Summary:

- Danaher has undergone a radical transformation from a real estate trust to a leader in the life sciences industry through strategic acquisitions.

- The company’s focus on continuous improvement and efficiency, guided by the Kaizen philosophy, has been a driving force behind its success.

- Danaher’s recent divestments and increased focus on its core businesses have led to strong financial performance and growth, making it an attractive investment option.

Sundry Photography

Introduction

As a long-term-oriented investor, I’m always searching for companies that also orient themselves to the long term. There are many ways you can measure that, and yes, it is somewhat subjective. But I believe few companies do it better and more decisively than Danaher (NYSE:DHR).

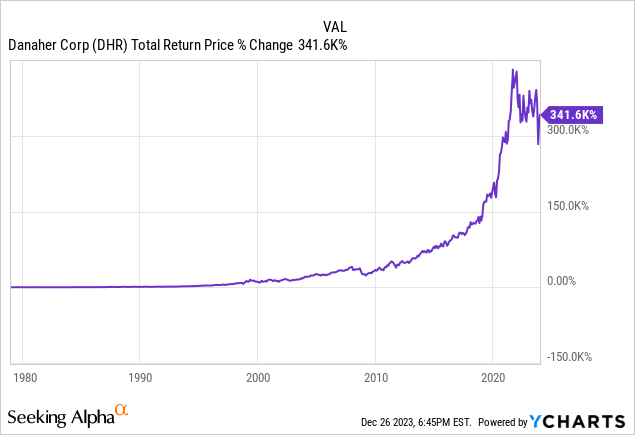

And while a chart of the share price doesn’t always tell the whole story, in the case of Danaher, I believe it’s a strong indicator of the quality of this business and its management.

Danaher is a life sciences company, but it hasn’t always been; many years ago, it was merely a real estate trust. So, how did a real estate trust become a life sciences rock star? Danaher’s story is one of radical transformation spearheaded by a management team laser-focused on capital allocation.

Danaher’s transformation was no accident.

In today’s article, we’ll explore Danaher, its financial performance, but, more importantly, its constant proactive adaptation to market trends, which allowed it to rise to the top of the pack.

A One-of-a-kind Transformation

Many companies utilize M&A to unlock growth; some use it to consolidate market share, others use it to enter new growth verticals, and yet, other times, it’s about acquiring talent.

Some companies use it to achieve a sort of corporate facelift, whereby a “boring” stable business acquires something “sexy” to generate positive buzz on the street, which may be followed by a re-rating higher vis-a-vis an improved earnings multiple. I’d argue an example of this would be AT&T (T), through its acquisition of Warner Bros. (WBD), though this was later undone.

M&A is common. What is uncommon is Danaher’s approach to it.

As I mentioned in the introduction, Danaher has utilized M&A to radically transform its business; after all, how else could a real estate trust become a pioneer of the life sciences space? Let’s discuss how things came together.

From Real Estate to Manufacturing Tools

Danaher’s dominance within the life sciences space didn’t happen in one fell swoop; it’s actually the product of multiple successful reinventions. Danaher’s first big transformation was from that of a real estate trust to a manufacturing tools provider.

They accomplished this transformation through a series of acquisitions in the manufacturing tools space, including Chicago Pneumatic, Qualitrol, and Easco Hand Tools. After just years of being founded, they acquired a dozen companies successfully. These early moves established a clear strategy.

M&A is in Danaher’s DNA.

In addition to acquisitions, they have routinely disposed of non-strategic business segments; one of those early dispositions was part of one of its first acquisitions, Chicago Pneumatic, where it sold off the part of the business that wasn’t geared towards manufacturing tools.

