Summary:

- Danaher has demonstrated very steady growth in financial metrics over the decade with very solid free cash flows.

- The company is experiencing headwinds to continue growth given the harsh macro environment.

- Also, my valuation analysis shows the company is fairly valued with little upside potential.

Lintao Zhang/Getty Images News

Investment thesis

Danaher Corporation (NYSE:DHR) was one of the most successful healthcare stocks during the COVID-19 market rebound. The stock is now trading close to 52-week lows and much lower than all-time highs. It is fair in my opinion, given declining financial metrics due to near-term headwinds and decreasing sales from COVID-related products. Also, my valuation analysis suggests there is little, if any, upside potential for the stock.

Company information

Danaher is a diversified global life sciences and diagnostics company. The company’s business portfolio includes many products and services, including scientific instruments, dental equipment, water treatment systems, and industrial technologies. Danaher is a conglomerate comprising more than 20 operating companies. DHR’s research and development, manufacturing, sales, distribution, service, and administrative facilities are in more than 60 countries.

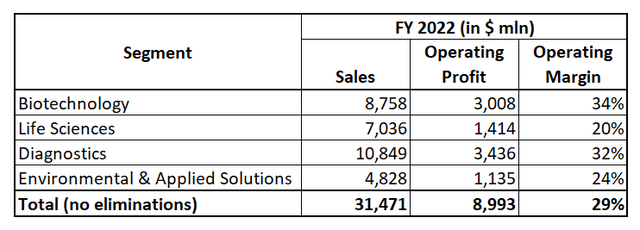

The company grows its business both organically and via acquisitions. For example, according to the latest 10-K of DHR, in 2022, the company acquired ten enterprises. The firm is organized under four segments (“Biotechnology, “Life Sciences”, “Diagnostics”, “Environmental & Applied Solutions”) with the fiscal year ending December 31.

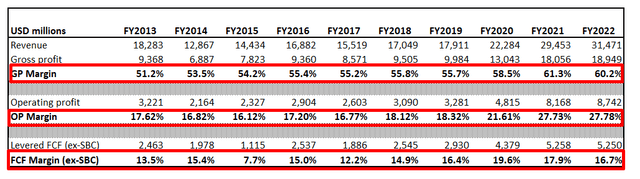

Author’s calculations based on the latest 10-K

Financials

The company demonstrated steady revenue growth at 6.2% CAGR over the last decade. What is important and what I like about DHR’s financials is the stellar profitability with gross, operating, and free cash flow [FCF] margins expanding significantly.

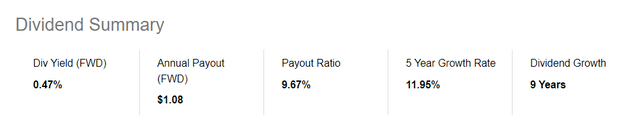

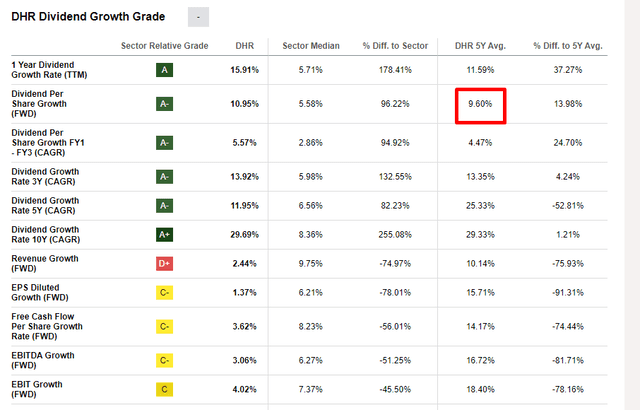

The company is in a net debt position, which is in line with historical capital allocation. The debt-to-equity ratio looks relatively modest and the liquidity position is solid even if inventory is deducted from current assets. I consider DHR’s capital allocation strong since the company has been paying dividends to shareholders for 29 years in a row with dividend hikes for 9 consecutive years. The dividend yield is tiny at below half a percent since the payout ratio is meager.

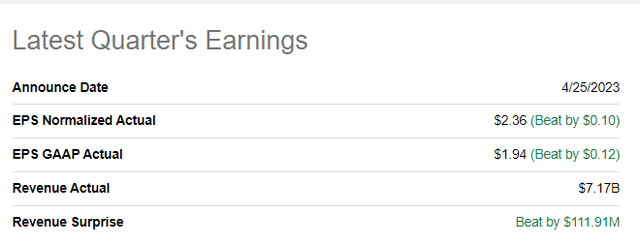

Consensus estimates expect the company’s growth trajectory to remain stable over the next five years, though both revenue and EPS are expected to shrink in FY 2023, given the current challenging macro environment. I would like to emphasize that the company never missed consensus estimates in the last sixteen quarters straight, according to the earnings surprise section of Seeking Alpha.

