Summary:

- Coupang’s stock has underperformed since its IPO, but consistent revenue growth, margin expansion, and GAAP profitability since early 2023 make it a compelling buy now.

- Emerging opportunities include Coupang Eats, Taiwan expansion, Coupang Play, and Fulfillment and Logistics by Coupang (FLC), all contributing to revenue growth and diversification.

- Coupang Eats benefits from lower customer acquisition costs due to the adoption from its extensive e-commerce network.

- Risks include the potential failure of growth strategies and challenges in Taiwan and the Farfetch acquisition, but the overall outlook remains positive.

Michael Vi

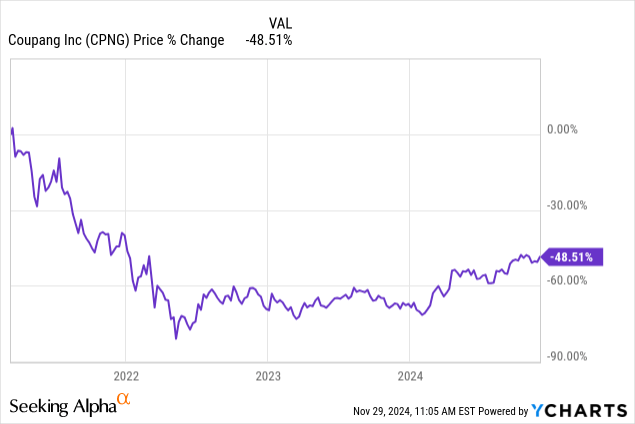

Anyone who purchased Coupang (NYSE:CPNG) near the time of its Initial Public Offering (“IPO”) on March 10, 2021 has likely been highly disappointed in the stock’s performance and regretted the day they bought it. The stock is down nearly 50% since the IPO.

Despite the rough start, there are reasons for investors to purchase the stock today. Coupang has consistently produced above 20% year-over-year revenue growth since the third quarter of 2023. Its focus on operational efficiency and increasing scale has helped the company achieve margin expansion and GAAP profitability on a trailing 12-month (“TTM”) basis since the beginning of 2023. The company has added several emerging opportunities with significant revenue and earnings growth potential that should diversify its business.

This article will discuss Coupang’s emerging opportunities and third quarter 2024 earnings report. It will also examine a few risks, valuation, and why the stock is a buy.

Emerging opportunities

1. Eats

Coupang Eats is a Korean food delivery service similar to DoorDash (DASH) and Uber (UBER) Eats. I was initially dubious about the company’s food delivery business. After all, several years ago, some investors thought food delivery services had an unsustainable business model. However, DoorDash’s latest results indicate food delivery may be a viable long-term business. The U.S.-based food delivery service has recently expanded its margins over the last several quarters and posted its first quarter of net income profitability in four years. The stock of DoorDash has risen significantly over the previous several months as investors realized that food delivery has the potential for profitability in the long term for companies adept at scaling businesses and achieving operational efficiency. Eats hopes to produce similar results.

Chief Executive Officer (“CEO”) Bom Kim said the following about Eats on its fourth quarter 2023 earnings call:

As we see one-time investments such as new merchant acquisition promotions expire, we expect Eats’s positive underlying unit economics along with scale to drive cash generation in the future. What is equally exciting is the positive externalities we’ve seen in customer engagement across our products and offerings.

The above commentary suggests that once its promotions to jump-start Eats expire, the company will eventually generate cash and profitability as the food delivery operation grows and spreads the cost of operating Eats over a more extensive customer base. CEO Kim also notes that Eats helps customers engage with the brand and boost the usage of its other offerings.

Coupang has a potential advantage over DoorDash in terms of customer acquisition costs because it has an existing customer base from its e-commerce business that it can plug into its food delivery business. South Korean demographics are also highly favorable toward food delivery. Statista predicts that by the end of 2024, the online South Korean food delivery market will reach $38.82 billion and grow at a compound annual growth rate (“CAGR”) of 5.05% to reach $49.67 billion by 2029. If Coupang can successfully drive its Eats business to profitability, it can diversify its revenue streams and build more robust engagement with its brand.

2. Taiwan

Coupang started test operations internationally in 2021, starting with Singapore, Japan, and Taiwan. Management likely decided to test the above markets with its e-commerce platform because they are very similar to South Korea, which has a rapidly growing e-commerce market with a tech-savvy population. The Japan test did not go well, and the company concluded that it would be unable to gain much traction in the Japanese market against the dominance of Rakuten and Amazon (AMZN). The company has pulled out of Japan in March 2023. It is still in Singapore, but has prioritized growth in Taiwan.

