Summary:

- Danaher has maintained a net earning margin above 15% since 2017.

- In 2024 Q3, the company had a 36.36% liabilities-to-assets ratio, the lowest level since 2017.

- Danaher’s largest customers have reduced their excess of COVID-19-related products. So, Danaher expects a further boost in its sales.

- The company has been successful in generating growth through acquiring other companies. In the last ten years, half of Danaher’s growth has come due to this strategy.

Thomas Barwick/DigitalVision via Getty Images

Investment Thesis

I consider Danaher Corporation (NYSE:DHR) a good investment opportunity. The company has kept its net earnings margin relatively stable. Since 2017, this margin has been above 15%. In addition, Danaher has successfully acquired other companies. Over the past decade, this strategy has generated about half of Danaher’s growth.

The company has reduced its liabilities-to-assets ratio. In 2024 Q3, this ratio was 36.36%, the lowest level since at least 2017. The reduction will allow the company to be more resilient if a crisis occurs.

In the first nine months of 2023, Danaher indicates that its largest customers have reduced the excess of COVID-19-related products. In addition, the company indicates that its largest customers have returned to their usual order levels. With stable levels of inventories of Danaher’s customers, the company would increase its sales and net earnings.

Introduction

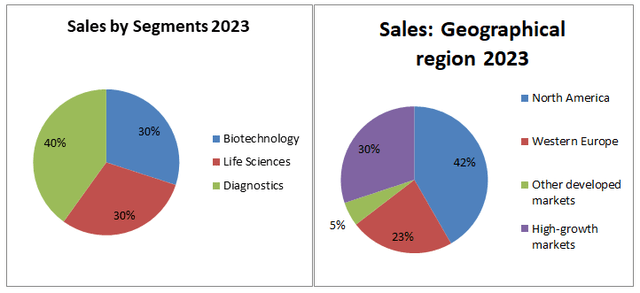

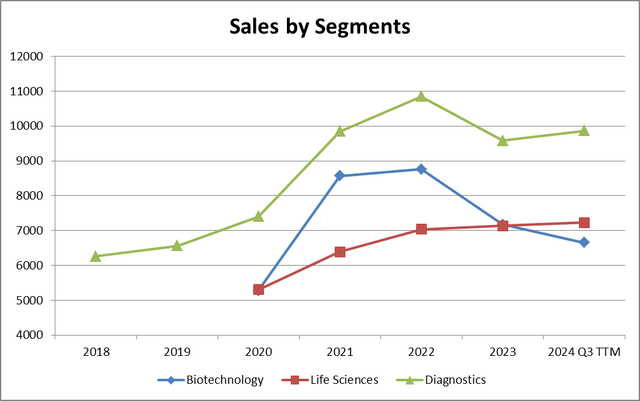

Danaher Corporation is an American company headquartered in Washington, D.C. The company has three business segments; namely Biotechnology, Life Sciences, and Diagnostics. In 2023, the Diagnostics segment accounted for 40% of the sales, while the other two segments accounted for 60% of the sales in that year, as shown in the left chart below.

Image was created by the author with data from filings

By geographic area, Danaher has 42% of its revenues in North America, followed by Western Europe with 30%. Meanwhile, the remaining geographic areas accounted for 28%, as shown in the right chart above.

Most of Danaher’s revenues come from recurring revenues. Products such as consumables, services, and operating-type lease ((OTLs)) are recurring, which require frequent replacement. In 2023, the recurring revenues represented 78% of the revenues, as depicted in the next chart.

Image was created by the author with data from filings

The Life Sciences segment had the lowest proportion of recurring revenues, with 61%. Meanwhile, the Diagnostics segment had 88% of its revenues attributed to recurring revenues. These figures are good characteristics because Danaher has a stream of constant sales coming from recurring revenues.

Operating Margin and Sales

Before starting, the reader should know that in 2020, Danaher decided to split its Life Sciences segment in two. The first segment remained with the previous name, Life Sciences, while the second segment is Biotechnology.

