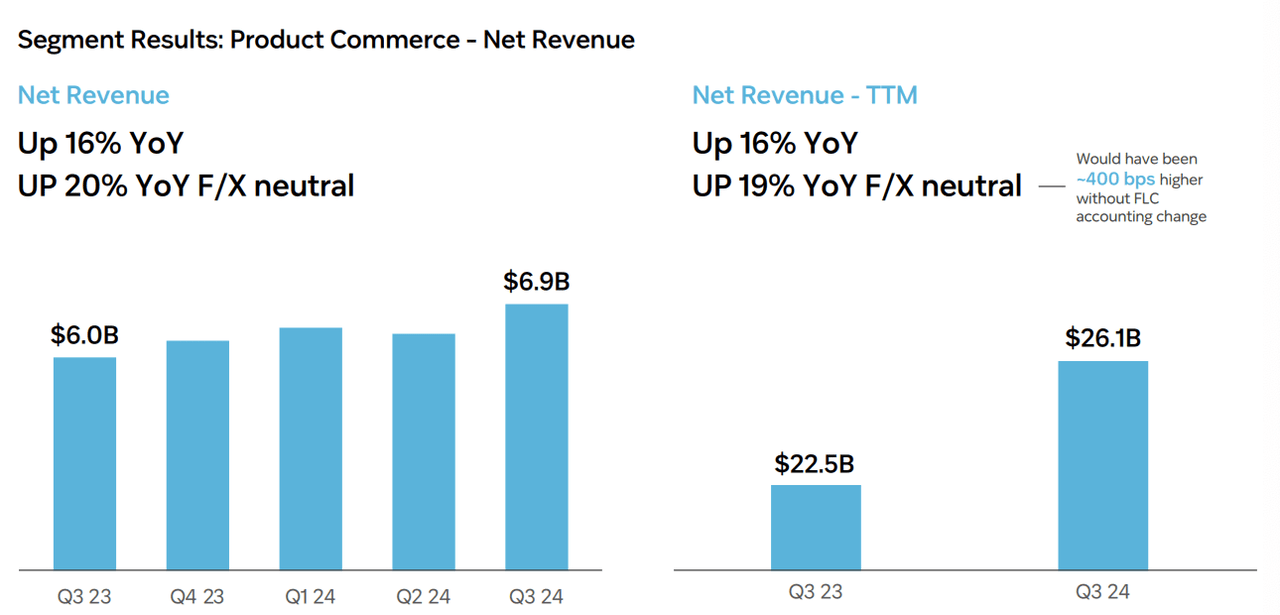

Coupang Product Commerce 3Q24 Net Revenue (Coupang)

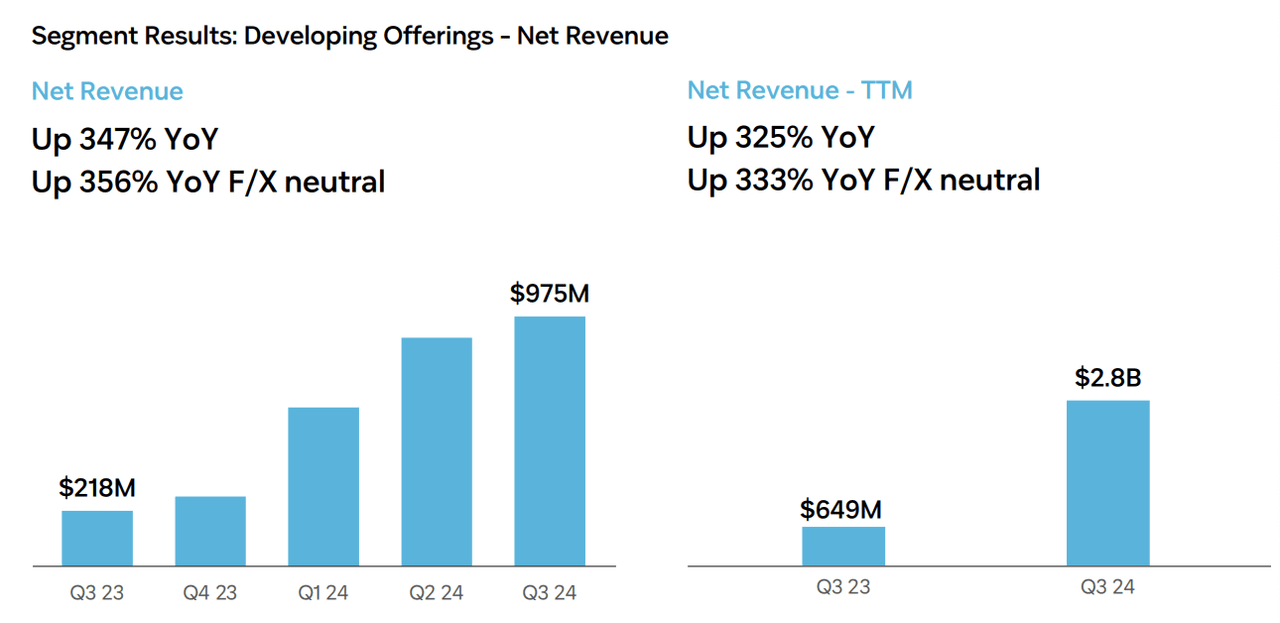

Developing Offerings: These include the recently acquired Farfetch (online luxury fashion marketplace), Coupang Eats (food delivery), Coupang Play (content streaming), Coupang Pay (fintech), Coupang Ads and Coupang Taiwan (retail operations). This segment generated just about $2.8 billion (9.7% of total revenue, 3Q24), with an impressive 356% year-on-year growth for the third quarter.

