Summary:

- Credo Technology offers critical interconnect solutions for connecting GPUs produced by NVIDIA, enhancing performance and energy efficiency in data centers, making it a strong AI infrastructure player.

- Despite competition, Credo’s proprietary technology and nimbleness enable it to quickly adapt to market changes and customer needs, especially when it comes to balancing energy usage between power-hungry GPUs and power-constrained data centers.

- Credo’s strategic partnerships with major hyperscalers and involvement in the HiWire Consortium enhance its market position and growth potential in high-speed connectivity solutions.

- With a trailing non-GAAP P/E of 124x, Credo may appear overpriced relative to the IT sector, but, it is important to go beyond the academic dimension to justify a higher target.

- Also, with high expectations, come volatility risks for Credo, but with geopolitics likely to come to the fore in 2025, NVIDIA’s stock is likely to suffer more.

hh5800

While NVIDIA (NASDAQ:NVDA) produces the superfast chips needed to support GenAI, Credo Technology (NASDAQ:CRDO) plays a crucial role in ensuring that these are connected in data-intensive environments energy-efficiently.

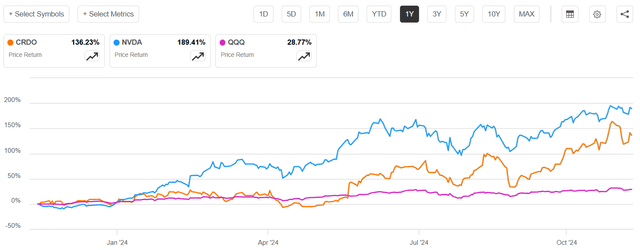

Still, investors have trusted the semiconductor giant more, explaining why its stock has outperformed Credo’s last year as shown below.

Nonetheless, having outperformed the Invesco QQQ Trust (QQQ) by more than 100%, Credo remains a key player in AI infrastructure, and this thesis aims to show it is now a better choice for those aiming to stay invested in the innovation theme while being shielded from bilateral trade-related risks likely to emerge in 2025.

I start by providing some insights into potential heat dissipation issues facing NVIDIA’s latest generation Blackwell GPUs (graphics processing units), an area where Credo’s interconnect solutions could gain traction as AI stretches the boundaries of data center power consumption.

NVIDIA May Face Risks in 2025 Because of Geopolitics

GPUs have been gaining rapid adoption in data centers since January last year due to their ability to support GenAI applications like ChatGPT while handling vast amounts of data. However, for all its supercomputing prowess, the Blackwell GPU could be prone to overheating in server racks packed with chips, according to a report by PC Mag.

Normally, in such cases, customers like Meta Platforms (META), Microsoft (MSFT), and xAI are requested to carry out design modifications for cooling at the data center level to address the problem. However, adjusting power delivery to reduce heat generation may come at the cost of performance, especially in light of Blackwell’s inference performance being touted as 30x faster than the previous Hopper generation. Now, Blackwell’s sales may be impacted depending on how data center operators adjust.

Shifting to geopolitics, NVIDIA’s recent market gains seem oblivious of tariffs likely to be imposed by President-elect Trump, potentially impacting its global supply chains including certain passive electronics components sourced from China. In this respect, there are already tariffs in the form of a 25% duty on items assembled in China like graphics cards and motherboards. Now, in case these are increased to 60% by the Trump Administration, it would significantly raise production costs, leading to higher prices for consumers and reduced sales volume.

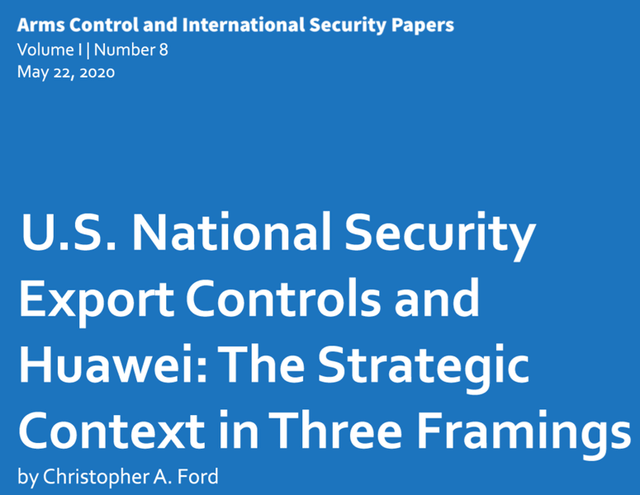

Coming to cutting-edge chips, NVIDIA’s H100 had not yet been developed in 2020, but, it is the previous Trump administration that initiated targeted controls on exports of emerging technologies and advanced semiconductor manufacturing equipment in the name of national security, resulting in a more confrontational approach towards China.

These continued under the Biden Administration but could be tightened further by U.S. authorities next year in their effort to contain Chinese tech ambitions, leading to volatility in NVDIA’s stock and impacting its long-term growth in a market that remains significant. This explains my hold position.