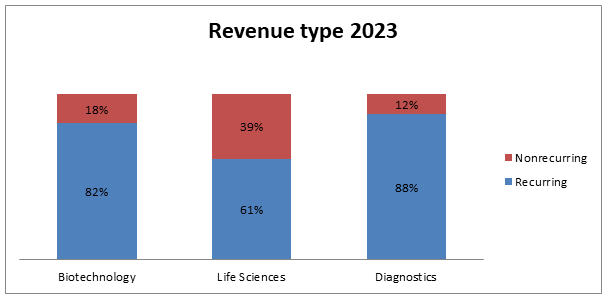

In my view, the most important characteristics of Danaher are its net earnings margin and operating profit margin. Since 2017, the company has achieved a net earnings margin above 15%, as shown in the left chart below. Thus, Danaher has paid particular attention to maintaining a stable cost-to-sales relationship.

Image was created by the author with data from filings

When breaking down the operating profit margin by sector, Danaher has kept its operating profit margin in proportion to its sales. Since 2020, the Biotechnology and Diagnostics segments have exhibited an upward trend in their operating profit margin, as shown in the right chart above. Only the Life Sciences segment has exhibited a decline in its operating profit margin.

In my opinion, Danaher’s prudent cost management strategy has been the key factor in navigating two negative events that occurred since 2022. The first was the post-COVID-19 effect on Danaher’s sales. The second event is the Biotechnology bankruptcy crisis.

COVID-19 does not have the same priority as it used to have for governments and institutions. Due to this situation, global sales of COVID-19-related products have declined. Danaher’s Biotechnology and Diagnostics segments are not an exception, and have seen a decline in their sales since 2022, as shown in the chart below. However, as I indicated in the paragraph above, the company has managed to be profitable in this negative scenario.

Image was created by the author with data from filings

In 2023, the biotechnology sector saw 41 companies filing for bankruptcy. Another report indicates that there were 27 companies filing for bankruptcy. The Biotechnology sector is in financial woe due to the post-COVID-19 environment. Even Danaher has seen a decline in its sales, as depicted in the previous chart. However, Danaher does not exhibit financial problems for the reason explained earlier in this section.

Destocking

Danaher indicates that its customers are reducing their inventory levels. COVID-19 was the catalyst for Danaher’s customers to accumulate inventories. However, since 2022, these companies have been using their inventories. Due to this situation, they have reduced the acquisition of new products and services. In the 2023 Q4 Earning transcript, Danaher indicated the following:

The environment in North America and Europe is stable with customers still working through inventory built up during the pandemic.

In 2023, Danaher’s customers were still using their inventories. Albeit, the outlook improved in the first three quarters of 2024. In the transcript of the Annual Evercore ISI HealthCONx Healthcare Conference, Danaher said:

So what we saw in the third quarter and that is part of the trend that we have been seeing all year is that larger customers essentially have used the inventories that they’ve had and were back to their normal ordering patterns.

The declaration suggests that Danaher will not be impacted by its customers’ inventories. Thus, Danaher’s revenues and earnings would grow again. To put it in context, in the 2022 Q4 earning transcript, the company said that the non-COVID-19 related products grew more than 20% in 2021 and 2022.

M&A

Danaher has been successful in acquiring other companies. In fact, in the past decade, more than half of Danaher’s growth was due to this policy. To explain to the readers how this strategy has allowed Danaher to improve its financial position, I use 2020 as the starting period. The goal is to analyze the most recent and relevant acquisitions.

In March 2020, Danaher acquired the General Electric’s biopharma division, which was later renamed Cytiva. General Electric (GE) was facing a difficult time, with high debt levels, which forced the company to sell its biopharma division. In addition, in March 2020, the uncertainty of the coronavirus was the deciding factor of that operation.

Timing was the key factor for the acquisition of Cytiva. General Electric was going through a difficult time, and at that moment, Danaher acquired Cyvita.

Danaher acquired Aldevron in 2021. The company indicated that the operation was for approximately $9.6 billion. In addition, Aldevron reported revenues of approximately $300 million in 2020.

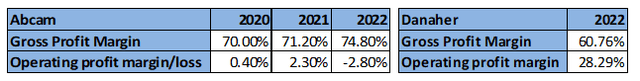

The next important acquisition was in December 2023, when Danaher acquired Abcam for approximately $5.6 billion. As depicted in the next table, during 2020-2022, Abcam reported excellent gross margins. However, Abcam was not able to control its operating expenses. In fact, the company reported an operating loss of 2.80% in 2022.

