Summary:

- Coupang’s recent earnings report led to a share price slump, but the stock remains undervalued.

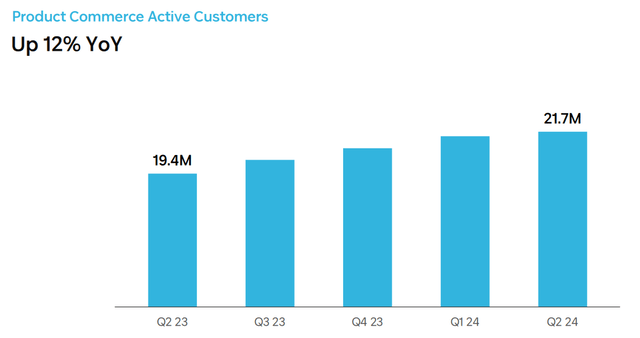

- The company’s near-term prospects are optimistic, with significant growth in revenue and active customer numbers.

- Coupang’s Developing Offerings segment, despite current losses, is growing rapidly and holds significant future potential.

Michael Vi

Investment Thesis

Coupang (NYSE:CPNG) delivers a mixed Q2 2024 result. That’s the headline, a miss on its topline, which saw its share price slump by more than 5% after hours.

However, I argue that there’s a lot more to this investment under the surface. And yet, the issue with Coupang is that there’s so much under the surface, that makes surfacing a clean narrative a challenge.

For my part, I like this investment a lot. Even though I recognise that in the market’s impatience, this stock may remain undervalued for a while.

We have a lot to go through here, so let’s get to it.

Rapid Recap

Back in May, I said,

Here’s the setup. You are asked to pay around 16x EBITDA for Coupang’s Core business. The Core business is OK. Nothing special.

But what makes this investment unique, is that its balance sheet has ample cash. Also, crucially, Coupang’s very fast-growing Development Offerings, which grew by 143% y/y excluding its Farfetch acquisition, are being afforded no value, and come for free.

Author’s work on CPNG

This is a stock that I’ve been bullish on for quite some time. And now, on the back of this earnings report, I reiterate my bullishness.

Coupang’s Near-Term Prospects

Coupang is an e-commerce company that focuses on providing a vast selection of products, rapid delivery services, and competitive prices to its customers. Their commitment to customer experience and operational excellence has allowed them to achieve significant growth in both revenue and active customer numbers.

They offer both first-party and third-party sales, with newer categories like Fashion and Beauty showing especially rapid growth. Additionally, their merchant services, such as advertising and Fulfillment and Logistics by Coupang (”FLC”), are expanding rapidly, and we’ll discuss this more soon.

In the near term, Coupang is optimistic about its growth prospects, driven by accelerating customer acquisition and increased spending across all customer cohorts.

The company has achieved notable milestones, including over $2 billion in operating cash flow and consistent GAAP profitability. Their initiatives in new categories and markets, such as Eats and their operations in Taiwan, show promising early results and are expected to drive further growth. Coupang’s strategic investments and disciplined capital allocation aim to sustain high growth and profitability.

However, Coupang faces challenges with its Developing Offerings segment, which reported increased losses. This segment includes investments in new markets and services, such as Eats and Taiwan.

While these investments are crucial for future growth, they currently represent significant costs.

Given this balanced background, let’s now delve deeper into what’s under the hood here.

Important Context

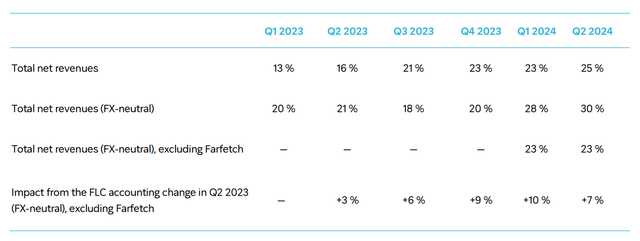

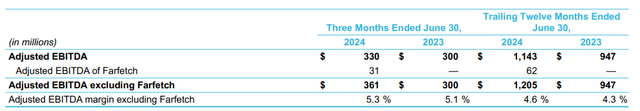

Before we go further, please spend a moment looking at the table that follows.

What’s obvious to you? Look again.

What’s obvious is that there are a lot of different puts and takes, which makes a clear narrative for investors challenging to discern. But these headwinds are temporary. Case in point, the acquisition of Farfetch is already two quarters underway. This means that after another 2 quarters, whatever Farfetch makes will be added to Coupang’s organic revenues.

Further, Coupang’s Fulfillment and Logistics by Coupang (”FLC”) accounting charge, is a change in how revenues get reported. It doesn’t affect the bottom line profitability, but it does mean that revenues are reported on a net basis, after costs, rather than on a gross basis. This sounds complicated. All that it means in practice is that compared with the prior year, the pace of revenue growth doesn’t look that impressive. The key figure that, I believe, is most important is Coupang’s 18% y/y revenue growth rates, reported in USD, not including Farfetch, which isn’t even shown in the table above.

Next, let’s discuss Coupang’s fundamentals.

Coupang Is Growing At Around 15% to 18% CAGR

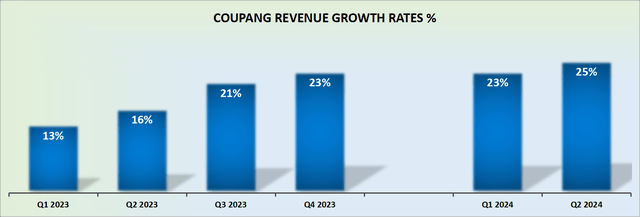

There are a lot of different dynamics under Coupang’s revenue growth rates. And I believe that the market doesn’t like it all that much when there isn’t a clean “pure play” story. The market prefers simple narratives.