Coupang launched its Rocket delivery service in Taiwan in 2022, and it’s a hit. CEO Bom Kim said on the company’s fourth quarter 2023 earnings call:

Another incremental investment that is proving its potential on growth, scale, and impact is Taiwan. We’re excited about the opportunity to challenge tradeoffs and WOW customers in a geography with an attractive retail market. Since launching Rocket in October of 2022, Taiwan’s customers and revenues have continued to compound at an incredible rate, more than doubling over the last two quarters alone. It’s a pace of adoption and growth that exceeds what we experienced in Korea over the same period of time after the launch of Rocket. In Taiwan, we’re able to leverage the advanced technology, learnings, and processes, among other assets, that we’ve developed over many years. We expect that to enable us to reach profitability in Taiwan faster than we did in Korea. Many of our incremental investments benefit from our already strong customer cohort behavior.

When CEO Kim discusses WOW customers, it refers to a subscription service equivalent to Amazon Prime. WOW provides customers with free shipping and returns, along with several other benefits. If WOW similarly benefits Coupang to the way Prime benefits Amazon, WOW members will be much more valuable than non-members. Statista states that between 2015 and 2019, “Prime members spend an average of 1,400 U.S. dollars on the online shopping platform every year, compared to 600 U.S. dollars spending of non-Prime members.”

Coupang brought a similar WOW loyalty program to Taiwan, so it likely expects the country to be a significant growth engine. Taiwan may become as big a market for the company as its home South Korean market.

3. Play

The company launched Coupang Play, a South Korean subscription-based video streaming service similar to Amazon’s Prime Video, in December 2020. It’s one of the fastest-growing streaming services in the company’s home market. Maeil Business Newspaper states:

Online video service (OTT) Coupang Play is fast chasing Netflix, the No. 1 market leader. As it attracted a large number of users through live broadcasts of popular sports such as U.S. professional baseball, the modifier “Coupang Play = Sports Restaurant” was added. With the gap in the number of users between the two platforms narrowing to the lowest ever, it is expected that Coupang Play will be able to cross the giant Netflix mountain in the future.

Coupang Play is part of the company’s services with WOW, making the subscription far more valuable for users.

4. Fulfillment and Logistics by Coupang (“FLC”)

FLC is a service that manages inventories, storage, and deliveries for third-party retailers, primarily small and medium-sized businesses lacking the resources to invest heavily in warehouses, delivery vehicles, and technology systems to run a reliable and speedy logistic service. FLC can deliver packages for most orders within 24 hours using its Rocket Delivery service. FLC is similar to Amazon’s Fulfillment by Amazon (FBA). Chief Executive Officer Bom Kim said about FLC on the company’s third quarter 2024 earnings call:

We continue to see impressive momentum in our FLC offering, which also expands the selection that customers can enjoy with free Rocket Delivery. Our growth in units, sellers, and overall volumes in FLC continued this quarter at the strong pace we’ve seen throughout the year, each of them growing over 130% year-over-year. FLC is also in the early stages of its growth trajectory, and we believe it will be a significant part of our growth story for years to come.

In 2023, Coupang was the number one e-commerce player in South Korea, with a 49.4% market share. The two and three other e-commerce players are Naver, at 27.6% market share, and GMARKET, at 7.0% market share, respectively. Unlike Coupang, which directly operates its logistics, Naver and GMARKET rely on third-party providers such as CJ Logistics. Although CJ Logistics is a quality logistics provider, Coupang’s direct control over its logistics may give it quicker processing times, better delivery speed, more consistency and reliability, and better customer satisfaction. Naver and GMARKET could find it challenging to gain market share against Coupang’s FLC and Rocket Delivery competitive advantages.

4. Coupang’s Farfetch acquisition

Coupang acquired global online luxury company Farfetch Holdings on January 31, 2024, for $500 million. Although Farfetch generated around $4 billion in Gross Merchandise Volume (“GMV”) at the time of purchase, it was in danger of bankruptcy without a capital infusion. CEO Bom Kim said the following about the acquisition on the fourth quarter 2023 earnings call:

A note about Farfetch. While we weren’t seeking an acquisition we came across a rare opportunity to buy a sector leading service with $4 billion in GMV for a $500 million investment. We hope in a few years we’ll be having the conversation about how Coupang turned Farfetch into a business that transformed the customer experience around luxury fashion, while also providing strategic value for Coupang. It’s too early for that conversation today. Even if that full potential is not fully realized we’re highly confident that this will prove to be a prudent financial decision. We’re already executing on a plan to make Farfetch self-funding with no additional investment beyond the announced capital commitment.

