Summary:

- Danaher Corporation’s core sales growth rate is expected to turn positive as 2024 progresses.

- Margins are expected to improve with easing comparisons, cost-cutting, and operating leverage as sales recover.

- Valuation is reasonable on FY25 and FY26 consensus earnings estimates.

blackred

Investment Thesis

Danaher Corporation’s (NYSE:DHR) core sales growth rate is expected to turn positive as 2024 progresses, with customer inventory destocking ending by the second half of 2024 in the bioprocessing business and improving order trends in the Biotechnology and Life Sciences segments. Further, the strength in the Diagnostics segment and easier Chinese business sales comparisons in 2H 2024 should support the company’s revenue growth in the coming quarters.

Margins should also improve with the help of easing comparisons, cost-cutting, and operating leverage as sales recover, especially in 2H 2024 and FY25.

While the valuations look slightly expensive versus the historical average on FY24 earnings, one needs to consider that we are close to the bottom of the cycle, and the valuation on FY25 and FY26 earnings is reasonable. Also, I believe the downward earnings revision cycle is likely behind us with inventory destocking near completion and order trends improving. This coupled with good growth in coming years can improve investor sentiments around the stock. Hence, I continue to rate the stock a buy.

DHR Revenue Analysis and Outlook

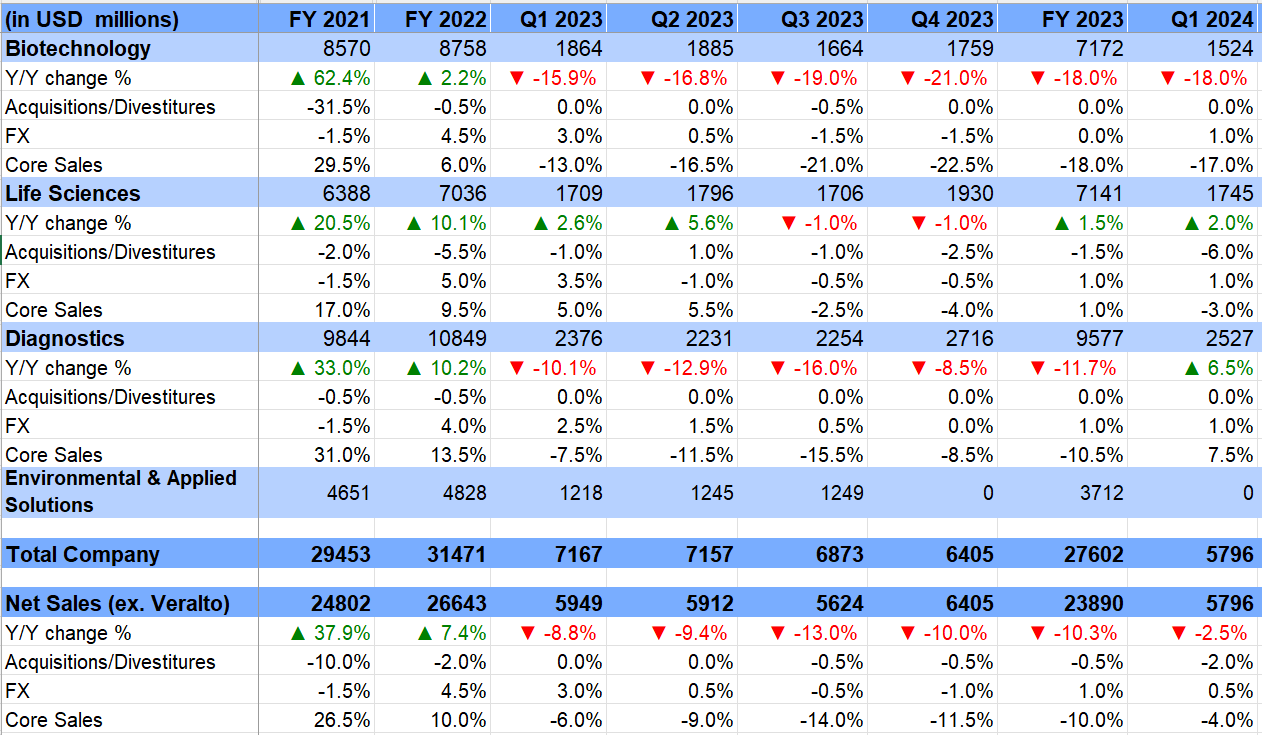

I last covered DHR in November 2023, where I discussed the company facing near-term temporary headwinds from COVID-related demand normalization and customer inventory destocking. However, I rated the stock a buy as I expected the impact of these headwinds to become less worse in the coming quarters. The company has reported its Q4 2023 and Q1 2024 results since then and things played out as expected and the stock saw a nice outperformance as investors realized that the bottom is near. While the net sales declined 2.5% Y/Y in Q1 2024, this was much better compared to the ~10.3% Y/Y decline the company saw for FY23, supporting my thesis.

Excluding a 2% favorable impact of acquisitions and a 0.5% negative impact of FX translation, the core sales declined 4% Y/Y.

