Summary:

- Danaher Corporation is facing near-term headwinds due to COVID-19-related demand normalization and customer inventory destocking in its Biotechnology segment.

- However, these headwinds are temporary, and the company’s medium to long-term growth story is attractive.

- The company has a healthy balance sheet, strong exposure to high-growth end markets like Biologics, and a history of driving shareholder value through portfolio transformation and strategic M&A.

monsitj

Investment Thesis

Danaher Corporation (NYSE:DHR) faces near-term headwinds due to the COVID-19-related demand normalization and customer inventory destocking in its Biotechnology segment which is negatively impacting its revenue growth. However, these headwinds are temporary in nature and the company’s medium to long-term growth story is attractive. The company has an excellent track record of driving shareholder value through portfolio transformation and is continuing to make progress in this regard including the recent Veralto spin-off and Abcam acquisition. These portfolio improvements strengthen its core Life Science business and bodes well for the company’s future growth. In addition, the company has a healthy balance sheet which positions it well to do further bolt-on M&A. Further, the company has good exposure to high-growth end markets like Biologics which should also benefit its revenue growth in the coming years.

The medium to long-term margin outlook is also favorable as one-time charges related to the alignment of cost structure with lower volumes and separation of Veralto incurred this year should not recur next year. Further, as the company returns to growth towards the end of FY24, benefits from these cost-reduction actions should aid the margin growth. The valuation is at a slight discount versus historical on next year’s bottom-of-the-cycle EPS. I believe the stock can be a good contrarian bet for medium to long-term investors as we approach the bottom in FY24 and the company returns to growth from FY25 onward.

Revenue Analysis and Outlook

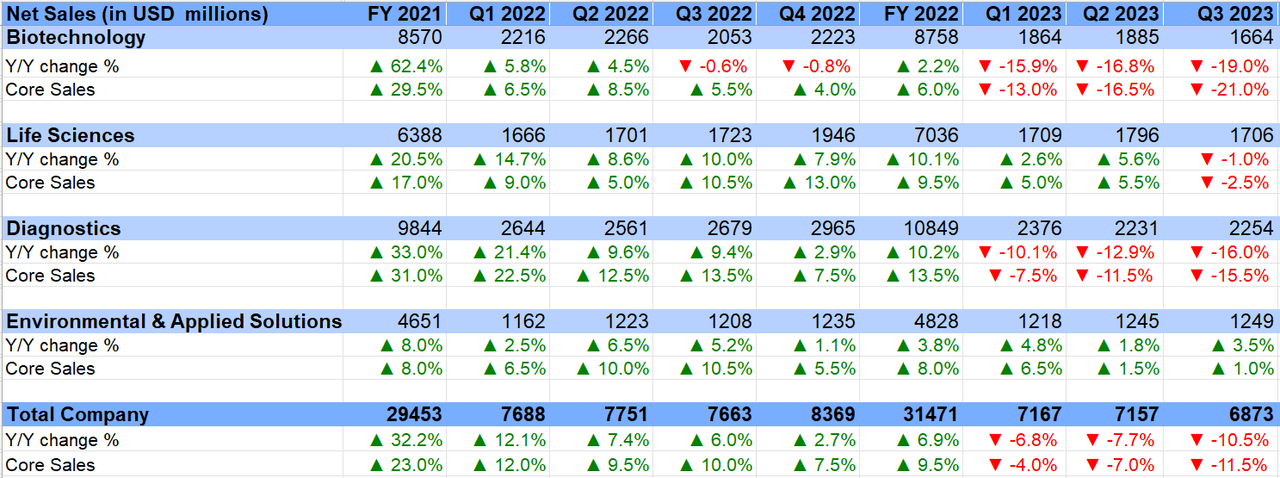

After benefiting from Covid-related demand tailwinds in FY21 and FY22, the company’s sales turned negative in FY23 as this demand started to normalize. In the third quarter of 2023, DHR’s net sales of $6.873 billion declined 10.5% Y/Y led by an 11.5% Y/Y decline in core sales due to lower demand for COVID-19-related products and resulting in weakness in the Biotechnology, Life Sciences, and Diagnostics segments. However, the Y/Y decline in sales was partially offset by a 0.5% favorable impact from FX translation and a 0.5% contribution from acquisitions.

In the Biotechnology segment, net sales decreased by 19% Y/Y with a 21% Y/Y decrease in core sales driven by weak end-customer demand for COVID-19-related therapeutics and vaccines and customer inventory reductions in the bioprocessing business. Bioprocessing business core sales declined by over 20% with an approximately 45% decline in China as clients focused on reducing excess inventory. Core sales in the discovery and medical business also declined Y/Y as a result of weak demand for lab filtration, medical and diagnostics, and genomics product lines which more than offset the increased demand for protein research products.