Management is taking a calculated risk here. Investors hope that the deal’s potential upside, which includes Farfetch gaining market share, generating more revenue, and improving profitability under Coupang’s management, offsets several potential downside scenarios, including possible integration challenges. Even if this deal fails to work out, Coupang has a solid enough financial position to handle the potential fallout.

So far, Farfetch has made significant progress under Coupang. CEO Kim indicated on the company’s third-quarter 2024 earnings call that Farfetch has already come close to achieving breakeven, which is management’s goal by the end of 2024.

5. Advertising

Coupang closely studies what works for other e-commerce websites worldwide, and Amazon and MercadoLibre’s (MELI) success in advertising has not gone unnoticed. Coupang is in the early stages of replicating those companies’ advertising successes by developing various advertising tools and services for advertisers. Currently, the company has the following ad types:

- AI (Artificial Intelligence) smart ads

- Sales optimization ads

- Manual bidding ads

The company explains AI Smart ads on its website as follows: “AI Smart Ads analyzes Coupang customer’s demand in real-time, and among the range of products you offer, it picks the best product that many customers are looking for in Coupang, automatically advertises that product, and discovers new products with growth potential.” It describes sales optimization ads: “With the target ratio of the ad revenue (ROAS) Sales Optimization Ad, you can expect stable sales growth. There is no need to think about keywords and bids—just enter the ROAS. The Coupang algorithm automatically optimizes ads so that you can expect efficient campaign operation and sales growth.” Manual bidding ads are where the advertiser bids on keywords.

Out of all the above growth drivers, advertising might be at the earliest stage, considering management talks the least about it on earnings calls.

Company fundamentals

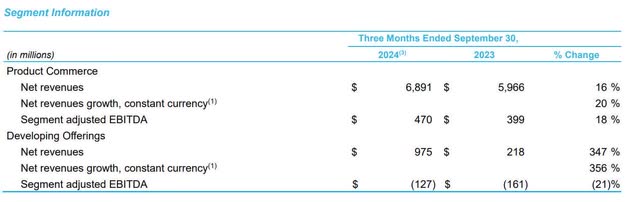

Although overall retail spending in Korea remained stagnant in the third quarter of 2024, the Product Commerce segment, essentially its e-commerce business, grew foreign exchange-neutral (“FXN”) revenue by 20% over the previous year’s comparable quarter.

Developing Offerings are what I referred to as Emerging Opportunities in the prior section of this article. The table below shows that Developing Offerings grew FXN revenue by 356%. However, although it is growing revenue faster, the segment is currently unprofitable at a negative $127 million adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Chief Financial Officer (“CFO”) Gaurav Anand said on the third quarter 2024 earnings call, “We remain confident about the potential for each of the initiatives within Developing Offerings, as demonstrated by the consistent momentum and strong customer response we have seen throughout the year.”

Coupang Third Quarter 2024 Earnings Release.

Product Commerce segment’s adjusted EBITDA margin expanded from 6.68% in the third quarter of 2023 to 6.82% in the same quarter in 2024. Developing Offerings segment’s adjusted EBITDA margin expanded from -73.85% in the third quarter of 2023 to -13% in the same quarter in 2024.

CFO Anand said on the third quarter earnings call:

Net revenues per Product Commerce Active customers grew 4% year-over-year in Q3 or 8% in constant currency. This was impacted by the short-term dilution from newer active customers that historically have lower spend levels in their early quarters. And as Bom noted earlier, we continue to see the spend levels of all our cohorts increase, even our oldest and highest spending cohorts.

The above quote means customers spent 4% more on average than the previous year, or 8% more in constant currency. He explained that new customers often spend less in their early stages, slightly diluting the overall average spending per active customer. However, as customers use the platform more, they spend more overtime.

