Summary:

- Super Micro Computer experienced significant volatility, surging to $1,230/share and plummeting to $480/share pre-split.

- Worse-than-expected Q4 FY24 earnings and the Hindenburg short-seller report weighed on the stock, but that may change.

- SMCI’s position in the AI sector and partnerships with Nvidia and AMD present a compelling long-term opportunity.

- SMCI’s expected strong revenue and EPS growth, driven by increased CAPEX spending, suggests potential for substantial returns, with analysts forecasting a 42% upside over the next 12 months.

- Valuation is no issue, and if SMCI achieves projected earnings and is repriced between 20-30x P/E, there is potential for 51% annualized returns over the next few years.

Mikhail Sheleh

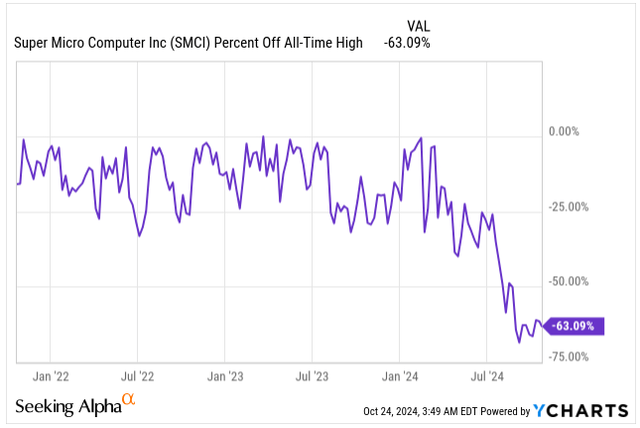

In Q1 2024, Super Micro Computer (NASDAQ:SMCI) (NEOE:SMCI:CA) was certainly one of the red-hot stocks, driven by the AI-investment narrative, which pushed the stock to its all-time high of $1,230/share by the end of March, compared to $300/share at the beginning of the year.

Following a 10-for-1 stock split in October, in my first coverage of the company on Seeking Alpha, I’ll further refer to SMCI shares using the split-adjusted price.

However, as we learned from the past, good things have to come to an end, and SMCI is no exception. The stock took a nosedive to $45/share, down roughly 63% below its all-time high.

Off All-Time High (Seeking Alpha)

In early August, SMCI reported its FY24 Q4 earnings, missing Wall Street’s expectations and its own guidance. Then, on August 27, Hindenburg Research, a well-known short-seller, published a negative report, revealing they had built a short position.

The following day, SMCI announced a delay in filing its 10-K with the SEC, citing the need for extra time to complete an internal review of its financial reporting controls.

With the stock trading near its 52-week low following the short-seller report and continuous negative sentiment, it’s a perfect time to dig deeper into the company’s business model and assess whether the weakness presents an attractive buying opportunity, particularly for long-term investors.

At the Right Place, At the Right Time

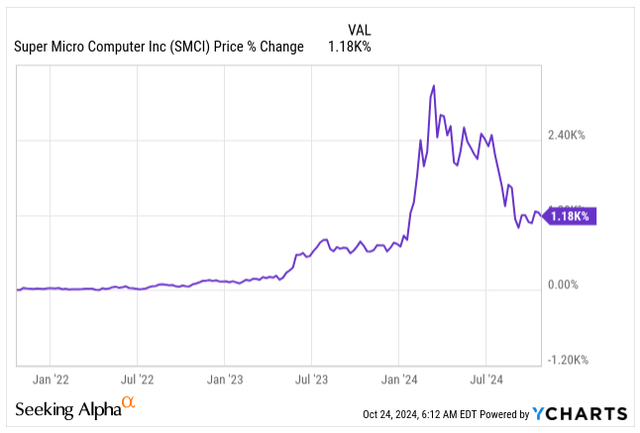

SMCI’s shareholders, who recognized the opportunity early enough and bought the shares prior to the extraordinary surge between 2023/24, are still sitting on a very comfortable 1,180% gain in a span of just three years.