The Life Sciences segment’s sales declined 1% Y/Y due to a 2.5% Y/Y core sales decline as a result of the decline in COVID-19-related sales and weaker demand across the pharma and biopharma customers.

The Diagnostics segment’s sales decreased 16% Y/Y due to a 15.5% Y/Y decrease in core sales resulting from lower COVID-related respiratory testing volumes at the company’s Cepheid business, partially offset by increased sales of non-respiratory disease tests, which grew over 20% in the third quarter.

Meanwhile, sales from the Environmental and Applied Solutions segment, which has now been spun off as a separate company Veralto (VLTO), grew 3.5% Y/Y with a 1% Y/Y increase in core sales due to increased sales in the chemical treatment solutions and ultraviolet water disinfection product lines attributed to strong demand across major end-markets including municipal, residential and industrial end-markets.

DHR’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, while the company is facing near-term headwinds that should impact its organic revenues in the fourth quarter and the first half of FY24, most of these headwinds are temporary in nature and don’t impact the company’s medium to long-term growth prospects. So, while the stock is down YTD, the medium to long-term investors who can wait for a few more quarters can see the company return to good growth towards the end of next year.

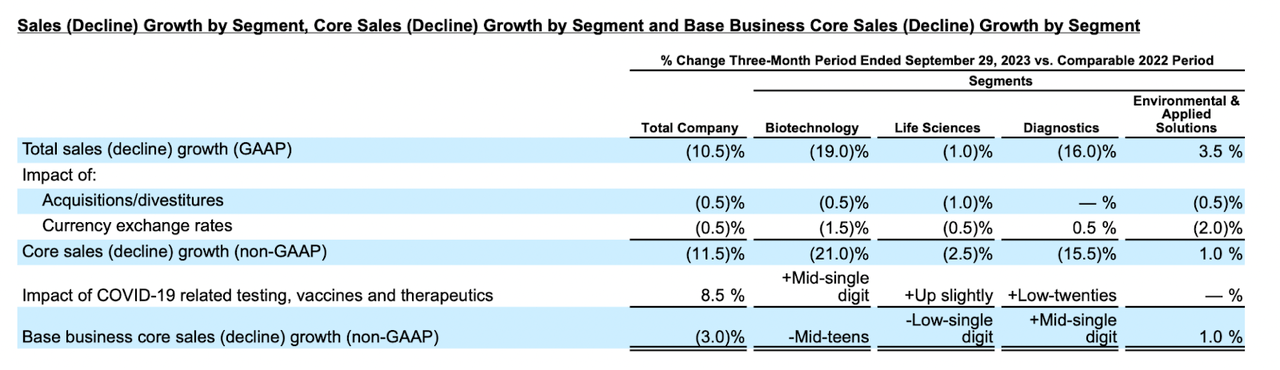

The first big headwind the company is facing is the normalization of demand post-COVID. If we look at the impact of demand normalization for COVID-19-related products for testing, therapeutics, etc, they negatively impacted last quarter’s total sales by 8.5 percentage points. Excluding its impact, the core base business sales decline was 3% Y/Y which was much better than the headline number of 11.5% decline in sales (excluding Acquisition/Divestiture and FX). For the first nine months of FY23, the COVID-19-related sales normalization was ~9% Y/Y headwind, and while I believe it will continue to present some headwinds in FY24, the extent should be much less than we have seen in FY23. So, the core sales decline which we are seeing should improve meaningfully.

DHR sales performance and adjustment for Covid impact (Company Presentation)

Other than the COVID-related demand normalization headwind, the company is also facing a headwind from inventory destocking at its bioprocessing clients which is impacting its Biotechnology segment. Over the last couple of years, due to high demand as well as supply chain challenges, the company’s bioprocessing clients stocked excess spare inventory to meet demand in case of supply disruptions/delays. With the supply chain constraints easing there is a focus on returning inventory to more normal levels and this is causing inventory destocking among these clients. The bad thing about inventory destocking is that it results in its clients ordering less than what is being consumed by them in order to keep their plants running. However, the good thing is inventory destocking can’t continue forever and, once it is over, even without any meaningful improvement in end-market demand, just the client ordering in line with consumption/usage could lead to a good improvement in sales. While the decline in order trend and book-to-bill of 0.8x in the bioprocessing business last quarter indicates there is still some pain ahead for the next couple of quarters, once the inventory destocking is complete and order trends inflect we could see good growth.