Coupang Developing Offerings 3Q24 Net Revenue (Coupang)

Impressive Growth And Improving Profitability, Stalled By Farfetch Acquisition In 4Q23

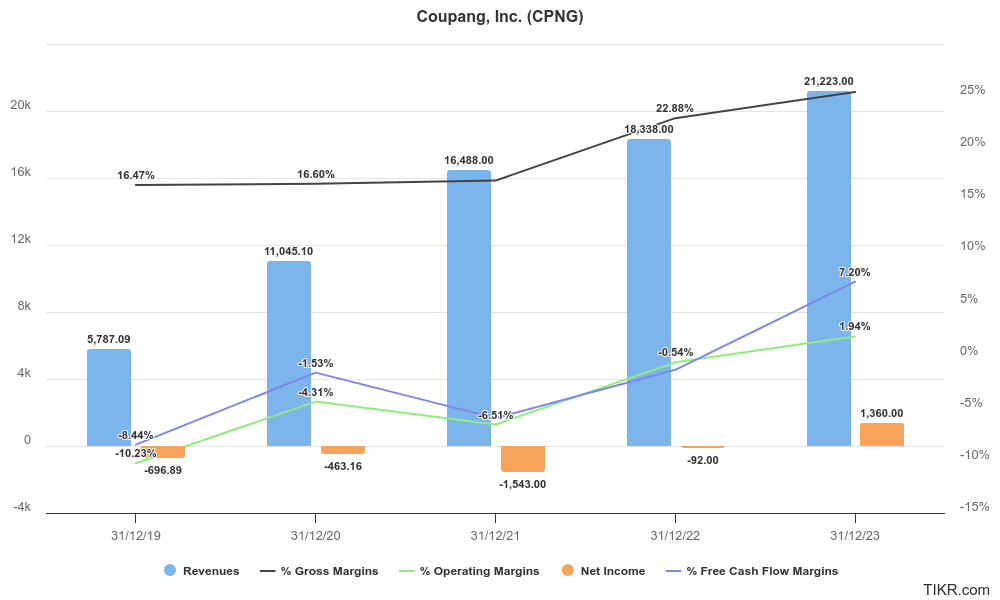

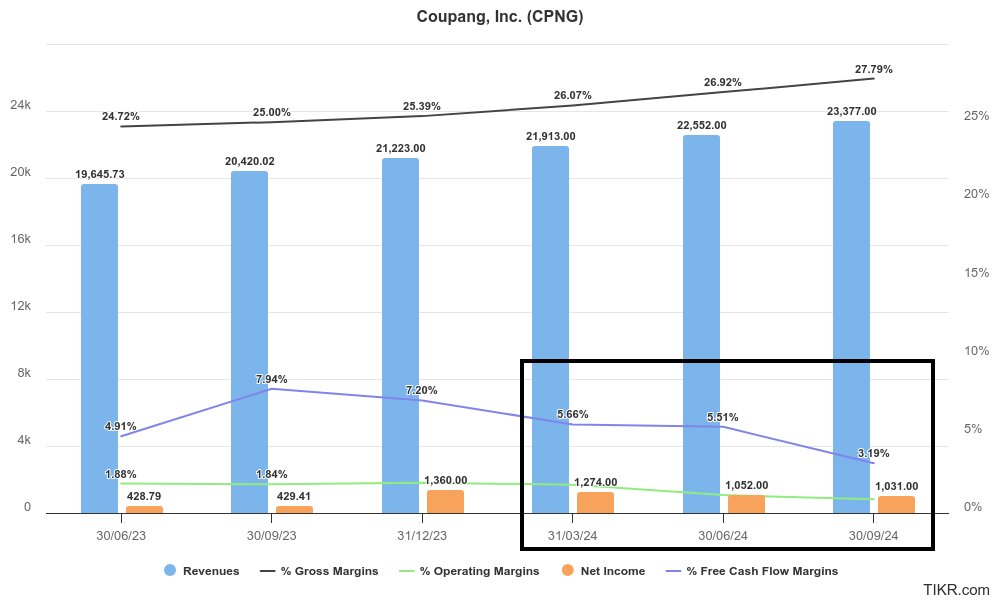

From FY19 to FY23, the company grew at an impressive CAGR of 38.4%. Simultaneously, Coupang improved its margins significantly from a 16% Gross Margin and -10% Operating Margin in FY19 to a 25.4% Gross Margin and 1.9% Operating Margin for FY23. Furthermore, by the end of 2023, FCF margins improved to 7.2%.

TIKR

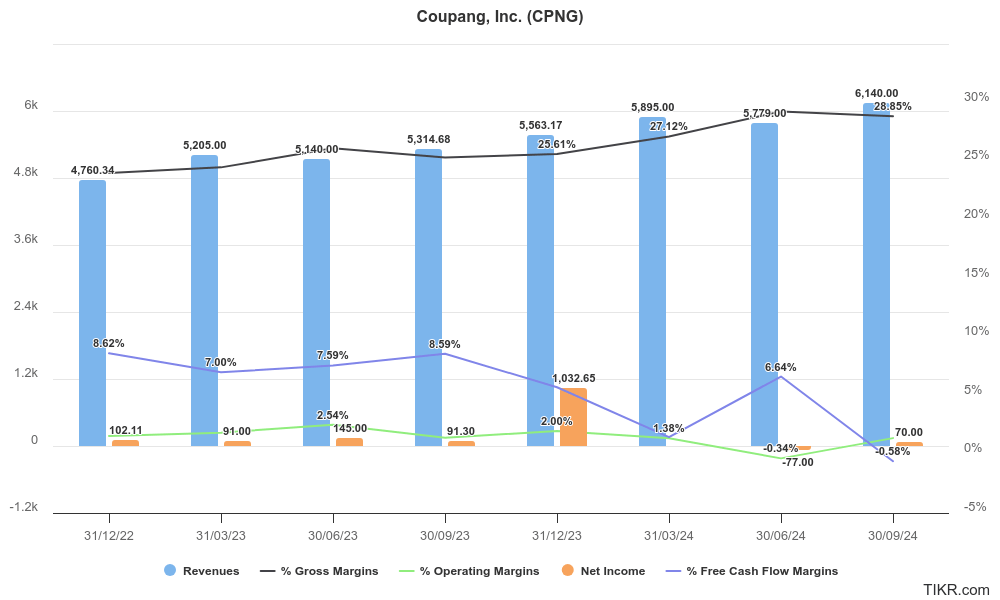

Zooming into the latest quarters, the company announced the acquisition of Fatfetch in December 18th, deteriorating the company’s margins considerably. On a quarterly basis, the negative impact on Operating Margins, Free Cash Flow and Net Income margins is apparent.

TIKR

On a TTM basis (Trailing Twelve Months), FCF margins deteriorated from 7.2% in FY23 to 3.2% in the latest third quarter of 2024. Free cash flow was $935 million for the trailing 12 months in 3Q24, down $578 million from the previous quarter due to nonrecurring working capital benefits and capital expenditure timing.

TIKR

On a positive note, Farfetch managed to achieve about breakeven profitability ahead of schedule on an Adjusted EBITDA basis (-$2 million in 3Q24 Vs -$31 million in 2Q24).

Farfetch Is The Key Driver Of CPNG Stock In The Mid-Term

As discussed previously, Coupang without Farfetch is performing quite well — the top and bottom lines are improving at a high pace. Coupang with Farfetch, however, remains less certain.

