Summary:

- Danaher Corporation stock has surged by 16% since our “Strong Buy” rating in June 2023, outperforming the S&P 500.

- The bioprocessing industry is facing near-term challenges, but long-term growth prospects remain strong.

- Danaher’s Q1 FY24 results showed a 4% organic revenue decline, but the company’s strong leadership and role in the biotech industry inspire confidence.

Makiko Tanigawa/DigitalVision via Getty Images

Since I presented my “Strong Buy” view on Danaher Corporation (NYSE:DHR) in June 2023, the stock price has surged by 16%, outpacing the S&P 500 (SP500) performance. At that time, I highlighted the near-term challenges of the bioprocessing industry and expressed my long-term optimism about their growth prospects.

They released their Q1 FY24 result on April 23rd with -4% organic revenue growth. I remain confident about the bioprocess and life sciences markets recovery and Danaher’s strong leadership team. I reiterate my “Strong Buy” rating with a one-year price target of $290 per share.

Weak Growth in Life Sciences and Bioprocessing in the Near-Term

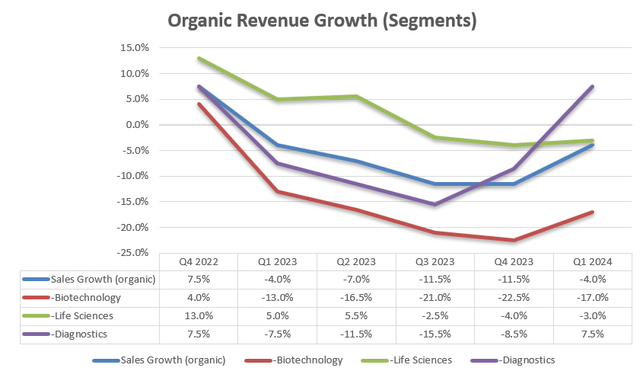

The organic revenue declined by 4% in Q1 FY24, primarily driven by weak growth in biotechnology and life sciences, as illustrated in the chart below. Due to the operating leverage, the core operating margin declined by 290bps year-over-year and adjusted EPS declined by 6.5%.

As discussed in my initiation report, the whole bioprocessing and Life Sciences markets are experiencing a downturn cycle in the post-pandemic period. There are two main reasons for the downturn. During the global pandemic, biotech companies overbuilt their Covid-related vaccines and therapeutics, leading to excess manufacturing capacities. As the Covid is fading away, the overbuilt capacities are being wound down, resulting in a downturn in the bioprocessing industry.

Another factor is the tightening of capital funding in the biopharma industry due to high interest rates. Many small and mid-sized biopharma companies had to reduce workforce and delay the R&D process to manage their balance sheet.

The best way to have a better understanding of the underlying market is to observe the industry players.

During Q4 FY23 earnings call, Charles River Laboratories (CRL) indicated that the constrained spending in biopharma and life science will persist into 2024, but they anticipated the demand would stabilize modestly during the year. In addition, they anticipated that small players would continue to spend cautiously until they have clear indications of the capital funding environment.

Repligen (RGEN) released their Q4 FY23 result on February 21, acknowledging 2023 was a challenge year for the bioprocessing market, and they anticipated the market will improve slightly during FY24.

It appears apparent that bioprocessing and life science markets are facing significant challenges in the near future. Danaher plays a crucial role in providing a broad range of equipment, consumables, and services for biotech companies, enabling them to accelerate research and delivery of biological medicines. There are several structural growth drivers for the development of biological medicine, including novel cell, gene, mRNA and other nucleic acid therapies. I remain optimistic about the long-term growth potential for biological medicines, as these new developments could potentially make vaccines and biotherapeutics for cancers.

FY24 Outlook

For FY24, Danaher maintains their original guidance of LSD decline in revenue with an adjusted operating margin of 29%. I am considering the following factors:

- -Biotechnology Segment: As discussed previously, industry players expect a moderate recovery in FY24. However, I acknowledge that it is uncertain when the Fed will start to cut interest rates and how fast they will cut. The constraints of capital funding in the life science industry could last for a while. Danaher’s Biotechnology business declined by 18% organically in FY23, and I believe the worst time has already passed. At least, life sciences companies don’t need to face the strong comparables caused by covid-related businesses such as vaccines and test kits etc. As such, I assume their Biotechnology business will decline another 15% in FY24.

