Summary:

- Telco businesses have fallen out of favor with investors due to rising interest rates and high leverage.

- Verizon Communications Inc. is 30% undervalued and offers a dividend yield of 6.64% for income investors.

- With capex spending normalizing, Verizon is now focusing on debt repayment and restructuring efforts to improve its financial position.

- The EPS growth expected is no higher than 2% annually, but the valuation is too cheap to ignore.

photobyphm

Telecommunication businesses have historically been seen as popular choices of income investors thanks to their high dividend yields, even as the growth has peaked for most.

Yet, the businesses have been out of favor, ever since the Fed hiked interest rates to 525 basis points in just 16 months, to fight inflation.

The reason is twofold:

- Telcos require major capex investments in their infrastructure to keep up with the breakthroughs in technology, piling up debt which acts as an anchor on future growth. This issue is compounded when interest rates rise, increasing the interest expense in the case of floating debt.

- With higher interest rates, the demand for high-yielding stocks falls as investors have the alternative to buy treasuries or invest cash in money markets, which yields up to 5.25% without risking the capital.

Nonetheless, the economy moves in cycles, and interest rates will eventually fall, increasing the attractiveness of quality, high-yield companies such as Verizon Communications Inc. (NYSE:VZ).

Staying for too long on the sidelines or investing in money markets instead, may leave investors with significant opportunity costs, once the market reverses and the yields fall.

Since my last coverage of Verizon in December, the stock has beaten the market, with a total ROI of close to 10%.

Seeking Alpha (Previous Coverage)

Today, as Verizon trades around $40 per share, the company remains at least 30% undervalued, with an attractive and well-covered dividend yield of 6.64%.

If you are hoping for major revenue or earnings growth, you may end up disappointed, since Verizon is a mature company operating in a mature market.

Instead, this opportunity is a reversal to the valuation mean, which could see up to 25% annual total ROI over the next few years.

Return To Shareholders

One of the key risks of investing in Telco businesses is the significant debt load the companies are carrying on their balance sheet due to the capex spending in infrastructure, which could jeopardize the sustainability of their dividends.

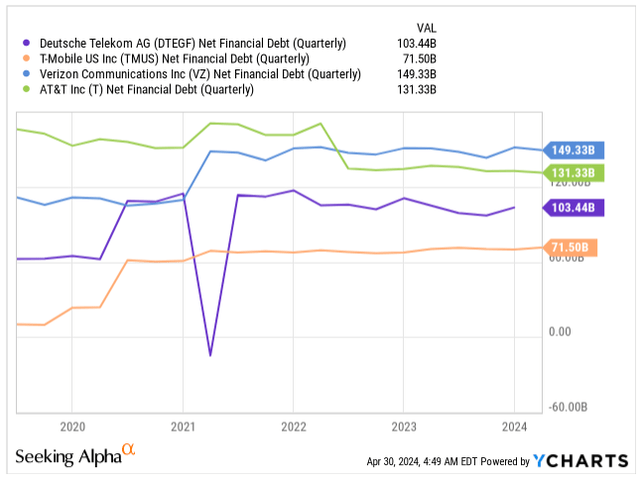

In fact, Verizon with $149.3B is the most levered, despite being a smaller company by market cap compared to T-Mobile US (TMUS) which carries only $71.5B as the company is not carrying as much debt from previous capex spending cycles before 5G.

Historically, AT&T Inc. (T) carried the most debt, but as the company spun off Warner Media back in 2022, this enabled it to pay down the debt now standing at $131.3B.

Deutsche Telekom AG (OTCQX:DTEGF), the company that holds a 50% stake in TMUS is currently carrying $103.4B of net debt on its balance sheet.

Net Financial Debt (Seeking Alpha)

So far, the debt load has not proven to be a major issue for Verizon as most of it is fixed-rate, but the elevated rates are negatively impacting the interest expense, increasing by 36% YoY to $1.6B in Q1 2024, pressuring the EPS.

Of the major telcos, Verizon currently offers the highest dividend yield:

- VZ: Dividend yield of 6.64%

- T: 6.52%

- DTEGF: 2.86%

- TMUS: 1.58%

While the yield is on the higher end of its historical range, with the lack of top and bottom-line growth, we should not expect much dividend growth.

Over the past five years, the company grew its dividend by a mere 10.3% and since 10 years ago the dividend has increased only by 25.4%, falling behind the rate of inflation.

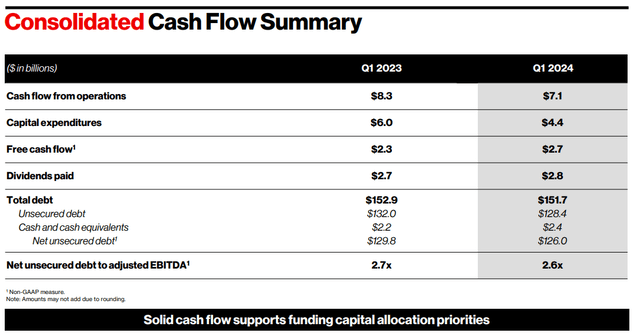

In Q1 2024, the cash flow from operating activities reached $7.1B, compared to $4.4B capex spending, resulting in a free cash flow of $2.7B, representing 15% growth YoY.

