Summary:

- I’m paying 30x forward free cash flow for Coupang, Inc.’s mature Product segment, but the Developing Offerings segment adds massive potential upside.

- Coupang’s net cash position (9% of market cap) gives it flexibility to invest and grow, further de-risking my investment.

- With expected EBITDA of $2.5 billion from the Product segment alone, the valuation looks reasonable, but the fast-growing Developing Offerings make it even more compelling.

- Coupang’s Developing Offerings, currently growing close to 100% y/y, are like an undiscovered gem—adding value without impacting the price I pay today.

Michael Vi

Investment Thesis

Coupang, Inc. (NYSE:CPNG) is a business that I’ve been bullish on for so long, but haven’t yet pulled the trigger on (this may soon change).

The bear case, from my perspective, is twofold. It’s not a US company; therefore, it’s never going to get that juicy US-equity multiple. Secondly, the company has two different segments, which makes for a less-than-simple story.

Indeed, as you know, the market loves simple stories. And simple stories get the highest multiples.

Accordingly, my thesis in a nutshell is that investors are asked to pay 30x forward free cash flow for Coupang’s mature Product segment, and get its rapidly growing Developing Offerings segment completely free.

What’s more, the business has about 9% of its market cap made up of cash, which further bolsters my bull thesis.

Here I describe exactly what I’m looking forward to in Coupang’s Q3 2024 earnings results on November 7th.

Rapid Recap

Back in August, I said,

I like this investment a lot. Even though I recognise that in the market’s impatience, this stock may remain undervalued for a while.

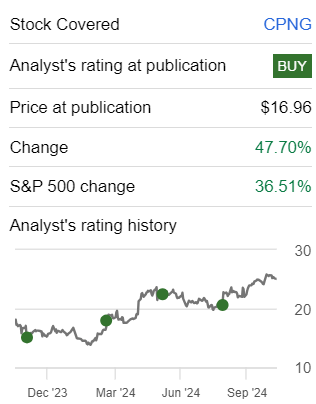

Author’s work on CPNG

As you can see above, I’ve been an unwavering CPNG bull. What’s more, my bullish call has nicely outperformed the S&P 500 (SP500).

Why Coupang? Why Now?

Coupang is a South Korean e-commerce company that aims to provide a top-tier customer experience. It offers a wide selection of goods, fast delivery, and low-cost pricing.

An example of its innovation is its use of eco-friendly delivery methods that reduce packaging waste, cut costs, and allow for rapid deliveries, all while remaining profitable.

Through continuous innovation, it optimizes logistics, allowing customers to receive their orders quickly, sometimes within hours.

Coupang’s near-term prospects are attractive, particularly due to its Developing Offerings such as its Eats platform and its expansion into Taiwan. Coupang’s WOW membership program, which includes benefits like unlimited free delivery, is driving customer adoption.

In Taiwan, the company is replicating the successful strategies used in Korea, focusing on customer loyalty and offering Korean products, which have seen significant growth.

Meanwhile, note that Coupang operates in an intensely competitive e-commerce landscape, where it faces challenges from Alibaba (BABA) and local players in Korea. The market is highly fragmented, with Coupang still capturing only a small share of the $560 billion retail market.

A Sneak Peek Into My Bull Thesis

Very briefly, I’ll explain exactly what I’m looking for in Coupang’s Q3 2024 earnings results in approximately 2 weeks.