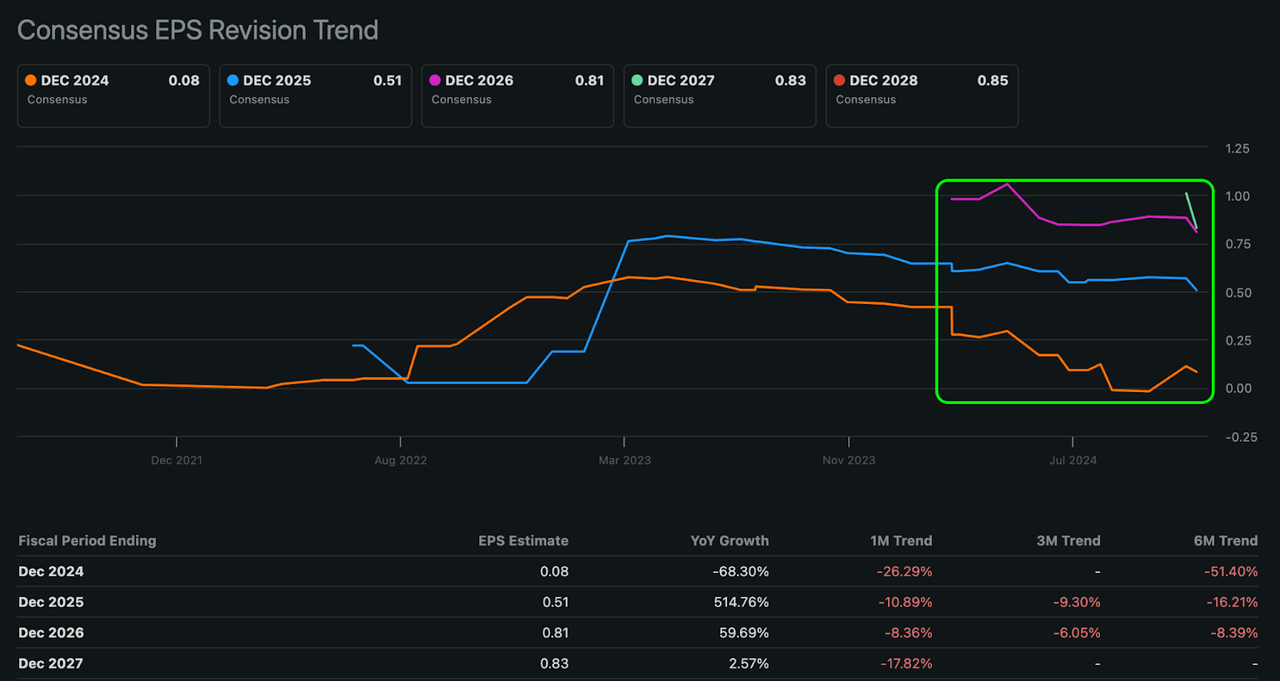

Since the Farfetch acquisition, analysts have revised Coupang’s bottom line considerably — from an FY24 $0.42 EPS to $0.08. It is therefore apparent, in my view, that the successful integration of Farfetch into the business will affect the company and stock dramatically.

CPNG EPS downward revisions (Seeking Alpha)

On the positive side, if Coupang manages to turn Farfetch around, the company is poised to benefit not only from exposure to an adjacent market not previously served (i.e., luxury goods) but also due to exposure in the European markets. Furthermore, as an online-first platform, Farfetch could benefit from exposure to Coupang’s loyal customer base and vertical e-commerce infrastructure and expertise.

It is worth noting, however, that the luxury goods market is suffering currently, as evidenced by the poor performance of top luxury conglomerates like LVMH (OTCPK:LVMHF) and Kering (OTCPK:PPRUF) whose stocks dropped -19% and -47%, respectively, over the past year. It is therefore unlikely to see a strong Farfetch over the coming quarters, with recovery likely to take several quarters before online luxury regains traction.

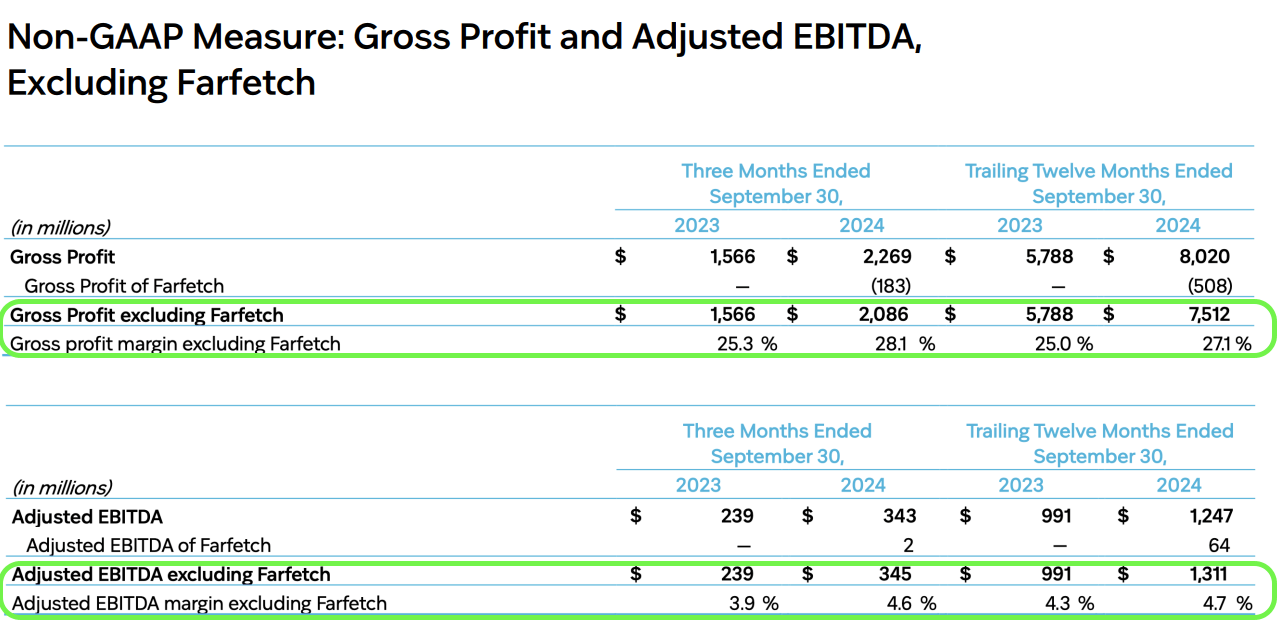

Continued Margin Improvement Excluding Farfetch

Excluding Fafetch, the company’s profitability measures continue to improve, evidenced by the 3Q24 Gross Profit Margin (TTM) of 27.1% (+210bps YoY) and Adjusted EBITDA Margin (TTM) of 4.7% (+40bps YoY).