- -Life Sciences: As more than 70% of segments are recurring in nature, the sluggish biopharma market would have less impact on Danaher’s Life Sciences business. I anticipate the growth for FY24 would be similar to their Q1 result (-3% organically).

- -Diagnostics: Danaher is going to face weak comparable in FY24, as the business declined by 11.7% in FY23. The weak growth in FY23 was caused by the diminishing of covid-related diagnostics revenue. If the business returns to their historical average growth rate, the revenue is more likely to increase by HSD in FY24.

Putting the three segments together, I calculate Danaher’s revenue will decline by -2% to -3% in FY24.

Valuation Update

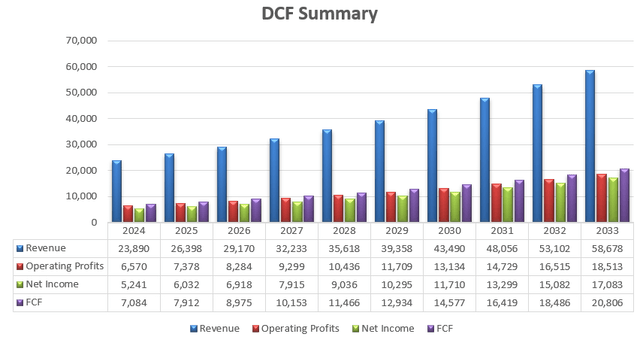

As discussed, I forecast they will deliver -2.5% organic revenue growth in FY24, reflecting the pressure from the weak biopharma industry. For the normalized revenue growth, I use the global biopharma industry growth as a reference. As Danaher provides the equipment and consumables for the global biopharma industry, Danaher’s business growth is tied to the overall industry growth. Fortune Business Insights forecasts that the global biopharma industry will grow at a CAGR of 7.9% from 2023 to 2030. As such, I assume Danaher will achieve 8% organic revenue growth in a normal market environment. In addition, as Danaher has consistently allocated capital towards M&A to consolidate the industry, I assume they will spend 10% of total revenue on M&A; thus acquisitions will contribute 2.5% of growth to the top line.

I expect their margin expansion will come from the gross margin expansion and SG&A leverage. Danaher has achieved impressive results by launching new and innovative products which carry much higher gross margin. For instance, in April 2024, Danaher launched their Xcellerex magnetic mixing system, addressing challenges during large-scale mAb, vaccine, and genomic medicine manufacturing processes.

As indicated over the earnings call, Danaher has been actively managing their costs, resulting in improvements in SG&A expenses. Therefore, I estimate their total operating expenses will grow at 8.5% annually, leading by 20bps margin expansion from gross profits and 20bps leverage from SG&A. The discounted cash flow, or DCF, summary can be found below:

Danaher DCF – Author’s Calculations

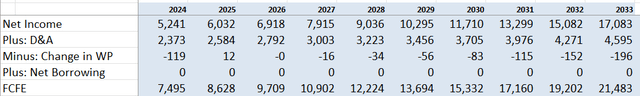

The free cash flow from equity is derived by adjusting net income with depreciation/amortization, net borrowings and net change in working capital.

Danaher DCF – Author’s Calculations

The cost of equity is calculated to be 11.46% assuming: risk-free rate 4.32% (US 10-Y Treasury Yield (US10Y)); beta 1.02 (SA’s data); equity risk premium 7%. The one-year price target is calculated to be $290 per share, according to my calculations.

Key Risks

End-Market Recovery: I think the biggest downside risk for Danaher is a slower-than-expected market recovery in the biopharma industry. The current high interest rate is detrimental to the overall capital funding for the biotech industry, especially for small and medium-sized companies. Nobody knows how quick and how fast the Fed will cut rates. If the end-market experiences a slow recovery, Danaher’s stock price might face further downside pressure in the near future.

China Growth: China accounts for more than 10% of their total revenue. As indicated over the earnings call, the demands in China remain weak as life science companies are tightening their capital spendings. Danaher expects their revenue in China to decline by HSD in FY24. Apparently, China would continue to drag Danaher’s overall growth in the near future.

Conclusion

While the life science market continues to face challenges in FY24, I am optimistic about the long-term growth prospects and I think the worst time for Danaher has already passed. I view the current down cycle as a good timing to accumulate Danaher stock for long-term investors. I reiterate my “Strong Buy” rating with a one-year price target of $290 per Danaher Corporation share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.