Summary:

- Thanks to its business model, Danaher has managed to reach operational excellence.

- Solid tailwinds will back up the company to continue its compounding path.

- The decrease in Covid-related sales has dropped the stock price and could be an excellent chance for long-term investors.

- I rate the stock a buy and fix a price target of $230.

jittawit.21

Danaher (NYSE:DHR) is a conglomerate of businesses that operates in the life sciences sector. DHR stock is down 25% since maximums and dropped 10% after the latest quarterly results. However, the company’s prospects are still intact. Therefore, investors have a great chance to buy this long-term compounder.

High-quality business model

Danaher’s activity can quickly be summed up into selling machines and, subsequentially, selling the consumables to use and maintain them.

Broad portfolio to benefit from long-term tailwinds

They divide their activities into four different segments:

- Biotechnology: The company develops technology to accelerate research and development of biological treatments. It is expected to grow at High Single Digits (slide 15).

Source: Danaher Overview Presentation

- Life Sciences: This segment offers a broad range of tools for studying genetic blocks, proteins, and cells. It helps to discover diseases, identify treatments, and create medicines and vaccines. It is expected to grow at HSD too (slide 19).

Source: Danaher Overview Presentation

- Diagnostics: Danaher sells products that hospitals and laboratories use to diagnose illnesses, such molecular, acute care or genetic (slide 21).

Source: Danaher Overview Presentation

- Environmental & Applied Solutions: In this segment, which will be spun off at the end of the year, we can find products that ensure essential goods’ quality, such as water and food. It is expected to grow in Mid Single Digits.

This segments will take advantage of solid market tailwinds. First, the overall population is progressively aging, which is expected to accelerate. Ultimately, more drugs made on Danaher’s machines are being consumed.

Then, the complexity of the treatments is rapidly increasing. The market is progressing by leaps and bounds. Then, more advanced devices are needed to carry out these treatments.

Finally, Danaher will benefit from the “Patent Cliff”. It is how the loss of patents from big pharmaceuticals has been named. By the end of this year, big pharma companies will lose drug patents. $200B of income from the patented drugs is at risk. As a result, other players will start manufacturing those medicines for what they will need Danaher’s machines.

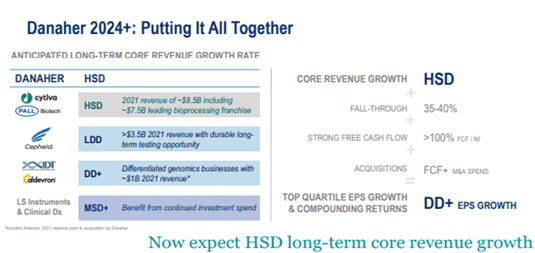

Source: Danaher Investor Day

Overall, the company expects to have HSD long-term organic revenue growth. Furthermore, backed up by a progressive margin expansion, M&A, and a robust FCF Conversion, earnings, and FCF should grow at rates over the double digits (slide 10).

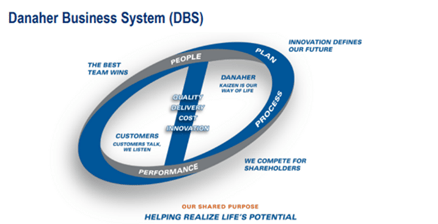

Danaher Business System

Danaher uses the Kaizen system to reach operational excellence based on optimizing processes by making changes (sometimes minimal) with significant impact. In addition, each change is closely monitored for expected effects. Danaher is focused on delivering quality, reducing costs, and constantly innovating. Therefore, customers and shareholders benefit from this.

Source: Danaher Investor Day

Out of all the premises of the Danaher Business System, I highlight the following. First, employees are trained to be very efficient. Once hired, Danaher teaches them to be more productive thanks to a three months training. Furthermore, they follow a constantly updated manual detailing what each employee should do daily, repeating what is essential and how to achieve it.

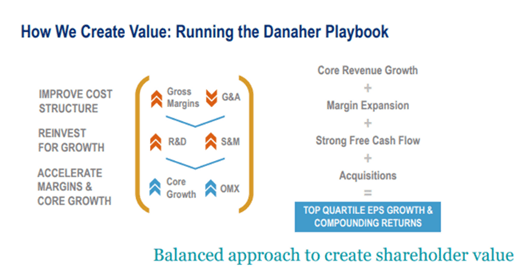

Then, Danaher is obsessed with controlling costs. The more the cost are reduced, the more they can reinvest and increase margins (slide 8).