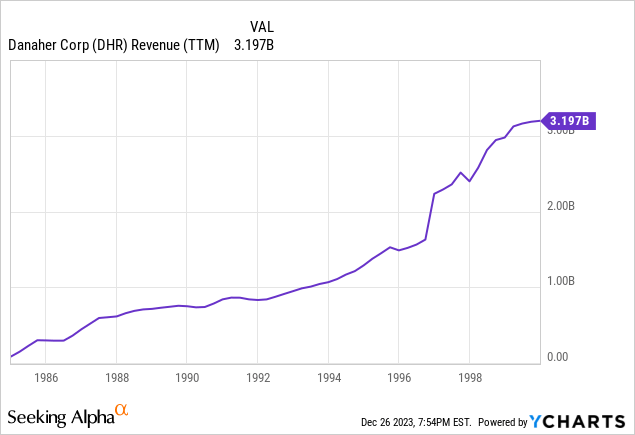

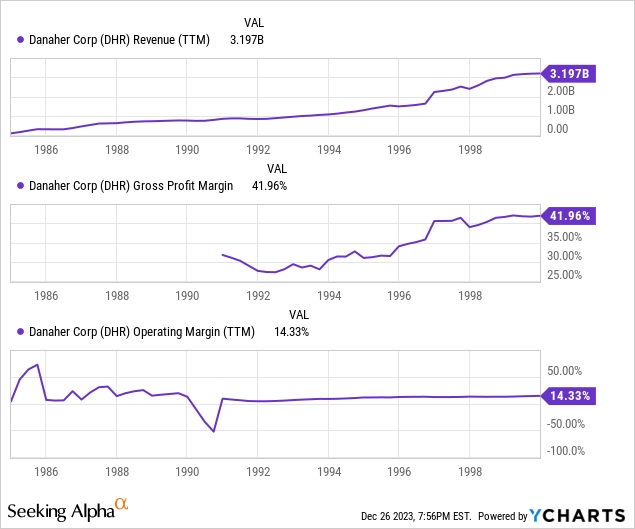

As a result of that transformation, Danaher’s revenues exploded from less than half a billion dollars in the early 1980s to more than $3.2B at the turn of the century. Gross margins followed a similar trend, expanding from around 30% to upwards of 40% in the same period.

These early years were likely defining for the company; it achieved remarkable financial success as it leaped into a new business vertical with attractive fundamentals, then doubled down by acquiring companies in that vertical to gain share and service a greater variety of customer needs.

Kaizen

Before we move on to Danaher’s next reinvention, let’s touch on the mindset that helped to make them possible, something part of Danaher’s guiding philosophy, Kaizen.

Kaizen is a lean manufacturing principle stemming from Japan that emphasizes continuous improvement in all aspects of operations. This mindset is deeply ingrained in the company’s culture, fostering an environment where innovation is encouraged and expected.

At Danaher, Kaizen manifests in a relentless pursuit of efficiency and quality, with employees at all levels empowered to identify and implement improvements. Because of that, I’d argue that this Kaizen philosophy was the driving force of Danaher’s radical reinvention.

Danaher in the 2000s

Having seen great success expanding into manufacturing tools, Danaher continued its M&A-fueled expansion, acquiring its way into new verticals like life sciences and dentistry.

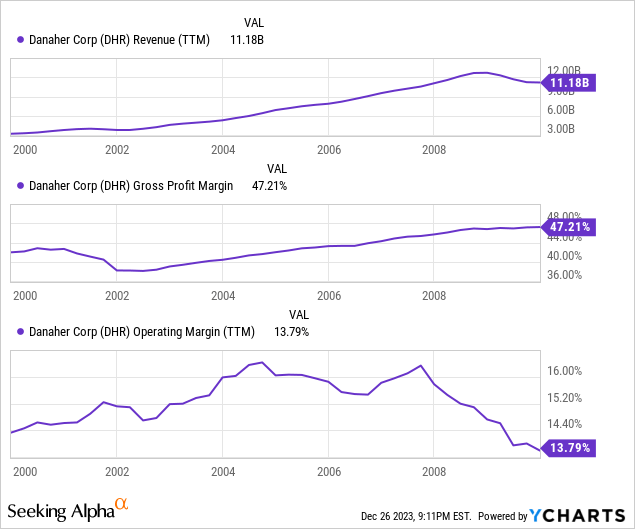

In the 2000s, Danaher truly became a conglomerate, operating many business units and serving very different groups of customers. And for a while, things looked great, and revenue continued to bolt higher alongside the margins.

Impressively, gross margins even held up in the face of the great financial crisis of 08, and revenue only declined slightly. Unfortunately, in this phase, operating margins showed signs of deterioration, declining from ~16% in 2008 to 13.8% in 2010.

The 2010s to Today

After multiple decades of sustained growth, the business had reached a scale few companies have ever achieved. But increasingly, conglomerates were no longer in vogue; failures at companies like GE highlighted the challenges of running a conglomerate with such wide-spanning operations.

In my view, the 2010s was truly the period when Danaher decided to go all in on life sciences. Acquisitions like that of Beckman Coulter played right into that vision, but with operations spreading out across so many industries, more needed to be done.

To help enhance the focus and streamline operations, the company spun off two major parts of its business through two new companies, Fortive (FTV) and Envista (NVST). Fortive took on the industrial tools side of the business, and Envista took on the dental side of the company.

Both companies continued with their robust product offerings in their respective niches, but jettisoning the slower-growing segments allowed Danaher to focus on the parts of the business with a better runway for growth ahead.