CPNG Profitability Excluding Farfetch (Coupang)

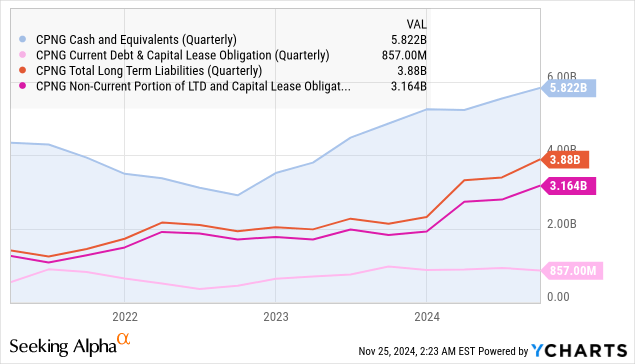

Healthy Balance Sheet

Coupang is in a healthy financial position:

-

Coupang’s Cash and Equivalent position covers its debt of $4.0 billion by +$1.8 billion.

-

Debt-to-Equity ratio of 37.3%.

-

TTM Operating Cash Flow ($1.8 billion) covers Debt payments easily.

-

Interest Expense ($114 million) is covered by Interest Income ($217 million).

Coupang Balance Sheet, 3Q24 (YCharts)

Market Insights

According to Statista, Coupang is South Korea’s largest e-commerce player with a 22.5% share of total sales in 2022, topping NAVER Corporation (OTCPK:NHNCF), the second-biggest player in the market. Its market leadership is further reinforced by being the most visited online platform, with 7.35 million unique visitors in June 2024.

These metrics highlight Coupang’s strong consumer appeal and competitive edge in one of the world’s most digitally advanced markets, suggesting a robust outlook for sustaining its leadership and capturing additional market share.

The South Korean Economy

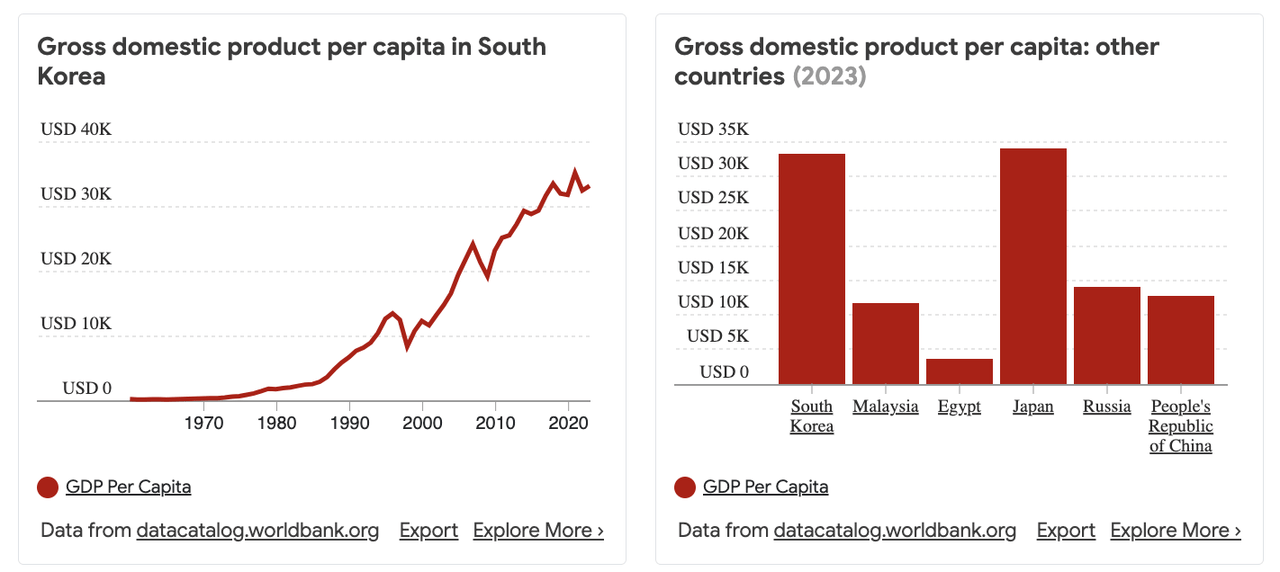

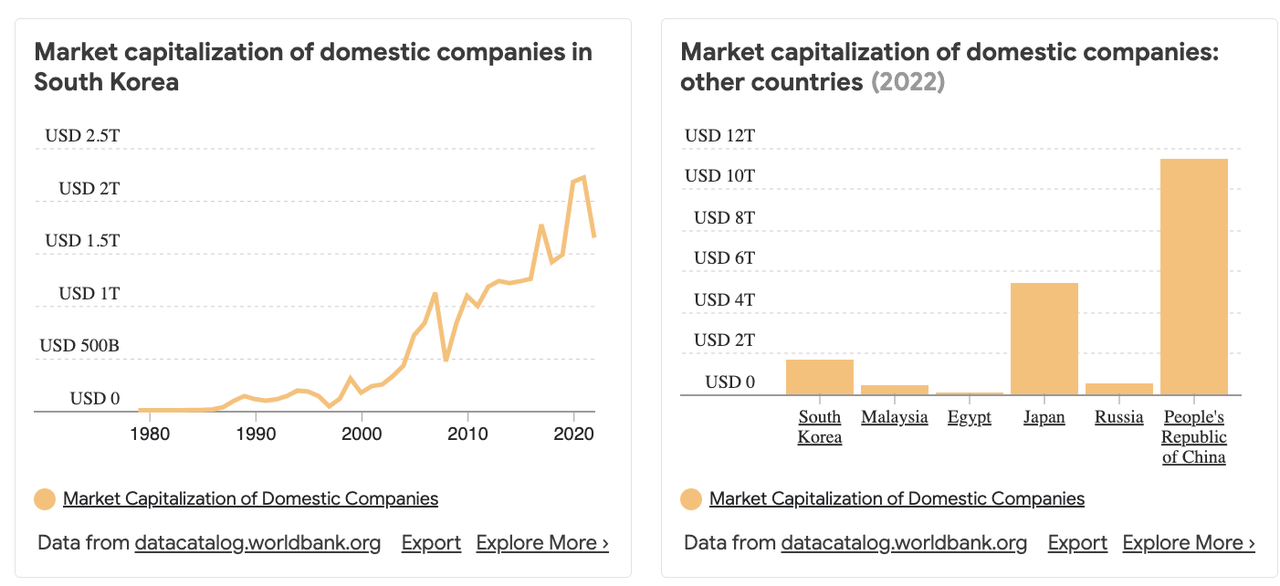

South Korea is a thriving economy, driven by innovation, advanced infrastructure, and a tech-savvy 52 million population. With a GDP per capita exceeding $30,000 in 2023, the nation has transformed from a low-income country in the 1960s to a global economic powerhouse.

