Summary:

- Danaher is a highly regulated oligopoly with a strong management team and high recurrent demand, making it an outstanding business.

- The company operates in the healthcare field, manufacturing laboratory equipment and consumables used in drug development, with a 75% recurrent demand and really high switching costs.

- Danaher operates in a market with multiple tailwinds, including an aging population, complex drugs requiring sophisticated machines, and the prescription of drug patents from large pharmaceutical companies.

urfinguss/iStock via Getty Images

Danaher (NYSE:DHR) is one of the best businesses in the world. It operates in a highly regulated oligopoly with very high recurrent demand. DHR is ruled by a very capable management, which is a great capital allocator. Danaher is currently experiencing a “Covid-19 hangover” since it was greatly benefited by all the investment in the development of the vaccine. After normalizing these figures, Danaher seems to be ready to start compounding again. I think the price is close to being attractive and could be a good opportunity to buy this outstanding business for the long term. In this article, I will not focus on the current situation of the slowdown in their bioprocessing business, which suffers from the destocking of biopharma customers. This part can be discussed in a future article; now, I want to focus on why it is one of the best businesses in the world, some ways to understand the business model and value proposition of the company.

Business model

Danaher is a conglomerate of companies (more than 20), which mainly operates in the healthcare field as it manufactures laboratory equipment that needs tons of one-off exclusive consumables used for investigating new drugs. These consumables are approved by the FDA during the investigation process of a new drug. This allows Danaher to have a 75% recurrent demand, making cash flows predictable and stable and the switching costs really high, as once the FDA approves the drug, the machines used in the research and development process are included in the regulatory process, so if the pharma company wants to change Danaher as a supplier, the drug must be sent to phase 1 again. The costs and risks of this movement do not compensate for the cost savings raised by changing the supplier of machines. This is why I find Danaher to be one of the most appealing options for exposure to the healthcare sector without incurring R&D and patent risks.

A market with many tailwinds

Danaher operates in a market that will experience many tailwinds. Overall, the market expects CAGRs of between 8%-11%, numbers that, in my opinion, thanks to the good capital allocation of Danaher, their good M&A approach, their economies of scale, and their oligopoly situation with TMO, seem reasonable to me.

Moreover, this will be boosted by the continued aging population in the developed world. The more complex drugs will need more sophisticated and reliable machines for their R&D, and finally, the patient cliff. This consists of the prescription of drug patents from large pharmaceutical companies. This allows other companies to manufacture the same drug, but of course, they need the entire approval process, so DHR and TMO will be present throughout the manufacturing process of this wave of “white label” drugs. About $200 billion is expected during this decade.

Danaher business segments

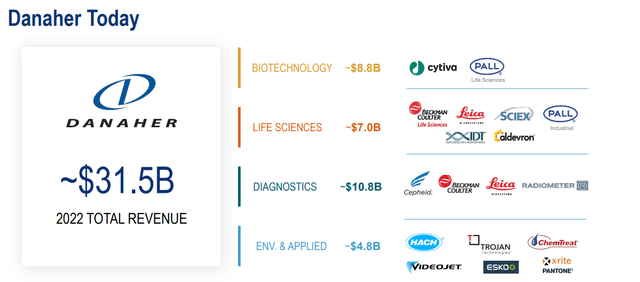

Danaher segments its business into four different fields, but “Environmental and Applied Solutions” will be a spin-off at the end of the year. In my opinion, this is a good movement, as it is the less profitable and less recurrent segment. The “Biotechnology” segment was included in “Life Sciences” until the past year, but now it is an independent one.

Biotechnology (28% of 2022 revenue) is the newest segment of the company. “Biotechnology businesses provide a comprehensive portfolio of technologies, tools, and services that enable the discovery, development, and manufacturing of biologic and genomic-based medicines”. (2022 annual report)

Life Sciences (22% of 2022 revenue): “a broad range of instruments and consumables that are primarily used by customers to study the basic building blocks of life, including DNA and RNA, nucleic acid, proteins, metabolites, and cells in order to understand the causes of disease, identify new therapies, and test and manufacture new drugs, vaccines, and gene-editing technologies”. (2022 annual report)

Diagnostics (34% of 2022 revenue): “The Diagnostics segment offers clinical instruments, reagents, consumables, software, and services that hospitals, physicians’ offices, reference laboratories, and other critical care settings use to diagnose disease and make treatment decisions. (2022 annual report)

