Summary:

- Despite recent challenges, Danaher remains resilient and strategically positioned for long-term success.

- Danaher’s 4Q23 results, while showing declines, highlight strategic steps and acquisitions, setting the stage for sustained growth.

- Despite hurdles, my confidence in DHR stock is unwavering. The company’s track record and proactive measures make it a robust investment, with plans to seize opportunities in stock price weaknesses.

Sergey Khakimullin

Introduction

It’s time to talk about one of my favorite investments. My most recent article on the Danaher Corporation (NYSE:DHR) was written on October 26, when I used the title “Why Danaher Is One Of My Favorite Long-Term Investments.”

Since then, shares are up 26%, beating the already stellar 18% return of the S&P 500 by a notable margin.

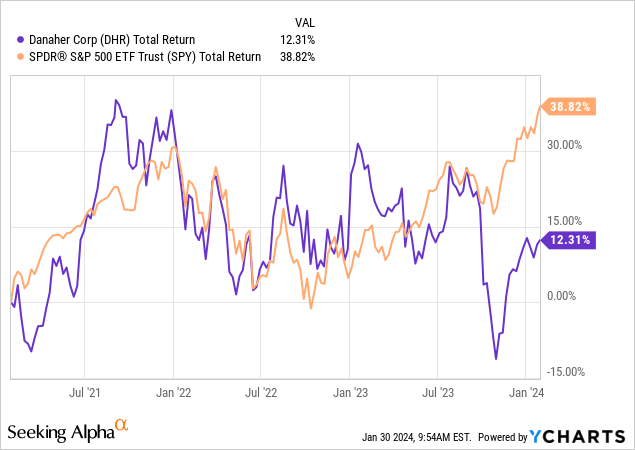

With that said, over the past three years, DHR has returned just 12%, underperforming the S&P 500 by roughly 27 points.

In general, Danaher investors are not used to underperformance.

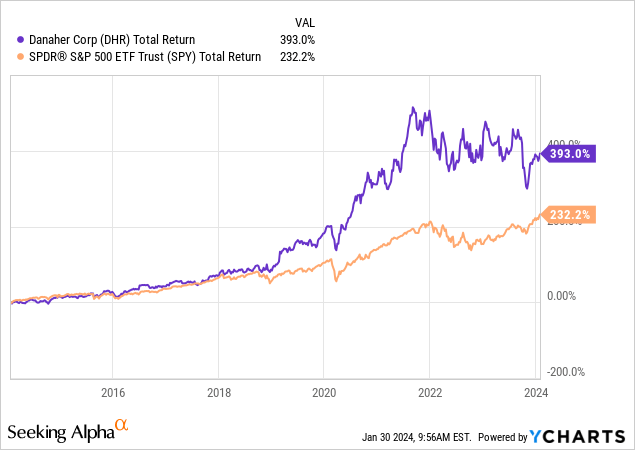

Since 2014, DHR shares have returned more than 390%, beating the 232% return of the S&P 500 by a huge margin. If we were to zoom out further, outperformance would grow even more.

Danaher’s current underperformance is based on a few factors:

- The healthcare giant benefitted tremendously from the pandemic, which means that the post-pandemic years came with underwhelming growth.

- Because of the pandemic, the stock surged to a very lofty valuation. It usually takes time until buyers return.

- China, which used to be a major growth market, is struggling with economic headwinds.

- In general, elevated rates have pressured demand for expensive healthcare equipment.

As Danaher just released its 4Q23/FY23 results, this article will shed light on challenges and opportunities.

Although 2024 will be another weak year, the company sees growth returning in the second half of 2024, which should be followed by a strong period of elevated growth as the company continues to benefit from strong secular growth and has some of the best businesses in the sector.

I remain very bullish and will use any correction this year to expand my position.

So, let’s dive into the details!

What To Make Of Headwinds?

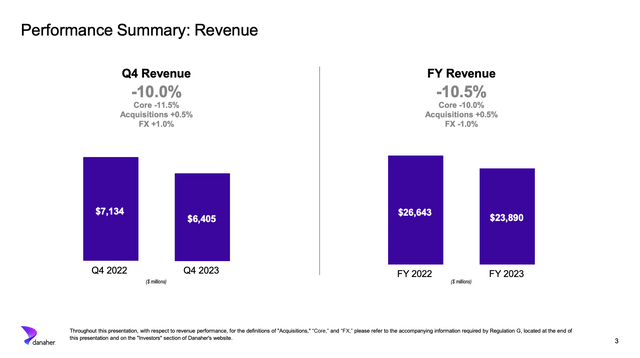

Total sales for the full year came in at $23.9 billion, reflecting a 10% decline in core revenue.