Key industries include technology, e-commerce, and manufacturing, with the market capitalization of domestic companies growing significantly, reaching over $2 trillion.

However, demographic challenges loom, as the fertility rate has declined sharply, signalling potential future labor force constraints.

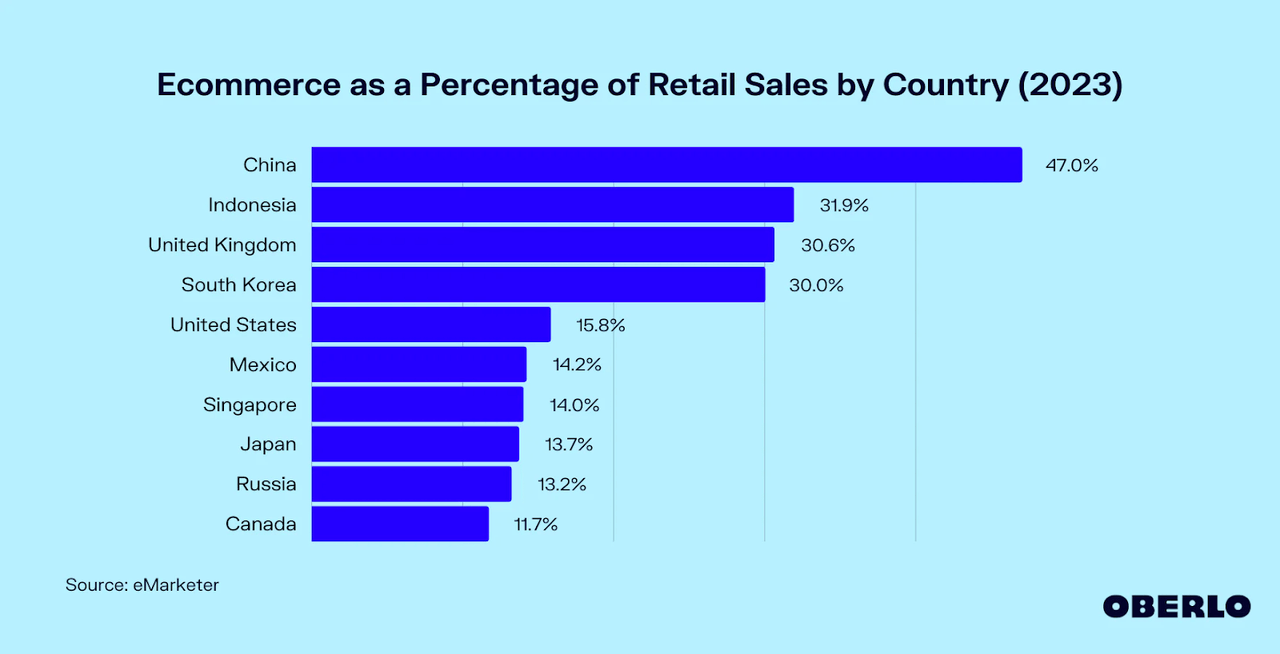

Although South Korea is not a particularly big market compared to the US or China, its high penetration of online retail sales demonstrates innovation and a strong appetite for online shopping.

Coupang Is The Leading Destination In South Korea

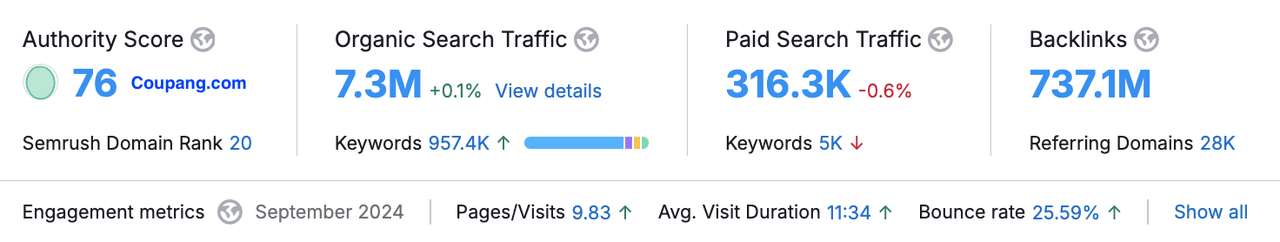

Due to the nature of e-commerce and its reliance on reach, retention, and conversion of web traffic, online user data can provide us with valuable insights into how Coupang is doing against its competition. Furthermore, a solid online presence and traffic provide Coupang with significant leverage related to online advertising.

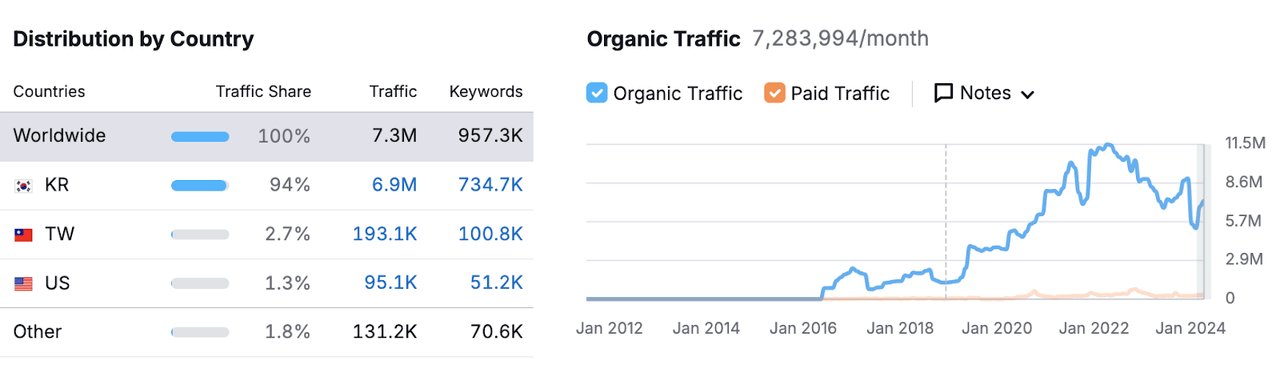

According to Semrush, Coupang leads the organic and search traffic/SEO in South Korea.