Environmental & Applied Solutions (15% of 2022 revenues): In September 2022, the Company announced its intention to spin off its Environmental & Applied Solutions business into a publicly-traded company. The transaction is expected to be tax-free for the Company’s shareholders. “The Environmental & Applied Solutions segment offers products and services that help protect precious resources and keep global food and water supplies safe”. (2022 annual report)

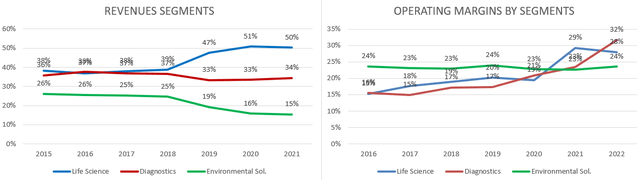

In the image below, we can see the evolution of the business segments prior to the announcement of the creation of the biotech segment. While Environmental & Applied Solutions seems to be lagging, the other segments are performing very well, and this is one of the reasons for its spin-off.

Despite the difficulty of the business itself, I think it is not necessary for the non-professional investor to fully understand every aspect and machine of the business. The main idea here is that Danaher is the “picks and shovels” of the pharma industry, operating under a razor-blade business model backed up by great management and economies of scale. All these make Danaher one of the best business models in the world, and my hypothesis is backed up by the recurrent nature of the business and the high margins it produces. Returns may seem a little bit low, but there is a reason for this, which I will discuss later.

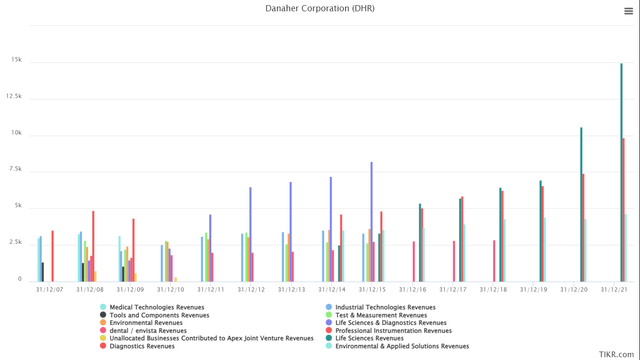

A history of M&A and spin-offs

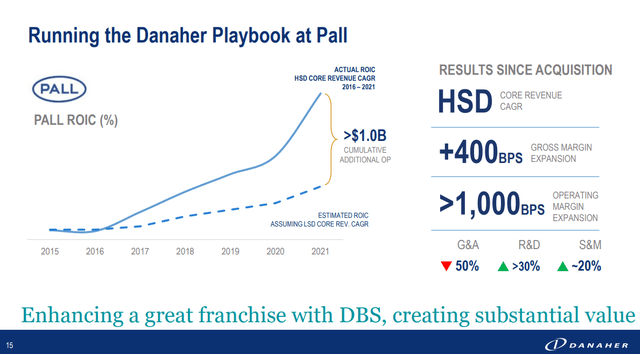

Something that characterizes Danaher is its long-term history of business acquisitions. They are masters of optimization and the integration of smaller companies into their core business model throughout the “DBS system”. In the 2022 Investor Day, there are several examples of this optimization, such as the one carried out with Pall. The company has spent over $57 billion in acquisitions made with cash since 2014.

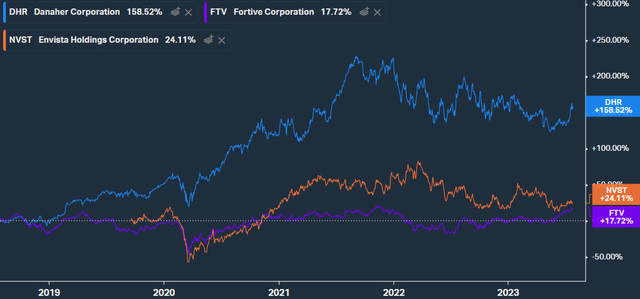

Danaher’s history is marked not only by constant acquisitions related to parts of the business but also by continuous spin-offs of less recurring, capital-intensive segments of the company. In the year 2015, the “Industrial”, Fortive Corporation (FTV), segment was spun off, and in the year 2019, it was the turn of the dental segment, Envista Holdings (NVST). In the image below, the evolution of the business segments of the company is shown. If we take a look at the performance of these new public companies, compared to Danaher, they have been much worse. Personally, at the end of the year, I will sell my part of Environmental & Applied Solutions and buy more Danaher shares, as I expect the result to be the same as in these two examples.

