Summary:

- Coupang is an e-commerce company with strong growth in active customers and revenue, primarily operating in South Korea.

- The company offers a diverse product portfolio, including Rocket Delivery, Quick Commerce, Rocket Fresh, Coupang Eats, Coupang Play, and Coupang Pay.

- Coupang’s acquisition of Farfetch is expected to drive revenue synergies and expand its presence in the luxury fashion industry.

Sundry Photography

Thesis

Coupang, Inc. (NYSE:CPNG) was incorporated in 2010 and is an e-commerce company headquartered in Seattle, WA. CPNG’s IPO date was March 11, 2021, and it began trading at $63.50 per stock, giving CPNG a market cap of $102.2. As of April 3, 2024, the stock price was $18.56 and is down over 70% from all-time highs, mainly attributed to high losses and low margins. But, I think things are changing. With strong year-over-year active customer growth, CPNG’s revenue has doubled, and, in 2023, the company reported positive operating margins for the first time. Overall. I see CPNG positioned for continued growth as the company heavily invests in its long-term strategic growth, incorporating its logistics infrastructure investments and its recent 2024 acquisition of Farfetch, which I believe will further drive profits moving forward.

Google Finance

Product Portfolio

CPNG’s product portfolio is comprised of six product offerings, which are Rocket Delivery, Quick Commerce, Rocket Fresh, Coupang Eats, Coupang Play and Coupang Pay. These product offerings seamlessly integrate into one platform to create a unique consumer experience.

Rocket Delivery

Coupang has invested billions of dollars into its logistics infrastructure to provide 99% of orders to be delivered within a day. Since launching Rocket Delivery in 2014, Coupang has also included dawn and same-day delivery. This specifies orders placed at midnight to be received at 7 AM the next day, or in the morning to receive it that very day.

Quick Commerce

After introducing Rocket Delivery, Coupang invested in its delivery value chain to introduce Quick Commerce. Quick Commerce delivers customer’s orders to their doorstep within minutes. This ultra-fast delivery infrastructure permits customers to procure essentials quickly and has greatly benefitted from the COVID-19 pandemic.

Rocket Fresh

Rocket Fresh became South Korea’s largest online grocer and its coverage spans all the consumer’s grocery needs. The product utilizes Coupang’s Rocket Delivery network and cold-chain logistics technology to freshly ship orders directly to customers in a few hours. Customers have fresh fruit, vegetables, meat, and thousands of other items available through their user-friendly online platform.

Coupang Eats

Coupang Eats is an online food delivery service with a variety of restaurants customers can choose from. It supports thousands of restaurant owners from large corporations to small businesses. It is another product that emphasizes Coupang’s trademark convenience.

Coupang Play

Coupang play has been Korea’s fastest-growing OTT player over the last two years. It allows customers to stream and live-stream exclusive sports and events to the latest movies, news, and Coupang original series. It hosts content from South Korea, the U.S., and beyond, which provides content everyone can enjoy.

Coupang Pay

Coupang Pay is Coupang’s new fintech that provides fast and seamless payments across all Coupang products.

Merchant Products

Alongside the retail product offerings mentioned above, Coupang offers merchants to engage with their platform. Merchants can sell their own products through Coupang’s e-commerce, food delivery, and advertising channels.

Keeping Competitors Out

End-to-End Logistics Infrastructure

I believe Coupang’s core competitive advantage is its end-to-end logistics, which includes last-mile delivery. Unlike Amazon, Coupang focused on its consumer experience and invested billions into its end-to-end logistics infrastructure, which includes AI and custom robotics, to strengthen its competitive advantage for the last 14 years. As of 2022, Coupang had over 1,362 patents for its technology-enabled supply chain, which controls all operations, fulfillment, and logistics capacity.

The company’s logistics capabilities are exemplified through its Rocket Delivery and Quick Commerce delivery. I view its supply chain to be difficult to replicate as the initial, maintenance, and growth capital expenditures rely on billions of invested dollars into automobiles, warehouses, human capital, and research and development. If a competitor succeeds in overcoming the capital expenditure and build time associated with Coupang’s logistics infrastructure, there are still many operational and logistical planning challenges that will affect the product offering.