Price Development (Seeking Alpha)

For those who were not familiar with the company, like myself, SMCI specializes in higher-performance server and storage solutions. It designs and manufactures efficient, application-optimized systems built on Intel’s (INTC) wide-spread x86 architecture, which was released back in 1978. These systems are mainly used in conventional data centers, AI data centers, cloud computing, and 5G markets.

Basically, SMCI was with the right product at the right place, benefiting from the heavy AI data center CAPEX spending, creating strong partnerships with the AI chip leaders such as NVIDIA (NVDA) and Advanced Micro Devices (AMD), positioning SMCI basically at the forefront as a key beneficiary for its complementary AI server systems as the demand grows.

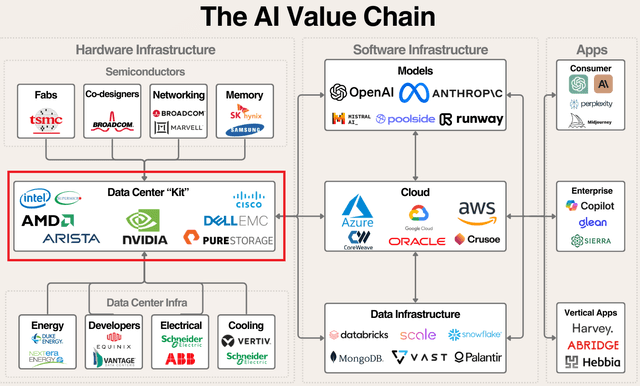

To put the AI Value Chain in perspective, a picture like the one below can help us understand where SMCI’s business fits in the grand scheme of things, in the highlighted red square as a “data center kit” powering Software Infrastructure.

AI Value Chain (Generative Value)

SMCI serves two key segments of customers:

- Firstly, Large Enterprises are the “bread-and-butter” of SMCI’s business, oriented at a high-performance solution for data analytics, machine learning, and enterprise resource planning. This segment makes as much as 40% of the company’s revenue.

- Secondly, Small and Medium Businesses (SMEs) are seeing positive benefits from SMCI’s cost-effective and scalable solutions. Although SMEs are smaller compared to large enterprises in terms of revenue, this segment is growing 25% YoY. That’s particularly important as roughly 43% of US GDP is created by SMEs.

SMCI’s revenue stream is dominated by product sales, which make up around 90% of the total sales, with less than 10% coming from maintenance, support, and customer engineering services. This, in my view, makes the company’s revenue stream somewhat cyclical, but as the installed customer base grows, eventually, more revenue will become recurring.

Likewise, SMCI’s business benefits from vertical integration, allowing the company to design and manufacture components in-house, supporting a “building block” architecture which in return enables fast customization and short time-to-market, particularly as the AI field is highly competitive, and the main objective is to stay at the forefront of innovation.

The Negative Sentiment

Recently, SMCI has been feeling the heat following the negative report published by Hindenburg Research, which readers can read with all the allegations on their website.

SMCI has faced accusations previously. In 2018, the company’s shares were temporarily delisted from Nasdaq after failing to file financial statements.

In 2020, the SEC charged SMCI with prematurely recognizing revenue and understating expenses over a period of at least three years. According to the SEC:

Super Micro executives, including Hideshima, pushed employees to maximize end-of-quarter revenue, yet failed to devise and maintain sufficient internal accounting controls to accurately record revenue. As a result, the orders find, Super Micro improperly and prematurely recognized revenue, including by recognizing revenue on goods sent to warehouses but not yet delivered to customers, shipping goods to customers prior to customer authorization, and shipping misassembled goods to customers.

Following the short-seller report, SMCI announced a delay in the annual Form 10-K filing with the SEC, giving the company time to review its internal financial controls.

