Summary:

- Danaher’s annual results show a decrease in sales and EBIT due to the boost in sales of the COVID-19 pandemic.

- The company has made strategic acquisitions and spin-offs to improve its business segments and position itself for long-term growth.

- Danaher’s participation in the J.P. Morgan Annual Healthcare Conference highlighted its recurring demand, potential growth opportunities, and focus on attractive end markets.

gorodenkoff

It’s been 5 months since I published my first article about it Danaher (NYSE:DHR). Many things have happened since then, such as the presentation of annual results or the spin-off of Veralto. This article will aim to summarize all of this and update the thesis, as well as outline the new segments that make up Danaher.

Annual Results

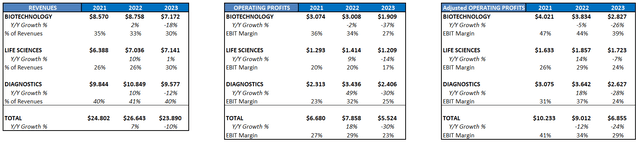

On January 30th, Danaher presented its 2023 annual results, and rose by 4.75% in the session. This year has been a transitional year for the company, thanks to the spin-off of Veralto and being immersed in a downward cycle of spending by its end customers. Therefore, sales for the fiscal year have decreased by 10% if we exclude the impact of Veralto. EBIT has decreased by 30%, and the margin has fallen from 29% EBIT margin to 23%, although its adjusted EBIT margin still stands at 28%. Most of these adjustments are due to impairments, non-cash expenses that do not affect the company’s cash generation. FCF margin dropped by 21%, FCF margin decreased from 24% to 21%, and FCF/Net Income conversion rose to 121%, all excluding the impact of Veralto.

Source: Author’s representation

Below, I will include some comments made during the conference call. In December, they completed the acquisition of Avcamp, which will aid the Life Science segment. The 10% sales decline includes a 9.5% impact from COVID-related sales declines (as expected). They mention that the portfolio transition and macro situation will continue into the first half of the year, but they are better positioned to ride secular trends and achieve higher sales growth rates in the long term. Demand in developing countries is less affected, and the situation in China remains somewhat challenging. Long-term, China should be a strong growth engine as the country is trying to build its own pharmaceutical industry. However, it’s worth noting that China’s comparison (12% of Danaher’s sales) was challenging due to a unique subsidy program, especially in academic markets, which accelerated the acquisition of many life science research tools.

In recent years, the company has improved with the spin-offs of Veralto and Envista, as well as the acquisitions of Cytiva, Aldebron, and Abcam. Additionally, Cepheid is now 6 times larger than before the pandemic and is likely to enjoy recurring demand each flu season, thanks to its 4-in-1 tests. They do not expect the book-to-bill ratio to exceed 1 at any point in the year, but they anticipate a slight improvement from the current 0.8-0.85. Danaher operates without cancellation invoices, which is better for customer satisfaction, although it may be detrimental to the company in some instances. I believe it’s the right way to operate to endure and maintain those long-term customer relationships.

J.P. Morgan 42nd Annual Healthcare Conference 2024

On January 2nd, Danaher participated in an interesting conference organized by JP Morgan. During the event, they discussed the future of the company and shared valuable pieces of information, which I will outline below.

They already have 80% recurring demand, compared to 68% in 2018. Being a recurring business, they are in close contact with their end customers, who inform them of changes in trends and new innovations. The DBS system has been refined for 40 years. Long-term growth estimates do not take into account potential drug launches for Alzheimer’s or GLP-1 nearly, so there are positive opportunities, and the long-term guidance may be conservative.

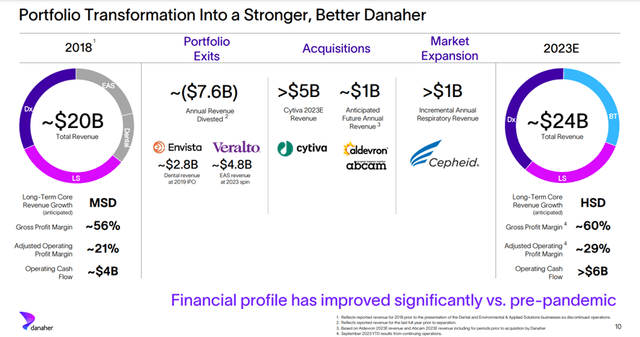

They also presented an interesting image depicting the transition Danaher has undergone, thanks to the spin-off of two of its businesses, Envista and Veralto, the acquisition of Cytiva, Aldevron, and Abcam, and the positive impact on Cepheid due to Covid-19. The 4-in-1 tests have become a recurring source of revenue, estimated at around $1.5 billion each flu season. With this improvement in the business and its prospects, we could consider that Danaher deserves an upward re-rating from the average 23x FCF it has traded at over the last 10 years.

Source: 2024 Danaher at JPM Healthcare, slide 10

Next, I will share some statements made by Rainer Blair – President and Chief Executive Officer.

He explained the steps they take when making an acquisition:

“And you see here that we always use the three dimensions of market where we develop a proprietary perspective on an end market looking for long-term secular growth drivers that are sustained. We look at companies, of course, in that market and once again, develop a proprietary perspective on the defensiveness — defensibility of their competitive advantage or our ability to create one. And then, of course, we look at the financial model, the valuation of that. And when all of those three dimensions intersect, not one, not two, but all three intersect, that’s when we execute on a transaction and drive the power of compounding returns over the long term.”