The COVID-related disruptions have impacted the near-term growth trajectory in several industries including high-quality businesses in recent years. Investors who were able to look beyond these disruptions have benefited nicely. A good example from an entirely different industry is Netflix (NFLX) which saw high new user additions during COVID. However, once the situation began normalizing, the net user additions turned negative and now it has returned back to historical growth levels. The stock reacted in line with new user additions going up during COVID, then correcting when net user growth turned negative and then recovering as the company returned to historical levels of growth. Investors who didn’t get carried away with excitement during COVID, didn’t become overly pessimistic when the stock went down, and understood that these were temporary disruptions were the ones who actually made good money. And NFLX is just one example, there are several more across my coverage including industrial, consumer, technology, and housing where there were similar trends.

I believe the same would hold true for DHR as well and the investors who don’t get overly pessimistic on the stock due to these temporary near-term headwinds should get rewarded in the medium to long term once the impact is gone and the company returns to historical growth levels. The company is exposed to attractive end markets like biologics where there is strong underlying demand. While some investors are worried about the near-term weakness in the bioprocessing business, for the long term, management is expecting a high single-digit growth outlook for its bioprocessing business driven by end-market growth, product innovation, and strong execution.

Management also continues to focus on long-term growth and is driving shareholder value through portfolio transformation. In line with this management recently completed the Veralto spin-off and announced the acquisition of Abcam to strengthen its Life Sciences portfolio. The company has an excellent history of creating shareholder value through strategic M&A which has helped it outperform the S&P 500 (SPY) by a good margin over the long run. The company has a healthy balance sheet with net leverage (net debt to TTM EBITDA) of ~1.17x as of the last quarter end which should enable it to continue doing value-accretive bolt-on M&A and position the company for long-term growth despite macroeconomic challenges.

Overall, while there are near-term temporary headwinds, the company’s medium to long-term revenue growth prospects remain attractive.