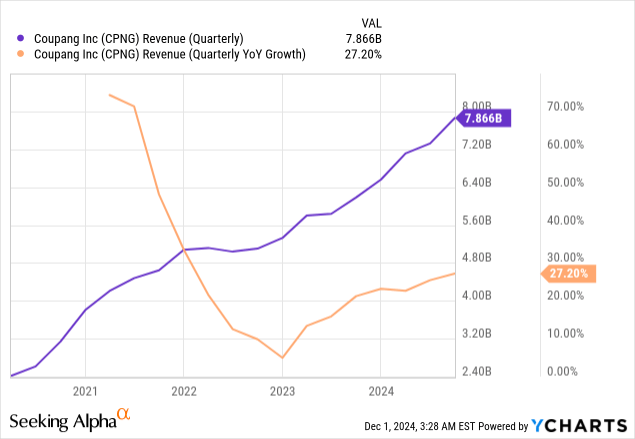

Coupang’s revenue grew 27.20% year-over-year (excluding the Farfetch acquisition, growth was 20%) to $7.86 billion, beating analysts’ estimates by $110.68 million. Its FXN revenue growth was up 32% over the previous year’s comparable quarter (excluding the Farfetch acquisition, FXN revenue growth was 25%)

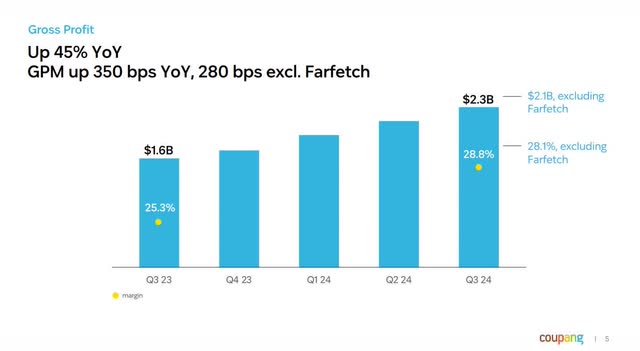

The following shows that Coupang’s gross profit grew around 44% year over year to $2.3 billion. When gross profits grow faster than revenue, an investment becomes more attractive to investors. The company considers gross profit growth a vital indicator. On the earnings call, CFO Anand pointed out the following: “I would also like to emphasize the importance of growth in gross profit as a primary indicator of our overall underlying growth, given the evolving mix of various offerings, services, and channels within our business.”

Coupang Third Quarter 2024 Investor Presentation.

The Product Commerce segment’s gross profit grew 28% to $2.1 billion, compared to the previous year’s comparable quarter. The segment’s gross margins rose 280 basis points to 30%. CFO Anand highlighted the reasons behind the margin expansion: “We continue to see benefits from increased efficiencies across operations, including benefits from greater utilization of automation and technology, further supply chain optimization, and the scaling of margin accretive offerings.”

Coupang Third Quarter 2024 Investor Presentation.

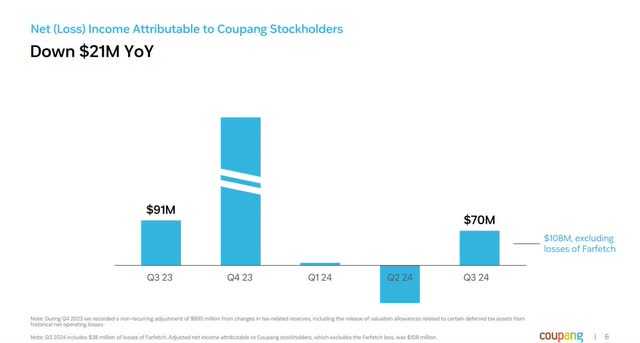

Net income attributable to Coupang shareholders, excluding Farfetch, was around $108 million in the third quarter of 2024, and diluted earnings per share were $0.06, beating analysts’ estimates by $0.05.