The short-seller report is one of the key reasons behind the more than $30B market cap wipe-out, but SMCI’s shares have now stabilized. As long as SMCI’s financials are accurate and will not require a rework of its previously published earnings, which could show lower earnings, I am of the opinion that all the bad news is priced in for the time being with limited downside potential.

As an answer to the report, SMCI announced its intention to form a committee to review its financial controls. The objective was to assure investors that it did not expect major retrospective changes to its most recent and potentially future financial reporting.

As investors, we cannot ignore the fact that SMCI’s position in the fast-growing AI sector is a compelling proposition for those seeking attractive ROR. Judging from my perspective, the company’s efforts to address the accusations and its leading market position in partnering with critical AI chipmakers suggest a potential for recovery and attractive returns moving forward.

The Future Is Bright, So Are Earnings

Digging into the last earnings report, which in fact underperformed the analysts’ and company’s expectations, makes little sense at this stage as we are just a few days away from reporting its Q1 FY25 earnings on November 6. Hence, let’s look at what we could expect from the following earnings report.

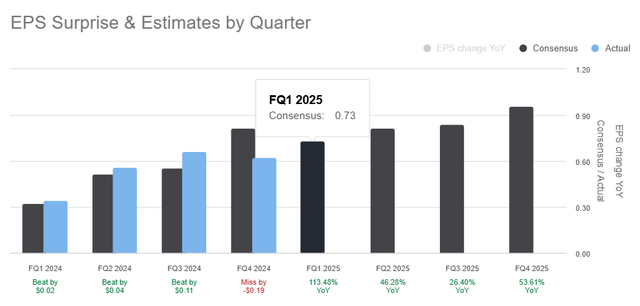

Looking ahead, analysts are expecting SMCI to deliver revenue of $6.45B during Q1 FY25, which would mark a 3.2x increase from the same quarter the prior year and an average EPS of $0.73. High estimates range from $0.91 to lows of $0.67, which would, on average, mark a 2.4x YoY growth.

EPS Estimates (Seeking Alpha)

Compared to the previous quarter’s EPS of $0.62/ share on a split-adjusted basis, that’s an attractive 20% QoQ growth.

Over the last four quarters, SMCI has beaten analysts’ expectations three out of four times, which shows relatively good forecast accuracy. However, let’s not forget that in Q4 FY24, the company missed the estimates by 30.6%, which was also one of the reasons for the recent underperformance.

If we look beyond the worse-than-expected Q4 FY24 earnings and Hindenburg report, SMCI’s outlook remains strong, fueled by increasing demand for AI chips and AI-optimized servers. Nvidia, AMD, and TSMC’s leadership underpin the industry’s optimism. They expect the AI chip market to grow as much as 10x over the next decade, and if this optimism materializes, SMCI will be one of the key beneficiaries.

Thanks to the increasing demand, SMCI is also strategically investing in building up its production capacity via initiatives in the US and Malaysia to double the output of its AI-focused product offering.

Based on analysts’ expectations, the company could reach as much as $37.6B by FY28 in revenue, which would represent a 36% annualized growth rate compared to today’s $14.9B.

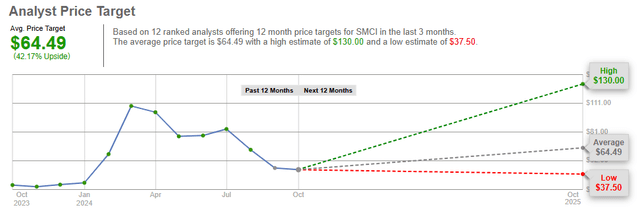

That’s also one reason analysts have rather optimistic price targets for SMCI’s share price, with a consensus at $64.50/share, representing potential 42% upside compared to today’s share price over the next 12 months.

Analyst Price Target (IBKR)

SMCI’s Attractive Valuation

You might be thinking, given the stock performance over the last few years, that SMCI’s stock would be significantly overvalued.

