Summary:

- Danaher Corporation will complete the spin-off of its Environmental & Applied Solutions business, which will be called Veralto.

- Veralto is divided into two segments: Water Quality and Product Quality & Innovation, with a focus on safe drinking water and environmentally-friendly packaging.

- Veralto will use a derivative of Danaher’s value creation framework and prioritize M&A for growth, but debt and lower credit rating may pose challenges.

- At the implied valuation, Danaher looks a lot more attractive than Veralto.

designer491

On Monday, the 2nd of October, Danaher Corporation (NYSE:DHR) will finish the spin-off of its Environmental & Applied Solutions business. The company will be called Veralto (NYSE:VLTO) and will start with an inclusion into the S&P 500. I covered the spin-off already when it was announced last year, but now we have much more data and can value the business. Danaher is the largest position in my investment portfolio at 12% currently. Let’s dive into it.

What is Veralto?

Veralto is split into two segments: Water Quality (consisting of Water Analytics and Water Treatment; 60% of sales) and Product Quality & Innovation (consisting of Marking & Coding and Packaging & Color; 40% of sales).

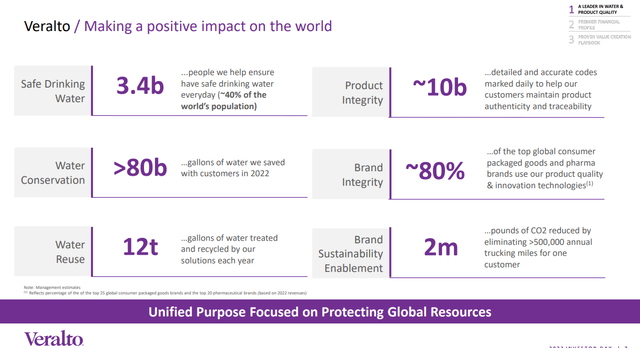

These businesses enjoy secular tailwinds from a growing need for safe drinking water and a reduction in wasting water or an increase in water reuse, as well as innovation in the product packaging space to reduce environmental impact and costs for companies.

Impact of Veralto’s products (Veralto Investor Day)

Veralto Enterprise System

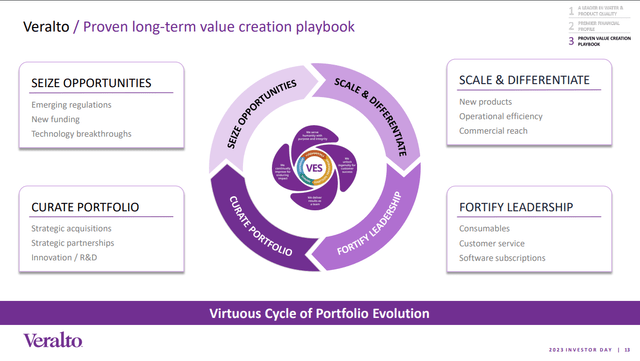

Maybe the biggest reasons for Danaher’s long-term success can be attributed to its Danaher Business System (“DBS”), a framework to drive continuous improvement, innovation, and growth in the company. Like the previous spin-offs Fortive (FTV) and Envista Holdings (NVST), Veralto will also use a derivative of this system: The Veralto Enterprise System (“VES”). The main essence is the same: drive profitable growth with a proven system and culture of continuous improvement.

Veralto Enterprise System (Veralto Investor Presentation)

Fundamentals Compared to Danaher

Post-spin Danaher will have three segments left: Biotechnology ($8.8 billion in sales in FY 22), Life Sciences ($7.0 billion in sales in FY 22), and Diagnostics ($10.8 billion in sales in FY 22) compared to Veralto with $4.8 billion in FY 2022 sales.

| Sales FY 22 | operating margin | Recurring % of sales | |

|---|---|---|---|

| Biotechnology | $8.8 b | 34% | 79% |

| Life Sciences | $7.0 b | 20% | 60% |

| Diagnostic | $10.8 b | 31% | 89% |

| Water Quality | $2.9 b | 23% | 56% |

| Product Quality & Innovation | $2.0 b | 25% | 59% |

We can see that Veralto’s divisions are quite a bit smaller than the remaining Danaher businesses. Operating margin and recurring sales are similar to Life Sciences, while Biotechnology and Diagnostics have significantly higher margins, partly from the much higher percentage of recurring sales.

Value Creation

Veralto deploys a very similar value creation framework as Danaher, focusing on improving the cost structure (improve gross margins, reduce general and administrative expenses), reinvesting for growth (invest in research & development and sales & marketing), and accelerating core growth.