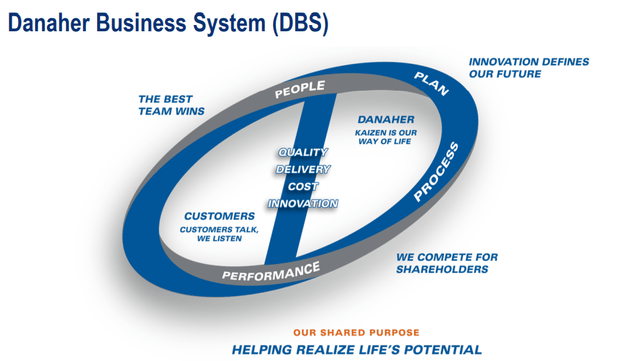

DBS system, something unique in the world

This great business model is supported by management focused on outstanding capital allocation and, above all, a business culture focused on the process of continuous improvement under the DBS (Danaher Business System) method. Something similar to the well-known 1% rule. Thanks to the book “Lessons from Titans” and the chapter focused on Danaher, I have been able to extract nine essential points for summarizing the DBS system.

- Playbook guide for workers.

- Workers prior training.

- Cost management.

- Shareholders’ importance and their long-term thinking.

- Recurring demand as a protection against economic cycles.

- Eight essential metrics for measuring performance.

- M&A approach for improving the business.

- M&A price importance for achieving good results and returns.

- Performance of all the members of the company.

Competition

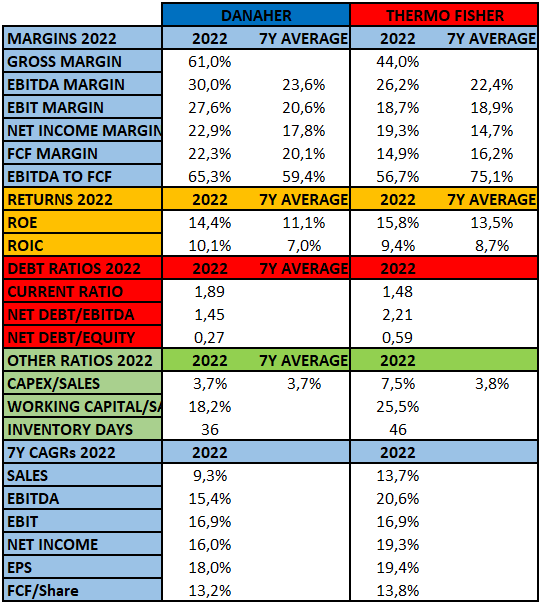

I have prepared the next table with data extracted from TIKR, so a comparison against Thermo Fisher (TMO) can be made at first sight. If we take a look at the margins, those of Danaher are clearly better. The debt situation and capital intensity are slightly better at Danaher as well. Returns are almost the same, and the last 7 years CAGRs are better for TMO. At the end of the day, I would not mind owning any of them (even both), as Danaher’s numbers and corporate culture seem better to me, although Thermo Fisher’s more diversified portfolio may be an advantage. Anyway, both are the main players in a very compelling and bright future market.

Author’s Representation

Management

The CEO is Mr. Rainer Blair, who has been in the company for a little over 2 years and only has 0.11% of it ($20 million). A positive point here is that Danaher requires the CEO to have at least 5 times his base salary in shares ($1.2 million, a very low salary for a company that invoices $30 billion, although the annual compensation can go up to $17 million) (3 times for the Executive Director and 2 times for the Senior Vice President). The positive comes when we see that the two Co-Founders, Steven Rales and Mitchell Rales, still own more than 10% of the company together and are both on the board of directors.

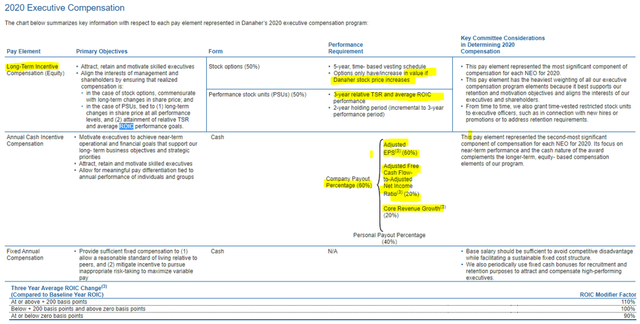

There are two types of compensation plans. Long term, linked to stock performance (above the 55th percentile for S&P 500 stock performance) and ROIC (2% improvement over a 3-year range). The short-term plan is linked to the adjusted EPS (there are up to 8 adjustments, but they don’t change the GAAP EPS much either; for example, in 2020, it only increased by 4% but by 18% in 2021), the FCF-to-net income ratio, and core business growth. We have all the important metrics I like to follow, so it could not be better.