This contraction was attributed to a slight decrease in the base business and a substantial COVID-19-related headwind of approximately 9.5%.

In the fourth quarter, sales fell to $6.4 billion, as core revenue experienced an 11.5% decline, with a 4.5% contraction in the base business and a significant COVID-19-related headwind of approximately 7%.

Geographically, developed markets saw a low double-digit decline, impacted by lower respiratory and COVID-19 vaccine and therapeutic revenues, along with ongoing investment normalization in pharma and biopharma end markets.

High-growth markets also faced challenges, with a high single-digit decline, including a mid-teens drop in China due to the persistently challenging economic landscape.

Moreover, the adjusted operating margin experienced a decrease of 420 basis points, primarily attributed to lower volume in the Biotechnology and Diagnostics segments and costs related to productivity initiatives.

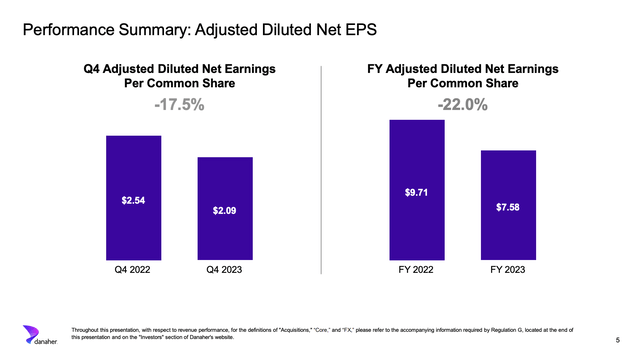

As a result, adjusted EPS declined by 17.5% in the fourth quarter. The full-year adjusted EPS was down 22.0%.

Moving over to one of the company’s most important financial metrics, free cash flow, for the full year 2023, Danaher’s free cash flow reached $5.1 billion.

Although free cash flow declined by 21.5% year-over-year, 2023 marked the 32nd consecutive year where the free cash flow to net income conversion ratio exceeded 100%, which underscores the company’s consistent track record of converting a substantial proportion of its net income into cash.

It’s also indicative of high-quality earnings.

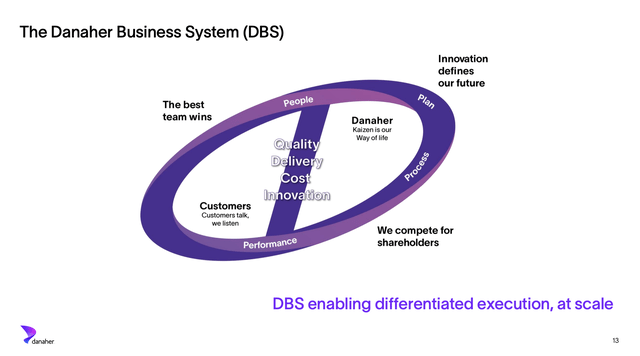

This consistent ability to convert earnings into substantial free cash flow speaks to Danaher’s efficient operational management and disciplined approach to capital allocation, which is part of the Danaher Business System (“DBS”), its model that has allowed it to build an M&A-fueled healthcare powerhouse.

During the JPMorgan Healthcare Conference in early January, the company noted that DBS is not just a set of tools but a cultural framework that permeates the organization.

It enables efficient execution, continuous improvement, and innovation across all operating companies within the portfolio, ensuring sustained growth and competitiveness.

With that said, the earnings call revealed a lot of good news, even if certain segments struggled with some of the aforementioned headwinds.

The Bigger Picture Remains Bullish

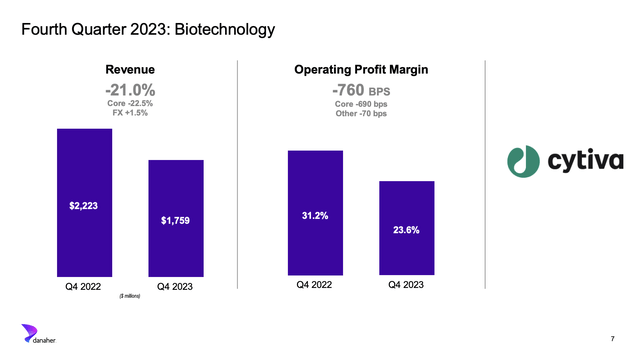

Digging a bit deeper, in the Biotechnology segment, Danaher reported a 21% decline in revenue, with core revenue down by 22.5%.

