Summary:

- Danaher reported okay Q3 earnings, with “cautiousness” probably being the best adjective to describe the release.

- The company has finally returned to growth and forward-looking commentary seems positive, but management seems reluctant to put numbers around their optimism.

- There might be a reason behind the conservativeness, which I explain in this article.

EXTREME-PHOTOGRAPHER/E+ via Getty Images

Introduction

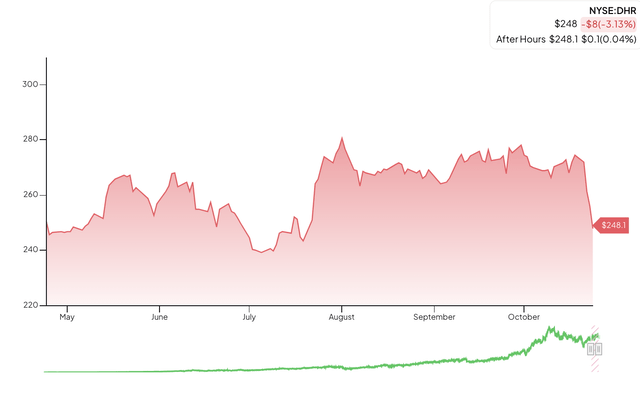

Danaher (NYSE:DHR) reported earnings this week, and the market did not like these. I don’t think there’s much to comment on, to be honest. Not much has changed for Danaher since Q2, and nothing was thesis-breaking in the Q3 release. We can, however, speculate about management’s ongoing conservativeness. The stock is down almost 10% since reporting earnings, something which might be a “conscious” decision by management:

Despite the adverse market reaction (which might be justified to an extent), there was some positive news, so let’s get on with it.

Good earnings, but “caution” is the word

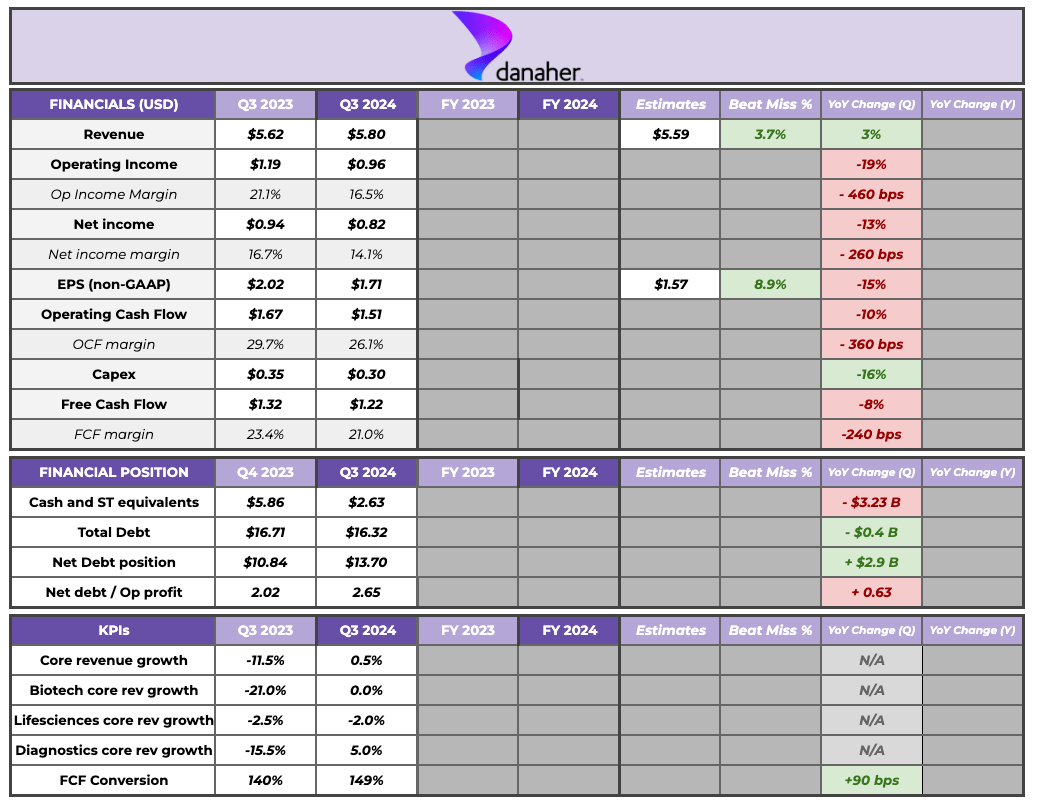

This is Danaher’s summary table for Q3:

Made by Best Anchor Stocks

Danaher’s earnings were probably characterized by one word: cautiousness. The company beat analysts’ (and their own) top and bottom-line estimates again. This was Danaher’s 16th quarter in a row beating top and bottom-line estimates, and beats have been pretty substantial. The company has beaten revenue and earnings estimates by an average of 3.2% and 10%, respectively, this year.

