Summary:

- Danaher just reported its 1Q23 earnings, which included somewhat weak guidance, causing the stock to sell off.

- While COVID benefits are unwinding rapidly, pressuring 1Q results and its outlook, the company remains upbeat about its core business, which continues to benefit from high secular growth.

- While this sell-off isn’t fun, it’s great news for long-term investors who get to accumulate at much more favorable prices.

Sundry Photography

Introduction

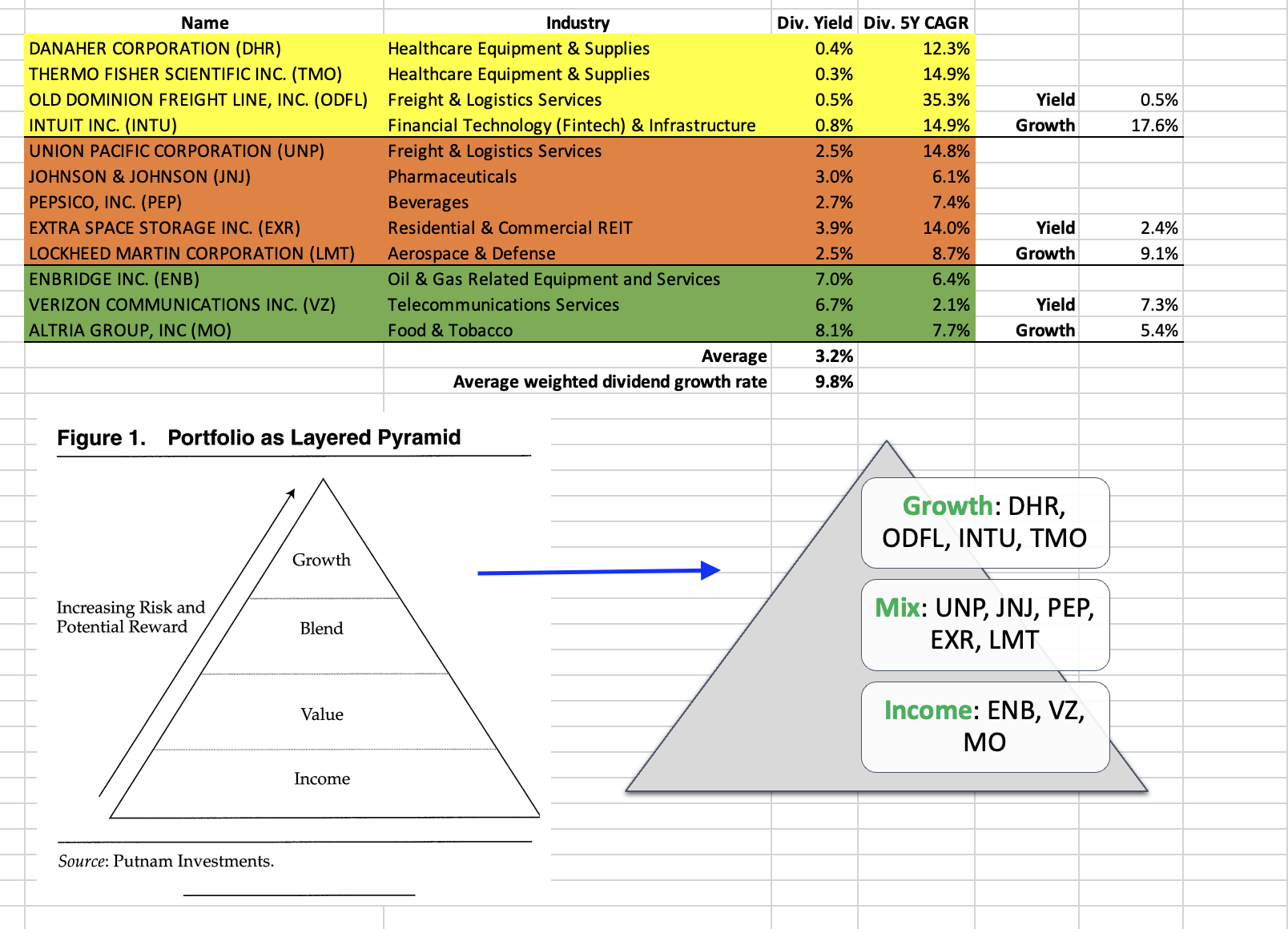

The Danaher Corporation (NYSE:DHR) is one of my all-time favorite dividend growth stocks. In a recent article, I explained why I would include it in any dividend growth strategy that incorporates low-yielding and fast-growing dividend companies. I used the pyramid strategy, as the overview below shows.

Leo Nelissen (Article: Danaher: The Secret To Successful (Dividend) Investing)

Based on that context, I’m writing this article with somewhat mixed feelings. The company just reported its earnings. While these earnings weren’t bad, they caused a sell-off as investors had hoped for better guidance.

The good news is that I’m finally getting another opportunity to add DHR shares. DHR has become my second-smallest position, as I haven’t added a lot to the position in recent months. Also, its performance was lackluster, as investors aren’t keen on holding growth stocks in a high-rate environment.

