Summary:

- Danaher’s bioprocessing business faces short-term challenges in 2023, but the company remains a strong investment opportunity in the Medtech sector.

- The company’s razor-blade business model, leading positions in attractive end markets, and strong organic growth combined with M&A make it a compelling investment.

- Despite short-term headwinds, Danaher is expected to achieve normalized high-single-digit organic sales growth and maintain a high operating margin after the spin-off of Environmental & Applied Solutions.

Extreme Media

The bioprocessing business represents over $8 billion in sales, accounting for more than 30% of Danaher’s (NYSE:DHR) total revenue following the spin-off of Environmental & Applied Solutions. In 2023, the bioprocessing business is expected to face challenges as large pharmaceutical companies destock Covid-related products, while emerging biotech companies tighten opex and capex spending to navigate funding difficulties. However, I believe these headwinds in the bioprocessing business are short-term in nature, and I encourage investors to capitalize on this golden opportunity to invest in Danaher.

Why I think Danaher is best-in-class in the Medtech sector?

Razor-blade business model: Following the separation of Environmental & Applied Solutions, over 80% of Danaher’s sales will be recurring in nature. These products encompass a steady stream of consumables derived from an extensive installed base. They hold high value and serve as mission-critical applications for the entire life science industry. This razor-blade business model extends across Danaher’s Life Sciences, Diagnostics, and Biotechnology segments. The highly recurring nature of their business model brings about similarities to a Software-as-a-Service company.

Leading positions in attractive and fast-growing end markets: Danaher holds prominent positions in end markets such as biotechnology, molecular diagnostics, and clinical diagnostics. These end markets possess strong long-term secular growth drivers. With next-generation drugs, gene and cell therapy, mRNA, and gene editing with CRISPR still in their early stages, the development funnel has seen a tenfold increase over the past five years according to Danaher’s management team. Additionally, biotech and pharma companies must procure certain Danaher products to meet regulatory requirements, enhancing the resilience of Danaher’s business.

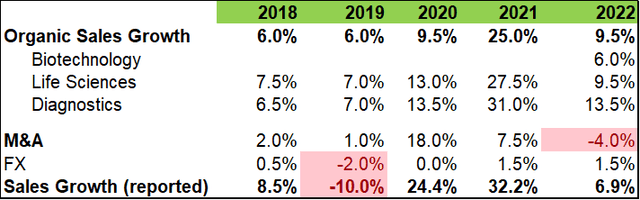

Strong Organic Growth + M&A: In general, I am not inclined towards companies that rely solely on mergers and acquisitions for growth. Organic growth holds greater importance for future success. In the Medtech industry, I consider Danaher and Thermo Fisher Scientific (TMO) to be exceptional since their growth stems from both organic initiatives and M&A. The table below illustrates Danaher’s impressive organic sales growth as well as its M&A-driven growth.

Danaher 10K, Author’s Calculation

Utilizing the Danaher Business System (DBS), Danaher has consistently demonstrated a strong track record in integrating acquired businesses and actively managing their portfolios. Noteworthy acquisitions include PALL in 2015, Cepheid in 2016, and Cytiva in 2020, all of which Danaher successfully integrated using the DBS approach. Simultaneously, Danaher has been actively divesting non-core and low-growth businesses like Dental and Environmental & Applied Solutions.

Through a combination of organic growth, strategic acquisitions, and divestitures, Danaher’s core sales growth has accelerated from low-single-digit figures before 2015 to high-single-digit figures following the separation of Environmental & Applied Solutions. Recurring revenue has increased from 45% in 2015 to over 80% projected for 2024, based on my calculations. Furthermore, the operating margin has improved from 17% in 2015 to the current level of 30%. The noteworthy evolution of their portfolio is commendable.

Danaher expects to complete the spin-off of their Environmental & Applied Solutions business in the fourth quarter of 2023. Following the separation, I anticipate Danaher to achieve normalized high-single-digit organic sales growth and maintain a high operating margin. Additionally, the spin-off will position Danaher as a pure Medtech company.

Why is Danaher’s Bioprocessing business experiencing weakness this year?

The bioprocessing business is a significant revenue contributor for Danaher, generating over $8 billion in sales and accounting for more than 30% of the company’s total revenue after the spin-off of Environmental & Applied Solutions. Danaher has consolidated Cytiva and PALL into the bioprocessing group, solidifying its position as the largest player in single-use technologies for the pharmaceutical and biotech industries. Their products are widely used in upstream and downstream applications, supporting customers in moving drugs from research and development to final commercialization.

Danaher expects low-single-digit growth for its bioprocessing business in 2023, which is lower than the usual high-single-digit growth. The question of why the bioprocessing business is weak this year parallels the inquiry into why Danaher’s stock price is currently underperforming.

In the bioprocessing sector, 80% of sales come from large pharmaceutical companies, while the remaining 20% is contributed by emerging biotech firms. Sales to large accounts have grown at a mid-single-digit rate, lower than the previous year, as these companies destock inventories related to Covid testing and vaccines. Danaher anticipates this destocking trend to continue throughout the year.