As I mentioned in my first article, all the cash they received during the pandemic has been used to make good acquisitions:

“So once again, positioning ourselves in highly attractive end markets, Aldevron, the gold standard for delivering nucleic acid in the highly attractive genomic medicines end market. And Abcam, as we just spoke of, the gold standard for proteomic research and analysis in the world. So once again, improved end market positioning while at the same time improving the financial profile of the business”.

They also provide perspectives on the long-term tailwinds of the business:

“If we simply reflect on the size of the drug development pipeline, that continues to grow. We had 34 approvals in the U.S. last year by the FDA, which is a very high number from a historical perspective. And there continues to be an enormous amount of development underway. When we look at the relatively low penetration of biologic drugs in the market, less than 10% worldwide, and patients who could use these biologic drugs for various reasons don’t have access to them. If we think from a diagnostic perspective, diagnostics are, from our point of view, a catalyst for ultimately driving value-based healthcare, identifying the right patient at the right time for the right treatment, and the right treatment means knowing that a particular patient will respond to the therapeutic treatment ultimately prescribed. So, we see secular growth drivers, not only here in the U.S. but also in Europe and in China, remaining firmly intact.”

Some numbers and conclusions

They expect the first half of 2024 to be weak, with a negative impact on sales, hitting bottom in the cycle and experiencing positive growth in the second half of the year, despite expecting low single-digit declines in sales for 2024 overall. I believe the stock rose nearly 5% on results day, but if the second half of 2024 doesn’t unfold as they have predicted, it’s highly likely that the market will punish it.

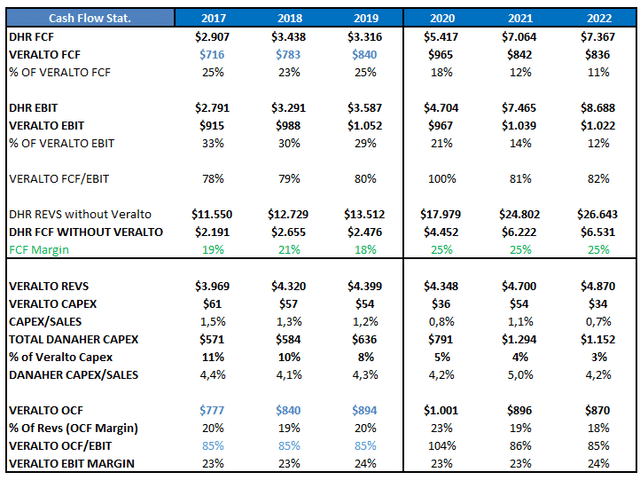

In the image below, I show the FCF of Veralto and Danaher excluding Veralto. The numbers in black are provided by the company, as Danaher provided quite a bit of information until 2020. The numbers in blue, all between 2017 and 2019, are estimates made by me. What we can see is that the FCF margin of Danaher excluding Veralto increased from 18% to 25% thanks to the pandemic. This year, it has stood at 21%, but if we consider that CAPEX will normalize somewhat because there will no longer be a need for massive production to meet demand (we normalize it to 4% of sales) and order volumes return to normal, and therefore, margins are not as affected by Danaher’s fixed costs, we may see FCF margins of around 25%-28% for the company, translating to FCF growth of between 11% and 14%. It’s worth considering that the management is not taking into account potential positive impacts on sales from the treatment of new diseases, and I’m not sure to what extent they are considering the patent expirations mentioned in the first article.

Source: Author’s representation

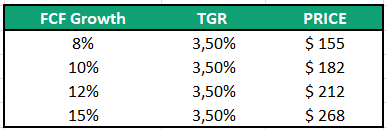

But, if we want to dispel any doubts, we can always build a 10-year Discounted Cash Flow model and see different FCF growth rates and what Fair Values we would get. In this case, I have used a 10% discount rate and a long-term growth rate of 3.5%. Based on all of this, I rate Danaher as a Buy.

Source: Author’s representation

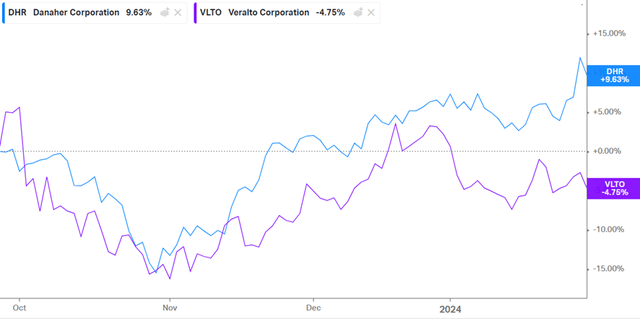

Just to wrap up, here we have the difference in the performance of Danaher’s stock and Veralto’s stock since the day of the spin-off. As has been the case with other spin-offs, it is expected that this performance difference will persist in the long term, as Danaher divests itself of less profitable, slower-growing, and more capital-intensive businesses.

Conclusion

Danaher has undergone a transformation process during this year. Undoubtedly, all the events that have occurred have made the analysis of the company in the short term more challenging. The good news is that the long-term outlook remains intact, and even slightly improved, so my confidence in the business model and management team remains very high.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.