In this article, we’ll discuss all of this and answer the question if now is a good time to buy or not.

So, let’s get to it!

What To Make Of 1Q23

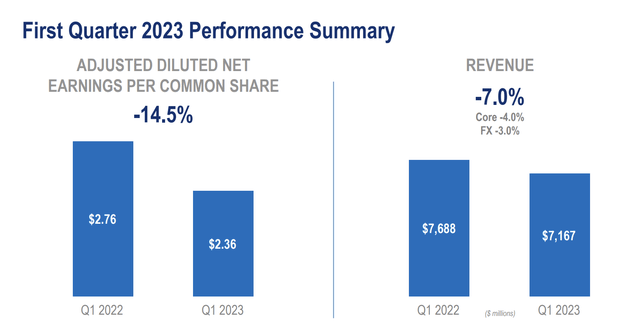

Let’s start with the headline numbers. In 1Q23, Danaher reported $7.2 billion in revenue, which is 6.4% below the prior-year quarter result and $140 million higher than expected. So, not that bad.

Core revenue growth was down 4% with forex headwinds of 300 basis points.

Adjusted EPS came in at $2.36, which is $0.10 higher than expected and down 14.5% compared to 1Q22.

One major headwind was COVID, which benefited the company in both 2020 and 2021. Now, these benefits are unwinding. According to the company (emphasis added):

COVID-19 revenues were a headwind of approximately 10%. Geographically, core revenues in developed markets declined mid-single digits, primarily as a result of lower COVID-19 revenues. High-growth markets were up low single digits, with a low single-digit decline in China. Results in China were better than expected, driven by a quicker-than-anticipated recovery in diagnostic testing and a more favorable life science research funding environment.

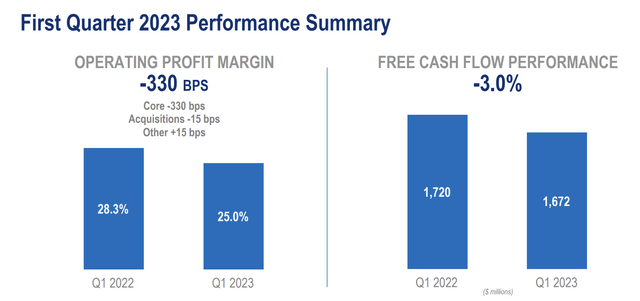

Danaher’s gross profit margin for the first quarter was 61%, while the operating margin of 25% was down 330 basis points. The company generated $1.7 billion of free cash flow in the first quarter, which translates to a decline of 3.0%.