Image was created by the author with data from filings

I believe that the operating profit margin was the main driver for the Abcam acquisition. I think Danaher can reduce the operating expenses of Abcam. In 2022, Danaher had a lower gross profit margin than Abcam, as depicted in the previous tables. However, Danaher was able to obtain a higher operating profit margin.

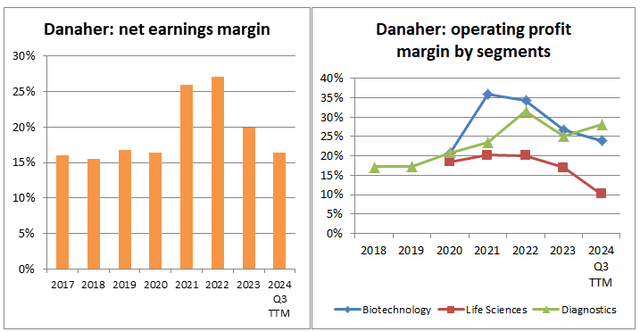

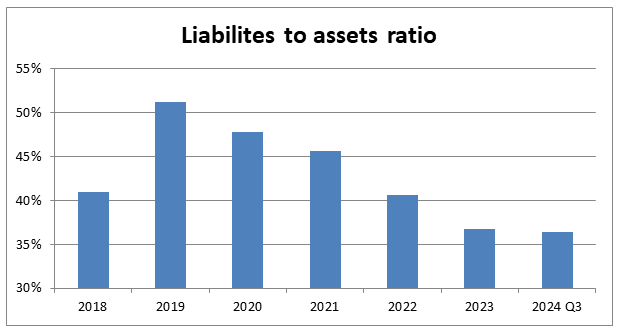

Liabilities to Assets Ratio

Danaher has reduced its liabilities to assets ratio. Since 2019, this ratio exhibits a downtrend, as shown in the next chart. In 2019, the liabilities-to-assets ratio was 51.22% and declined to 36.36% in 2024 Q3 TTM. The decline indicates that the company is becoming averse to having high debt levels.

Image was created by the author with data from filings

Danaher’s long-term debt is the key to understanding the decline. In 2016, this component was $21,516.7 million and declined to $16,324 million in 2024 Q3. In 2019, Danaher issued $10.8 billion of debt to acquire Cyvita; an operation that concluded one year later.

Goodwill and other intangible assets ((net)) considerably increased between 2019 and 2020. These two components were important to increase Danaher’s assets and reduce the liabilities-to-assets ratio.

In my opinion, in the upcoming years, Danaher will execute an important acquisition. The liabilities-to-assets ratio has reached its minimum value since 2018. So, the company has reduced the burden of the debt.

2024 Q3 Earning Report

Hitherto, the focus of this article has been on Danaher’s financial performance over time. This section discusses Danaher’s financial performance in 2024 Q3.

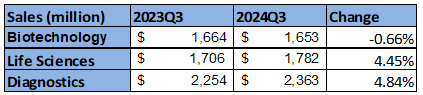

During the third quarter of 2024, Danaher saw a 3.09% increase in its sales. The Life Sciences and Diagnostics segments led that increase, as seen in the next table. The Life Sciences segment grew due to acquisitions of new businesses in 2024, while the Diagnostics segment grew due to the increase in core sales. Biotechnology was the only segment with a decrease in its sales.

Image was created by the author with data from filings

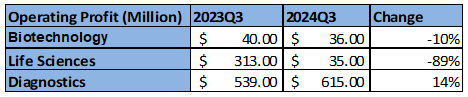

However, Danaher’s net earnings exhibit a negative aspect. In 2024 Q3, net earnings dropped by 27.55%, reaching $810 million. The Biotechnology and Life Sciences segments declined 10% and 88.82%, respectively, as depicted in the next chart.

Image was created by the author with data from filings

The Life Science segment saw a decline in its operating profit. In 2023 Q3, this segment reported an operating profit of $313 million and declined to $35 million in 2024 Q3. Due to this decline, Danaher’s net income dropped. The main reason for this decline was an impairment recorded for $222 million (($169 million after-tax)) in the genomics consumable business of the Life Sciences segment.

