Summary:

- Danaher is an industry-leading serial acquirer with an iconic business system.

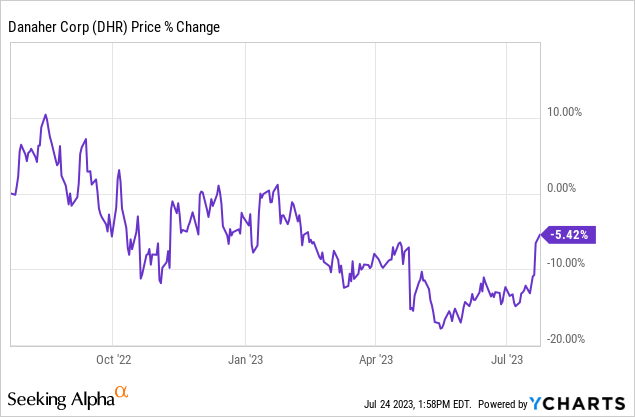

- After a boom in Danaher’s sales during the pandemic, demand is now slowing as customers are facing inventory build-up and liquidity challenges.

- Beyond the current headwinds, Danaher’s market position, balance sheet and cash flow generation remain strong and will position the company for secular growth over the long term.

- At current share prices, Danaher offers investors a great opportunity to buy a high-quality compounder at a fair valuation.

ADragan/iStock via Getty Images

Danaher (NYSE:DHR) is probably one of the most cited serial acquirers with an amazing track record and iconic business system. Over the past decades, shareholders have been pleased with outstanding results and increasing shareholder value. Even the great uncertainty in the wake of the pandemic only reinforces the strong market position and excellent demand of the individual businesses. Now, for the first time in years, the company is facing a slowdown in demand and a level of uncertainty that has long been absent from Danaher’s valuation.

However, Danaher’s businesses remain critical to the industry as they continue to innovate and support a broad range of customers. As a result, the company’s long-term prospects are promising, while investors can pick up shares at a lower price.

Business Model

Danaher is a serial acquirer that currently consists of 20 operating companies, each with a leading position in biotechnology, life sciences, diagnostics, and environmental and applied technologies.

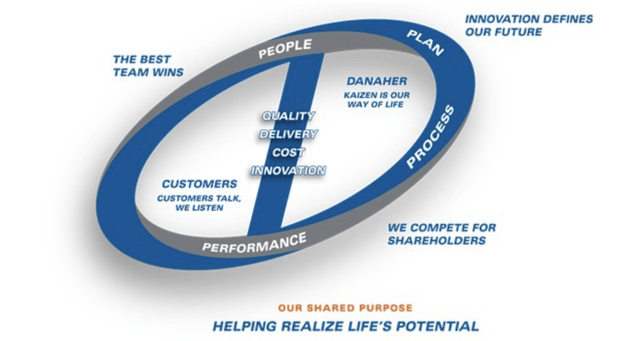

The company was founded in 1984 by Mitchell and Steven Rales with the vision of creating an innovative manufacturing company focused on continuous improvement and customer value. These values originally came from Kaizen, a Japanese management approach that Danaher has adopted over the years. Similar to the Toyota Production System, the Danaher Business System (DBS) was developed.

Danaher Business System (annual filing)

After Danaher acquires a company, it implements the DBS into the existing culture to enhance its effectiveness. In doing so, Danaher remains cautious and preserves the independent strength and culture of each business through a decentralized management structure. In order for both sides to benefit, it is important to comprehensively assess the corporate fit of each potential acquisition target. This is where Danaher differs from traditional holding companies such as Berkshire Hathaway (BRK.A) or Exor (OTCPK:EXXRF), which do not limit their TAM and minimize their involvement in the existing business.

However, Danaher points out three key criteria for potential acquisitions:

- Attractive Markets: We assess the market, including secular growth drivers and opportunities for consolidation.

- Company Profile: We analyze the company’s market position and potential, including brand strength and margin expansion opportunities.

- Value Creation: We consider potential in the context of DBS, our segments and our overall portfolio, including opportunities to extend global reach, advance technology and improve quality of life.