During the quarter, the dividends paid reached $2.8 billion, which leads to a negative free cash flow payout ratio, however, similar to 2023, the company expects the free cash flow to build up throughout the year.

In 2023, Verizon paid $11B in dividends with a free cash flow of $14.6B, resulting in a comfortable 61.1% payout ratio, and I’m expecting a similar development this year.

Cash Flow Summary (VZ IR)

As a result of the heavy capex spending and significant debt loads, telco businesses are generally not repurchasing back their shares, instead, they focus on paying down debt.

One of the reasons why I decided to mention Deutsche Telekom in this article, even though their operations are predominantly in Europe, is that European investors are not subject to withholding tax on their dividends. The company is expected to deliver double-digit EPS and dividend growth, which may make this investment opportunity more attractive compared to US telcos.

Q1 2024 Earnings

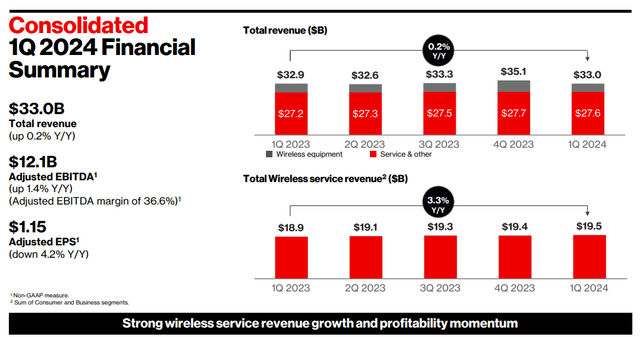

Verizon’s Q1 was a mixed bag with $33B in revenue, increasing 0.2% YoY and EPS of $1.15 falling 4.2% from a year ago, but beating analysts’ expectations.

The company has a strong position in the industry with a quality customer base and the largest EBITDA.

During the quarter, wireless service revenue growth continued to climb for its sixth consecutive quarter and increased 3.3% YoY to $19.5B.

Adjusted EBITDA reached $12.1B, increasing 1.4% YoY driven by improved efficiency and better revenue performance compared to the previous year.

Financial Summary (VZ IR)

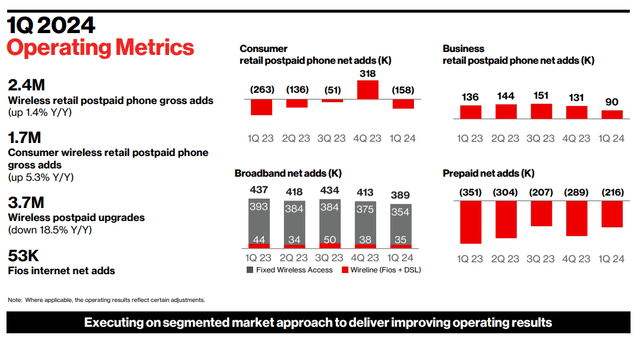

Analysts were expecting a loss of 92k postpaid phone subscribers during the quarter, but instead, Verizon lost “only” 68k of the subscribers. This is a key metric as these customers tend to spend the most.

By losing 158k consumer postpaid subscribers, Verizon keeps struggling to hold onto this group, a development we have seen for the better part of the last year, yet 100k better results compared to the same quarter a year ago.

Instead, the company is keeping its focus on business mobility, adding 90k business postpaid subscribers during the quarter, however, this is the slowest growth in the last five quarters.

Overall, the total post-paid net losses were 68k, 59k net loss improvement from a year prior.

The broadband business continues to be the key growth driver for Verizon, now with more than 11M subscribers. The company added 389k subscribers and last year the user base grew by 18%.

Operating Metrics (VZ IR)

The wireless industry is in a difficult position as the growth is slowing across the board and competition is fierce, fighting for each customer.

That’s one of the reasons why the companies are not receiving much love from investors at the moment.

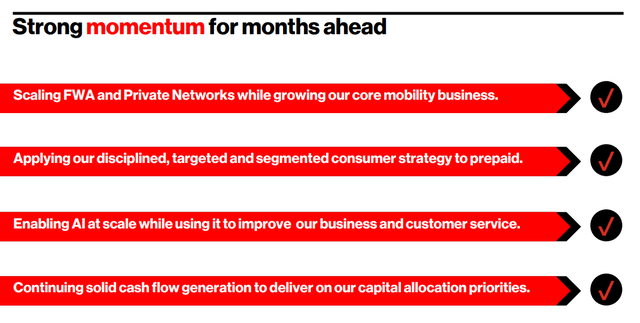

While I do not expect an immediate reversal of the sentiment since we are talking about a highly leveraged and mature industry, Verizon is undertaking restructuring efforts in its own ranks by recently replacing chief marketing officer and focusing on growth in service revenue.