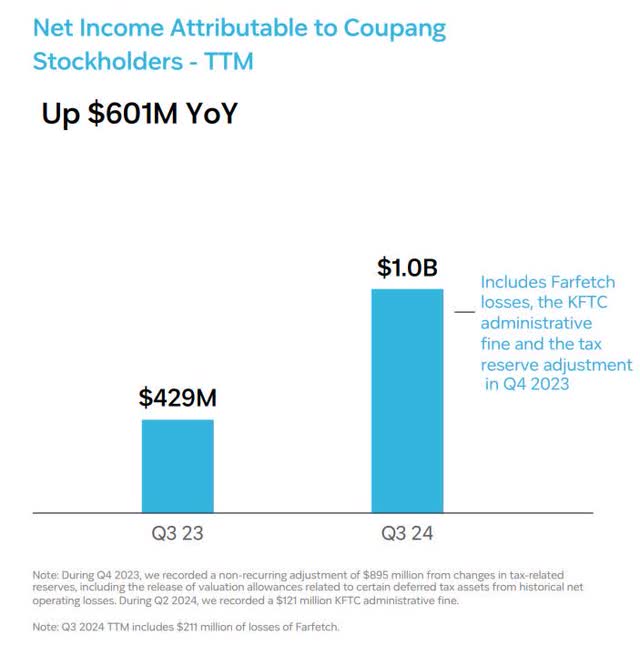

Coupang’s trailing 12-month (“TTM”) net income grew 140% year-over-year to $1.0 billion.

Coupang Third Quarter 2024 Investor Presentation.

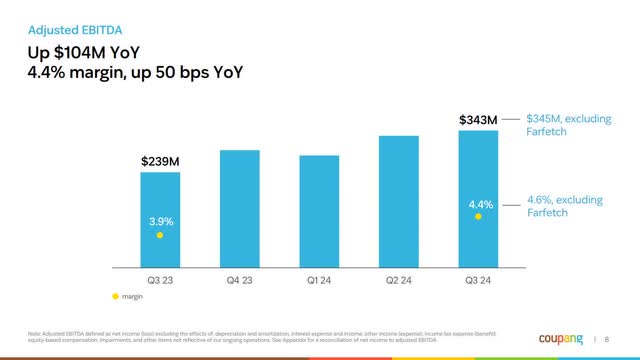

The company’s third-quarter adjusted EBITDA, which is its core operating profits, rose 43.5% to $343 million for an adjusted EBITDA margin of 4.4%. CFO Anand said on the earnings call, “We continue to be confident in our ability to consistently deliver expanding consolidated margins on an annual basis going forward.”

Coupang Third Quarter 2024 Investor Presentation.

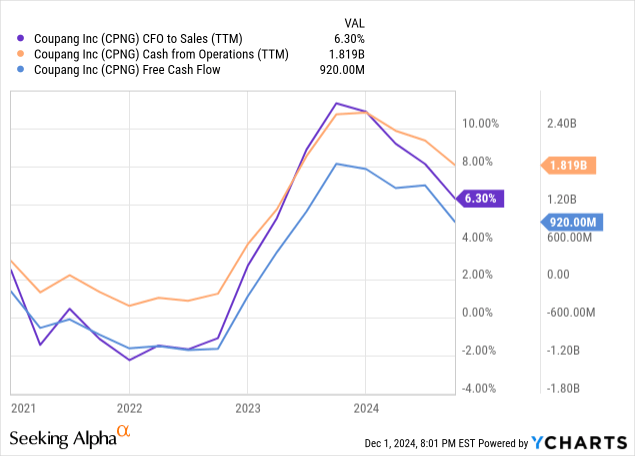

Coupang’s TTM cash flow from operations (“CFO”) to sales dropped from over 10% at the beginning of 2024 to 6.30% at the end of the third quarter. As a result, its TTM CFO dropped from $2.65 billion at the start of the year to $1.81 billion in the third quarter. The company generated $935 million of TTM free cash flow (“FCF”), a drop of $578 million TTM FCF sequentially.

CFO Anand said the following about FCF:

There is no structural change in our free cash flow generation and this variance is driven primarily by certain nonrecurring working capital benefits that we previously communicated were in the prior trailing 12-month period as well as the timing of significant capital expenditure payments. The majority of the increase in CapEx relates to infrastructure investments that we are making in Korea, which creates some unevenness in the timing and levels of spend. We are exploring strategies to reduce the capital intensity of our real estate operations while also maintaining operational control over these strategic assets.

At the end of the third quarter of 2024, the company had $5.822 billion in cash and equivalents and $1.194 billion in long-term debt.

Valuation

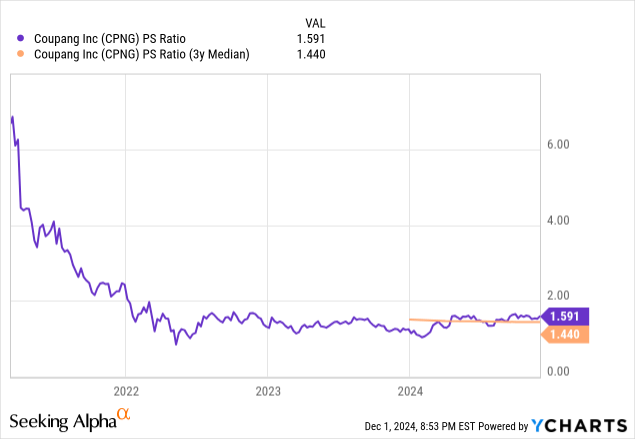

Coupang’s price-to-sales (P/S) ratio is 1.591, slightly above its three-year median.