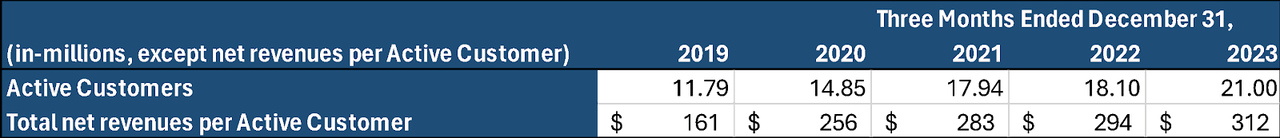

Rocket Delivery and Quick Commerce are the differentiating factors between Coupang and its e-commerce competitors. I believe this is proven by Coupang’s continued active customer and revenue growth Q/Q and YoY since inception. Coupang’s revenue grew by 90.48%, 53.38%, 11.83%, and 18.46% in 2020, 2021, 2022, and 2023 respectively. Coupang’s end-to-end logistics infrastructure remains to provide a product offering its competitors cannot provide as evidenced in the table below.

The table reveals that Coupang’s active customer base is growing year over year while their net revenues per active customer are growing as well. I believe this proves Coupang’s end-to-end logistics infrastructure is a competitive advantage, providing unparalleled customer satisfaction with low customer churn, and is a core component of Coupang’s brand, which will drive growth into the future.

Catalyst

Coupang Acquires Farfetch Holdings for $500 Million

The global personal luxury and goods segment is projected to generate a revenue of $368.90 billion in 2024. This sector is anticipated to grow at an annual rate of 3.22% (CAGR 2024 – 2028). It is projected that online sales will account for 15.4% of this market by 2024, supported by the trend of online sales increasing and retail sales decreasing for the last 6 years. What’s more? South Korea spent almost $17 billion on luxury goods just at the start of 2023, providing a massive window of opportunity for Coupang.

In addition to the future CAGR of this sector strengthening Coupang’s revenue streams, the Asian Pacific market has the strongest demand for personal luxury and goods. In 2022, the Asia Pacific market stood at $109.42 billion. Specifically, South Korea has the world’s highest per-capita spending on personal luxury goods, which is growing rapidly. This vertical, within the sector, is also projected to experience rapid growth due to the region’s increasing middle-class population. Overall, according to Coupang’s 4Q23 presentation, South Korea’s commerce market has a total CAGR of 4%. South Korea’s commerce market is expected to grow from $483 billion to $563 billion between 2023 – 2027 respectively.

So, I view the acquisition of Farfetch, by Coupang, to be a significant catalyst for revenue synergies that will drive competitive advantage. Coupang announced the completed acquisition of Farfetch Holding’s business and its assets on January 31, 2024. Farfetch Holdings is a leading global marketplace for the luxury fashion industry with sustained YoY revenue growth. I believe this acquisition will add substantial amounts to Coupang’s net revenue. If I break down the deal, Farfetch will benefit from the acquisition due to an injection of $500 million, access to Coupang’s innovative logistics infrastructure, and integration into South Korea’s market. I think these synergies are inevitable to aid in Coupang’s positive long-term EPS, as it will further promote Coupang’s revenue growth and meet South Korean consumer’s demands.

Furthermore, Farfetch operates globally and much of its operations and revenues are received from the United States. Coupang can utilize Farfetch’s brand and reputation in the U.S. to expand its U.S. customer segment aggressively. Therefore, this acquisition will streamline Coupang’s product offering, take advantage of growing online sales, meet consumer’s demands, and add another product line to compete effectively against competitors.

I believe Coupang’s Farfetch acquisition is also foreshadowed by history. Prior mergers and acquisitions, within the commerce industry, have targeted the expansion of online channels and products to penetrate markets and boost sales. In 2023, Shein acquired a third of Forever 21’s operations, Sparc Group, and Sparc took a minority stake in Shein for an undisclosed amount. I believe this strategic partnership underlined a few synergies that boosted revenues. Firstly, I view the merging of customer bases to have been beneficial as both share similar demographics. Then, both partners can realize a sales boost through sharing their supply chain and sales channel expertise. Shein is an expert in all things e-commerce and Forever 21 is an expert in retail. Forever 21’s retail market will also aid in Shein’s market presence in the United States. For these reasons, the strategic partnership between Shein and Forever 21 was successful. So, I believe Shein’s and Forever 21’s strategic partnership signs the success of Coupang’s acquisition of Farfetch. Both deals share similar synergies, as users will be merged, brand recognition will be utilized to penetrate both domestic markets, and supply chain integration will increase revenue and sales.