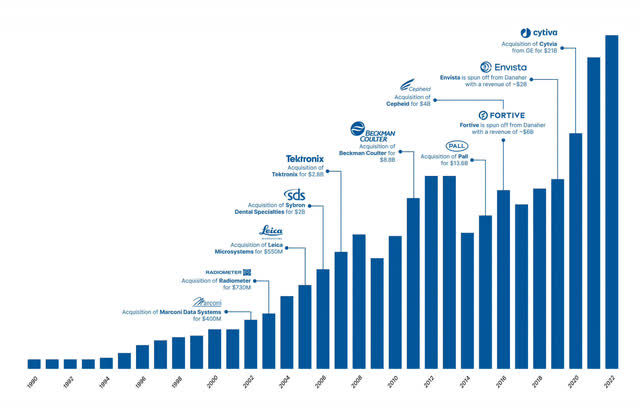

Over the years, Danaher began to shift its focus and concentrate its portfolio on leading healthcare science and technology companies. To this end, the company has spun off its industrial businesses through Fortive (FTV) and its dental business through Envista (NVST). In the fourth quarter of this year, Danaher plans to complete the refocusing process by spinning off its Environmental & Applied Solutions segment.

What remains (besides the Environmental & Applied Solutions segment) are the Diagnostics, Biotechnology and Life Sciences segments, which currently contribute about 85% of Danaher’s total sales in 2022.

Danaher’s History of Acquisitions (Quartr_App)

Therefore, and because of other great articles on SA regarding Danaher, I will focus on these 3 segments.

Diagnostics

Danaher’s Diagnostics segment consists of six businesses that account for approximately 35% of Danaher’s total sales in 2022. Through these businesses, Danaher provides a broad range of clinical instruments, reagents, consumables, software and services used by hospitals, reference laboratories and other critical care settings to diagnose disease and make treatment decisions.

As biomedical testing instruments, systems and related consumables are core competencies, it is reasonable to expect that this business segment is not immune to the post-pandemic slowdown in demand, which also offset the double-digit base business growth rates in Q1/23. However, as this year’s development only represents a return to normal demand, the outlook remains promising.

Diagnostics Portfolio (annual report)

Biotechnology

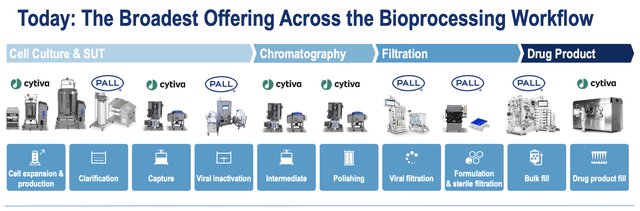

Similar conclusions can be drawn for Danaher’s next business segment. Through its Biotechnology segment, Danaher provides technologies, consumables, services and solutions that enhance the development or manufacture of therapeutics, such as vaccines. Industry leadership in bioprocessing is the most recent accomplishment, achieved through the acquisition of Cytiva in 2020. Together with Pall Corporation, it has created a strong business that Danaher says generates mostly recurring revenues with high single-digit growth.

Bioprocessing Workflow (Investor Presentation)

Together, the two companies provide strong coverage of the entire bioprocessing workflow, allowing Danaher to offer a more comprehensive service and greater customer value. In addition, the recently established Biotechnology segment has enabled Danaher to enhance its product offering with other complementary acquisitions, such as GoSilico, which provides software to help digitize downstream process development.

More broadly, both companies should benefit from several secular growth trends as the development and approval of therapeutics continues to shift toward biologics. In addition, the R&D pipelines are full, and this is likely to continue even after the pandemic-related boost wears off.

Overall, Danaher should benefit from these trends as its share of the bioprocessing workflow increases. In addition, the complete service offering creates customer confidence that can benefit both sides in the future. Nevertheless, this segment is no exception to the normalization of demand, as evidenced by the 13% decline in core sales in Q1/23. In this case, the shrinking demand is due to the high inventory levels of large customers and the liquidity and financing challenges of small biotechs. According to the most recent earnings call, Danaher’s management expects the bioprocessing business to perform similarly to Q1/23 for the remainder of the year, while reiterating its strong conviction in future opportunities.