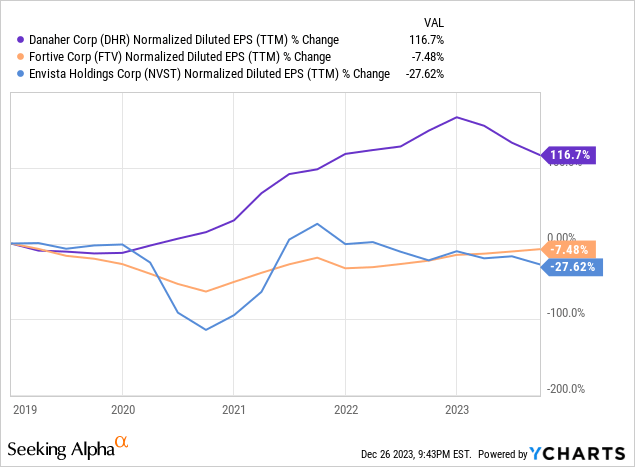

As you can see, over the past five years, Danaher managed to double its EPS, whereas Fortive and Envista have both seen declines.

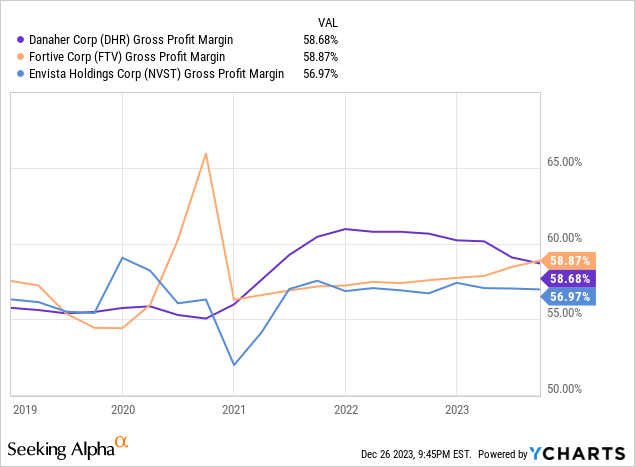

But as you can see in the chart above, these declines in its EPS were not due to suffering profitability of the underlying goods; in fact, the gross margins at all three companies have been relatively stable, if not growing slightly. Danaher’s moves allowed it to focus all of its efforts on the best part of its business, and the shareholders have been handily rewarded for that focus.

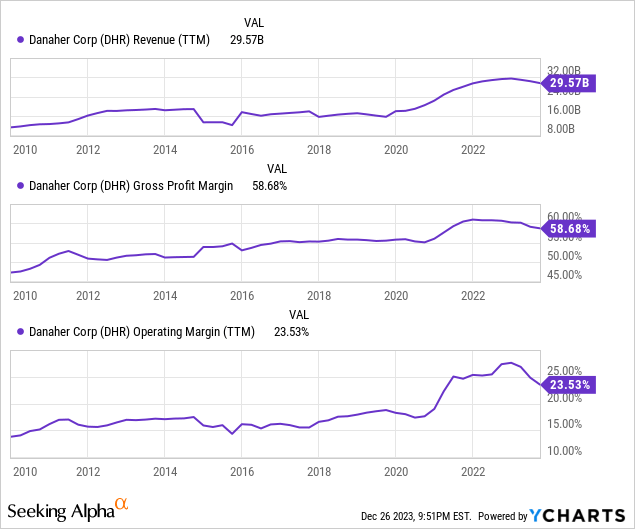

The result of that increased focus couldn’t be any clearer: while gross margins marginally improved, its operating margins soared, and so did revenue overall.

While part of that growth could be attributed to a ramp-up of life sciences spending during the COVID-19 pandemic, it has clearly shown some stickiness as the revenues are still much higher than where they were at the start of 2020. Leaner operations led to a more efficient business.

Veralto

After Danaher spun off its industrial and dental tool business, it continued its evolution even further by spinning off its water quality business as Veralto (VLTO). I won’t spend all that much time discussing the merits of Veralto in this article, but for investors in Danaher, it is one more piece of evidence signifying that their commitment to proactive reinvention remains.

I believe that investors can feel confident that should life sciences slow and their confidence wane, management would quickly identify a new industry to attack and then quickly dominate.

Few companies can pivot so swiftly as Danaher; in my view, that is their biggest strength.

Can the growth story continue?

While Danaher has had an impressive run, one must wonder, how long can this story continue to play out? After such a long history of major deal, after major deal, followed by game-changing divestments, how much further can the business be optimized? And once major deals slow or come to an end, can the stock continue its run?