The bioprocessing core revenue saw a substantial decline of over 20%, which aligned with expectations.

Discovery and medical components declined in the high teens.

Despite these challenges, the company remains confident in the long-term growth trajectory of the biologics market.

Why?

According to the company, market trends indicate a stable environment in North America and Europe, where customers are gradually working through inventory buildup resulting from the pandemic.

However, demand and activity levels in China remain weak as customers prioritize programs and capital conservation.

Despite these near-term challenges, the underlying demand for biological medicines continues to rise, as 2023 witnessed a record number of FDA approvals for biologic and genomic medicines, with a development pipeline at an all-time high.

Speaking of developments and innovation, over the last several years, Cytiva has accelerated investments in innovation, as shown by the launch of Cytiva Protein Select technology.

This technology, designed for affinity chromatography resin, streamlines the recombinant protein purification process.

Notably, there are currently more than 1,800 recombinant proteins in development, and this technology facilitates faster and more efficient process development.

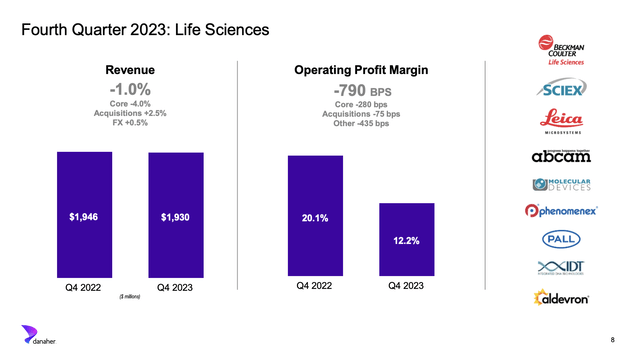

Moving over to Life Sciences, this segment reported a revenue decline of 1% and a core revenue contraction of 4%, including a low single-digit decline in the base business.

Despite these figures, Danaher expanded its capabilities and portfolio with the strategic acquisition of Abcam, completed in December 2023.

Meanwhile, the genomics consumables-based business showed a flat performance, with robust demand across various categories offset by declines in next-generation sequencing and basic research.

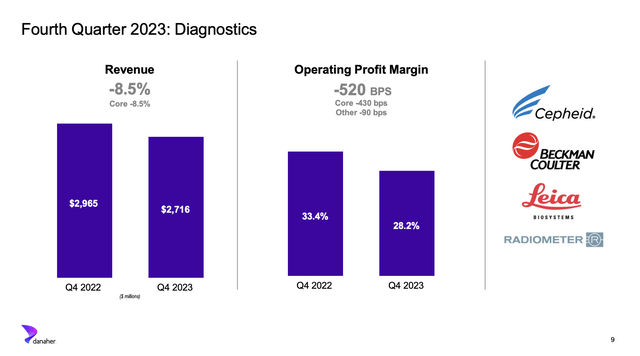

In the Diagnostics segment, reported and core revenue both declined by 8.5%.

However, Beckman Coulter Diagnostics led the way with over 10% core revenue growth, showing notable strength in clinical chemistry and immunoassay.

What I found very notable is that Cepheid’s respiratory business exceeded expectations, with revenue of $650 million in the quarter, surpassing the initial assumption of $350 million.

The strong performance was attributed to the high prevalence of circulating respiratory viruses, driving higher volumes and a preference for Cepheid’s 4-in-1 test for COVID-19, Flu A, Flu B, and RSV.

To put things in perspective, the Cepheid respiratory franchise is now 6x larger than it was before the pandemic!

Based on everything said so far, for the full year 2024, Danaher expects core revenue to decline in the low single-digit percent range.

This projection assumes a decline in the first half of the year, followed by a return to growth in the second half.

The company also anticipates a 50 basis point improvement in the full-year adjusted operating profit margin compared to 2023.

In other words, if management is right, 1H24 will be the bottom of Danaher’s business, potentially followed by consistent growth.