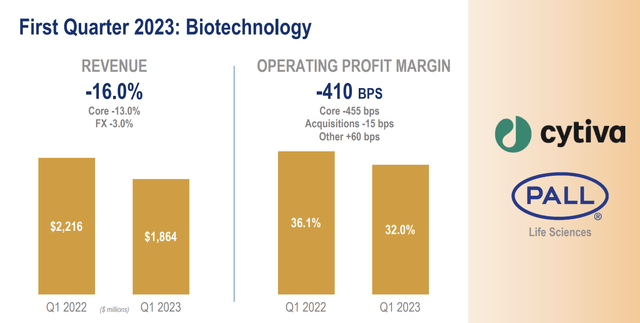

The company’s biotechnology segment reported a decline in revenue, while its base business core revenue growth was in line with their expectations of low single digits in the first quarter.

One major issue was related to the challenging macroeconomic environment, as the company witnessed softer demand globally at many of its emerging biotech customers. Pressures on liquidity and funding accelerated their efforts to conserve capital leading to project delays and cancellations. Danaher anticipates that the inventory normalization process will continue through the second half of the year, resulting in largely consistent second-quarter and full-year base business core growth in bioprocessing.

In other words, the biotechnology segment is seeing some unwinding COVID-related benefits that are amplified by a very challenging funding (high rates) environment.

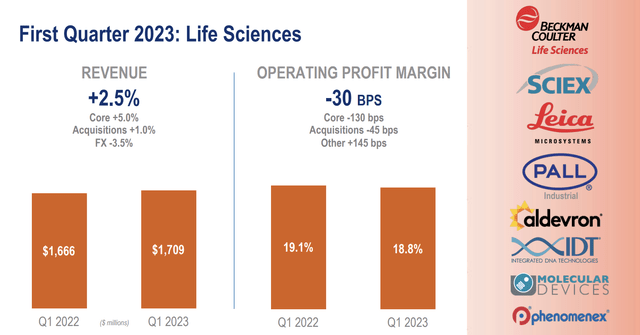

In its Life Science segment, the company reported 2.5% growth, boosted by 5.0% core revenue growth. While margins were down, the company saw healthy demand and none of the funding issues that pressured its Biotechnology segment.

Funding levels and sales funnels remained healthy across most major geographies and end markets. The demand for our advanced solutions remains strong, notably for recent innovations such as the SCIEX ZenoTOF7600 and Leica Microsystems, Mika.

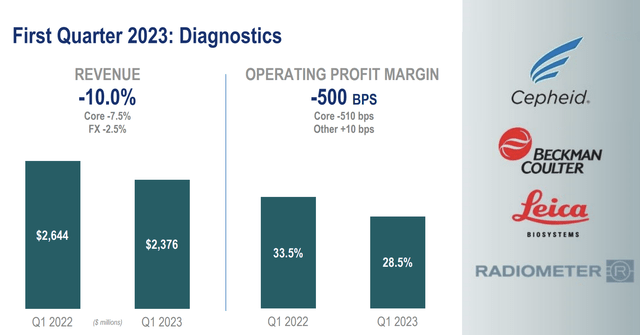

The Diagnostics segment didn’t do nearly as well. Its revenue broke down by 10% – 750 basis points of this came from core weakness. What’s interesting is that this segment was significantly impacted by COVID. While non-COVID core revenue was up by double-digits, COVID-related respiratory testing volumes were down big.

While this is bad news (or good news, as we’re finally post-COVID), the company still saw higher-than-expected COVID testing and demand for other tests. That’s an unexpected tailwind, so to speak.

In COVID-related respiratory testing, customers continued transitioning high throughput testing to the point of care and consolidating their point-of-care PCO testing platforms onto the gene expert. As a result, Cepheid’s respiratory testing revenue of approximately $550 million in the quarter exceeded our expectation of $450 million. This was driven both by higher volumes and the preference for our 4-in-1 test for COVID-19, Flu A and B and RSV.