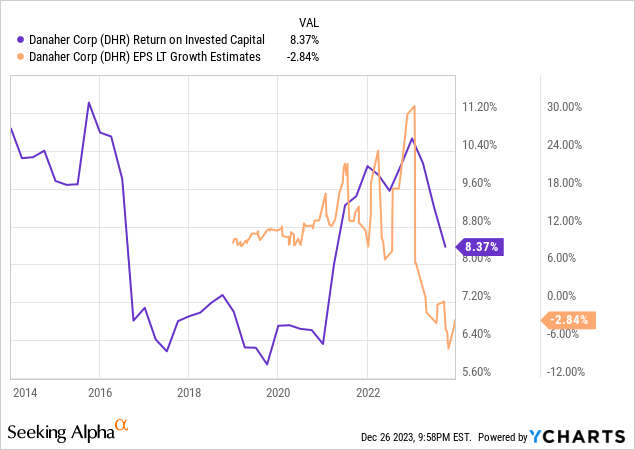

And it’s a good question because the business is indeed showing some signs of slowing down; long-term EPS growth estimates are down, as well as returns on invested capital. Additionally, the FTC is likely to impede future growth as potential deals face increased scrutiny and higher chances of outright opposition.

If the company loses access to the sort of transformative deals it was able to execute in the past, it loses a critical growth driver and will become increasingly reliant on organic growth to drive returns. Luckily, the life sciences space is forecasted to continue growing at a rapid clip (15.12% CAGR through 2028, according to some researchers).

A rising tide tends to lift all boats.

So, for now, the company still seems like it can truck along, but investors would be wise to monitor the pace of transactions going forward.

Valuation

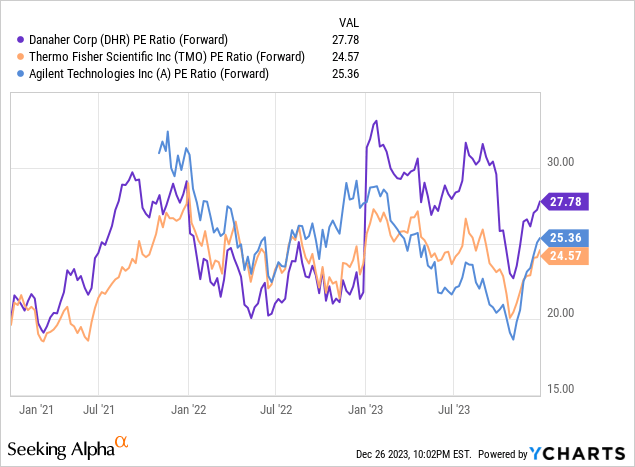

Looking at the valuation of Danaher against peers Thermo Fisher Scientific (TMO) and Agilent Technologies (A), we can see that Danaher trades at the highest forward earnings multiple of 27.7X, and both Thermo Fisher and Agilent trade somewhat lower, around 25x.

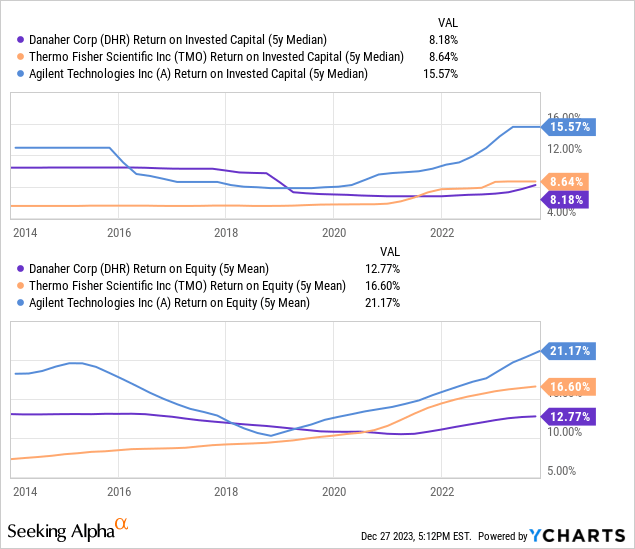

Perhaps at odds with that premium valuation, over the past 10 years, Danaher has deployed capital at lower rates of return compared to its peers. Perhaps boosting Danaher’s premium is the possibility for further transformative M&A, as they are a clear leader in that space. Ultimately, it will be subjective based on the individual investor whether they believe that a small premium is warranted; in my case, I do.

Conclusion

In conclusion, Danaher’s journey from a real estate trust to a leading force in the life sciences industry exemplifies the power of strategic transformation and continuous improvement. Its adoption of Kaizen and a focused M&A strategy has positioned it as a resilient and innovative leader capable of navigating the complexities of a rapidly evolving market. The company’s ability to continuously reinvent itself while maintaining robust financial performance is a testament to its strong management and vision.

While its future may not be as rosy as its past, its steady growth and commitment to strategic evolution make it an attractive proposition for long-term-oriented investors.

I rate Danaher a “Buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DHR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.