Source: Danaher Overview Presentation

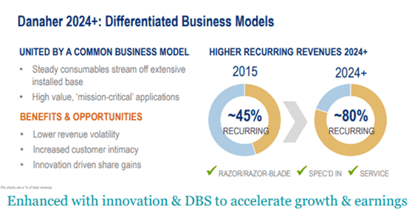

In addition, its business model focuses on recurring revenue, eliminating less recurring segments through spin-offs (making those subsidiaries independent). They have gone from 45% recurring revenue in 2015 to 75% in 2022, intending to increase it to over 80% in 2024 onwards (slide 7).

Source: Danaher Investor Day

What’s more, the performance of its companies is measured based on FCF, ROIC, organic growth, margins, customer experience, quality, internal occupancy rate, and retention. Indeed, when acquiring a company, they review those metrics monthly for the next three years.

The acquisition of Pall Sciences shows how good this system is. Danaher expected low single-digit organic growth, now growing at high single digits. In addition, ROIC has been higher than expected, and they have also significantly increased margins.

Powerful competitive advantages

The biotech market is quite complex. Thus operational excellence and a good reputation are a must. Danaher and Thermo Fisher (TMO) dominate a highly fragmented market, making it an oligopoly. They are both expected to keep increasing their share, acquiring smaller companies, and expanding their competitive advantages.

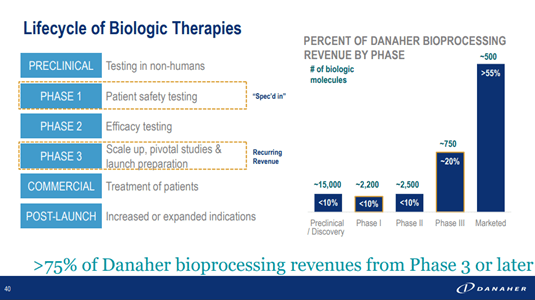

First, Danaher is protected by high switching costs. In effect, it takes around ten years to finish the manufacturing process. This process goes through several phases. However, if, for any reason, the client wants to start using another company’s equipment, he must begin the whole process over again. Therefore, customer relationships tend to last long once a machine is sold, thus providing recurring sales (slide 40).

Source: Danaher Investor Day

Secondly, in the biotech sector, there are many barriers to entry. The authorities and manufacturers are cautious about who provides and sells machines and medicines. As a result, reputation is critical to get licenses. Danaher and TMO have an outstanding reputation as the largest in the industry.

Finally, Danaher has a ROIC of around 10% (slightly over TMO’s ROIC), a couple of points higher than its cost of capital. Nevertheless, they are not remarkable returns. However, this sector is not very profitable, and only Danaher and TMO can achieve those returns. In addition, we must consider that M&A, quite important in the industry, considerably reduces the ROIC (mainly because of the excess Goodwill). Indeed, the challenge of getting good returns on capital prevents new competitors from entering the market. On the contrary, Danaher has a ROIC above its WAAC, thanks to the DBS and the company’s culture. Therefore, they are highly protected against competitors.

Best in class alignment with shareholders

One of Danaher’s best traits is the quality of the management team. In a complex market, having a competent executive team is crucial.

The board of directors averages more than ten years of experience in the company. The CEO has held the position since 2020 but has been with the company since 2010. Before assuming the role, he led multiple Danaher businesses and served as Vice President of the Life Sciences segment, generating excellent organic and inorganic growth.

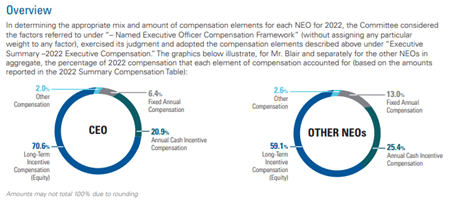

Moreover, the insiders and the executive compensation (pages 41 to 47) show how aligned the board is with the shareholders. Over 10% of the outstanding shares are owned by the Rales brothers, founders of the company. This represents a fortune of around $20B, which is reassuring. Then, approximately 25% of the executive compensation is determined by short-term results, conditioned by adjusted EPS, cash conversion, and organic growth. Furthermore, 50% of the compensation is determined by long-term objectives, which are total shareholder return and ROIC.