Despite the fact that the company saw a decline in its net earnings, I am not of the opinion that these results indicate that Danaher is in financial woe. In 2024 Q3, the sales increased, and the decline in Danaher’s earnings was due to the impairment.

Risk

The Life Sciences segment shows a decline in its operating profit margin. In 2022, this figure was 20.10%. Almost two years later, in 2024 Q3 TTM, Danaher reported a 10.21% operating profit margin. Thus, this figure halved in that period.

The Biotechnology segment is still affected by bankruptcies. In fact, as of October 2024, the sector is facing difficult times, with 22 companies that have filed for bankruptcy.

The Life Science and Biotechnology segments represent 60% of Danaher’s revenues. Therefore, if both segments have a negative outlook for several years, it will affect Danaher’s revenues and earnings negatively. This scenario would cause a decline in Danaher’s stock price.

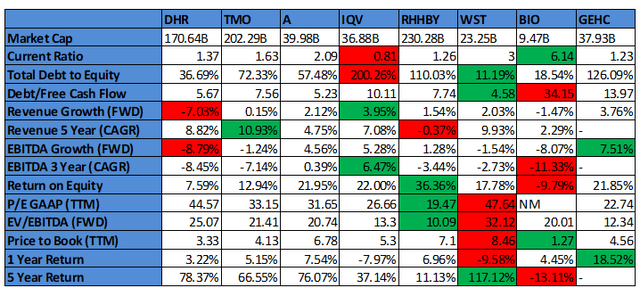

Peer Analysis

This section will implement the peer analysis among Danaher, Thermo Fisher (TMO), Agilent (A), IQVIA (IQV), Roche (OTCQX:RHHBY), West Pharmaceutical Services (WST), Bio-Rad (BIO), and GE HealthCare Technologies (GEHC). I chose these companies because they have business activities in at least one of Danaher’s business segments.

Danaher does not exhibit short-term liquidity problems. Its current ratio is 1.37, which indicates that it has more current assets than current liabilities, as shown in the previous table. In addition, Danaher has the third-lowest total debt-to-equity ratio among its peers. The same happens with the debt-to-free cash flow ratio, since the firm has the third-lowest value. These figures indicate that the company is prudent in managing its debt.

For 2024, Danaher expects the lowest revenue and EBITDA growth among its peers. Thus, this year, the firm has had a difficult time. Furthermore, the company has the second-worst 3-year EBITDA growth. However, Danaher has the third-largest 5-year revenue growth, and a 7.56% ROE. These figures suggest that Danaher has been able to be profitable even when its revenues and EBITDA are declining.

The P/E and EV/EBITDA ratios suggest that Danaher is overvalued. It has the second-highest values among its peers. Albeit, the price-to-book ratio suggests that Danaher is undervalued. It is the second company with the lowest ratio. Therefore, the valuation metrics show mixed results.

Due to the expected decline in Danaher’s revenues and EBITDA, the company has the second-poorest 1-year price return. However, the 5-year returns show a different story. Danaher exhibits the second-highest 5-year price return.

In my opinion, Danaher has acceptable results. It does not show debt problems. In addition, the company shows a 7.39% return on equity, indicating that it is a profitable firm. The only problem is the expected revenues and EBITDA growth rates for this year, which are negatives. However, the 5-year revenues show excellent results.

Conclusion

In light of the analysis presented in this article, I consider Danaher to be an excellent investment opportunity. Although Danaher’s revenues have declined since 2022, the company has maintained its operating profit margin at relatively stable levels.

For the last ten years, Danaher has implemented a successful M&A strategy. During this period, half of Danaher’s growth came from acquiring other companies. In addition, Danaher has reduced its liabilities-to-assets ratio, reaching 36.36% in 2024 Q3 TTM, its lowest level since at least 2018. This reduction indicates that the company is less vulnerable to financial crises.

In December 2024, Danaher indicated that its largest customers exhibit normal order patterns. So, Danaher’s largest customers have burned out the excess of COVID-19-related products. I think that in 2025, the company will see its revenues and earnings increase at their normal growth rates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.