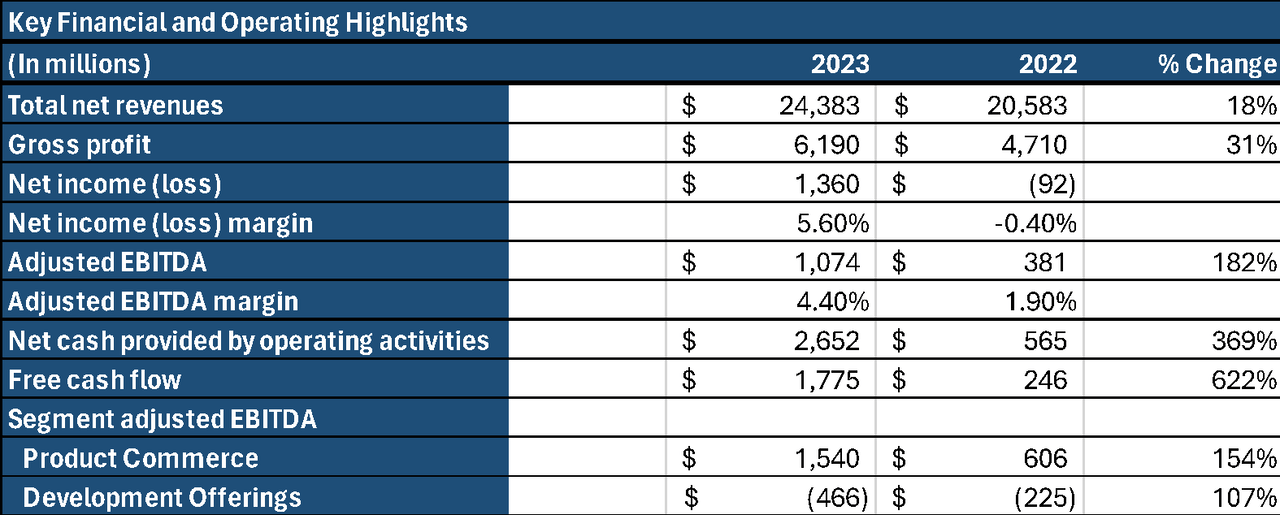

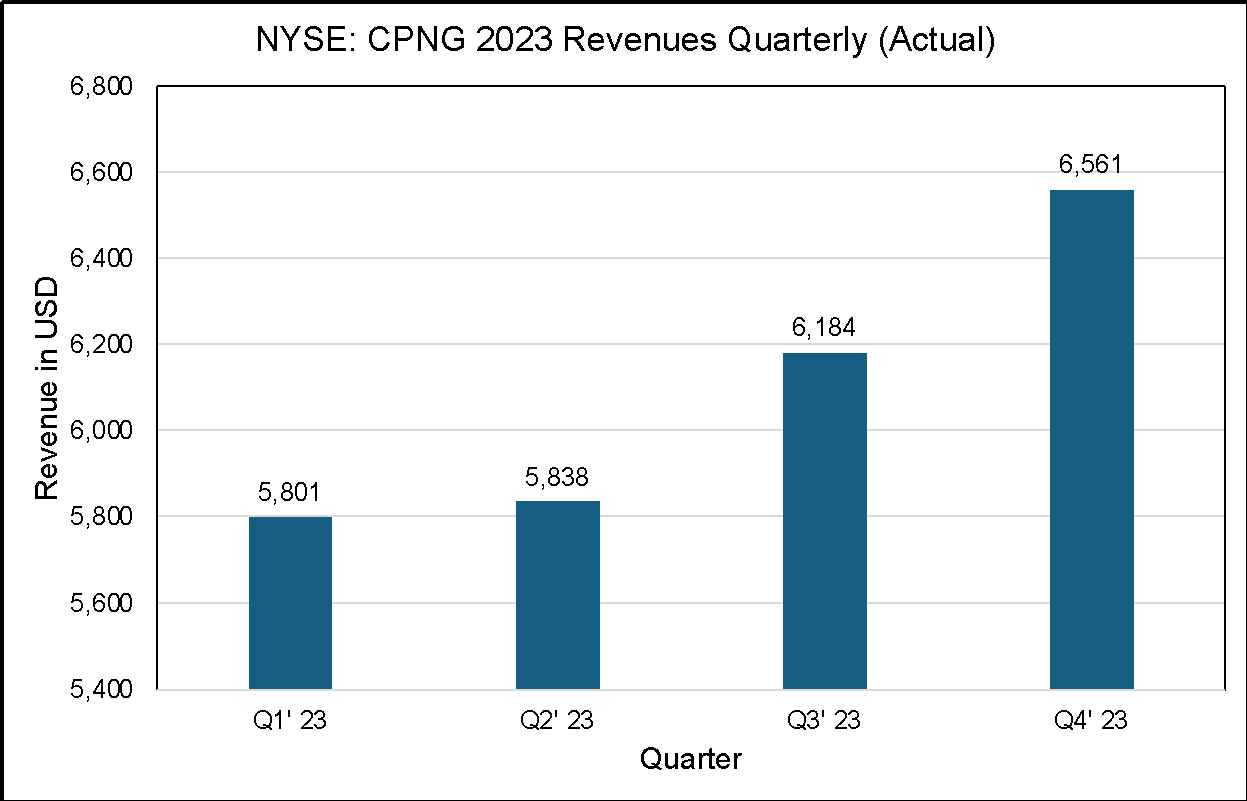

Financials

In Q4 2023, Coupang’s revenue reached $24.4 billion, a 18% YoY growth. In particular, Graph 3 shows Coupang posted Q/Q growth in 2023 with 13.4%, 15.9%, 21.2%, and 23.2% growth in Q1’23, Q2’23, Q3’23, and Q4’23 respectively. Additionally, Table 2 highlights their net income increased from negative $92 million to $1.4 billion in 2022 and 2023 respectively, which denotes a 5.6% net income margin in 2023. Moreover, the free cash flow was $246 million and $1.8 billion in 2022 and 2023 respectively, which indicates a 622% YoY change. Their total debt to EBITDA ratio was 2.2x in 2023. Their balance sheet also denotes LTM average of 33.33 days for inventory to turn into sales versus Amazon’s 40.56 days. Furthermore, Coupang’s LTM return on equity is 41.7% versus eBay’s 48.1% and Amazon’s 17.5%. Overall, I believe Coupang has good financial health and is in a great position to compete.