That’s part of the story. At their peak price of $1,230/share (pre-split), the shares were trading at a P/E valuation of around 60x, which is very hefty for a company whose 10-year average P/E stood at 14x.

Ultimately, the stock crumbled, but not because of its rich valuation but because of the short-seller report and relatively poor Q4 FY24 earnings.

However, the 14x P/E valuation I mentioned above should be taken with a pinch of salt, particularly as the AI tailwinds started benefiting the company just recently.

That points to the fact that SMCI should be repriced as the growth is expected to accelerate:

- FY25 Expected EPS of $3.40, 54% YoY growth

- FY26 Expected EPS of $4.34, 28% YoY growth

- FY27 Expected EPS of $5.74, 32% YoY growth

This major growth is still expected following a 109% EPS growth in FY23 and 87% growth in FY24, which is quite remarkable and one of the reasons why I consider SMCI to be a true growth stock.

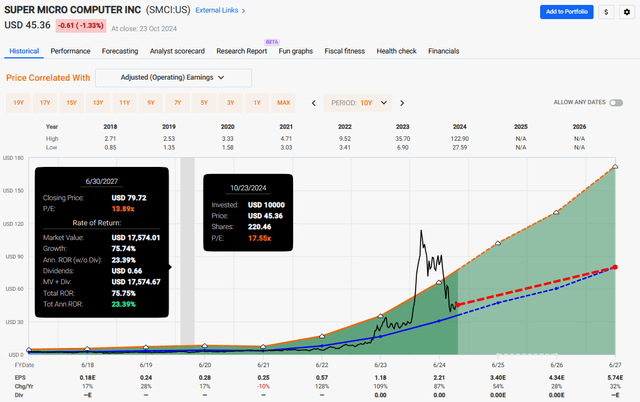

Now, if we assume that SMCI does not deserve to be re-priced and instead treat the 10Y P/E average as a benchmark for the future, with the growth materializing, SMCI could still deliver up to 23% annualized returns with shares reaching $79.70/share price by the end of FY27, but this is rather an understatement, in my opinion.

SMCI Valuation (FAST Graphs)

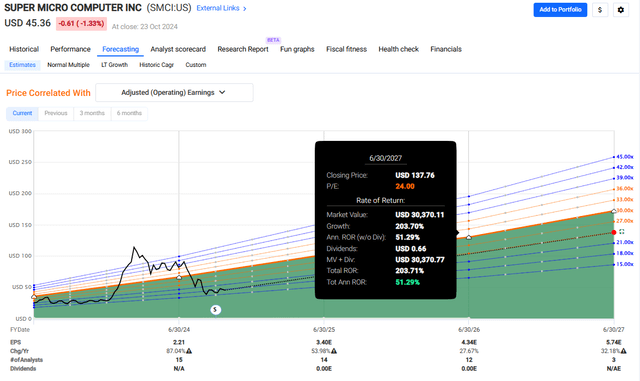

Instead, my take is that if SMCI managed to deliver the expected growth, the stock should be repriced with a P/E somewhere between 20-30x. Even if we take the more cautious view and assume 24x P/E by the end of FY27, investors could see up to 51% annualized returns.

SMCI Valuation (FAST Graphs)

Investor’s Takeaway

As this is my first coverage of Super Micro Computer on Seeking Alpha, I took a bit more holistic view of the business. Even though I conclude that the Hindenburg short-seller report is troubling and the Q4 FY24 relatively poor earnings are not something to write home about, I think the negative sentiment presents investors with an interesting opportunity to snap up shares of this hyperscaler. Yet, we may see more near-term volatility, particularly as the broader market trades at lofty valuations, and AI companies, in particular, are in the cross-hairs.

Any reduction in CAPEX spending by large-cap companies aimed at reducing the commitment to build AI data centers would likely harm SMCI’s future prospects. However, as it stands today, I expect the company to address all the short-seller accusations and if the expected growth materializes, investors buying the shares today could be handsomely rewarded over the next few years as recovery might be on tap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.