Summary:

- Cyngn has experienced a lot of volatility late, with some of that built into the company because of its absence of revenue.

- Despite having no revenue, the firm has a solid balance sheet and it has a unique and potentially valuable vision.

- Though speculative, the company has gained further legitimacy and is worth looking into because of some recent developments.

Vanit Janthra/iStock via Getty Images

One fairly large market that must exist in order for the modern economy to function is the industrial vehicle market. Forecasted to reach $80 billion in size by 2023, this industry offers attractive prospects for the right kind of companies that can add value in unique and innovative ways. One company dedicated to providing such value is Cyngn (NASDAQ:CYN). With a special emphasis on software that it hopes will help industrial vehicles to achieve autonomous functionality, there is the potential for the business to grow at a rapid pace and to generate attractive margins. Today, the company is still very much early stage. But given recent developments and the company’s long-term vision, it might make sense for some investors, those dedicated to the growth ideology, to consider a stake in the enterprise at this time.

An innovative play on industrial technology

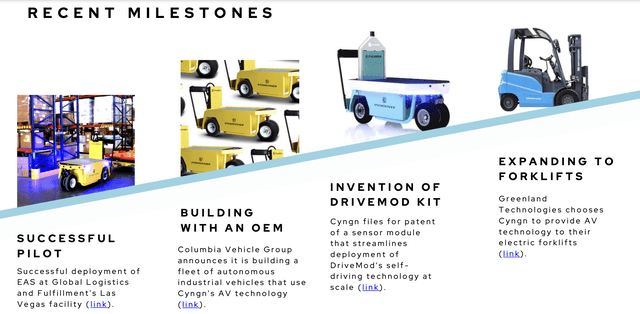

If I could state one overarching goal as the goal set by the management team at Cyngn, it would be for the company to become a significant player in the industrial software market. The business operates by integrating their full-stack, autonomous driving software, known as DriveMod, on two vehicles that are manufactured by OEM customers. This integration can be done either by retrofitting existing vehicles or by integrating into them during their assembly. The core to the company’s vision is its Enterprise Autonomy Suite to be compatible with sensors and components from other hardware firms for the purpose of collecting and analyzing data from them. Using its Cyngn Insight technology, which operates as an intelligent Control Center, the company hopes to provide fleet management analytics, teleoperation, and diagnostics. On top of this, the company also has an aspect to its business called Cyngn Evolve, which provides a wide variety of data optimization tools like performance analytics, simulations, machine learning infrastructure, and more. These, as well as DriveMod, all fall under the Enterprise Autonomy Suite.

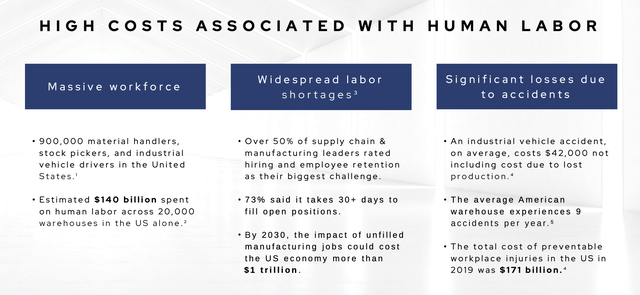

Long term, the company’s vision is for its Enterprise Autonomy Suite to become a universal autonomous driving solution for customers for the purpose of optimizing efficiency and reducing operating costs. To be very clear, management’s intentions have been stated boldly. In an investor presentation, the company said that its goal is to reduce the high costs associated with human labor. Already, there are an estimated 900,000 material handlers, stock pickers, and industrial vehicle drivers across the US alone, with about $140 billion spent annually on human labor throughout the 20,000 warehouses in the country. In addition, there also appears to be a shortage of workers for this space, with the company even saying that 73% of supply chain and manufacturing leaders attest to the statement that it requires 30 or more days to fill open positions. Add on top of this the estimated $171 billion in preventable workplace injuries that exist across the US every year, and it becomes clear how the idea of autonomous vehicles could be appealing to many.

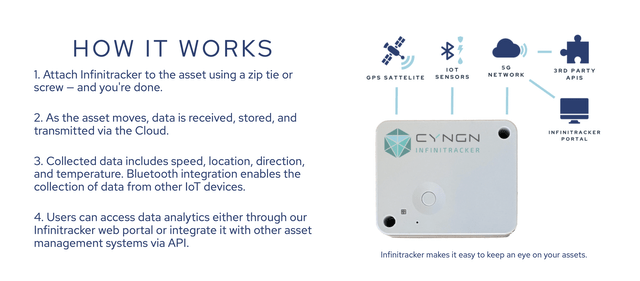

Recently, shares in the business have been rather volatile. On May 5th alone, the company’s stock surged higher, closing for the day up 18%. There was no clear or obvious news that came out during that day. Instead, this move higher was likely a result of a development that was announced on May 4th. In short, the company launched a new product called Infinitracker. This device serves as a GPS asset tracker and IoT (Internet of Things) platform that management says can be placed on almost any industrial asset. The goal of this device is to provide real-time location, speed, temperature, and direction of travel data for the asset it is paired up with. Using Bluetooth, the device can also collect data from other sensors, send it to the company’s cloud platform, and analyze it for various purposes. Although this technology is not new in and of itself, what is remarkable is management’s claim that the battery only needs changed or charged about once every 15 years.

Though this may seem like a significant departure from the company’s core vision, it does actually fit with the software-oriented business model the company has been focused on. Operations aside, it’s also remarkable because of its ability to generate revenue for the company today. In both 2020 and 2021, the company generated no revenue. Its net losses in 2020 and 2021 were $8.34 million and $7.80 million, respectively. Meanwhile, operating cash flows were negative to the tune of $7.92 million and $8.64 million, respectively, during these time frames. For a fee of $300 for the first three years of operation per unit, as well as a $10 per month charge thereafter, this device has the potential to generate some significant value for the business if it gains enough traction.

There was one other development for the company, but that took place on April 29th. On that date, the business announced the closing of a private placement of stock that ultimately brought in gross proceeds of $20 million. The business ended up issuing 6.45 million shares in exchange for this, implying a price per share of $3.10. Some of these units, it should be said, were actually pre-funded warrants. But that has little in the way of meaning in the grand scheme of things. Adjusting for this share issuance, the company should have around $42 million in cash as of this writing. It has no debt on hand and a market capitalization of $125.46 million. That implies an enterprise value of $83.47 million.

Takeaway

Conceptually speaking, Cyngn seems to be an interesting business with some attractive potential in the long run. I generally don’t like companies that are pre-revenue and that are generating significant losses and cash outflows. But the absence of debt and the significant amount of cash on hand, combined with the new product release, suggests to me that there could be something here. I am unlikely to buy shares in the company still. But I can understand why many growth-oriented investors who want to capture the upside associated with the industrial software space would be drawn to this firm.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!