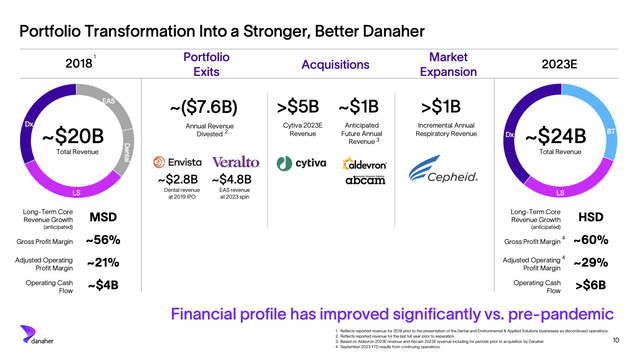

Moreover, during its earnings call, the company noted that it has strategically strengthened its portfolio through mergers and acquisitions, such as Cytiva, Aldevron, and Abcam.

As we can see in the overview below, the “new” Danaher business is a pure-play healthcare giant after both Envista (NVST) and Veralto (VLTO) were spun off in recent years. These gaps were filled by new companies.

Comparing the 2023 DHR business to the 2018 business, we see that it is now a business with expectations of high-single-digit annual core revenue growth, higher margins, and stronger free cash flow.

In addition to that, proactive steps were taken to improve the cost structure, and the consistent application of the Danaher Business System has driven lasting process improvements and facilitated the launch of breakthrough solutions.

Danaher Stock Valuation

So far, I have to say that I really like the 4Q23 results. Sure, the decline in revenue, earnings, and free cash flow isn’t great. However, this was expected.

What matters is that the company has a very bright future, thanks to streamlining its business, strong secular growth in healthcare, and fantastic franchises that continue to show what they are capable of.

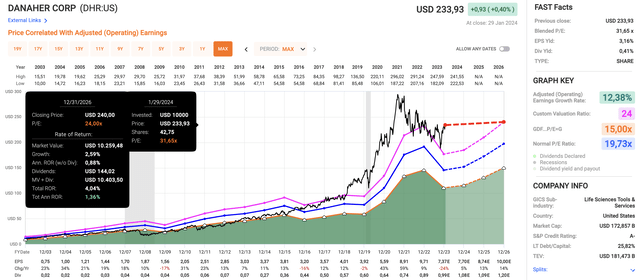

As we can see in the chart below, analysts expect 13% to 14% growth per year after 2024, which would be similar to the pre-pandemic recovery.

That makes sense, as this is what the company said during its earnings call:

Despite the near-term headwinds from destocking, our confidence in the health and long-term growth trajectory of the biologics market remains as strong as ever. – DHR 4Q23 Earnings Call

The problem is that DHR is not cheap.

Using the data in the chart above:

- DHR currently trades at a blended P/E ratio of 31.5x.

- Its normalized P/E ratio is 19.7x. However, I believe that a 24x earnings multiple makes more sense, as a prolonged period of double-digit EPS growth is likely – this time without non-healthcare segments.

- If we use a 24x multiple, its dividend (just 0.4% yield), and expected EPS growth, we get an implied annual return of roughly 1% through 2026.

While this number is purely technical, it shows that a lot has been priced in.

With that said, this somewhat makes sense. After all, the company’s recent “struggles” were all predictable. There was no need to let DHR get really cheap if the likelihood of a strong recovery is very high!

Hence, I also do not expect a major correction to allow investors to get DHR at very attractive prices.

As I am currently long, my goal is to buy DHR on 8-10% stock price weakness if I get the chance.

I will apply this strategy until the stock is a top 3 holding of my portfolio, as I truly believe that DHR is one of the best wealth compounders money can buy.

Takeaway

Despite recent challenges impacting Danaher’s performance, including pandemic-related headwinds and economic struggles in key markets like China, my confidence in the company’s long-term prospects remains unwavering.

The 4Q23 results, while showing declines in revenue and earnings, were anticipated, and the strategic steps taken to streamline the business and strengthen the portfolio through acquisitions position Danaher for sustained growth.

While the current valuation may not be cheap, the company’s track record, commitment to innovation, and proactive measures make it a solid investment for the future.

I plan to capitalize on any stock price weakness to further build my position, reflecting my strong belief in Danaher’s potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.