If we narrow down to the latest earnings report, DHR reported a 14.5% decrease in adjusted EPS on a YoY basis with revenue declining about 7% compared to a year ago. Though, the quarterly performance was above consensus estimates.

Core revenue, excluding the impact of acquisitions, divestitures, and foreign exchange, dropped 4%. This was driven by lower COVID-19-related income. Excluding COVID revenue, base business core revenue rose 6%, compared to 8% growth in the previous quarter. the company is facing near-term revenue headwinds which mainly relate to the bioprocessing business because small emerging biotechs have canceled or delayed projects in the current uncertain environment. Gross margin for the quarter was solid at above 60% level, though operating margin shrank more than three percentage points due to the impact of lower COVID volume in the biotechnology and diagnostics businesses.

Overall, I believe that Danaher’s financial performance has been strong over the long term but it is apparent that the company faces short-term headwinds, though they are not secular, in my opinion. I think that the nearest quarters will demonstrate the management’s ability to manage harsh environments.

Valuation

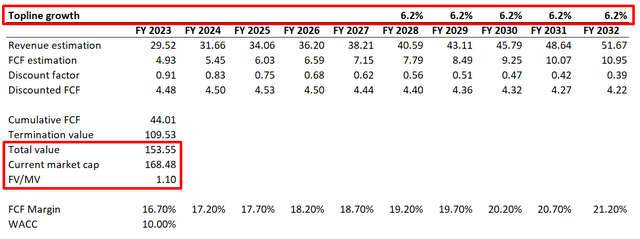

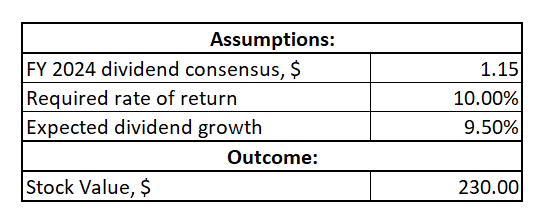

Danaher is paying dividends, so I can use both the dividend discount model [DDM] and discounted cash flow [DCF] approach for valuation. WACC will be the same for both methods, which is suggested by valueinvesting.io to be at about 10%.

Let me start with DDM. For the current dividend, I take FY 2024 dividend consensus estimate, projected at $1.15 per share. For dividend growth, I take dividend per share forward growth and round it down to 9.5%

Incorporating all assumptions to the DDM template gives me DHR’s stock fair value of $230 per share which is about exactly the same as the current share price.

Author’s calculations

To cross-check my DDM let me now do the DCF analysis. I have earnings consensus estimates up to FY 2027, and then I expect revenue to grow at a historical topline CAGR of 6.2%. For FCF margin I use the actual ex-SBC figures from FY 2022 and expect it to expand by 50 basis points each year as the company scales up.

As you can see from the above calculations, according to DCF analysis, the stock is slightly overvalued. The premium might be fair given the company’s strong brand and unmatched profitability metrics. Overall, I believe that the stock is fairly valued, so I do not expect any significant upside movements in the stock price over the short term.

Risks to consider

As I mentioned at the beginning of the article, the company fuels its growth organically and with the help of acquisitions. This adds risks to the business, which relate to integrating new entities into the DHR conglomerate. Moreover, the acquired companies themselves may not pay off the money invested, especially given the rich valuations we have seen in the last couple of years. DHR finances its acquisitions with leverage, which poses additional credit risks for the company.

Also, the company operates globally which adds geopolitical risks, especially given the current uncertain situation in the world. Operating globally also means foreign exchange risks for the company in case of unfavorable fluctuations. Foreign exchange risks might be mitigated with hedging, though hedging is not for free as well.

Danaher sells equipment and tools, so there is always a risk of the company’s product obsolescence in case technological disruptions occur. For example, a new innovation in diagnostics or life sciences could make existing products less relevant, which will ultimately hit the company’s financials. The company also faces the risk of supply chain disruptions, which can also severely hit the company if it fails to adapt.

Bottom line

To sum up, I believe that Danaher can be a very good company to invest in, but there are a couple of reasons I give the stock a neutral rating. I am not buying because there is minimal upside potential at current levels, if any, according to my valuation analysis. Also, the company is experiencing headwinds, and FY 2023 financial metrics are expected to decline

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.