Summary:

- I reiterate my ‘Strong Buy’ rating for Danaher, with a one-year price target of $310 per share, citing recovery in bioprocessing and market share gains in molecular testing.

- Danaher’s bioprocessing market shows high-single-digit growth in orders, with stabilization in China, and is expected to sustain recovery in Q3 and FY25.

- Cepheid’s market share gains in molecular testing, including FDA authorization for its Hepatitis C RNA test, highlight Danaher’s innovation and growth potential.

- Despite cautious outlook for China, I project Danaher will outpace market growth, driven by molecular testing, M&A, and margin expansion, with improved capital funding in life sciences.

Morsa Images

I reiterated my ???Strong Buy??? rating for Danaher (NYSE:DHR) in my previous article published in April 2024, pointing out Danaher???s worst time has already passed. The company???s Q2 result on July 23 demonstrated further recovery in its bioprocessing business. Their Cepheid business continues to gain shares in the attractive molecular testing market. I reiterate ???Strong Buy??? with a one-year price target of $310 per share.

Recovery in Bioprocessing Market

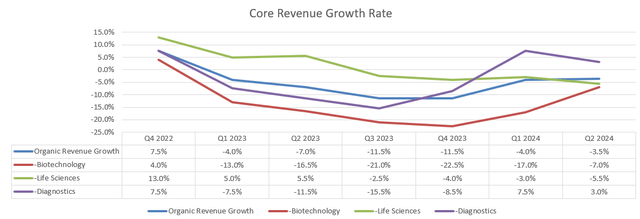

During their Q2 earnings call, the management highlighted that the recovery in bioprocessing market, with high-single-digit sequential growth in orders across both U.S. and European markets. Additionally, the bioprocessing market in China stabilized during the quarter. As depicted in the chart below, Danaher???s organic revenue declined by 3.5% during the quarter, indicating a further business recovery in their biotechnology sector.

I anticipate the bioprocessing market will sustain their recovery in Q3 and FY25 for the following reasons:

- During the recent conference in September, Thermo Fisher Scientific (TMO) indicated some improvement in the biotech funding environment, along with recovery in clinical research market. As the Fed has entered the interest rate cut cycle, the capital funding in the life science industry is more likely to improve over time, in my view.

- With fast-growing technologies in biotech and technology advancement in AI, I anticipate more biotech startups will leverage AI technology for drug discovery and development process, which will create more demands for bioprocessing instruments and consumables.

- Danaher has a strong market position in the single-use bioprocessing end-market. Allied Market Research predicts the single-use bioprocessing market will grow at a CAGR of 18.4% from 2021 to 2030 driven by advancements in vaccines, monoclonal antibodies, and personalized medicines.

Market Share Gains in Molecular Testing

Another key takeaway from the earnings call was their share gains in molecular testing market, driven by the strong performance of Cepheid business. In June, the FDA granted Cepheid marketing authorization for its Hepatitis C RNA test. As indicated over the earnings call, Cepheid’s test is the first molecular-based point of care test for Hepatitis C, allowing patients to be tested and treated during the same visit. The Hepatitis C RNA test is a perfect example of Danaher???s innovation in their molecular testing market. The management expressed strong confidence in the long-term growth of their Cepheid business.

Growth Outlook and Valuation

Danaher is set to report their Q3 result on October 22nd before the market open, and they confirmed their Q3 and full-year guidance on September 4th. As such, I don???t anticipate there is any earning surprise for their FY24 result. I forecast their core revenue will decline by low-single-digit as they guided.

For the normalized growth from FY25 onwards, I am considering the following factors:

- I continue to project Danaher will outpace the market growth, with the molecular testing being one of the main growth drivers. I anticipate Danaher will grow its revenue by 8% organically, slightly higher than the industry growth of 7.9%, as analyzed in my previous article.

- I continue to forecast the company will allocate 10% of total revenue towards M&A, contributing 2.5% to the topline growth.

- I project 40-50bps annual margin expansion, driven by 10-20bps from gross profit due to new products and growth of consumables; 20bps from SG&A operating leverage and 10bps from R&D optimization.

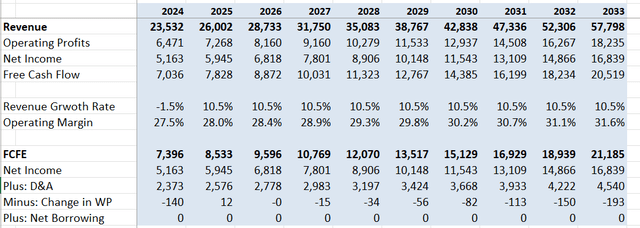

As the Fed has cut the interest rate, I update the cost of equity to 10.2% assuming: risk-free rate 3.6%; beta 1.02; equity risk premium 6.5%. With these new assumptions, the DCF and free cash flow from equity (FCFE) can be summarized as follows:

The one-year target price is estimated to be $310 per share after discounting all the future FCFE at the rate of 10.2%.

Key Risk

I think the biggest risk for Danaher remains their China operations. China accounts for more than 10% of total revenue, declining by high teens in Q2 FY24. Although the management believed the market presents signs of stability, they remain cautious about the market recovery in China. The management noted some government stimulus in the life science market in China; however, they don???t anticipate these measures to translate into orders in FY25.

Conclusion

It is encouraging to see the bioprocess market beginning to recovery, and I anticipate capital funding in life science will improve in 2025. I think Danaher is well positioned in the fast-growing biotech market. I reiterate ???Strong Buy??? with a one-year price target of $310 per share.

Analyst???s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.