Financials

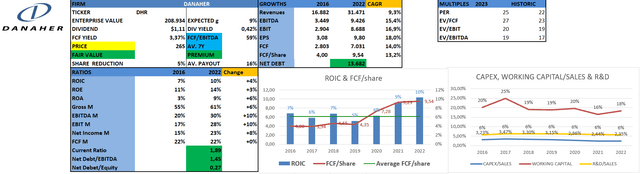

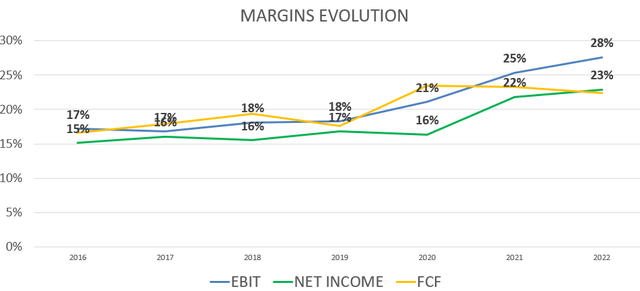

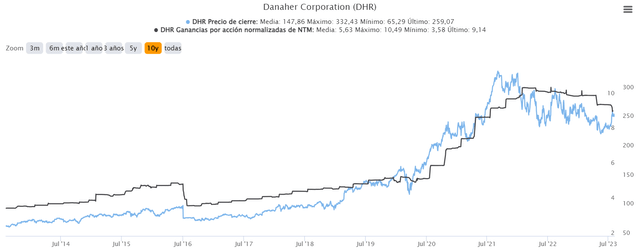

In the image below, we can see some of the most important financial metrics of the company. The evolution of the business has been marvelous. It has been able to grow all its important financial metrics at really good CAGRs. They have made a margin and seen their returns expand too while keeping low levels of debt. I want to make some comments about the most important ones.

Danaher has been able to expand its margins thanks to the spin-offs of its less profitable and less recurring businesses. Its main focus has been on the transition of its product portfolio towards healthcare and bioprocessing. The increase in the recurrence of its products and the high price power of its consumables have also played an important role.

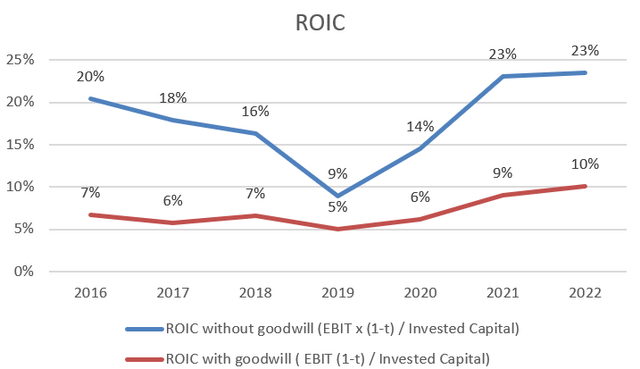

Danaher’s ROIC may seem a little bit low (10%) compared to the market mean (13%-14%) but this has a reason that may not be as evident at first glance. Danaher allocates approximately 10% of its sales to R&D and capex. However, if we think in numbers instead of percentages, we see how these figures are remarkably large. Few companies can allocate such an amount of money annually (which in turn represents a low percentage of their sales) to the development and research of new products, so this constant investment “expands the MOAT” despite the apparent low return. In addition, this fact makes it not so attractive for new players to allocate so many resources and efforts by trying to disrupt Danaher, as they are going to obtain such low returns (and on top of that, have to compete against the experience and financial muscle of companies like DHR or TMO). So we can think that the low ROIC of companies like DHR or TMO is actually a barrier to entry or a competitive advantage that they have. In addition, as these are companies that are in a constant search for M&A, it would be convenient to assess the ROIC of the acquisitions in larger time frames because the operational efficiency that they achieve on the acquired businesses takes time. Another approach could be to calculate ROIC without taking goodwill into account; by doing this, the ROIC increases substantially.