Life Sciences

In 2005, Danaher established its Life Sciences business with the acquisition of Leica Microsystems and several subsequent acquisitions. In 2022, the Life Sciences business contributed approximately 22% of total sales through a broad range of instruments and consumables that enable customers to study and analyze DNA, RNA, and more. Danaher also has leading businesses in industrial filtration, mass spectrometry and microscopy.

Life Sciences Portfolio (annual report)

The most recent notable acquisition in this segment was Aldevron in 2021, a leading manufacturing partner that provides critical nucleic acids and proteins used in the manufacture of gene and cell therapies, gene editing technologies, and DNA and RNA vaccines. A popular example of Aldevron’s significant role in innovation is its contribution of the linearized DNA template for Moderna’s COVID-19 vaccine. The company’s slogan, “the basis for breakthroughs,” seems perfectly appropriate.

In general, Danaher’s Life Sciences segment should be well positioned to drive customer value, and therefore shareholder value, in the future.

Business Outlook

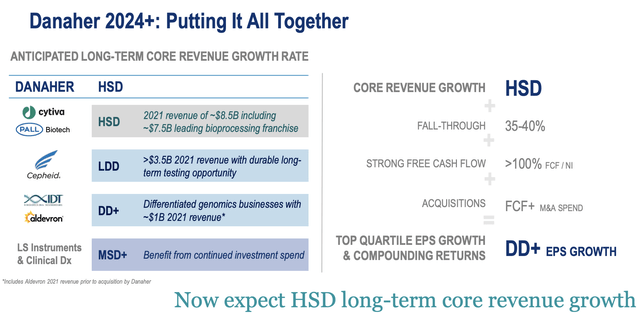

Putting together Danaher’s businesses, we have a very promising runway for future growth. Danaher itself provided an EPS growth outlook for 2022 in its investor presentation for the period after the spin-off and normalization of the industry.

Danaher’s Outlook for 2024+ (Investor Presentation 2022)

According to the presented goal, investors can expect double-digit EPS growth and high single-digit revenue growth from Danaher as of 2024, indicating higher margins or potential share repurchases.

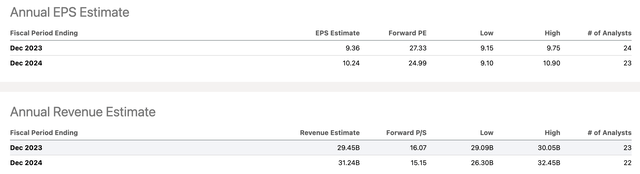

Analyst Estimates for 2023/2024 (SeekingAlpha)

Until then, analysts expect Danaher’s revenue to decline 6.42% this year to $29.45 billion, while earnings per share will decline only 4.5%, reflecting Danaher’s solid cost management. Danaher’s broad product offering and close customer relationships allow the company to anticipate demand and respond rapidly to changes. As a result, the company is in a very solid position to navigate through this challenging year, and the expansion of its service offerings should only strengthen this ability for the challenges that lie ahead in the company’s environment.

We also see the ability of serial acquirers to be opportunistic in challenging markets and add thriving companies to their portfolio. Danaher’s current CEO, Rainer Blair, summarized it as follows:

We will continue to invest, as we have over a long period of time, in high-impact growth opportunities. We will continue to strengthen our market-leading positions and our overall portfolio, with a clear eye towards ensuring long-term, sustainable positions in attractive markets around the world.

From my perspective, this combination of promising organic growth and opportunistic acquisitions is exactly what an investment needs to be a long-term compounder. So let’s take a look at Danaher’s cash flows to assess Mr. Market’s current opinion.

Cash Flows

In order to analyse a company’s ability to generate cash from operations, I focus primarily on its free cash flow. Despite the usual calculation (OCF – CapEx = FCF), I adjust the operating cash flow for changes in net working capital and the expenses for stock-based compensation.

Using this approach, I try to get closer to the actual and sustainable cash generation of the business through the perspective of its owners.