These continuous beats have created some sort of expectation of an upward revision in guidance, but management has refused to touch it throughout the year. Danaher came into the year expecting a low-single-digit decline in core revenue, and despite the company delivering “better-than-expected” results throughout the first three quarters of the year, these expectations have remained unchanged…

For the full year 2024, the Company continues to expect that non-GAAP core revenue will be down low-single digits year-over-year.

This is probably making some investors uneasy about the timing of the recovery in bioprocessing, more so considering that management commentary is pretty favorable:

In bioprocessing, we were encouraged with the continued positive momentum we saw in the quarter. Notably, orders increased high single-digits sequentially, which is the fifth consecutive quarter of sequential order improvement, and our book-to-bill ratio improved to approximately 1.0.

Danaher’s management has a track record of being conservative and sandbagging guidance. I don’t see anything wrong with this, especially if they expect that they will be able to repurchase more shares in the future (more on this later). Let’s take a look at some good news.

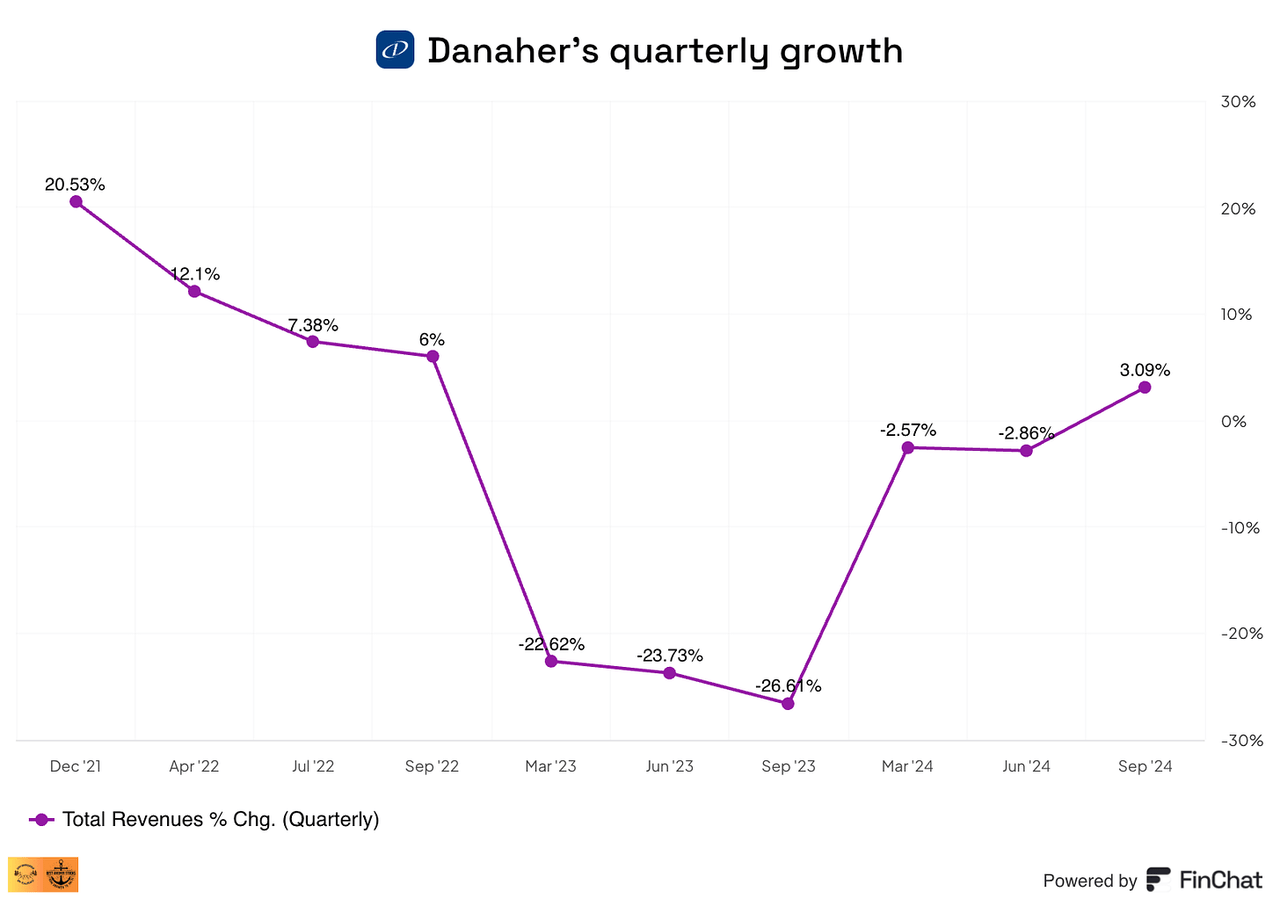

First, Danaher has returned to growth. It was the company’s first growth quarter since September 2022. Post-pandemic financials seem to have stabilized to an extent, although the company is still immersed in the bioprocessing downcycle. Core revenue growth was 0.5%, which is lower than the reported 3% but still in positive territory:

Finchat.io

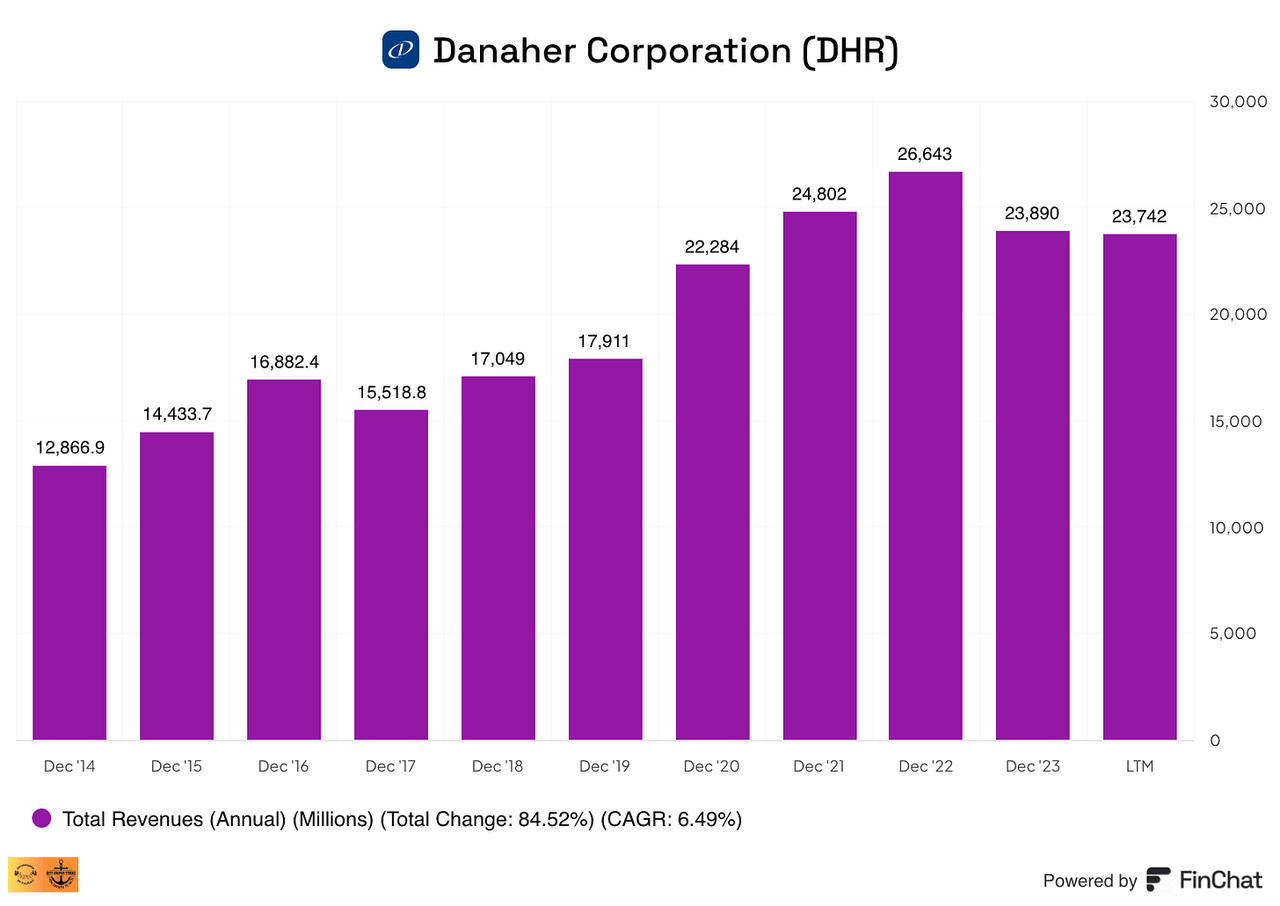

It’s interesting to see that the pandemic benefited the company in a pretty significant way. Danaher entered the pandemic with $18 billion in revenue. Revenue is back on the growth path, and today’s levels are significantly higher than those of 2019 despite bioprocessing still going through destocking. Of course, not all growth has been organic, as there have been acquisitions and divestitures along the way:

