Summary:

- Danaher is currently rated as a hold as the stock price has not reached attractive levels yet.

- The demand for Danaher’s products in the biopharma industry has declined due to destocking and reduced investment in the sector.

- Danaher’s solid position and its strong competitive advantages make it a company worth considering for long-term investment.

- We incorporate Thermo Fisher and Sartorius in our Danaher’s assessment.

Sean Anthony Eddy

We rate Danaher (NYSE:DHR) as a hold as we consider that the stock price has not declined to attractive levels yet. One of its main competitors in the biopharma segment, Sartorius (OTCPK:SARTF), a very good company that we assessed in July, has reduced its forecast for the entire year 2023. If the demand for Sartorius’ products is expected to be weak, it is expected to be a rather similar scenario for Danaher. Even when we are holding Sartorius as we feel its long-term tailwinds are intact, Danaher deserves to be on our radar since the company has a very solid position in all the industries it operates, harnessing its strong competitive advantages based on its famous Danaher Business System (DBS), which, in turn, is based on Kaizen, a Japanese business philosophy that helps to ensure high-quality products, the elimination of waste, and improvements in efficiency, both in terms of equipment and work procedures. Given its primary strategy, M&A, Danaher acquires businesses that are subject to all the changes associated with its DBS, ensuring the maximum value generated by each of them. We will explore the quality of Danaher’s business model by comparing it with other players in the biopharma industry, such as Thermo Fisher (TMO) and Sartorius; then, we will calculate Danaher’s intrinsic value. We found that the stock price needs to decline a bit more to be attractive.

Context

The demand for Danaher’s products, particularly those associated with the biopharma industry and life sciences, was triggered by the COVID-19 scenario in 2020 and 2021, but then, in 2022, the sector experienced a decline as the virus was receding and most of Danaher’s clients still had a significant amount of stock of Danaher’s products in their respective inventories. This downward trend in demand was caused by a longer than expected destocking process from clients and a more moderate investment in the sector in the US and China in the last 2 years.

However, there are strong long-term tailwinds such as growth drivers associated with , and rising incomes in emerging countries, which convey better access to healthcare and rising demand for medications. What we like about companies like Danaher is that the company is not involved in all the risk associated with the research and launch of medical drugs but in providing support to the biopharmaceutical companies by supplying them with tools, equipment, and software to help them launch those medical drugs with more efficiency and efficacy, regardless of their success or failures in developing those medications and treatments.

Business model

There are four different business lines that are under the influence of the DBS inside the company:

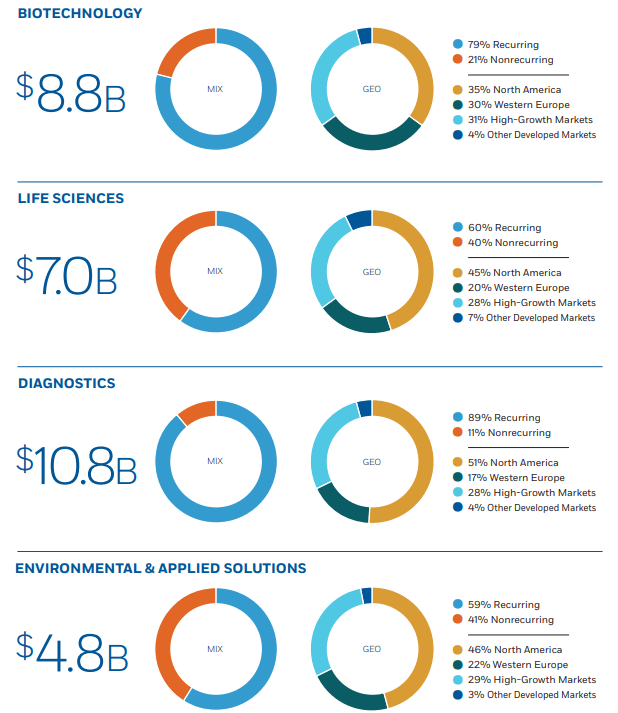

Danaher Annual Report 2022

The biotechnology segment, which represents around 28% of the total revenues and accounts for 79% of recurrent revenues, offers a wide range of tools, consumables, and services that help biopharmaceutical companies advance the research, development, manufacture, and delivery of biological medicines. Danaher’s solutions in this segment support a range of replacement therapies, such as insulin, vaccines, and other biologic drugs.

The life sciences, which represent around 22% of the total revenues and account for 60% of recurring revenues, offer a wide range of instruments and consumables mainly used to study the basic building blocks of life, such as DNA and RNA, nucleic acids, proteins, metabolites, and cells, in order to identify new therapies, test and manufacture vaccines, new drugs, and gene editing technologies.

The diagnostics segment, which represents around 34% of the total revenues and accounts for 89% of recurring revenue, offers clinical instruments, reagents, consumables, software, and services that hospitals, physicians’ offices, reference laboratories, and other critical care settings use to diagnose disease and make treatment decisions.

As such, around 84% of Danaher’s total revenues are exposed to a particular sector within the biopharma and pharma industry, which is amazing since the company started operating, during its first decades of foundation, in sectors more focused on automotive and industrial tools, transportation products, and precision instruments, passing by other different sectors after more than 50 years to reach the biopharma sector.