For Danaher, the calculation (based on TTM) looks like this:

| in $ million | |

| Operating Cash Flow | 8,498 |

| – Stock-based Compensation | 335 |

| – Change in NWC | -137 |

| = Adjusted Operating Cash Flow | 8,300 |

| – Net CapEx | 1,170 |

| = Free Cash Flow | 7,130 |

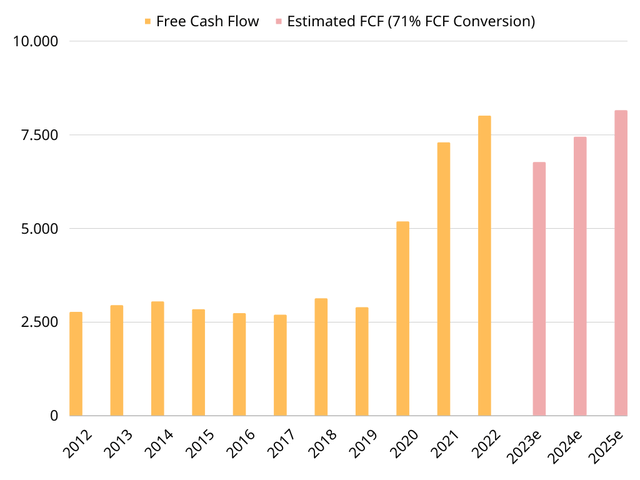

Comparing this result to an EBITDA of $10,576 million, we get an FCF conversion of 67%, which is actually relatively close to the pre-pandemic level of 2019. However, as we have previously recognized, Danaher’s improvements in profitability and pricing power of its businesses should be partially sustainable, allowing for a higher estimate of future free cash flow conversion. Overall, Danaher’s historical and future free cash flows can be illustrated as follows:

Free Cash Flow, 2012-2025e, in $ billion (own calculation)

Of course, it’s impressive to see that Danaher has been able to significantly increase its free cash flow over the past decade. But! Important to keep in mind while enjoying the chart above is that Danaher has made several significant spin-offs during this period, which makes a valuation based on its historical FCF CAGR unusable, or at least not meaningful.

Therefore, future predictions for 2023-2025 are based on EBITDA estimates and my assumption of 71% free cash flow conversion. According to the results obtained, we can expect FCF to decline this year, which is in line with management’s statement. However, once demand normalizes, Danaher’s growth will reaccelerate and investors will likely see new FCF highs starting in 2025. Again, don’t underestimate these levels as they exclude the Environmental & Applied Solutions segment, which currently represents 15% of Danaher’s total sales.

Headwinds and Risks

Having said that, I would like to briefly outline current headwinds and risks that could impact my views on future cash flows.

Demand Cool-Down tougher than expected

I have mentioned several times in this article that the current financial year represents a year of normalizing demand compared to the pandemic-related boom. However, if the financing and liquidity environment for biotech and healthcare companies remains stressed for longer than expected, the free cash flow assumptions for the next few years may not be achieved. This is definitely a short-term risk, but because of the industry-wide network that Danaher has built over the years, I think it is plausible to assume that Danaher’s management has a sensitive and reliable knowledge of the current situation. Therefore, I would rely on their expectations about the industry and the development of customer demand. Moreover, I’m confident that Danaher’s multiple secular growth trends and market leadership will offset these short-term headwinds.

Failure of Future Acquisitions

As mentioned earlier in this article, Danaher’s core competency is acquiring strategically valuable businesses and growing them through the Danaher Business System. In doing so, Danaher has built an outstanding track record in M&A that has made it a role model for many other companies in the industry and beyond. However, each acquired company is unique, and the markets served have changed significantly throughout Danaher’s history. As a result, there will always be a risk of acquisitions that do not deliver the expected results and were too expensive. In addition, if management tends to focus on short-term results, the company risks overextending itself with too many or too large acquisitions.

The risks described are certainly significant in their potential impact. However, Danaher’s excellent track record makes it one of the most reliable serial acquirers and therefore unlikely to take these major risks with acquisitions. In addition, I appreciate the presence of Steven and Mitchell Rales as major shareholders (they own about 11% of Danaher’s outstanding shares) and influential board members, with Mitchell Rales serving as Chairman of the Executive Committee and Steven Rales as Chairman of the Board. But Danaher’s compensation structure also provides long-term incentives for the executive team and aligns interests with shareholders. If you want to dive deeper into Danaher’s compensation program, I highly recommend the well-written article by @Heavy Moat Investments.

