Summary:

- Coupang is experiencing growth in customers, revenues, gross profits and EBITDA amid strong growth in South Korean e-Commerce.

- Coupang’s top-line growth is also accelerating.

- The company’s free cash flow has increased dramatically, which could potentially lead to new acquisitions.

- Shares are relatively cheap compared to other e-Commerce platforms, and I expect Coupang to continue expanding in the future.

Mirko Kuzmanovic

Coupang (NYSE:CPNG) is a South Korean e-Commerce platform that is seeing sustained growth in customers, revenues and EBITDA. The company last year acquired a luxury good-focused retailer and could do more acquisitions in FY 2024 and beyond in order to grow its top line and cash flow. Coupang is seeing a dramatic upswing in free cash flow, and the platform continues to make a convincing offer based off of its revenue-based valuation. Shares are relatively cheap, compared to other e-Commerce platforms like Amazon (AMZN), and I believe Coupang will continue to expand in the years ahead.

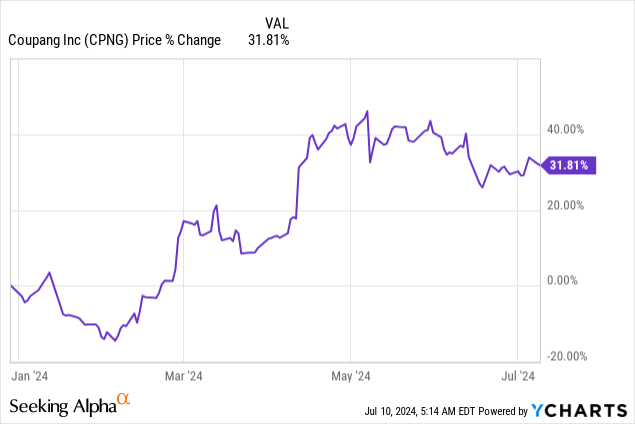

Previous rating

I recommended shares of Coupang as a buy in December 2023 — 2 Reasons For An Upside Revaluation In 2024 — after the e-Commerce company announced the acquisition of Farfetch Holdings (this acquisition has since been completed). Coupang is making serious free cash flow gains and is seeing positive momentum in its gross profits as well. I believe Coupang could make new acquisitions in FY 2024 given its significant upswing in free cash flow and shares, despite a ~32% price gain year-to-date, are cheap based off of revenues.

Customer, revenue and free cash flow growth

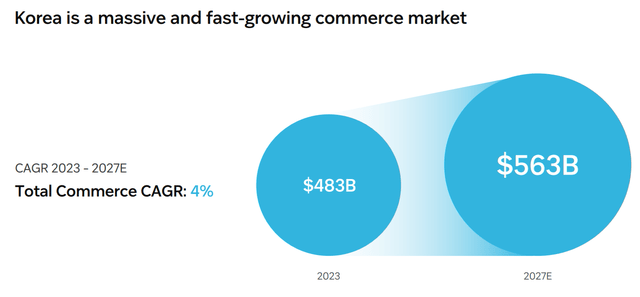

As South Korea’s largest e-Commerce platform, Coupang is participating in the growth of the company’s commerce sector. South Korea has a population of about 52M and is seeing sustained growth in its e-Commerce sector: The commerce market in Korea is set to grow to $563B by the end of FY 2027, implying a total expansion of 17% relative to a FY 2023 market value of $483B.

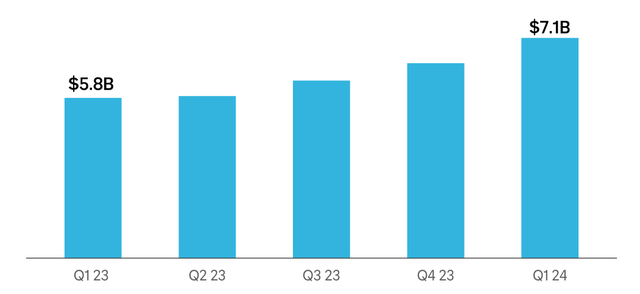

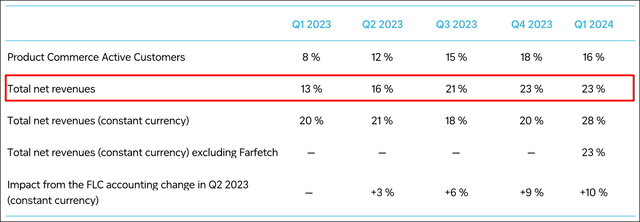

Because of these macro tailwinds, Coupang’s key performance metrics look healthy, especially the firm’s net revenue, gross profit and free cash flow. In Q1’24, Coupang reported total net revenues of $7.1B, showing 23% year-over-year growth (or 18% if adjusted for the acquisition of Farfetch).