Finchat.io

One of the reasons behind this improved performance was Cepheid, which again delivered an outstanding quarter. Cepheid’s revenue increased by double digits, and respiratory revenue was double that of management’s expectations. Danaher argued that a good portion of this outperformance came from stocking ahead of Q4. This might be one of the reasons why, despite a better-than-expected quarter, the company decided to leave the guidance as-is. At the beginning of the year, management expected respiratory revenue of around $1.5 billion at Cepheid; they increased this to $1.7 billion this quarter.

China continues to be a source of weakness. Management sees a more gradual recovery in that country than in the other geographies. This has been a cause for concern to some investors, along with Danaher’s reluctance to put numbers around their forward-looking optimism. If I were to point out one quote in the earnings call that might have led to Danaher’s poor post-earnings performance it would be this one:

I do believe this is going to kind of be a continuation of what we saw in 2024, which is pretty gradual recovery.

Analysts expect 8% core revenue growth next year. This seems unachievable after reading that quote, but not so much when considering that bioprocessing is expected to exit the year at a high-single-digit growth rate. It honestly seems like management is being pretty conservative here. There might be a reason for this, though.

Danaher continues to generate significant cash flow (around $5 billion in free cash flow over the last 12 months), and with management believing M&A is not worth it due to high valuations across the sector, we might see further buybacks in the near future. The company authorized a new buyback program in July 2024 that would allow the repurchase of up to 20 million shares. The latest buyback was conducted at an average price of $259, a price that’s higher than where the company is trading today (around $248).

I would not be surprised if we see further buybacks in the coming quarters. I acknowledge the company is not cheap, but buybacks will add value so long as the business does fine long-term and there’s no reason to believe it won’t. The most likely scenario is that if Danaher has significantly higher earnings in 5 to 10 years time, EPS will enjoy a further push from buybacks and Danaher will most likely trade at a multiple of its per share earnings (investors will have probably forgotten about the price paid for buybacks by then). Needless to say, if the company does not do well from here, then buybacks create a downward spiral. Management did mention last quarter that they looked at IRR when conducting their buyback.

Note that people tend to only think about top-line growth, but there’s also an operating margin expansion opportunity at Danaher. Margin drop-throughs are significantly above the current levels, and it’s only a matter of when growth returns and these incremental margins start to show up. Danaher’s gross profit grew 4% this quarter after 3% revenue growth (of which only 0.5% was core), showing that there’s operating leverage in the business.

The adjusted operating margin contracted 10 basis points due to increased investments. Still, management believes Danaher is a low-30s operating margin company at steady state, and the adjusted operating margin guidance for this year stands at 29%. We’ll likely see the bottom line grow faster than revenue once growth returns, and there could be a potential further benefit to EPS if management continues repurchasing stock. It’s obviously tough to envision a scenario of double-digit EPS growth when growth is nonexistent and margins are contracting, but that’s why (among other things) investing is tough.

In the table I shared above, you might see significant margin compression. This was caused primarily by an impairment charge of $222 million included in SG&A expenses. The impairment was related to a genomics business:

During the third quarter of 2024, the Company concluded that it had an impairment indicator for an indefinite-lived trade name within the genomics consumable business included in the Life Sciences segment. This determination was primarily the result of softness in the genomics market, including but not limited to the discontinuation of drug development programs announced in the third quarter and weaker demand at some of the business’s larger customers as well as reduced demand due to the reprioritization of drug development programs at other customers.