Coupang Online Search Organic Traffic (semrush)

Coupang Olnine Search Competitive Positioning Map (semrush)

A Qualitative Look

Strong Management With A Clear Vision

One of the things that stands out about Coupang is the clear vision and strong management during pivotal times, which became apparent several times over the last years.

First, during the COVID-19 lockdowns, Coupang, like many other e-commerce companies, faced unprecedented demand and supply chain bottlenecks simultaneously. In response, Coupang’s management elected to restrict the registration of new customers in favor of serving the existing ones as promised.

Second, the failed attempt to enter the Japanese market. After a two-year-old experimental delivery service, management decided to terminate its operations in Japan, refocusing its efforts in South Korea and Taiwan. Although a failure, this effort demonstrated management’s ability to test the waters in nascent markets and decisively commit or divest in new projects.

Third, the decision to pull out of a pre-2021 IPO to transform the company into an end-to-end e-commerce service that Coupang boasts today. The following excerpt from a related CNBC article with Coupang’s founder-CEO encapsulates the story:

So, “right at the eleventh hour — literally the weekend before we were meant to go to the printers”, Kim said he pulled out of the process, and instead set out on a year-long journey to transform Coupang into an end-to-end e-commerce platform designed to manage the entire customer experience, from desktop to door.

“If we wanted to provide something that really mattered to customers — 100 times better, exponentially better — we had to go through an enormous amount of change,” said Kim.

“We had to change our entire technology stack, the way we did business, our business model.”

“I think that was the most difficult, but the choice that I’m most proud of,” said Kim.

In my view, all three examples discussed above demonstrate a clear focus on the company’s core values, favoring long-term decision-making over short-term gains and investor-pleasing. In my experience, this type of evidence of consistent, solid business decision-making is rare, and I am inclined to pay a premium for CPNG stock due to the confidence and certainty provided by the management.

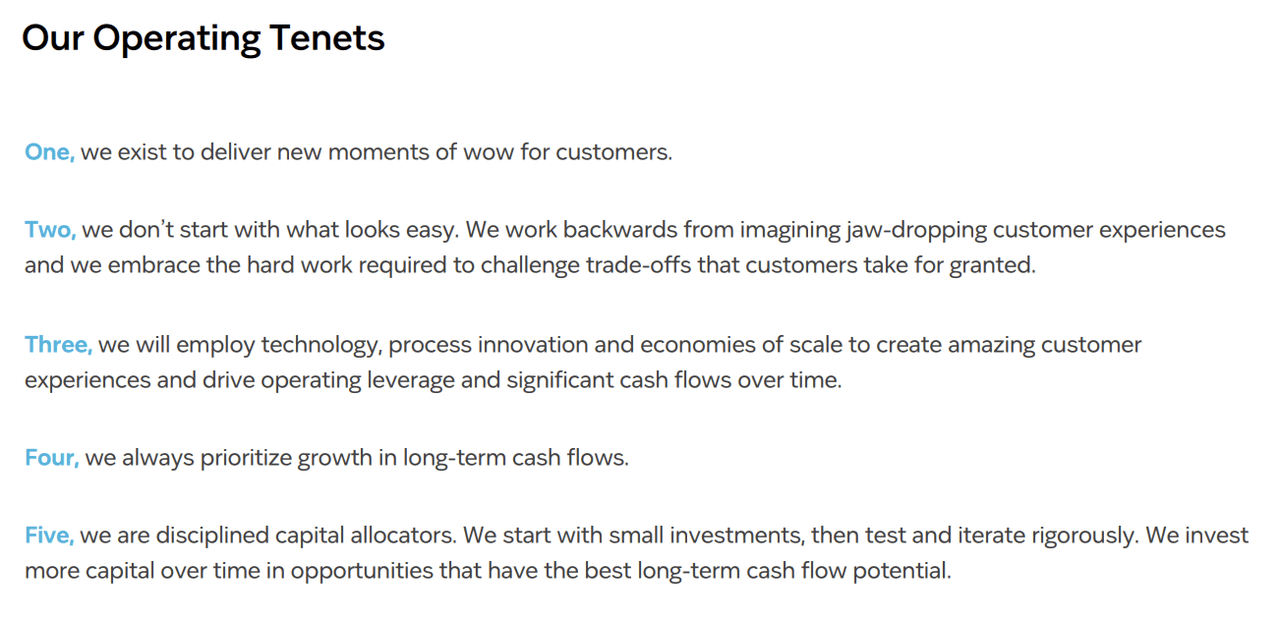

The company’s values and goals have been consistent throughout the years and in my view, Coupang proved its value and potential over the years, growing to be the most dominant e-commerce company in South Korea.