Furthermore, Radiometer experienced a significant increase in core growth driven by robust demand for blood gas testing in China. Similarly, Biosystems also observed mid-single-digit core growth, mainly led by advanced staining and digital pathology. Beckman Coulter Diagnostics surpassed expectations and achieved mid-single-digit core growth due to its strong presence in developed markets and China.

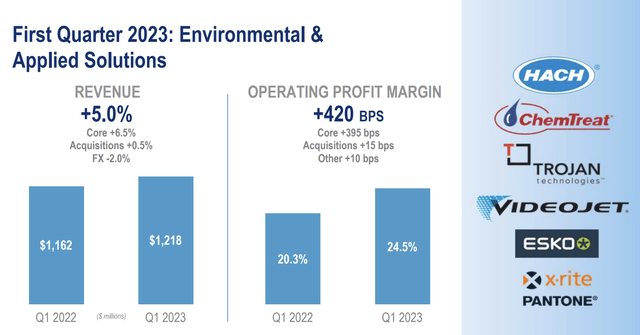

Last but not least, one of my favorite segments, Environmental & Applied Solutions, performed very well. This segment saw 5.0% revenue growth, as forex headwinds of 200 basis points offset 6.5% higher core growth. M&A added 50 basis points. Margins improved by 420 basis points, most of which came from higher core margins.

What’s also interesting is that despite severe industrial weakness (in general), the company benefited from secular growth and its ability to meet an increasing need for advanced tools. It also helps that more than half of this segment consists of water purification and related, which allows an industrial-focused segment to escape general economic weakness.

Strength was broad-based across both equipment and consumables, particularly in our industrial end markets. This performance highlights the resilience of the high-margin recurring revenue business model that make up water quality and the significant value our solutions provide in support of customers’ day-to-day mission-critical water operations.

Furthermore, this segment will be spun off later this year. While we’re still dealing with limited info, the company announced that this company will be headquartered in Waltham, Massachusetts. In February, it announced that the EAS segment would trade under the name Virala.

So far, I have to say that 1Q23 wasn’t bad. The company is seeing high growth in areas that are expected to be the backbone of its long-term growth. That’s great news. However, the impact of COVID is large, and I cannot blame investors for taking some money off the table as these tailwinds unwind – especially as I expect this unfavorable microenvironment to last.

Outlook & Valuation

Guidance is one of the reasons why DHR shares were soft after the earnings call. On a full-year basis, the company expects mid-single-digit core growth in its base businesses. The company also expects total core revenue to decline high-single-digits for the year as a result of lower COVID demand. In other words, a continuation of 1Q23 in the next few quarters.

According to the company (emphasis added):

So to wrap up. We’re pleased with our strong first quarter results. Our well-rounded performance is a testament to the durability and balanced positioning of our portfolio and our team’s commitment to leading and executing with the Danaher Business System. While the transition of COVID-19 from a pandemic to an endemic state is causing near-term disruption, there is no doubt that the past 3 years have helped shake Danaher into a better, stronger company.

Analysts expect DHR to generate $10.2 billion in full-year EBITDA. That would be a decline from $10.9 billion in 2022. Next year, that number could exceed $11.2 billion (excluding the Virala spin-off).