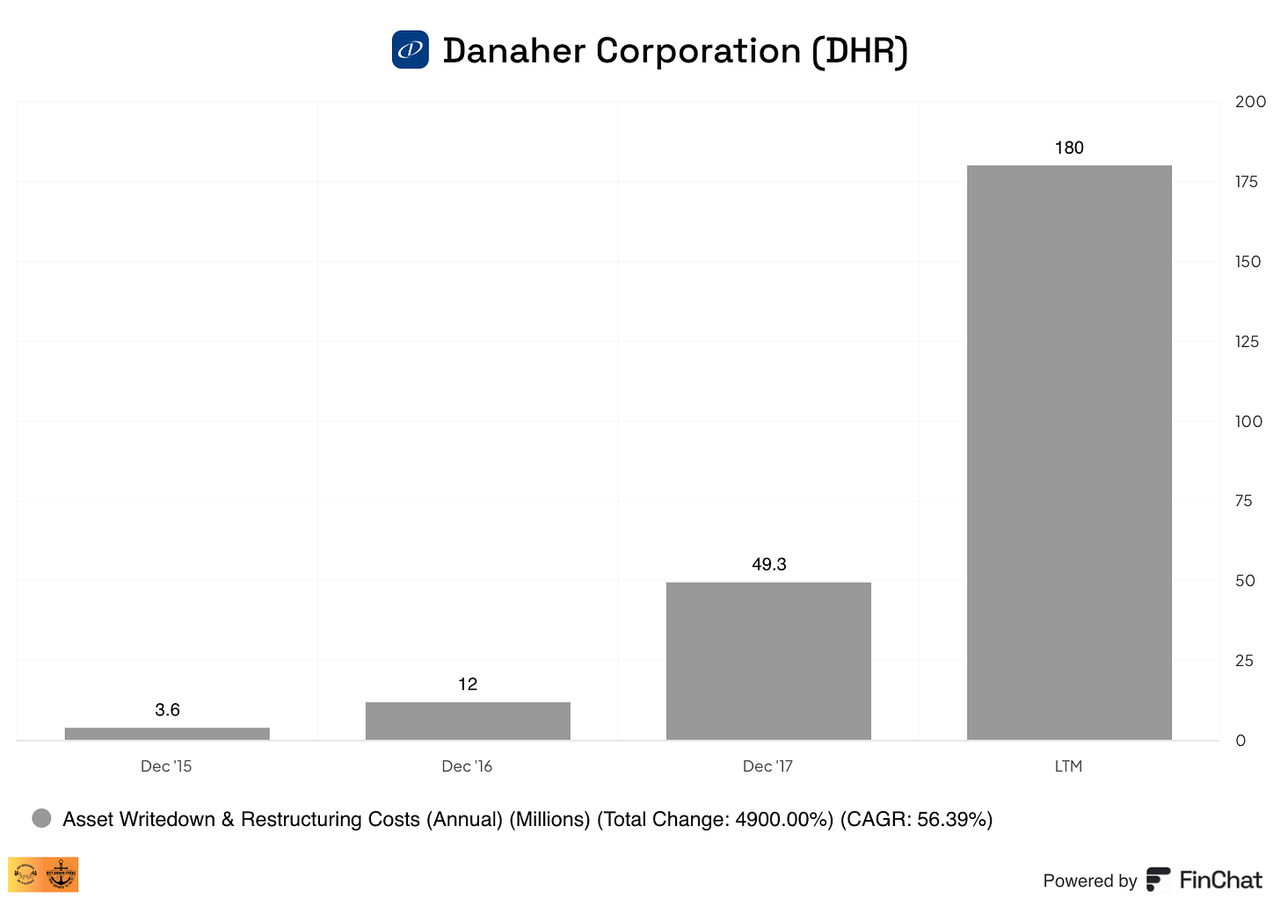

$222 million is significant for this quarter and LTM numbers. Note that it reduces this quarter’s and LTM’s operating income by 20% and 6%, respectively. Danaher is an acquisitive company, so it shouldn’t be unusual to see some impairment charges occasionally. It would definitely be worrying to see recurring and/or large impairments, but this is not the case for Danaher. $222 million is not large when considering Danaher’s asset base, and the company has only incurred impairments in 4 years of the last 10 (most of which were pretty much minimal):

Finchat.io

As it’s a non-cash charge it doesn’t impact cash flows, which is why you can see these were much more resilient. It’s something to monitor going forward in case it becomes more recurring.

Speaking about acquisitions, the Genedata acquisition seems to be an interesting one. It allows Danaher to participate in the drug discovery workflow. I recently added a new position to my portfolio and pointed out in my research that AI can potentially accelerate the drug discovery process significantly. Danaher should be a strong beneficiary of this trend. It seems like the company wants to be also somewhat “in control” of its pipeline.

All in all, it was an okay quarter from Danaher. The company is still immersed in the bioprocessing downcycle, but it does seem as if management is being a tad conservative here with guidance. This, together with a new repurchase agreement approved in July, might mean that the company wants to repurchase more shares at a lower price. If this were the case, it would basically mean they have little incentive to be very optimistic about the future here over the short-term.

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Anchor Stocks helps you find the best quality stocks to outperform the market with the lowest volatility/growth ratio. We look for top-notch quality compounders, with solid growth and lower volatility than you would expect.

Best Anchor Stocks picks have a track record of revenue growth combined with below-average volatility. Since the inception in January 2022, our portfolio has beaten the market by a significant margin.

There’s a 2-week free trial, so don’t hesitate to join Best Anchor Stocks now!