That said, investors can expect well-managed M&A execution in the future, which will significantly reduce the risks described above, but could also lead to a premium market price. So let’s dive into the valuation!

Valuation

At the current share price of $258.15, Danaher is valued with a market capitalisation of $190.31 billion. Taking into account the current net debt of $20.47 billion, we derive at an enterprise value of $210.78 billion.

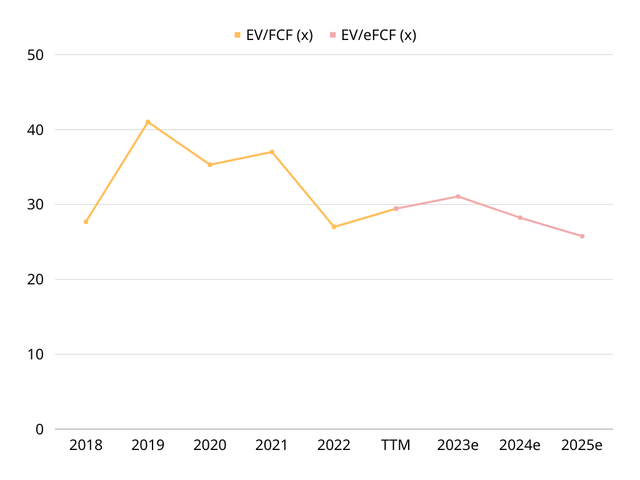

EV/FCF multiples, 2018-2025e (own calculations)

If we now relate this to the free cash flow calculated above, we get an EV/FCF multiple of 29.56x, which is higher than in 2022 because of the weaker first quarter of 2023 that I’ve included. As the rest of the year is likely to be in line with the first quarter, we should expect Danaher’s free cash flow to decline and therefore use the forward multiple of 31x. Compared to the 5-year average of about 33x FCF, the current valuation seems to be at least reasonable.

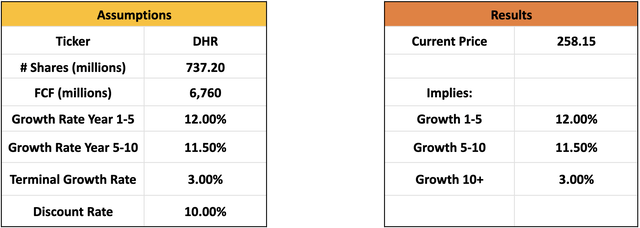

Reversed DCF (own calculation)

And I achieve a similar result using a reverse DCF model. Of course, it’s arguable whether my assumed free cash flow of $6.67 billion is adequate, since we’ve already calculated a free cash flow of $7.13 billion for the trailing 12 months. From my perspective, using the more sustainable free cash flow as expected for 2023 is the least I can do to get a useful result from this simple model. According to the results of my inverse DCF model, Danaher’s current share price implies a growth rate for years 1-5 and 5-10 of 12% and 11.5%, respectively. Given Danaher’s outlook and target growth rate of >10%, the current valuation seems reasonable but not massively undervalued.

Conclusion

In summary, Danaher has consistently demonstrated high quality through strong strategic execution, market-leading businesses, and strong cash flow generation. All of these aspects were enhanced during the pandemic, leaving Danaher with a solid balance sheet and market position to execute even better over the long term. Now, as the industry cools and the macro environment remains challenging, Danaher has the opportunity to further impress shareholders with the quality of its management and potentially even make opportunistic acquisitions. However, it will be interesting to monitor the continuing operations and the success of the upcoming spin-off this year.

From my point of view, Danaher currently offers a promising risk/reward ratio for long-term oriented investors who can take advantage of the current uncertainty to find an attractive entry point into a true long-term compounder. Consequently, I initiated a position this week and remain willing to add more shares if the upcoming results confirm my assumptions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR, BRK.B either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.