Credo’s China Exposure and Energy Efficiency

To this end, for fiscal year 2024, Nvidia’s revenue from China surged to $10.3 billion, marking a 78% YoY increase, driven by strong sales of AI-related products. These include the H20 AI chips specially developed for China which may be the most advanced data center chips available in the Chinese market.

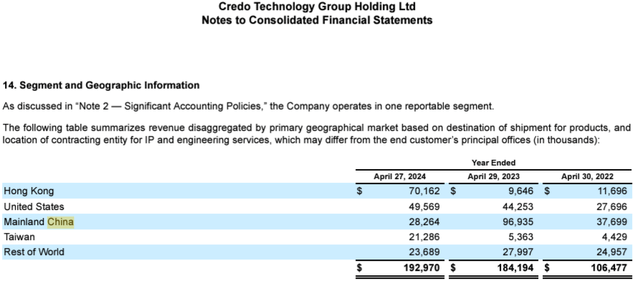

In sharp contrast, during its most recent fiscal year, Credo’s revenue from that country decreased to approximately $28.3 million from $96.9 million as shown below, showing reduced dependence on mainland China.

Looking deeper into its product portfolio, Credo’s interconnect solutions, like its 400G and 800G networking products, enable faster and more efficient data flow between GPUs, helping to minimize latency and maximize the GPUs’ processing power. Additionally, Credo’s solutions come with low-power configurations, making them ideal for energy-intensive applications in data centers, where reducing energy consumption is a priority.

Thus, as data centers increasingly adopt GPUs (instead of CPUs) for supporting supersmart applications, the need for high-speed, and low-latency connections becomes critical, an area where Credo’s interconnect solutions become handy, especially as AI workloads grow in complexity and size. Assessing how its ability to help organizations derive the full potential of GPUs, the company has enjoyed significant revenue growth, reporting revenues of $59.7 million in the first quarter of fiscal year 2025, marking a 70% YoY increase driven by strong demand for its high-speed connectivity solutions, particularly from cloud customers deploying AI infrastructures.

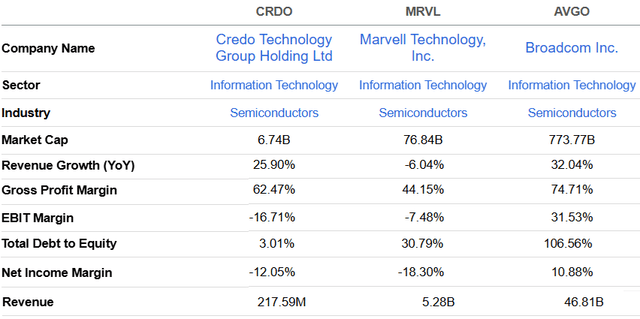

A Comparison with other Connectivity Providers like Broadcom and Marvell

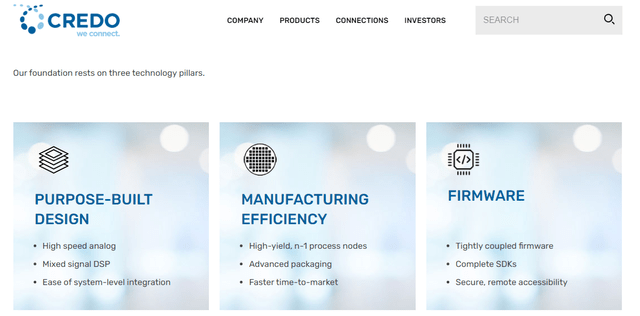

Now this growth has been achieved despite facing competition including from industry giants like Broadcom (AVGO) and Marvell (MRVL). This is explained by Credo offering competitive solutions based on its proprietary technology in high-speed Serializer/Deserializer (SerDes) technology, Active Electrical Cables (“AEC”), and optical DSPs (digital signal processing), critical for modern data center connectivity.

Thus, its purpose-built products have gained rapid traction among hyperscalers (giant public cloud providers) like Amazon (AMZN) and Microsoft as they allow for superior performance, and energy efficiency compared to its competitors’ offerings at a time when the focus is on reducing power consumption while having to transfer the data faster. Additionally, its smaller size confers it the ability to respond more quickly to market changes compared to its larger competitors, as shown below.

Noteworthily, its gross margins are higher than Marvell’s despite boasting a lower revenue base on which to spread its fixed costs, partly explained by Credo’s involvement in the HiWire consortium alongside 49 other names (including Broadcom) which have greatly benefited its market position, both when establishing standards and guiding how the technology is adopted within the industry, according to its strengths. As such, it can differentiate itself and command higher product pricing.