Source: Danaher Proxy Statement

I highly recommend this Seeking Alpha article, which compares Danaher and TMO. You can see a detailed dive into Danaher’s top-drawer executive compensation and its alignment with shareholders.

Risks

With a large percentage of recurring revenue, Danaher’s predictability and stability are top-notch. Therefore, it is less risky than the market average. Nonetheless, there are still some risks that we must factor in.

On the one hand, Danaher benefited from the pandemic, increasing revenues and margins. This year, the company expects $1.2B of Covid related sales (which represents 4% of total revenue), while last year they were up to $3B (or 10% of total revenue). This drop in revenue due to the end of the pandemic is what is negatively affecting Danaher. Still, it is nothing that was not foreseen. In fact, the risk is almost meaningless now, given that Covid related sales represent a low percentage of revenue.

On the other hand, M&A is of utmost importance for the company since it is a good source of revenue growth and innovation. The prices they pay in their acquisitions are usually relatively high, but finding companies at a bargain in this industry is very tough. Effectively, this impacts ROIC negatively due to the extensive goodwill. We have to consider that they will keep buying companies at premium valuations. However, it’s not something we should be concerned about in Danaher’s case since the acquisition history is on top of the line, and they always manage to improve the companies they acquire. Furthermore, we don’t have to worry about how the balance sheet is affected by acquisitions. Danaher’s financial health is remarkable for a serial acquirer (1.3x Net Debt/EBITDA and 1.5% average interest rate), and these acquisitions are mainly financed by the cash they generate and accumulate.

Valuation

The stock price has dropped 25% since historical maximums, with a recent 10% drop resulting from the quarterly results. In effect, revenue and earnings are normalizing after the Covid rush. Nevertheless, this deceleration was already expected. Furthermore, the core business is still growing at +MSD in a demanding year, which is encouraging for the future.

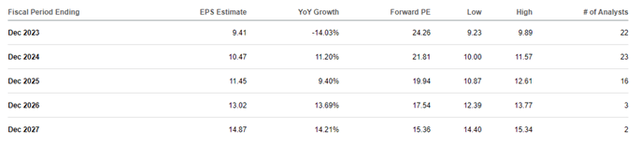

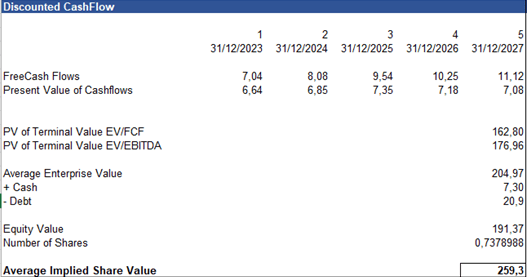

I project a 5% drop in revenue for this year and a 10% growth from this year to 2027 (including inorganic growth). Margins should fall this year to continue to increase slowly afterward. As a result, with a tax rate of 19.5%, profits would fall 16% this year.

Estimates mark a drop of 14%, which are in line with Q1 results and lower than in my model, so I’m being conservative. After that, profits should increase by above 10% annually until 2027. Regarding Cash Flows, I estimate the CapEx to be around 4%, a little below its average. With the effect of the D&A, CapEx, and CNWC, NI to FCF Conversion should be 110% on average for the following five years.

Assuming a WAAC of 10% (required return on investment) and a terminal multiple of 23x EV/FCF (below the median of the last five years), we get a value of $250. However, if we use an EV/EBITDA of 18x as the exit multiple, the value gets to $270. Averaging, I think Danaher’s shares are worth $260 to reach my required 10% IRR.

DCF Valuation, Author’s Creation

Moreover, the current price ($228) offers a 15% safety margin. Considering that the company is predictable and stable and I have been quite conservative with my predictions, I fix a target price of $230.

Conclusion

Danaher is a high-quality business, stable and predictable. It will continue with its sustainable growth runway, backed by solid tailwinds. The core business is still intact, and the recent drops have created a fabulous chance to buy shares of this company.

Because of this, I rate DHR stock as a buy, and I fix a price target of $230. I recently bought my first shares of this fantastic business, which I think will give great returns to shareholders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.