Valuation

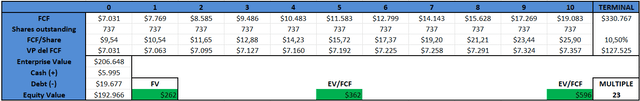

As of this writing, Danaher is trading at $265, which means the market is discounting an FCF growth of 10.5%, applying 10% as the discount rate and 4% as the TGR. I think this could be a conservative valuation model, as Danaher’s FCF/share has compounded at an annual growth rate of 13.2% during the last 7 years. Moreover, I am not taking into account any positive optionalities throughout M&A (we have already seen how good they are). Margin expansion should continue, as long as the recurring revenue keeps on increasing (currently at 75% of the revenue, compared to 45% in 2015). Moreover, Danaher’s WACC stands at 6.67%, but I am using a 10% discount rate in order to be more conservative and minimize any valuation error. If we want to have some margin of safety, I think that $220 could be a good starting point. That is why I rate the stock as a hold, but we are not far from attractive prices, so I think it is worthwhile to monitor it closely.

Price targets applying a 23x EV/(FCF/share) multiple are also displayed. Just to give you some perspective, since 2018, Danaher has never traded below 20x.

Author’s calculations based on data extracted from Seeking Alpha

Other important graphs

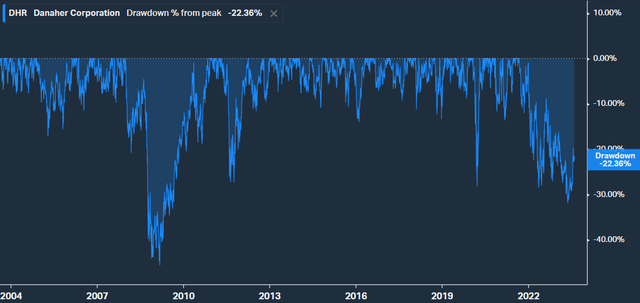

Danaher has recently had its second-biggest drawdown of the century. As we can see, drawdowns from peak rarely pass the -20%, so we may be before a great opportunity.

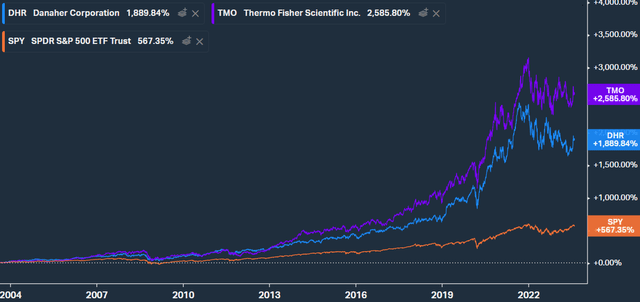

Danaher has been outperforming the market for two decades, but TMO’s total return has been greater.

EPS and stock price tend to have a high degree of correlation. Once they stabilize, Danaher should start compounding again.

Risks

As we have seen throughout the whole article, Danaher is a very resilient business with a massive scale that prevents the entry of new competition. Nevertheless, I have seen one risk that may be difficult for the private investor to assess, hence the importance of trust in the management and in the execution and good management that it has been doing for decades. I have already mentioned that one of the core activities of Danaher is M&A, with the operational risks that this entails. Many times, the success and return on investment of an acquisition depend on the price you paid for it. For example, in 2021, they carried out 14 acquisitions. The biggest one was Aldevron LLC. They paid $9.6 billion, generating $300 million in sales (32X sales), a price that seems very excessive to me. They paid $1.4 billion for the other 13 businesses they acquired that year, generating $100 million in revenue (14X revenue). It doesn’t seem cheap to me either.

Monitoring and valuing acquisitions is difficult, especially in a field as complicated as this one. A good management team is important because they have information and see synergies that we did not even imagine, and this is what Danaher managers have demonstrated. In the end, you have to trust, and the track record of these gentlemen is outstanding. We are private investors, but we cannot be experts in all the fields. So, despite the apparently high prices (the healthcare private market is usually an expensive one), I think this risk is reduced by the great management team backed up by the DBS system and the scale of the company.

Conclusion

In my opinion, Danaher is a very resilient business with little disruption, operating in a market that will always be crucial for the investigation of new drugs. Its business model and strong competitive advantages strengthen its oligopolistic position, backed up by competent management and one of the best corporate cultures in the world. I currently hold Danaher in my portfolio, but I am not adding at these prices as I have already done that below $240; in case of coming back to those levels, I would buy again. That is why I rate the stock a hold. Eventually, I think Danaher will continue beating the market for many decades and is a good way for having exposure to the healthcare sector without incurring in many risks intrinsic to it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.