CPNG author’s work

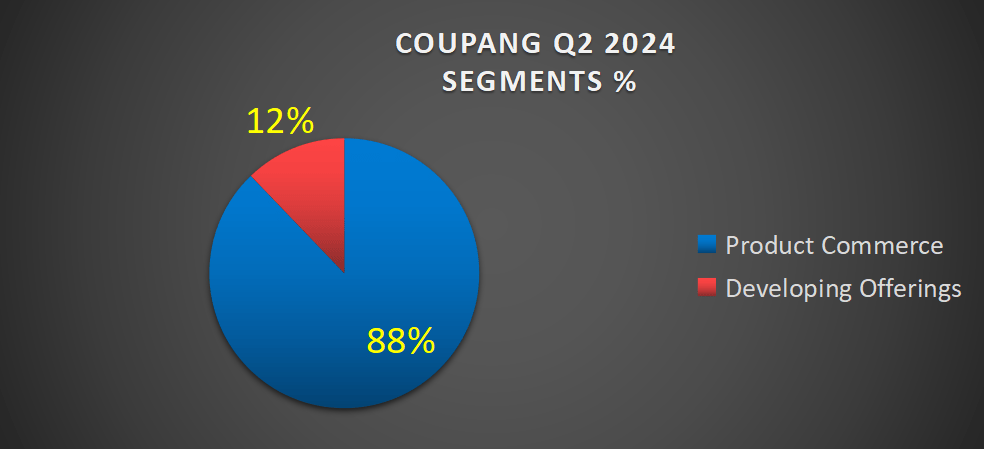

About 10% of Coupang’s total business comes from its Developing Offerings (see above). What’s more, note that Coupang’s Developing Offering business was up 177% y/y in Q2.

Naturally, this business unit will slow down in Q3 2024 and beyond. But if it turns out that despite slowing down, it could still deliver approximately 100% y/y revenue growth rates, I believe that investors could soon get a lot more comfortable backing Coupang.

With this background in mind, let’s now discuss its fundamentals in more detail.

Revenue Growth Rates to Moderate to +15% in 2025

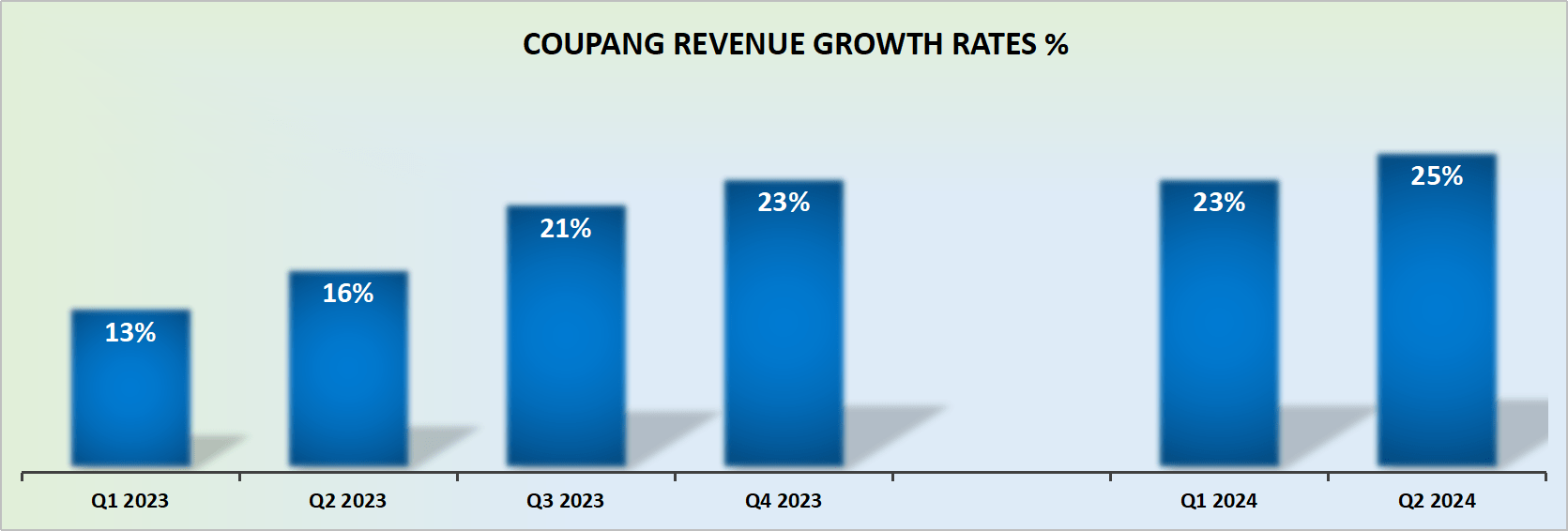

CPNG revenue growth rates

Allow me to describe the problem and the opportunity. The issue for Coupang is that it acquired Farfetch out of bankruptcy at a cheap price. Why is that a concern? Because it’s going to obfuscate Coupang’s near-term growth rates.

Put more simply, there’s a material amount of inorganic growth rates that has affected Coupang for two quarters thus far, and Coupang won’t lap that acquisition until early in 2025.