And then, to complicate matters further, the two core segments are growing at dramatically different rates.

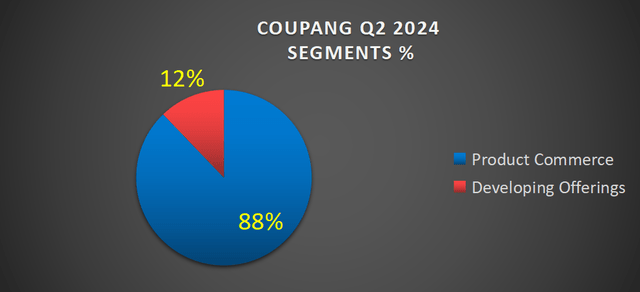

Coupang acquired Farfetch out of bankruptcy, which meant getting the business at fire sale prices. But the key to this thesis is to focus on its Developing Offerings Segment.

Coupang’s Developing Offerings Segment was up 177% y/y as-reported (meaning reported in USD, instead of FX-neutral, since CPNG’s market cap is listed in USD, it makes sense to think in USD). This figure does not include the Farfetch acquisition, as that skews the underlying prospects of this business.

The way I want to unpick this opportunity is that today, very approximately speaking, about 10% of Coupang’s total business comes from its Developing Offerings (see above).

This segment includes Coupang Eats (similar to Uber Eats), plus its International segment. And the underlying pace of growth from its Developing Offering is up 177% y/y. That’s nothing short of astonishing.

With this in mind, let’s now discuss its valuation.

CPNG Stock Valuation — 18x EBITDA

Before we go further, I want to make something clear about Coupang’s Developing Offering.

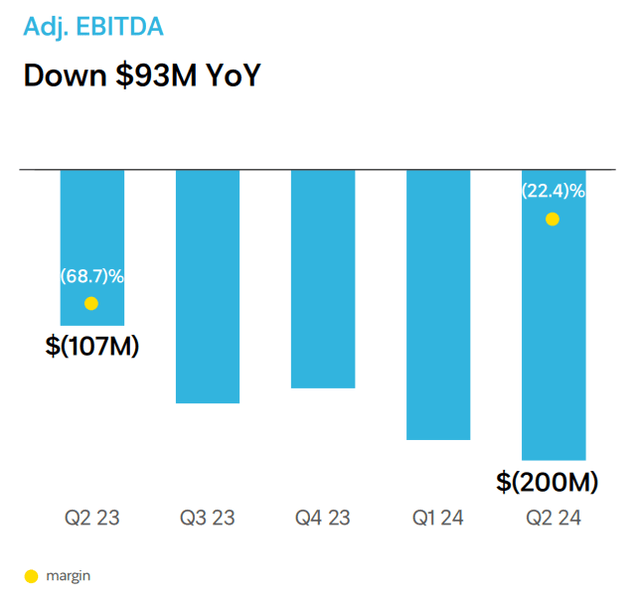

Yes, the EBITDA figures are becoming increasingly negative. But if you focus on the EBITDA margin figures, you’ll see that the figures have improved 4,630 basis points y/y.

Accordingly, I believe that at some point in the next twelve months, Coupang’s Developing Offering will reach breakeven, at which point, Coupang’s prospects will become a lot more compelling for investors, as they’ll have a growing Developing Offerings segment that is self-sustainable.

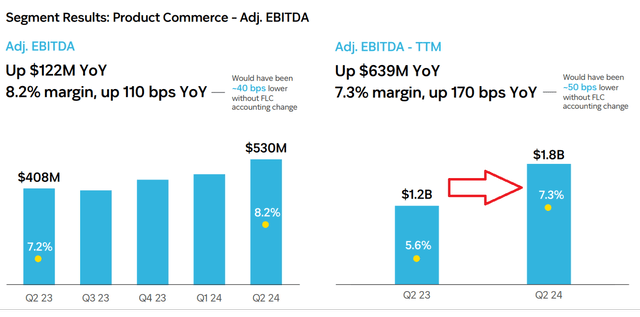

Now, consider the following graphic, with a focus on the red arrow.

What you see here is that Coupang’s Product Segment delivered $1.8 billion of EBITDA in the past twelve months. This figure would be adjusted to $1.7 billion, without the change in FLC accounting.

In sum, Coupang’s Product Segment EBITDA is up 42% y/y. This means that if we continue to see a further 20% increase in Coupang’s Product Segment over the next twelve months, this segment alone could make around $2 billion of EBITDA.

To round out our discussion you can see below how when Coupang’s adjusted EBITDA is reporting including its unprofitable Developing Offerings, the figures are rather less interesting:

With its EBITDA figures up 10% y/y to $330 million.

However, the way I see it is that investors are asked to pay approximately 18x forward EBITDA for Coupang’s core business, with its Developing Offering which is growing at more than 100% y/y organically, and likely to make up 20% of its total business in the next twelve months, for free.

The Bottom Line

When paying approximately 18x forward EBITDA for Coupang’s core Product Segment, investors effectively get the rapidly growing Developing Offerings, which include international ventures and Coupang Eats, at no additional cost. This Developing Segment, despite its current losses, is growing over +100% y/y and holds significant future potential.

Furthermore, Coupang maintains a robust cash position on its balance sheet, which provides a strong foundation for sustained growth and investment into these emerging segments without compromising financial stability.

This combination of a profitable core business and promising developmental ventures positions Coupang as a compelling stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.