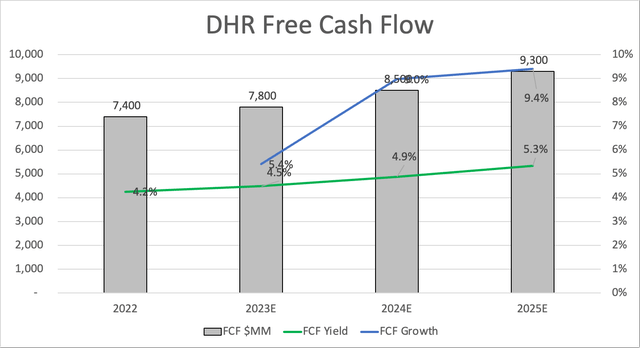

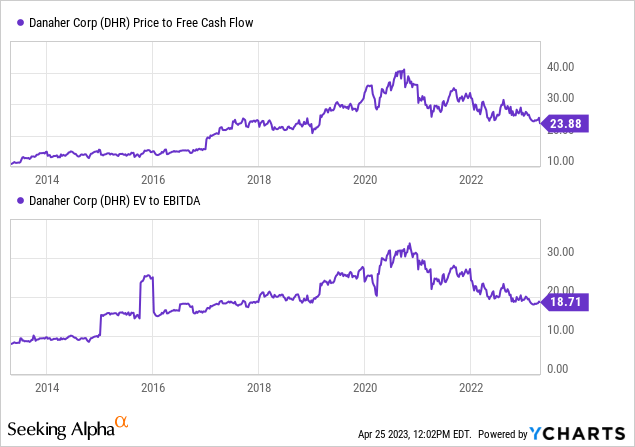

The good news is that free cash flow is expected to continue growing. This year, the company is estimated to generate $7.8 billion in free cash flow, followed by consistent high-single-digit growth in the next few years. This helps the valuation, as it would imply that the company trades at just 22x 2023E free cash flow.

That said, the company’s valuation has erased the entire surge caused by the pandemic. The implied price/free cash flow ratio is back to 2019 levels. The same goes for the EV/EBITDA multiple.

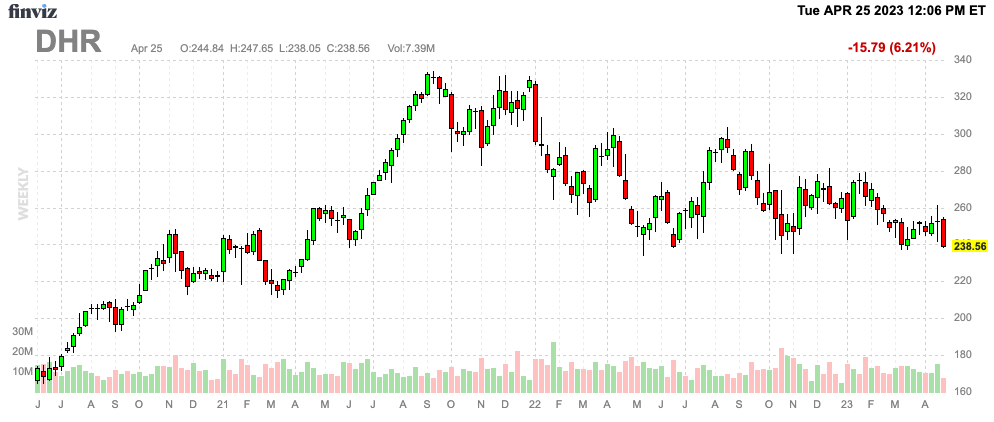

With that said, I added a few shares today. However, I still have cash reserved to double my DHR position. If the stock gets a technical breakdown toward $220, I will aggressively buy, making it a top-5 position in my portfolio.

FINVIZ

Based on everything said so far, my rating is neutral. While the valuation is fair, we’re not at prices that I would call attractive. That would be $220. I think DHR can go there if the market continues to weaken.

Overall, I expect 2023 to be very sluggish. After this year, when COVID headwinds fade, I expect the stock to restart a meaningful uptrend, hopefully, supported by higher general economic growth expectations.

Takeaway

Danaher’s quarterly numbers were mixed. However, given high expectations (above-average valuation), there was no room for error. Poor guidance and the related fact that 2023 sales will see a significant contraction aren’t helping the stock price.

However, I am taking advantage of the stock price decline and am excited to increase my investment in Danaher. The company’s core business remains strong thanks to the secular growth in various sectors, and even its industrial segment has done well, as it has avoided general economic weakness.

I anticipate that after 2023, Danaher’s stock price will rise again and outperform the market. In the meantime, I am eager to accumulate shares during any period of weakness.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.