The following table compares the one-year forward P/S of several publicly traded global e-commerce companies with similar market caps. The market uses a one-year forward P/S to compare a company’s current market cap to its estimated sales for one year forward, while also considering its potential profitability. This comparison shows that the market expects Coupang to translate more of its topline growth into earnings growth than its peers. It has the third-highest expected revenue growth rate at 17.27% and the highest expected EPS growth rate at 514%. The growth rate comparison suggests that Coupang’s valuation should exceed eBay’s (EBAY). What’s not shown in the table is that eBay has a much higher existing profit margin. eBay’s profit margin is 19.68%, and Coupang’s is 3.57%. The market may value eBay higher because of its longer track record, lower perceived risk level, and higher current profitability. Still, Coupang should have a slightly higher valuation. Suppose Coupang sold at a one-year forward P/S ratio of 2.0; its stock price would be $39.63, a 56% rise above the November 29 closing price of $25.36.

| Company name | Market Cap | One-year forward P/S ratio | One-year forward sales growth | One-year forward EPS growth rate |

| MercadoLibre | $100.64 billion | 3.98 | 22.37% | 37.42% |

| Sea Limited (SE) | $65.36 | 3.34 | 18.29% | 89.24% |

| JD.com (JD) | $54.18 | 0.33 | 5.59% | 8.57% |

| Coupang | $45.62 | 1.28 | 17.27% | 514.76% |

| eBay | 30.32 | 2.86 | 3.21% | 7.59% |

| Vipshop (VIPS) | 7.08 | 0.47 | 1.03% | 5.64% |

| Wayfair (W) | 5.791 | 0.55 | 2.67% | 108.06% |

Coupang’s one-year forward price/earnings-to-growth (“PEG”) ratio is 0.097 (One-year forward price-to-earnings ratio of 50.04 divided by analysts’ one-year forward estimated EPS growth rate of 514.76%). Usually, the market will allow a growth stock like Coupang to rise to at least 2.0 before considering it overvalued. Suppose the stock traded at only a one-year forward PEG ratio of 1.0; the stock price would be $262.52, up 936% over the November 29 closing price of $25.34. While I am unsure about the stock appreciating 900% over a short period, the market is likely undervaluing the company’s EPS growth potential.

Seeking Alpha

Usually, I would give the stock an FCF-based valuation here. However, I would like to see it produce more historical FCF history before valuing it using FCF margin, price-to-FCF, or a reverse DCF. Management currently focuses on maximizing revenue growth by investing heavily in infrastructure, technology, and customer acquisition instead of maximizing FCF.

Risks

Some of Coupang’s growth strategies may fail to pay off. For instance, Farfetch and the Taiwan e-commerce business may fail to become profitable, driving down the company’s consolidated profit margin and EPS growth rates. Although management is moving towards a breakeven with Farfetch, sustainable profitability is uncertain. After all, luxury e-commerce has yet to recover from a significant collapse, and in the long term, the business may not be viable.

Coupang’s Taiwanese e-commerce business faces significant competition. Companies like Sea Limited’s (SE) Shopee, PChome, Momo, and Ruten dominate the country’s market share. Management will likely have to invest significantly in the market without certainty that the investment will pay off. Taiwan also has substantial geopolitical risk; possible military invasion across the Taiwan Strait from mainland China obscures the island nation’s e-commerce upside. If a war breaks out in the region, the possibility that Coupang could lose its entire investment in its Taiwanese business is high.

Although the company’s one-year forward PEG ratio suggests a high upside, Coupang’s valuation may be low because the market heavily discounts the risk that the EPS growth may fail to show up. If you invest in this stock, understand that the market may continue valuing it at a lower relative valuation than e-commerce platforms in less risky situations.

Coupang is a buy

Despite the downside risks, Coupang’s strong brand, logistics capabilities, and focus on customer experience could differentiate it from competitors in all the markets in which it operates. Aggressive growth investors should consider adding a few shares before the market recognizes the company’s potential upside. I rate Coupang a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CPNG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.