Seeking Alpha

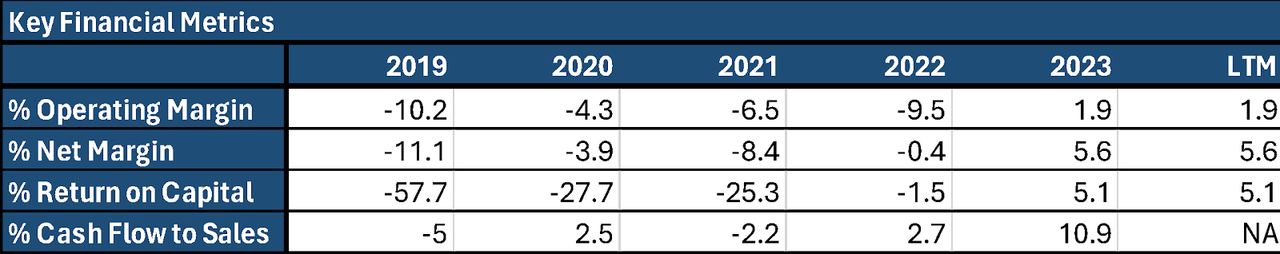

Over the past five years, Coupang invested heavily in its operational and logistics efficiencies to consistently increase its margins. The table below highlights the success of their long-term view, as Coupang’s net operating margins were -10.2% in 2019 and increased to 1.9% in 2023. This reflected an operating profit of $453 million for 2023 and five years ago that was a $1 billion loss. Additionally, the cost of sales benefited from highlighted efficiency improvements because its percentage of revenue decreased from 77.1% for 2022 to 74.6% for 2023.

Overall, I find Coupang’s financials very compelling as the company has continued to grow its active customer base, decrease customer churn, increase total net revenue per customer, increase net margins, and maintain a strong balance sheet with healthy debt levels.