Arguing the Case for Credo’s Higher Premium

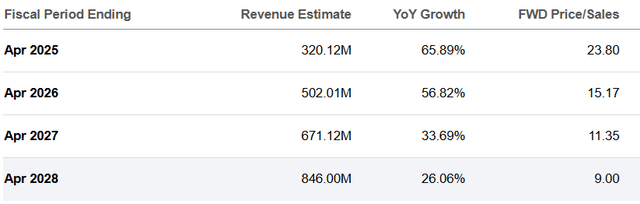

Looking at the opportunities, the AECs market is expected to expand by 45% CAGR from 2023 to 2028, reaching $2.8 billion. Now, if it could harvest just $900 million, or roughly one-third of this opportunity since there are three main players, sales for 2028 could surge by 366% based on the $193 million recorded last fiscal year. This is more than what analysts estimate as shown below.

Revenue estimates (seekingalpha.com)

Pursuing with a dose of caution, existing as a publicly listed company only since December 2023, it is loss-making and comes with a hefty trailing non-GAAP price-to-earnings of 124.34x which is 410% higher than the IT sector median which includes Broadcom, Marvel, or NVIDIA.

Still, it is important to look beyond the academic value of the P/E ratio, as there is also the growth potential of earnings, made possible by its positioning in a niche market that is catering to the specific needs of data centers. In this case, the P/E of 124.34x is below its five-year average by 36%, and adjusting its current share price of $43.34, I obtained a target of $59 (43.34 x 1.36).

To justify this bullish case, while NVIDIA can be credited as the market maker for accelerated GPUs, it faces competition not only from Advanced Micro Devices (AMD) but also from hyperscalers including Amazon and Alphabet who design their custom AI processors. Also, looking at technological evolution, new versions like Blackwell are more incremental developments in contrast with the relatively disruptive nature of the H100 launched nearly two and a half years back, without forgetting potential thermal issues. In this connection, during the fiscal third quarter of 2025 results on Wednesday, while NVIDIA’s CEO mentioned Blackwell’s adaptability to different cooling mechanisms, he also evoked a power-constrained landscape for AI data centers, something which just amplifies the appeal of companies like Credo.

In this context, Credo’s focus on energy-efficient interconnect solutions using SerDes for data transmission becomes even more relevant in high-capacity (120 kW) server racks housing tens of GPUs to help reduce overall energy consumption for hyperscalers deploying large-scale AI infrastructures. Now, some will argue that Broadcom, with its more diversified portfolio, is better in terms of a better risk profile (or a value stock), but, Credo’s more focused approach to emerging technology dynamics around energy efficiency for power-hungry GPUs puts it in a better position to harvest high-growth opportunities in the lucrative AI infrastructure business.

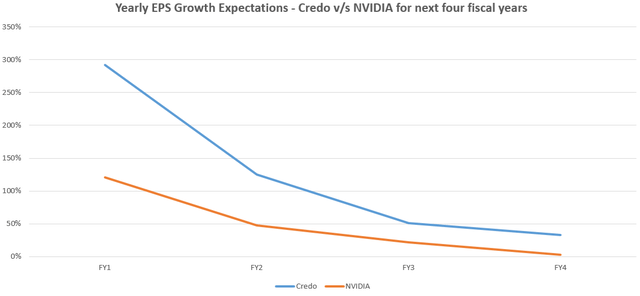

This justifies its P/E premium, and to this end, analysts expect EPS to grow at an astounding pace of over 290% YoY for fiscal 2025, or more than twenty times Broadcom’s. As for NVIDIA, the fact that its shares fell (in extended hours trading) despite reporting better-than-expected Q3 results hints that some analysts were disappointed with topline guidance for the next quarter, which fell short of the $41 billion expected by $3.5 billion.

Credo EPS expectations (seekingalpha.com)

Highlighting Potential Volatility Risks but Credo’s EPS Growth Should Outshine NVIDIA

Still, with investor expectations running so high, Credo needs to deliver to validate its valuation, which reflects a growth-oriented one relative to Nvidia and Broadcom. Therefore, one should expect acute volatility if it does not deliver according to what the market expects, like at the beginning of September when its stock dropped 8% after it reported the first quarter fiscal 2025 financial results. Also, it may have to spend more on R&D , which may impact profitability.

Still, Credo’s growth phase seems timely in the AI infrastructure market expected to grow at a CAGR of 30.4% from 2024 to 2030, which in addition to hardware and software also includes networking components needed to deploy AI workloads. To this end, the star of this market has up to now been NVIDIA, but, going forward, its revenue growth rate is expected to decelerate meaningfully, more problematic is EPS growth anticipated to eventually fall into the single digits as per the orange chart below.

On the other hand, Credo is expected to deliver better earnings growth in the next four years, as it gains market share through its energy-efficient interconnects and is able to ask for better prices as its products can somewhat compensate for Blackwell’s heat dissipation issues. Thus, after nearly two years of NVIDIA dominance, it may be time for investors to switch to Credo as the AI infrastructure business continues to flourish driven by cash-rich hyperscalers.

Charts built using data from (www.seekingalpha.com)

Finally, as a relatively early growth stage player for connectivity solutions in energy-constrained data centers, Credo is a buy because of significant future earnings growth potential as sells higher volumes, and also its balance sheet remains healthy with $398.6 million of cash versus only $16.7 million of debt.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.