Summary:

- Coupang’s near-term prospects are promising, driven by its strategic focus on customer experience and innovative service offerings.

- The crown jewel of this thesis is the very rapid growth in its Development Offerings segment.

- With a solid balance sheet and a core business already generating significant EBITDA, Coupang, Inc. is undervalued.

Mirko Kuzmanovic/iStock Editorial via Getty Images

Investment Thesis

Coupang, Inc.’s (NYSE:CPNG) prospects continue to improve, but meanwhile the share price remains undervalued.

More specifically, this is an investment thesis that I very much like. Here’s the setup. You are asked to pay around 16x EBITDA for Coupang’s Core business. The Core business is OK. Nothing special.

But what makes this investment unique, is that its balance sheet has ample cash. Also, crucially, Coupang’s very fast-growing Development Offerings, which grew by 143% y/y excluding its Farfetch acquisition, are being afforded no value, and come for free.

All in all, I believe there are many ways to be rewarded here.

Rapid Recap

On the back of its previous quarter’s result, I said,

I find it utterly remarkable that despite Coupang consistently delivering such strong and consistent returns, the stock was priced once again near its all-time lows just earlier this month.

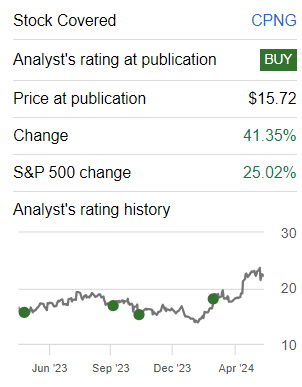

Author’s work on CPNG

CPNG is a stock that I’ve been bullish on for what feels like a lifetime. And for a really long time, I was proven wrong. And it felt disheartening to have been so early to the investment thesis. Indeed, I’ll often declare, that being early is the same as being wrong.

But now, at long last, my bull case appears to be gathering momentum. Here’s why.

Coupang’s Near-Term Prospects

Coupang’s near-term prospects appear promising, driven by a combination of strategic focus on customer experience and innovative service offerings.

The company’s relentless commitment to enhancing customer satisfaction and expanding its reach within Korea and Taiwan’s retail markets positions it for continued growth. Key initiatives like Rocket Fresh and Fulfillment and Logistics by Coupang are gaining momentum, allowing the company to offer a wider selection for customers and provide critical support to SMEs by leveraging its infrastructure and network.

Moreover, Coupang’s acquisition of Farfetch and its subsequent integration into Developing Offerings signal opportunities for further diversification and expansion. While the short-term focus remains on stabilizing Farfetch operations and achieving positive adjusted EBITDA, for now, Farfetch is causing a significant drag on Coupang’s EBITDA profitability.

Given this background, let’s now discuss its fundamentals.

Revenue Growth Rates Require Interpretation

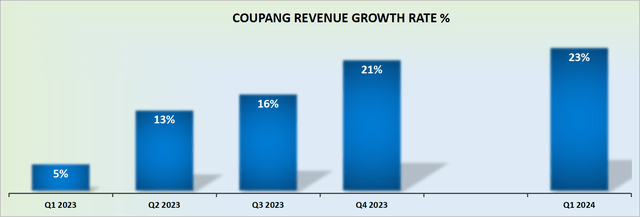

Coupang’s Q1 2024 revenue were up 23% y/y. That’s terrific. Simply great, right?

Well, here’s the problem. The market doesn’t care about the results already reported. The only thing the market cares about are the expectations of its future prospects.

And on that note, Coupang’s organic revenue growth for the remainder of 2024 is likely to moderate to around 15% CAGR. But is that such a problem?

I don’t believe it is. After all, Coupang’s share price has gone practically nowhere in the past couple of years. Essentially, I believe investors have well and truly capitulated on this name and moved on.

But there’s still more to this investment thesis at play.

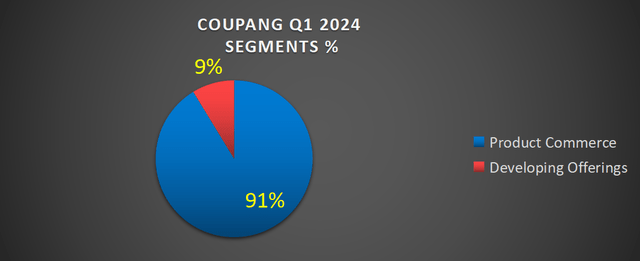

What you see above, is that nearly 10% of Coupang’s revenues come from its superfast growth, Developing Offerings segment.

Moreover, according to my very rough estimates, if this segment were to slow down its revenue growth rates from the 143% y/y revenue growth rates reported in Q1 2024 to approximately 90% to 100% y/y revenue growth rates in the coming twelve months, this segment’s revenue could reach approximately 15% of its total revenues.

And if that were to take place, all of a sudden, this thesis would become rather interesting. Particularly given that its underlying core business is already highly profitable.

Given this context, let’s now delve into its valuation.

CPNG Stock Valuation — 16x Forward EBITDA

This is an excerpt of what I wrote about Coupang last time,

[…] what’s even more confounding is that Coupang’s market cap is made up of nearly 20% net cash, and it’s already amply profitable. And yet, investors have wanted nothing to do with the South Korean e-commerce company.

However, I reaffirm that I’m highly bullish on Coupang, as I strongly believe that paying approximately 14x forward EBITDA for its core business is a remarkably compelling bargain price.

Since I penned those words above, CPNG’s share price has increased slightly. Nevertheless, I maintain that CPNG’s core business is most likely on a path toward $2.5 billion of EBITDA at some point in the next twelve months.

This puts its underlying business priced at 16x forward EBITDA. And then, moreover, there are two further aspects that meaningfully support my bull case.

Firstly, CPNG holds about $3.7 billion of net cash, which for a business that its core business is already printing more than $2 billion of EBITDA per year, is ample cash on its balance sheet.

Secondly, paying 16x forward EBITDA for CPNG throws in its Developing Offerings segment for free. Presently, its Developing Offerings segment is unprofitable. However, we must keep in mind that it’s not being operated today with a view towards maximizing its profitability.

The Bottom Line

In conclusion, Coupang is undervalued.

The integration of Farfetch and the very strong growth of its Developing Offerings segment is being given no value in the market.

With a solid balance sheet and a core business already generating significant EBITDA, Coupang’s core business, priced at 16x forward EBITDA, appears to be an attractive bargain, especially considering the potential upside from its Developing Offerings segment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.