And to complicate matters further, Coupang doesn’t provide investors with any sort of guidance.

And then, on top of that, putting aside Coupang’s Farfetch acquisition and related complications, its organic growth rates will be up against a much more challenging backdrop starting Q3 2024 all the way into H1 2025.

Basically, this is the key question that investors need to get super comfortable with: can Coupang be counted on to sustainably grow by +15% CAGR into 2025?

While that question sinks in, let’s move ahead to discuss its valuation.

CPNG Stock Valuation – 30x Forward Free Cash Flow

As an Inflection investor, I find Coupang’s net cash position of approximately 9% of its market cap mighty attractive. This provides Coupang with plenty of options and flexibility with how it progresses with delivering long-term value to shareholders. In fact, I’ll always argue that this is a positive consideration.

Next, this is how I see a path to investors’ upside opportunity. Coupang has two segments, its unprofitable Developing Offering and its Product Segment.

For now, let’s focus on its main business, its Product Segment.

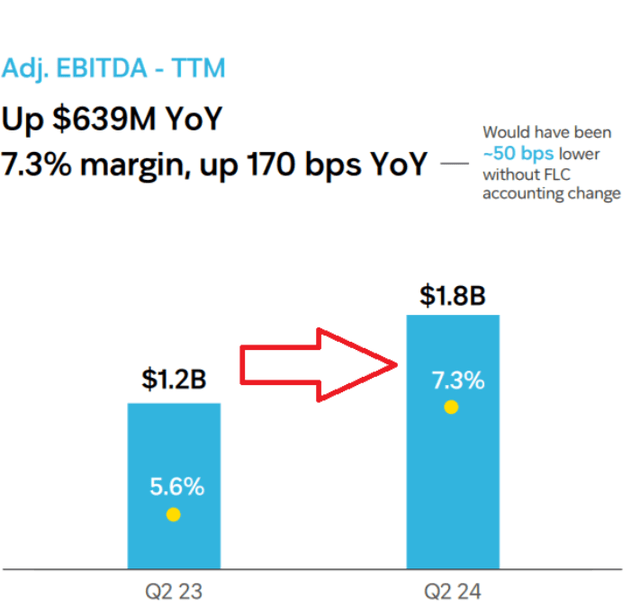

This is what I’m looking for in Coupang’s Q3 2024 results. Can I see enough evidence that Coupang can be on a path toward $2 billion of adjusted EBITDA from this segment?

If that’s the case, it would be rather easy to estimate that Coupang could deliver $2.5 billion of EBITDA from its Product Segment alone. This would mean that investors are paying 18x forward EBITDA for Coupang’s Product segment.

Even if we put aside $1 billion for capex requirements, this would mean that Coupang is being priced at 30x forward free cash flow. A reasonable figure, but nothing to get truly excited about. But that’s not where this story ends. Next is what truly gets me excited.

Remember Coupang’s Developing Offering segment? The one segment that was growing at somewhere close to triple digits? What would happen if that segment were to account for 20% of Coupang’s total business by mid-2025?

And what if, by that point, investors come around to the idea that Coupang’s Developing Offerings has reached breakeven on its profitability line?

Well, that would mean that investors getting involved right now, are getting Coupang’s fastest growing segment completely thrown in for free!

Investment Risks

There are two main risks.

Coupang is a non-US business, listed in the US. It will always be susceptible to any geopolitical stories, which will impact its valuation.

Secondly, the key to my thesis boils down to Coupang’s Developing Offerings reaching breakeven by mid-2025. If it doesn’t, then, investors are left paying 30x forward free cash flow for its Product segment, which while interesting, may not be worth paying such a high multiple for.

The Bottom Line

Paying 30x forward free cash flow for Coupang makes sense because it reflects the true value of its Product segment, which is already delivering consistent and growing profits.

The company’s market leadership, solid logistics infrastructure, and relentless focus on customer satisfaction all underscore the reliability of this core business.

But what truly excites me is the potential upside from its Developing Offerings segment. With its rapid growth and promising path to profitability, this segment could become a significant driver of future returns.

At today’s valuation, I’m essentially paying for a stable, profitable business—and getting Coupang’s fast-growing, game-changing Developing Offerings thrown in for free!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.