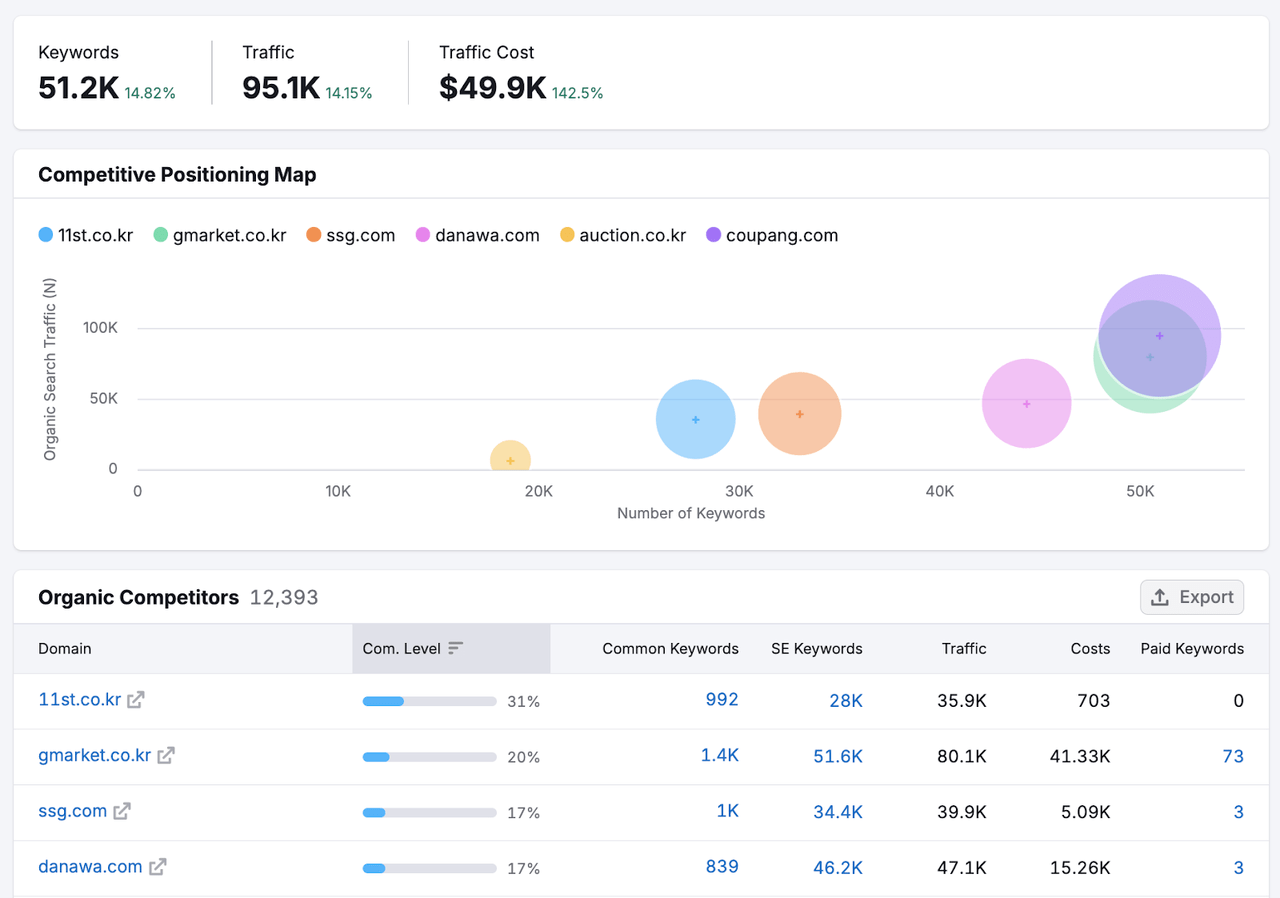

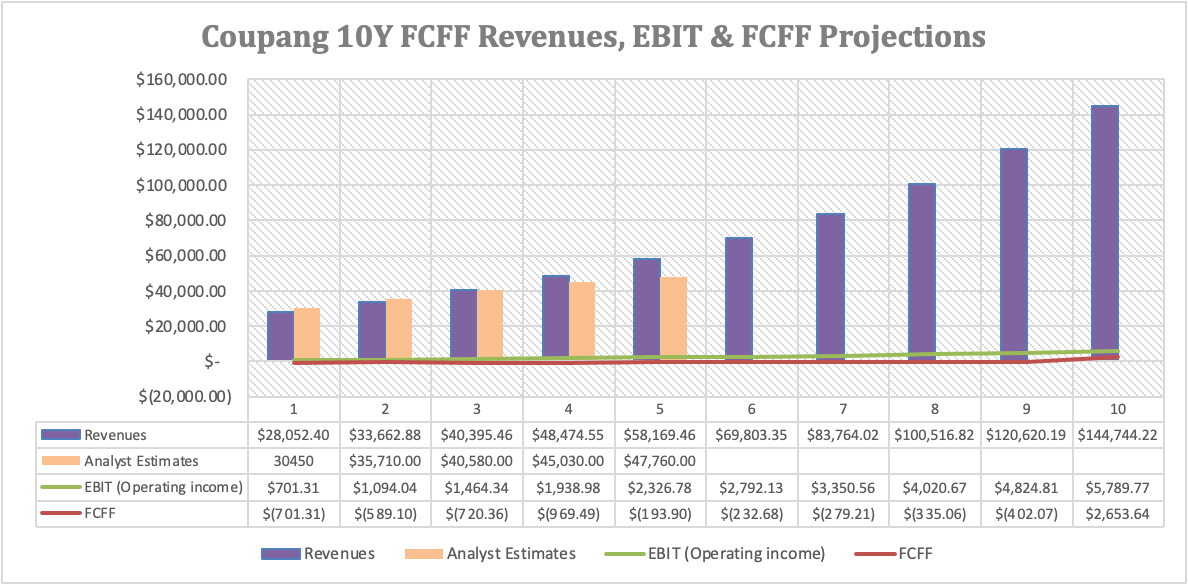

Significant Insider And Venture Capital Ownership

The company ownership includes a c.10% stake by individual insiders, 9.75% of which is owned by the founder and CEO of Coupang, Bom Suk Kim.

Coupang Company Ownership, 3Q24 (Seeking Alpha)

I generally find insider ownership essential and positive, since it aligns management with shareholders. Furthermore, founder-led companies with significant control are even more appealing due to the vision, leadership, and ability to perform long-term decisions that might be unpopular in the short term.

According to this study, Founder CEOs are more effective and efficient innovators than professional CEOs. They positively impact raw patent counts, citations per patent, and R&D intensity, which is especially helpful in more competitive industries like e-commerce. Finally, founder CEOs are more likely to take firms in new technological directions and pursue explorative and radical innovations.

Risks

-

Market Saturation in South Korea: With nearly half of the South Korean population already active Coupang users, the company faces limited opportunities for significant user base growth domestically

-

High Venture Capital Ownership: Significant shareholding by SoftBank (19.4%) presents a risk of selling pressure, as evidenced by its recent sale of $900 million worth of Coupang shares

-

Dependence on Farfetch In The Medium Term: The acquisition of Farfetch adds uncertainty, as it operates in the currently subdued luxury goods market, which has experienced weakened demand. Integration challenges or prolonged market weakness could pressure profitability.

-

Global Expansion Risks: Expanding internationally through Farfetch and Taiwan’s operations exposes Coupang to heightened competition, operational complexities, and geopolitical risks, potentially limiting the expected benefit

-

Intense Competition: Coupang competes with well-established local and global players across multiple sectors, including e-commerce, food delivery, streaming, and fintech. Increased competition could erode market share and margins.

-

Macroeconomic Factors: Coupang’s performance is tied to South Korea’s economic conditions, including GDP growth and consumer spending patterns. Any macroeconomic downturns could impact e-commerce and associated revenues.

- Political Turmoil and Uncertainty: The recent declaration of Martial Law introduces risks such as disruptions to Coupang’s operations, potential supply chain issues, and reduced consumer confidence or spending. Should political unrest escalate or protests intensify, logistics and delivery services critical to Coupang’s business model could face interruptions.