Margin Analysis and Outlook

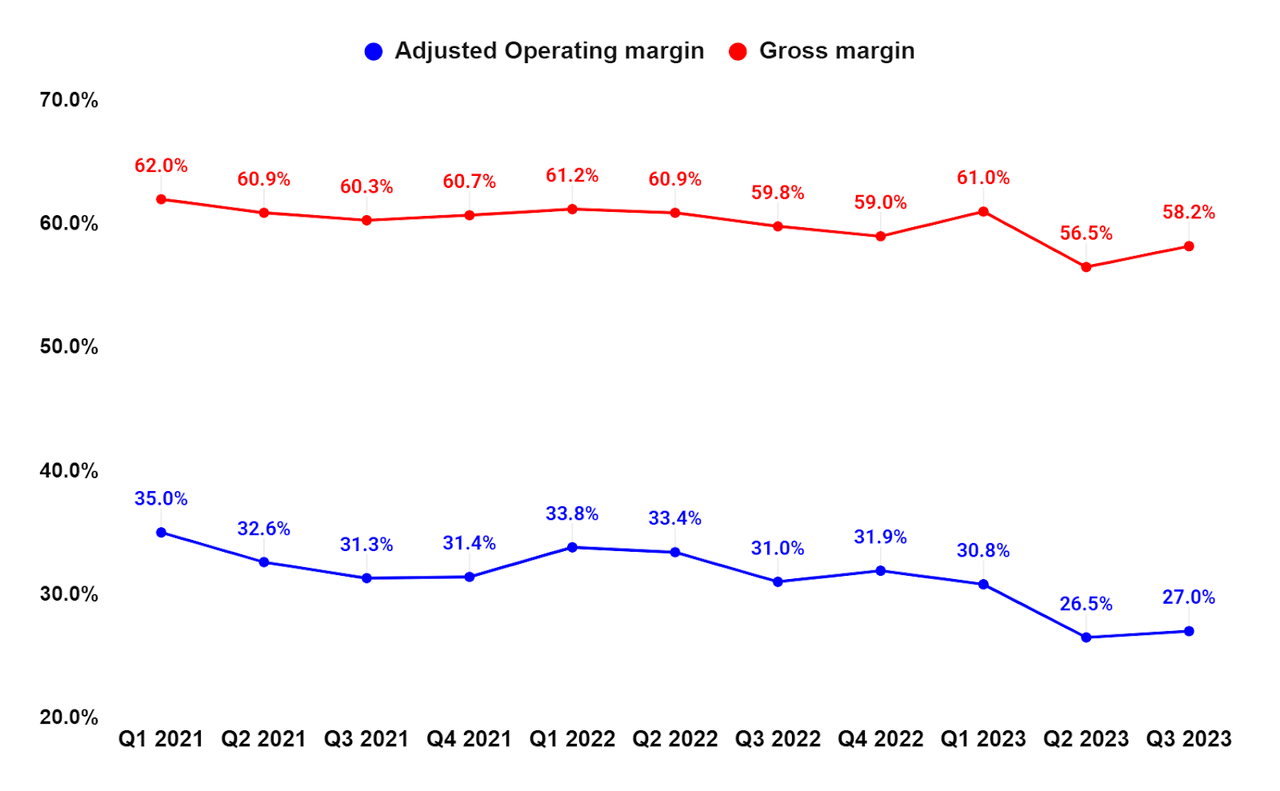

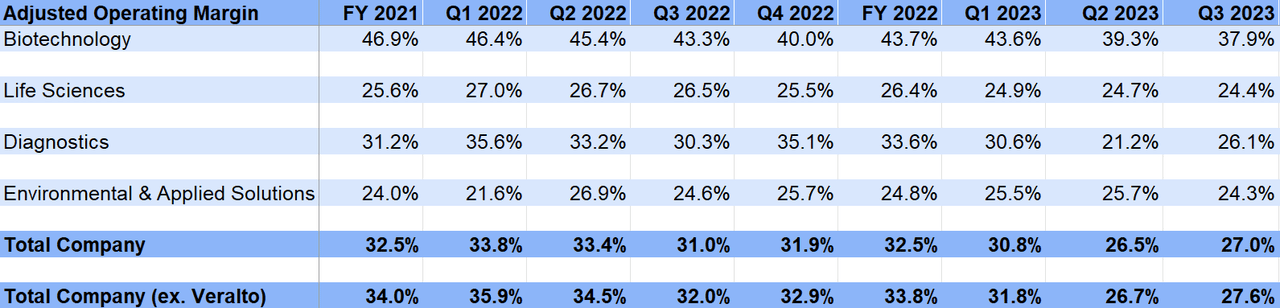

In Q3 2023, the company’s margin growth was adversely impacted by lower core sales in the Biotechnology and Diagnostics segments, unfavorable product mix, and costs associated with the separation of the company’s Environmental & Applied Solutions business to Veralto Corporation which resulted in a 160 bps Y/Y decline in gross margin to 58.2% and a 400 bps Y/Y decline in adjusted operating margin to 27%.

On a segment basis, the adjusted operating margin declined by 540 bps Y/Y in Biotechnology, 420 bps Y/Y in Diagnostics, 210 bps Y/Y in Life Sciences, and 30 bps Y/Y in Environmental & Applied Solutions segments.

DHR’s Gross Margin and Adjusted Operating Margin (Company Data, GS Analytics Research)

DHR’s Segment-Wise Adjusted Operating Margin (Company Data, GS Analytics Research)

Looking forward, Q4 is likely to be another tough quarter for margins but the company’s margins should expand in FY24.

The company took several cost reduction actions in recent quarters to align the cost structure with the lower volume it is seeing. This resulted in one-time charges which should not recur next year helping margins in FY24. Management anticipates ~$350 mn benefit next year as these one-time charges go away. Further, the company also incurred costs related to the Veralto divestiture which should not recur next year.

The company has a good long-term track record of continuous improvement and lean manufacturing and once the sales bottom, we should start seeing the benefit of the recent cost action in its incremental margins. Overall, I am optimistic about the company’s margin improvement prospects in FY24 and beyond.

Valuation and Conclusion

DHR is currently trading at 28.05x FY24 consensus EPS estimates and 25.05x FY25 consensus EPS estimates, which is at a discount versus the company’s average forward P/E of 29.02x over the last five years.

While there are near-term headwinds related to the normalization of COVID-19-related demand and customer inventory destocking in its Biotechnology segment, these headwinds are transient in nature and I believe the company should return to growth towards the end of FY24. Further, I like the company’s medium to long-term revenue growth prospects given its good exposure to attractive end markets like biologics and its excellent track record of driving shareholder value through value-accretive bolt-on M&A. The margin outlook in the medium to long term is also positive with the non-recurrence of charges incurred this year related to the alignment of cost structure with lower volumes and separation of Veralto. I believe the medium to long-term investor can use the current near-term headwinds as an opportunity to buy this long-term compounder at a reasonable valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Ashish S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.