Valuation

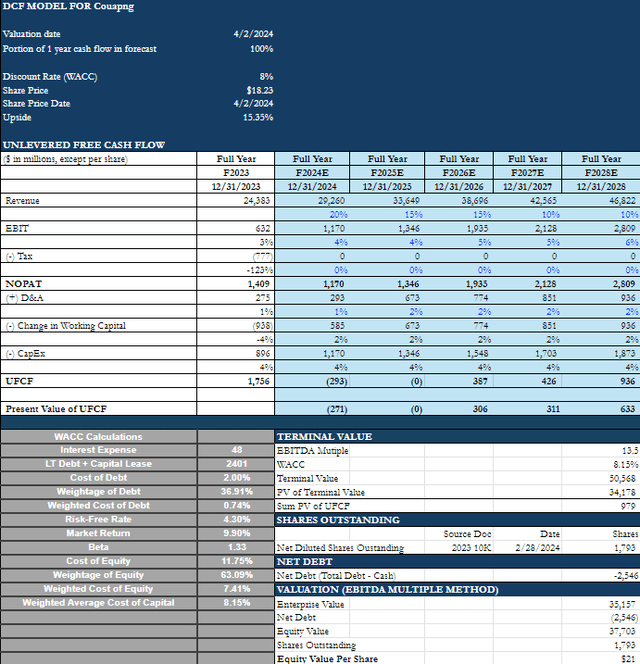

My Financial Growth Rate Projections

I used the DCF model to calculate Coupang’s intrinsic value. Therefore, I want to point out the main drivers of the DCF. Firstly, I justified the revenue growth rate through Coupang’s last 5-year average revenue growth rate of 43.71%. Although the South Korean e-commerce industry is expected to grow at a 4% CAGR, this is contrasted by Coupang’s largely growing user base, a recent reacceleration in revenue growth rebounding off of COVID, expansion into the Taiwanese market which saw 105% year-over-year growth, and the acquisition of Farfetch’s $2.32 billion revenues. Secondly, I justify the growth in EBIT margins due to Coupang’s last 5-year EBIT margins improving 1.26% year over year. Furthermore, Coupang’s SEC filings have stated their margins have been increasing due to growing expertise in operations management and supplier relationships. It is also important to note that the sector’s median EBIT margin is 7.61%.

My TEV / EBITDA and Equity Value Per Share Projection

I assumed an EBITDA multiple above the comparable companies’ TEV/EBITDA median of 10.0x. The comparable companies I used were Baidu (BIDU), eBay (EBAY), NAVER Corporation (OTCPK:NHNCF), Amazon (AMZN), Etsy (ETSY), JD.com (JD), and Alibaba (BABA) with TEV/EBITDA LTM of 4.9x, 10.0x, 12.9x, 22.4x, 19.9x, 20.4x, 5.2x, and 5.4x respectively. I decided Coupang deserves a higher multiple than the median due to its patented proprietary technology, which is its competitive advantage, and its higher revenue growth rate.

Then, I calculated the weighted average cost of capital (WACC) to be 7.91%. This is due to Coupang’s market equity value of $4.1 billion and the debt book value of $2.4 billion. Therefore, the debt weight is 36.91% and the equity weight is 63.09%. The 10-year treasury yield, as of 04/02/2024 is 4.354%, the market risk premium is 9.90%, and Coupang’s beta is 1.33. The tax rate was set at a standard 35%, which omits any DTAs or NOLs that can be carried forward. Finally, I calculated Coupang’s intrinsic value per share to be $21, representing a 31.65% undervaluation.

Risk

I believe there are two essential risks associated with Coupang’s forecast.

First, the e-commerce sector has competitors that have much larger total enterprise values and market share than Coupang. For example, Amazon has a total enterprise value of 1.849 trillion and has been a sector leader for many years. Companies like Amazon have the capital to invest and compete with Coupang’s innovative end-to-end logistics competitive advantage, which consists of billions of dollars invested into research and development, patents, artificial intelligence, robotics, automobiles, and human capital that allow Rocket Delivery and Quick Commerce to be a service. These competitors can also deploy capital to strengthen their competitive advantage in regions Coupang operates in., but this is mainly mitigated by Coupang’s pre-establishment and brand-name. It would be far more likely, in my opinion, that Amazon would buy out Coupang instead.

Second, the revenue synergies, from Farfetch’s acquisition, may not be realized in the immediate future. Primarily, the personal luxury goods revenues would strengthen Coupang in the United States and South Korea, but it may be a time-consuming and costly effort. Costs can also be sunk by integrating Farfetch into Coupang’s innovative end-to-end logistics supply chain.

Takeaways

The transition into online channels for retail commerce is a trend that is continually taking over the industry. Coupang has cornered a niche market in this segment by providing an innovative solution for consumer demand by creating an unparalleled end-to-end user experience. To maintain this competitive position, Coupang must continually extend its product offerings and product lines, exemplified through its acquisition of Farfetch, and continue increasing its net revenues per active customer. This will allow Coupang to create less customer churn and increase customer satisfaction. Accordingly, I believe Coupang has proven its business model and its ability to offer a unique customer experience leading me to give Coupang a Buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.