Valuation And Correlation Analysis

Key Assumptions And Methodology

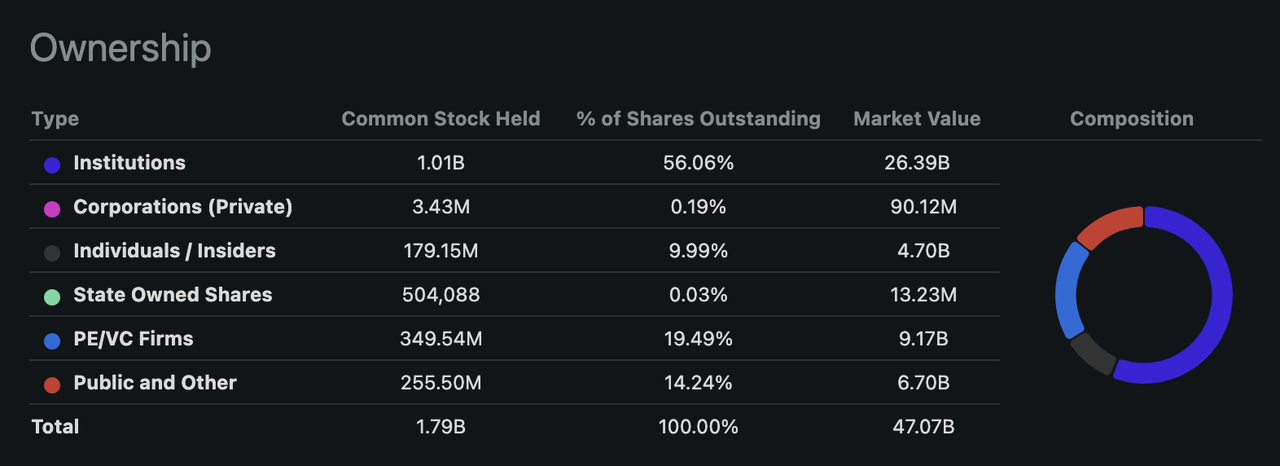

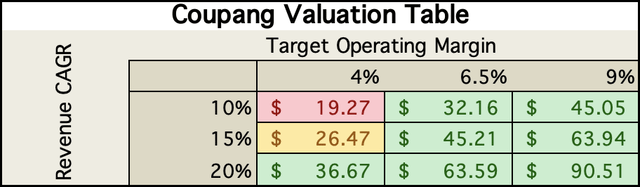

The DCF (Discounted Cash Flow) valuation uses an FCFF (Free Cash Flow to the Firm) approach. It assumes a cost of capital at 8.8% for the 10 years and thereafter. Informed by management’s long-term target Operating Margin (5-8%) the margin is varied at 4%, 6.5%, and 9% to represent bearish, inline, and bullish rates and assumes it will be achieved by 2029. Similarly, the 10-year Revenue CAGR is varied at 10%, 15%, and 20%, and assumes it will be maintained over the 10 years, while the terminal growth rate is set at 7%.

DCF Valuation Results

DCF FCFF 10Y CPNG Valuation (Author’s Figure)

The resulting valuation table demonstrates that only the bearish estimates result in a slightly overvalued stock, with a mean stock target stock price of $47, representing about an 88% upside.

Valuation Table (Author’s Figure)

Stock Correlation With Industry Factors And Major Assets

Over the past year, CPNG stock demonstrated low correlation with the major US indices including S&P 500 (SP500) and NASDAQ 100 (NDX) as well as Bitcoin (BTC-USD) and gold (XAUUSD:CUR). Interestingly enough, CPNG was also uncorrelated with its international peers, including the Chinese JD.com (JD) and South American MercadoLibre (MELI).

CPNG 1Y Major Asset Correlation (Author’s Figure)

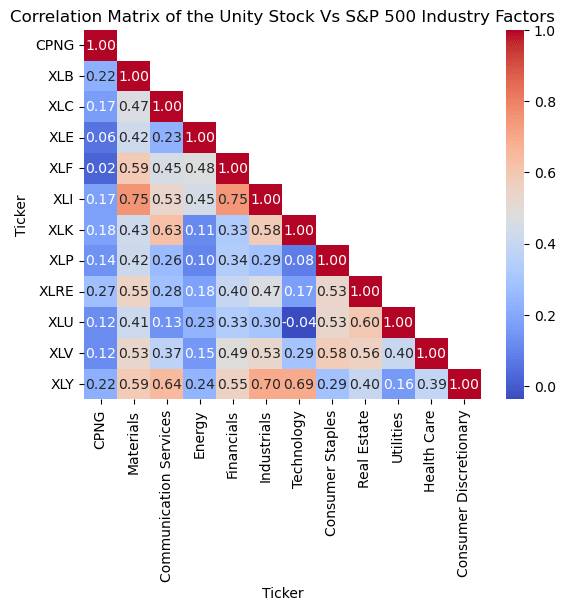

As expected due to its operations in South Korea, CPNG stock demonstrated low correlations with all US factors.

CPNG 1Y correlation with S&P 500 factors (Author’s Figure)

Action Recommendation

With a combination of Quant, Valuation and Future factors, I initiate CPNG stock with a “BUY” rating.

|

Factor |

Description |

Grade |

|

Quant |

Seeking Alpha Quant |

BUY |

|

Valuation |

Fundamental, Top-down, Multiple, Financial Health |

BUY |

|

Future |

Market Projections, Market Positioning, Economic Sensitivity, Ownership & Management |

STRONG BUY |

|

Overall |

BUY |

Conclusion

Coupang stands out as the leading e-commerce platform in South Korea, serving nearly half the population and benefiting from its customer-centric approach. This loyal user base not only drives Coupang’s dominance but also fuels the rapid growth of its Developing Offerings like Coupang Play, Coupang Eats, and Coupang Pay, which experience strong, triple-digit growth.

The acquisition of Farfetch is the most important driver for CPNG stock in the short to medium term, which pressures the company. Due to the acquisition in 1Q24 and a subdued luxury market, the online luxury platform is unlikely to perform strongly in the coming quarters. However, Farfetch is making progress toward profitability and if successfully integrated, it could unlock new revenue streams and extend Coupang’s reach into international markets.

Excluding Farfetch, Coupang’s core business is thriving, with consistent profitability improvements. The solid founder-led management also commands a premium for the stock.

The DCF valuation demonstrates an 88% upside on average for Coupang stock, and the correlation analysis shows a low correlation with the S&P 500, NASDAQ-100, Bitcoin and Gold, serving as a diversifying asset in portfolios.

The declaration of martial law and political conflict is considered temporary unrest and underscores the uncertainty clouding international markets.

Overall, while risks remain, particularly around Farfetch’s integration, Coupang’s market leadership and growth potential make it an attractive long-term investment. With a combination of Quant, Valuation and Future factors, CPNG stock is initiated as a “BUY.”

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea competition investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CPNG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.