The simple value creation algorithm used is as follows:

Core Revenue Growth + Margin Expansion + Strong Free Cash Flow + Acquisitions

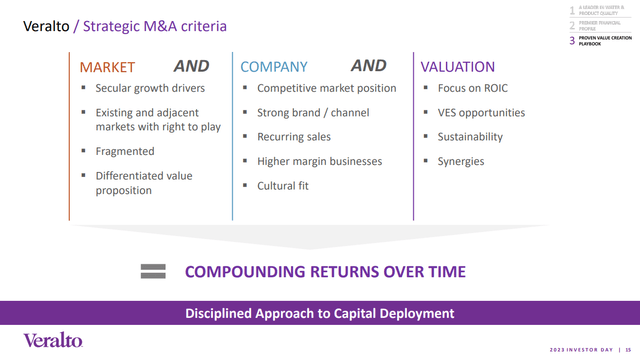

Both companies have a bias for M&A as the capital allocation priority. Veralto wants to buy companies in secular growth markets within its existing markets or as an expansion to adjacent markets with a differentiated value proposition to the current portfolio. The company needs a good market position and a strong brand with highly recurring sales that fit into the Veralto Culture. Valuation focuses on ROIC and wants to use VES to improve the business as described above.

M&A strategy (Veralto Investor Presentation)

Debt as an obstacle

Over the last years, Veralto didn’t get as much attention in Danaher as the other segments, one of the reasons why it was spun. As a standalone company, they should be able to focus more on M&A. Debt could be an obstacle to driving M&A growth. Post spin, Veralto will carry $2.6 billion in debt with $250 million cash and a $1.5 billion revolving credit line. This translates to a 2.0 times leverage. Danaher has a much lower leverage currently at 1.2 times.

Furthermore, Veralto received a Baa1/BBB credit rating, while Danaher has an extraordinary A3/A- rating. This makes future debt more expensive than inside of Danaher. Additionally, Veralto expects $70 million in incremental costs throughout its business as a standalone company, impacting operating margins by 140 bps.

Valuing both Companies

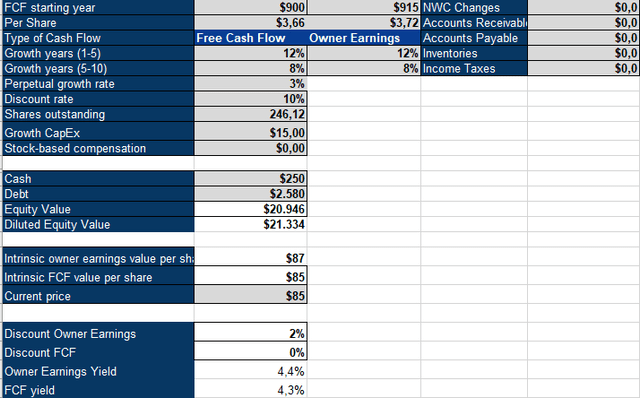

Cash flow is the most important part of a valuation, so I’ll value both companies with an inverse DCF model.

I did not find stock-based compensation estimates for Veralto and the company is rather asset-light: Capital Expenditures totaled just $34 million in 2022. I assumed $15 million of that was invested for growth. Using these numbers, I came to a required growth rate of 12% for the next five years and 8% for the following five. This compares to core sales growth estimates of Mid-single digits. Add margin expansion and M&A on top, I’d still find it hard to arrive at 12% growth over the next years, especially if we consider the additional costs as a standalone company. M&A will also be more challenging due to the factors described above.

Veralto Inverse DCF Model (Authors Model)

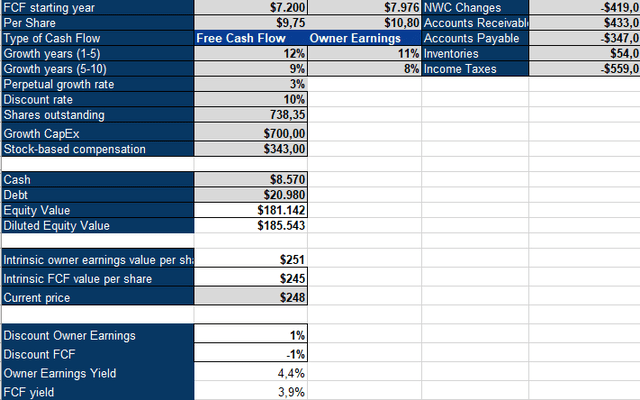

For Danaher, I used the numbers pre-spin-off. I used $700 million out of $1.22 billion in capex for growth because management commented about large growth investments as they optimized the supply chain post covid. We can see that Danaher has a very similar valuation profile, with 11% required growth in the next five years, followed by 8% for five years. At the same time, Danaher expects its remaining segments to grow core sales faster, around High-single digits, with a higher percentage of recurring revenues and lower debt with a better credit rating. Looking at these factors, I do not see why I’d keep Veralto and not sell it to buy more Danaher. A year ago, I came to a similar conclusion when I first looked at the spin-off announcement. In case the market overreacts and Veralto nose-dives over the next months, it could be worth revisiting, but not at a similar FCF yield than Danaher.

Danaher Inverse DCF Model (Authors Model)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.