The 5G synergies are taking much longer than expected to bring a positive impact, but Verizon keeps ramping up 5G fixed broadband services, with the service now being available to 30M households and 5G mobility network available to 175M people.

After investing heavily in the 5G network, Verizon is now back to a normalized level of capex spending, which should provide enough flexibility to accelerate debt repayment in H2 2024 and onwards, bringing the debt level closer to the company’s target level.

This should in turn relieve some of the interest expense pressure in the future, and with lower debt, unlock EPS growth, given the company delivered two consecutive years of negative EPS growth, first -4% in 2022 and -9% in 2023.

Goals for 2024 (VZ IR)

Valuation

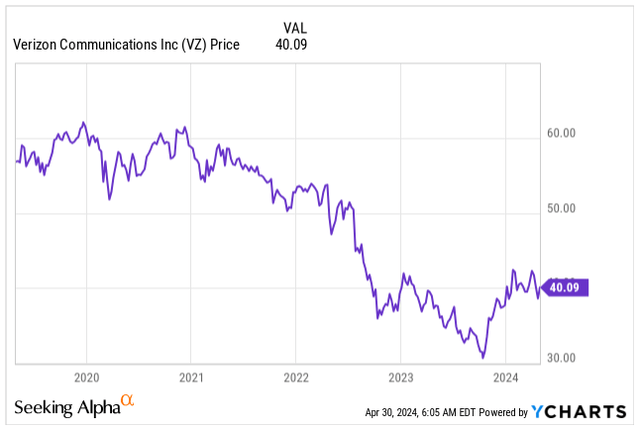

Given the lackluster performance of the last five years, during which the company’s stock price delivered a negative 30% return, investors had very little to celebrate.

Price Development (Seeking Alpha)

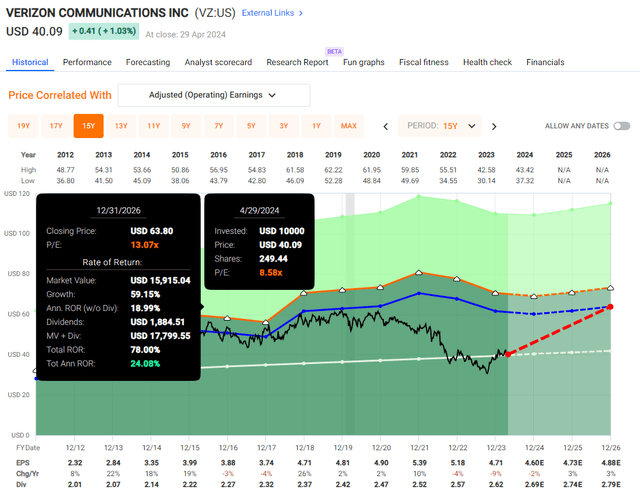

In turn, the underperformance has pushed the stock to a territory of very attractive valuation.

When we zoom out and look at the average valuation since 2004, the stock on average traded at a P/E of 13.57x.

Today, the stock is trading at a blended valuation of 8.58x, a P/E valuation that incorporates two forward quarters.

This gives us a good idea of how undervalued the stock really is.

In fact, Verizon has never been a fast grower. The EPS since 2004 grew at an annual rate of 2.95%, which is rather slow for my liking.

The expectations for the forward growth are very similar to its historical range:

- 2024: EPS of $4.60E, YoY growth of -2%

- 2025: EPS of $4.73E, YoY growth of 3%

- 2026: EPS of $4.88E, YoY growth of 3%

What I learned during my investment career, is that slow-growing stalwart businesses such as Verizon are trading like bonds.

It’s not worth it to dollar-cost-average your entry into the stock because you will end up earning very poor returns.

If you bought Verizon at the end of 2019 when the stock was trading below its historical average at a P/E of 12.6x, a valuation I would call attractive, you would still end up with -3.7% annual total ROI through today.

Instead, waiting for multiple years and buying the business during peak pessimism, understanding the business will survive the difficult economic landscape, proves to be the right strategy to beat the market with these types of interest rate-sensitive investments.

Today is still the time of peak pessimism. Buying Verizon anywhere below $40 is a great opportunity to beat the market over the next few years with enough margin of safety.

On the other hand, I would not buy the stock above $50 and certainly start trimming my position if the stock hits $55 as there is little potential for further returns at that stage.

Investors buying the stock today can expect up to 25% annual total ROI over the next few years as the stock reverses to its average valuation.

VZ Valuation (Fast Graphs)

Takeaway

In the last five years, with Verizon’s stock down 30%, investors have had little to celebrate.

Verizon is operating in a mature market with fierce competition and little growth going forward, an issue compounded by the highest leverage among all the major telco businesses.

In the face of the negative sentiment, the company is entering a phase of normalized capex spending, enabling it to pay down a portion of the debt, lower its interest expense, and drive low single-digit EPS growth.

Verizon is trading at least 30% below its intrinsic value, even as the EPS growth is not expected to accelerate.

With a 6.6% dividend yield and a significant margin of safety, the company presents a good entry point at $40 per share for income-seeking investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.