Importantly, Coupang’s revenue growth has been accelerating in recent quarter, creating a catalyst for continual gross profit and free cash flow growth in the quarters ahead. Coupang’s consolidated net revenue growth accelerated 10 PP compared to Q1’24.

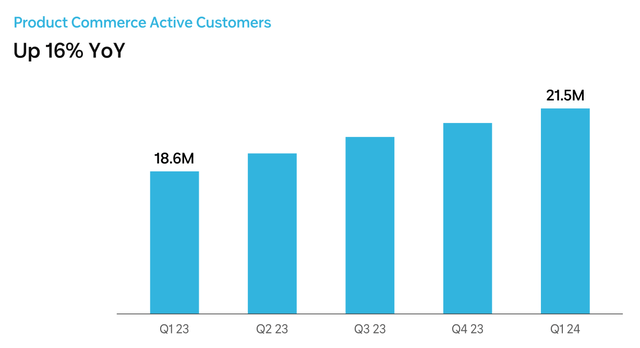

Growth in customers is underpinning Coupang’s platform and top-line growth. In the most recent quarter, Q1’24, the South Korean e-Commerce company grew its customers by 16% year over year to 21.5M. Its growth has been consistent and steady in the last year due to growing e-Commerce adoption by South Korean consumers.

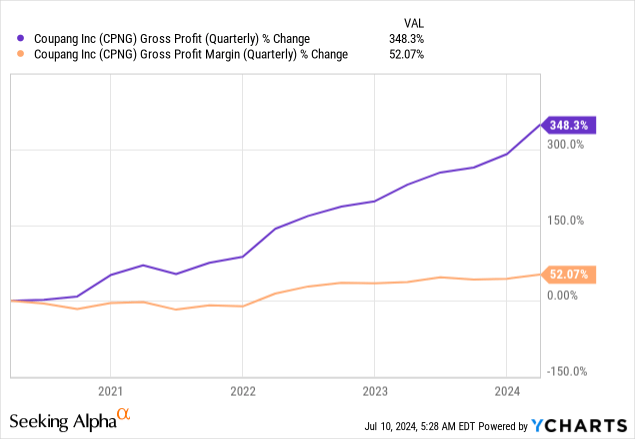

Coupang’s Q1’24 gross profit amounted to $1.9B, showing 36% year-over-year growth, while its gross profit margin expanded 2.6 PP year over year to 27.1%. The e-Commerce firm has seen steady growth in its gross profits as well as a significant expansion in its gross profit margin in the last five years.

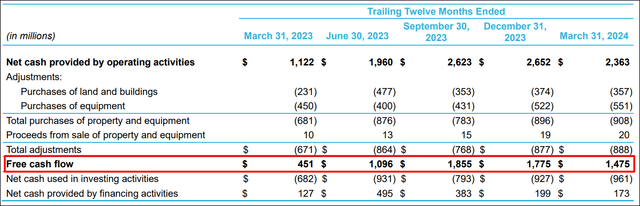

Coupang is widely free cash flow-profitable, which gives the e-Commerce platform firepower to acquire other companies, potentially also in the luxury goods market going forward. Coupang generated $1.5B in free cash flow in the March quarter (on a LTM basis) which meant that the company added a full $1.0B in FCF compared to the year-earlier measurement point. Coupang’s large free cash flow could either be invested in the organic growth of its marketplace offer, earnings-accretive acquisitions or stock buybacks, thereby creating a new catalyst for an upside move in Coupang’s shares.

Stable EBITDA margins

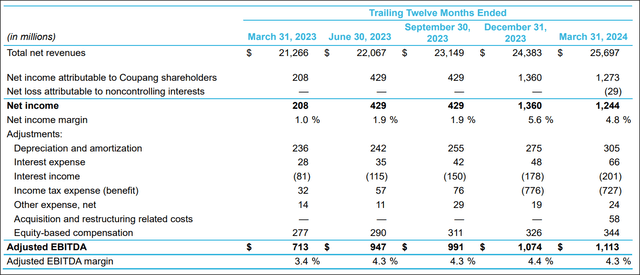

Coupang is growing its EBITDA and delivering fairly steady EBITDA margins in its core e-Commerce business. Coupang reported $1.11B in LTM adjusted EBITDA in Q1’24 — a key metric for companies that run e-Commerce businesses at scale — showing 56% growth year over year. Coupang’s EBITDA margin declined slightly on a Q/Q basis in Q1’24 (down 0.1 PP to 4.3%), but margins have been pretty stable in the last four quarters nonetheless.