Segment-wise, the Biotechnology segment posted an 18% Y/Y decline in sales due to decreased core sales in the bioprocessing business resulting from lower demand as customers reduced their inventory levels. Sales grew by 2% Y/Y in the Life Sciences segment driven by a 6% favorable impact of acquisitions, partially offset by decreased segment core sales, mainly due to lower demand from pharmaceutical and biopharmaceutical customers. The Diagnostics segment saw a sales growth of 6.5% Y/Y attributed to increased Y/Y core sales in molecular diagnostics and clinical diagnostics businesses.

DHR’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, I expect the company’s core sales growth rate to turn positive as the year progresses.

One of the biggest worries the company’s investors had going into the earnings was the weakness in the bioprocessing business. Many investors were expecting sequential weakening in bioprocessing orders to continue. However, the bioprocessing orders came well above expectations and the company reported a sequential increase. In addition to improving order trends, management also noted that cancellations are declining. In my previous article, I talked about the inventory destocking playing out in Danaher’s bioprocessing business. Below is the relevant excerpt.

Over the last couple of years, due to high demand as well as supply chain challenges, the company’s bioprocessing clients stocked excess spare inventory to meet demand in case of supply disruptions/delays. With the supply chain constraints easing there is a focus on returning inventory to more normal levels and this is causing inventory destocking among these clients.”

I also noted that inventory destocking can’t continue forever and once it ends, there can be a meaningful improvement in order growth and sales. The order trends indicate that we are close to the inventory destocking ending. I expect by 2H 2024 inventory destocking in the bioprocessing business should largely be in a rear view and the company should exit 2024 with strong order growth and core sales should also turn positive as the year progresses.

The Life Sciences segment, which was another weaker area for the company due to the weak financing environment impacting customers, has also started seeing improved order funnel QoQ as per management. While the company has yet to see this improved funnel convert into actual orders, I believe we should start seeing it in the coming quarters.

One thing which impacted both the Life Sciences and Biotechnology segments was the tough comps in Chinese market, where the first half of 2023 benefitted from the government’s stimulus funding. However, as the year progresses and comparisons ease in the second half, I expect China sales to become less negative.

The company’s Diagnostics segment is doing well with core revenue growth of 7.5% Y/Y last quarter and with comparisons easing and Biotech and Life Sciences segments expected to see sequential recovery in orders, I am optimistic that the worst is behind us. So, the growth outlook of the company in the second half of this year and FY25 is positive.