Furthermore, emerging biotech companies are primarily engaged in discovery and early-stage clinical trial phases. Danaher’s bioprocessing sales from these firms have declined by a mid-teens percentage due to the challenging biotech funding environment. In response, emerging biotech companies have tightened their operational and capital expenditures in 2023, resulting in layoffs. As a consequence, Danaher’s bioprocessing sales were flat in Q1 2023, with projected low-single-digit growth for the year.

In my opinion, Danaher is currently navigating a transitional phase following the surge in growth during the Covid period. Now, they are facing the descent from that peak as Covid testing and vaccine sales decline. This situation is more of a mathematical issue rather than a fundamental business problem. I believe they will experience normalized sales growth in 2024, and I’m not concerned about inventory destocking in the long term.

Regarding the weak biotech funding environment, I also view it as a short-term setback. Importantly, the biotech industry as a whole is thriving, particularly with the increasing focus on biologics and genomic medicines. Innovations such as gene and cell therapy, mRNA, and gene editing with CRISPR are still in their early stages.

Other Risk: China

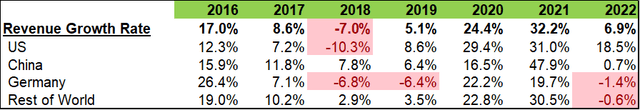

China accounts for approximately 13% of Danaher’s total sales and has been an important growth driver for the company. The table below illustrates Danaher’s sales growth across different geographical regions.

Danaher 10K, Author’s Calculation

Danaher anticipates low-single-digit growth in China this year, driven by the market’s recovery from the post-Covid period. They also expect the bioprocessing business activity level to normalize in China, similar to the United States. China represents an attractive market for Danaher as the country aims to improve its healthcare system. Danaher’s biotechnology, life science, and diagnostic products play a vital role in supporting the entire healthcare industry. However, it is worth noting that the ongoing political tensions between the US and China could potentially introduce challenges for Danaher in the future.

Outlook and Valuation

Despite the short-term challenges faced by the bioprocessing segment, Danaher still foresees mid-single-digit core growth in its base business for 2023. They have also provided guidance for a 30% adjusted operating margin this year, reflecting their efforts to adapt their cost structure and capacities in response to the transition of Covid-19 to an endemic state. From my perspective, their near-term guidance appears reasonable. Although the shift of Covid-19 from a pandemic to an endemic state may cause disruptions in the short term, I believe Danaher has a promising future ahead.

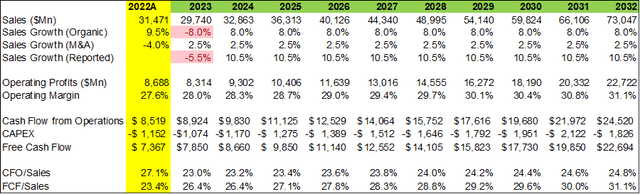

To estimate the fair value, I use 2-stage DCF model. Please note that I haven’t separated Environmental & Applied Solutions business in the model. As Environmental & Applied Solutions will be spin-off as a separate public company, my DCF model calculates the combined value of Danaher.

I assume their normalized organic growth rate to be 8%, in line with Danaher’s high-single-digit projection. As Danaher has a long-term M&A track record, I assume 2.5% of additional growth coming from acquisitions. In the model, the operating margin will be expanded to 31.1% in 2032.

DCF Model-Author’s Calculation

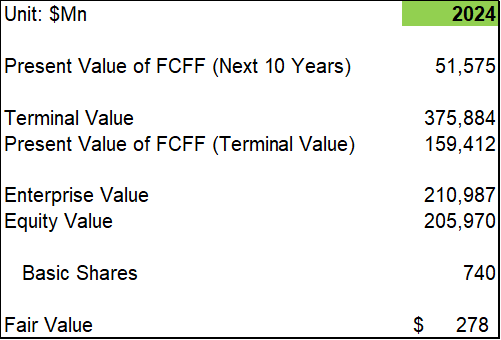

The free cash flow conversion is forecasted to increase from 23.4% in 2022 to 31.1% in 2032 in the model. I use 10% of WACC and 4% of terminal growth rate. With all these assumptions, the present values of free cash from the firm over the next 10 years and terminal value are estimated to be $51 billion and 159 billion, respectively. Adjusting gross debt and cash balance, the fair value of Danaher is $278. Danaher is undervalued currently.

DCF Model-Author’s Calculation

Conclusion

In my portfolio, Danaher has consistently been a significant holding within the health care sector. I view them as an exceptional group of leading franchises serving attractive end markets with durable secular growth drivers. Additionally, the strength of their balance sheet provides them with the optionality to enhance their businesses both organically and through disciplined M&A. I highly recommend investors to seize this golden opportunity to invest in Danaher. Based on my assessment, I would assign a “Strong Buy” rating to Danaher.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR, TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.