Upcoming Q2 earnings release

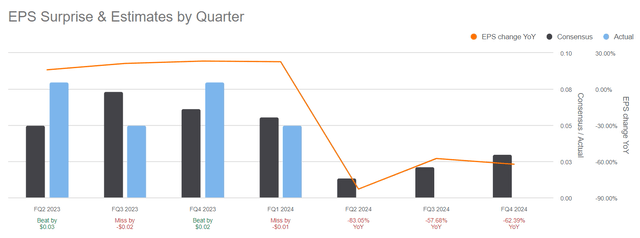

Coupang is expected to generate positive EPS of $0.01 per-share for its second fiscal quarter, according to SA-provided consensus estimates. Results are expected to be released in the first week of August. Coupang, however, is investing heavily in its growth and EPS figures are not the most important, in my opinion. Coupang will likely have seen continual top-line momentum in Q2 which I would expect to come in at 15-17% on a year-over-year basis. Coupang may also give a crucial update about the success of the business integration of Coupang, which could be a catalyst for an upside revaluation. I also project stable EBITDA margin of ~4.0% and a continual free cash flow upswing driven by growing e-Commerce volumes on Coupang’s platform.

Coupang’s valuation

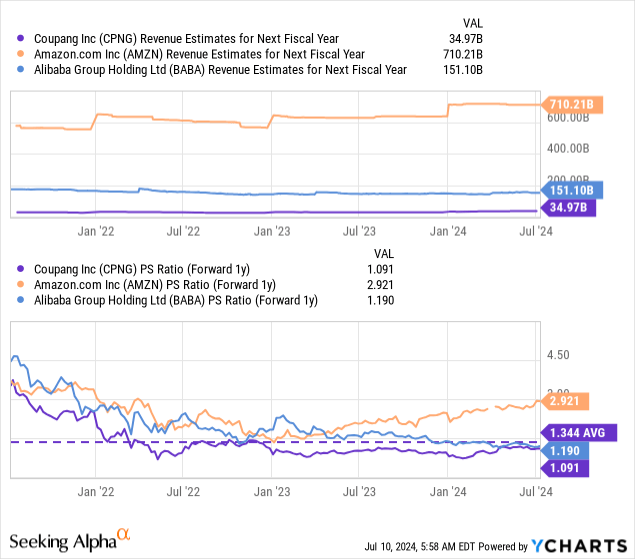

One of the single biggest selling propositions for Coupang is its low valuation based off of revenue. The e-Commerce platform is currently valued at a FY 2025 revenue multiplier of 1.1X, which is significantly below the company’s longer term (3-year) valuation average of 1.34X. Coupang is also cheaper, on a revenue basis, than Chinese company Alibaba (BABA) whose growth slowed to the single digits lately amid a slowdown in China’s economy. Alibaba, however, continues to represent excellent free cash flow value, and has a P/S ratio of only 1.2X. Alibaba is projected to grow, based off of consensus estimates, 7-8% in the next two years each while Coupang is expected to grow three times faster this year (+24%) and twice as fast (+16%) next year.

Amazon is much more highly valued based off of FY 2025 revenues than Coupang, at 2.9X, but this is in no small part due to Amazon’s revenues including significant contributions from its fast-growing Cloud business. The average P/S ratio of the industry group here is 1.7X.

In my opinion, Coupang could reasonably trade at a price-to-revenue ratio of 1.7X given its strong growth in customers and free cash flows, with incremental acquisition potential providing some fantasy for the e-Commerce company’s shares. A 1.7X P/S ratio implies a fair value of $33.28 which reflects 56% upside revaluation potential for Coupang.

Risks with Coupang

Coupang is focused chiefly on its e-Commerce operations, which makes the company a pro-cyclical bet that has strong potential for growth in a rising economy, but its key metrics are vulnerable to declines in case of a recession. What would also change my mind is if Coupang lost traction with its gross profit and free cash flow momentum. An absence of new acquisitions could further weigh on investor expectations and prevent a major share revaluation to the upside.

Closing thoughts

In my opinion, there is still a lot to like about Coupang as the e-Commerce platform is growing in all of its key metrics including net revenue, free cash flow, EBITDA, gross profits and customers. The e-Commerce firm is seeing progress, especially with its improving free cash flow profile as Coupang added $1.0B to its LTM FCF in Q1’24, compared to the year-earlier period. From a valuation point of view, I like Coupang a lot as I feel the company’s value proposition is stronger than the market is willing to recognize. With a P/S ratio of only 1.1X, Coupang is almost as cheap as Alibaba… which I see as widely undervalued. As a leading e-Commerce platform in South Korea, Coupang is a solid e-Commerce buy for investors that seek to participate in the long-term growth of the country’s commerce sector.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CPNG, AMZN, BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.