Danaher Margin Analysis and Outlook

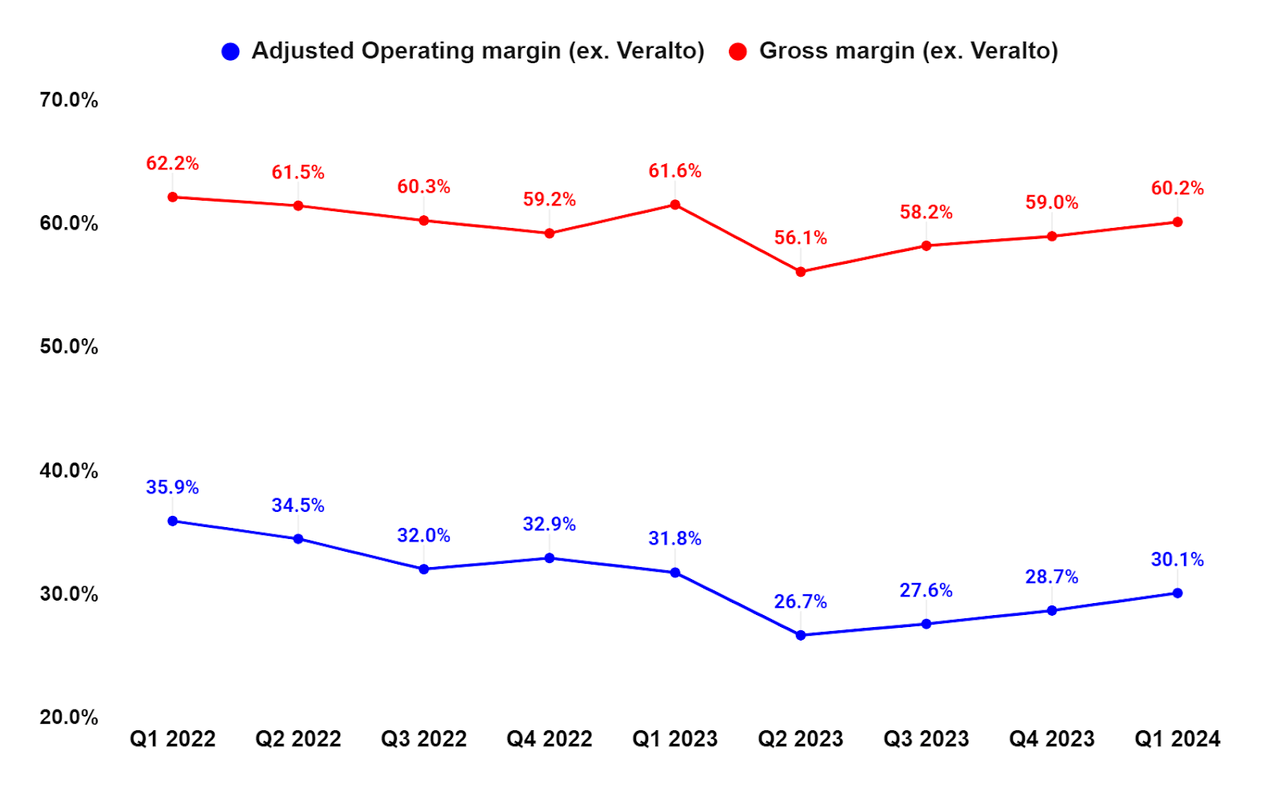

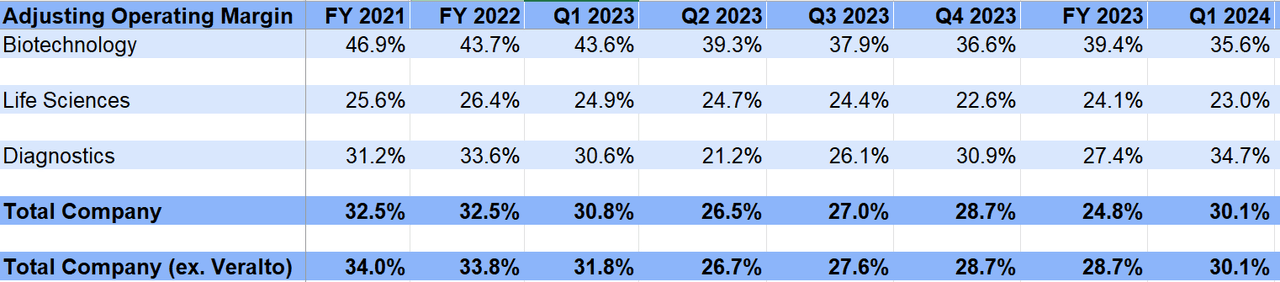

In Q1 2024, the company’s margin growth was negatively impacted by decreased core sales in the Biotechnology and Life Sciences segments, unfavorable product mix, and incremental dilutive effect of acquired business which resulted in a 140 bps Y/Y decline in gross margin (ex. Veralto) to 60.2% and a 170 bps Y/Y decline in adjusted operating margin (ex. Veralto) to 30.1%.

On a segment basis, the adjusted operating margin declined by 800 bps Y/Y in Biotechnology and 190 bps Y/Y in Life Sciences segments. However, the Diagnostics segment’s adjusted operating margin expanded by 410 bps Y/Y mainly due to higher Y/Y core sales.

DHR’s Gross Margin and Adjusted Operating Margin (excluding Veralto) (Company Data, GS Analytics Research) DHR’s Segment-Wise Adjusted Operating Margin (Company Data, GS Analytics Research)

The company has done a good job in terms of taking cost out of the business and aligning the cost structure with lower volume it is seeing. While Y/Y margin was down, the company has been able to improve its margin sequentially in the last three quarters. With a potential recovery in sales towards the end of this year and in FY2025, the company should benefit from operating leverage. Further, the margin comparisons are getting much easier from Q2 2024 which should help the company return to Y/Y growth from Q2 2024 onwards.

DHR Stock Valuation and Conclusion

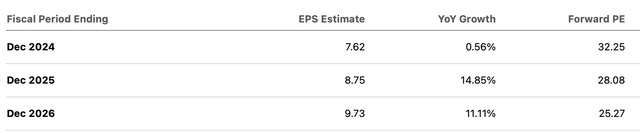

DHR is currently trading at 32.25x FY24 consensus EPS estimates of $7.62. While this is slightly higher than its 5-year average P/E of 29.53x, one needs to note that we are close to the bottom of the cycle. If we look at FY25 and FY26 EPS consensus estimates, the company is trading at a P/E of 28.08x and 25.27x, respectively which is reasonable given the company’s exceptional track record of creating shareholder value over the long term.

DHR consensus estimates and forward P/E (Seeking Alpha)

Also, with inventory destocking nearing completion and order trends starting to improve, the downward revision in EPS estimates which we have seen in the last year is likely behind us and the company is poised to see a good growth ahead. This should improve investor sentiment around the stock.

I believe the stock can continue to reward investors as revenue and margin recovery takes hold over the next couple of years and the stock sees good EPS growth. Hence, I believe DHR stock is a good medium-term buy.

Risks

- I am expecting a continued improvement in orders in Bioprocessing and Life Sciences businesses. If this doesn’t materialize then the stock can see some downside.

- The company has a solid history of growing through M&As. While it has done exceptionally well in terms of executing its M&A strategy, inorganic growth is relatively riskier compared to organic growth. There are always risks related to integration missteps, overpaying for an acquisition, and the leverage a company takes to make an acquisition. If the company doesn’t realize intended synergies or overpays for an acquisition, the stock price can see some downside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Gayatri S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.