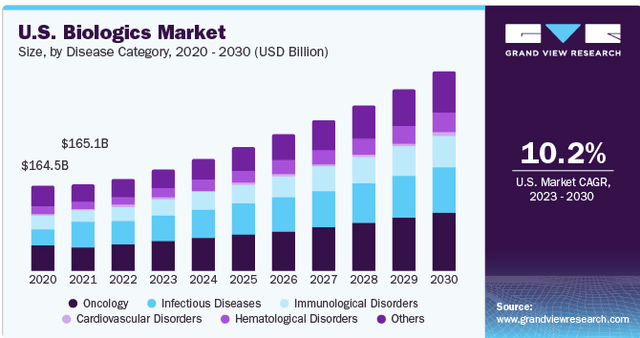

That indicates that Danaher, after lots of acquisitions and divestments over its history, has accumulated the wisdom to know which sector they need to be exposed to after decades, given its significant long-term growth prospects and strong competitive advantages; that sector is biopharmaceuticals and life sciences. For instance, the US biologics market can offer a 10.2% CAGR until 2030.

www.grandviewresearch.com

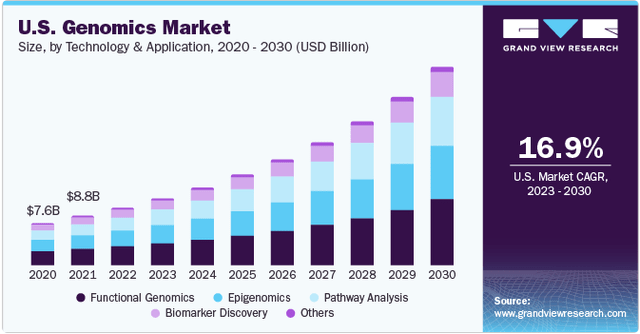

Or the genomic medicines, including cell and gene therapies, where Danaher has found an interesting niche as it offers the greatest prospects of curing the world’s most difficult-to-treat diseases, using the tools and knowhow offered by Danaher’s life sciences and diagnostic business lines to help biopharma innovators make progress in this sector. Here, we may see how the genomics market can offer a growth rate of 16.9% CAGR until 2030:

www.grandviewresearch.com

Veralto’s Spin Off

In October 2023, the environmental and applied solution business line was spun off under the name of Veralto. This segment offers products and services that help protect precious resources while keeping global food and water suppliers safe. There are two business lines within Veralto: the water quality and product identification business lines.

The company has been performing well, as it has delivered operating margins of around 22-23% in the last few years. However, the sector is unrelated to the biopharma and life sciences business lines, so Danaher decided that it would be better to launch a spin-off to allow the market to unlock value from it. Despite the fact that Veralto is a good company strongly influenced by the DBS, with solid margins and good long-term prospects, we did not feel attracted to buy the shares.

First, the market already knew that Veralto was a good company, so most likely the stock price would not be traded at cheap multiples. Second, from what we saw in Form 10, the management is not handsomely rewarded with a significant portion of the pie. Indeed, of the 1,000 million shares issued by Danaher for Veralto, around 23,252 shares were delivered to the Veralto management, which only represents 0.023% of ownership in the company. We would be more attracted to the shares if the management had received an ownership stake of at least 1%.

A management with a significant stake in the game would have way stronger incentives to have an outstanding long-term performance. Now, we think that the performance of Veralto after the spin-off would not be significantly different than before the spin-off, adding to the fact that the shares are not cheap.

Danaher Business System: Kayzen’s Influence

This concept about the way of doing things started in the 1980s with Danaher’s subsidiary, Jacobs Vehicle Systems. This cultural organization evolved over decades inside Danaher, which is a concept created by a Japanese business philosophy named Kayzen. It’s all about the processes and how they are constantly improved by the employees.

This concept involves the improvement of productivity as a gradual and methodical process. Any employee can be changed to another position at any time, and changes take place for better or continuous improvement. Kayzen’s small changes can influence quality control, just-in-time delivery, standardized work, the use of efficient equipment, and the elimination of waste.

The results of this concept applied to an organization are associated with greater staff satisfaction, improved customer satisfaction, a reduction in staff turnover, stronger employee loyalty, lower costs, greater efficiency and productivity, and better problem solving. Now we will see how this concept helped Danaher be ahead in certain aspects of its main peers.

Danaher compared to its peers

Maybe you are asking yourself how that concept of the DBS is applied to Danaher’s results, because we need to see results. Here, we present some results that show evidence that the DBS is not just a concept theory:

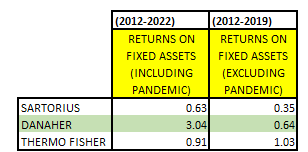

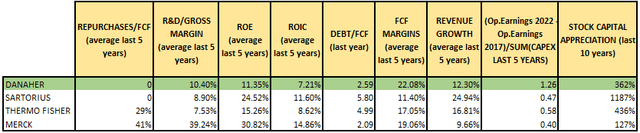

Author, Annual Reports, Danaher, Thermo Fisher, Sartorius

Applying the formula for return on fixed assets:

Return of Fixed Assets (RFA) = (Operating Income 2022 – Operating Income 2012)/(Fixed assets 2022 – Fixed assets 2012)

It’s just an approximation to know how much increase in operating income generates $1 of additional investment in fixed assets in the last 10 years. For instance, looking into the RFA (including the pandemic period), Danaher has outperformed its main peers in this metric, as the company, on average, has invested an additional $1 in fixed assets to produce $3.04 in additional operating income.

Conversely, Sartorius only generated 0.63 euros of additional operating income from 1 euro of additional fixed assets, whereas Thermo Fisher produced an additional $0.91 in operating income from 1 euro of additional fixed assets. However, we discovered other interesting things:

Author, Annual Reports

In the table above, we may see in the eighth column the difference in operating earnings between those earned in 2022 and those earned in 2017, dividing that difference by the sum of all the CAPEX spent in each of those 5 years. This metric indicates that Danaher, on average, generated $1 of CAPEX spent in the last 5 years, or $1.26 of additional operating income. That metric shows that the company is the one that generates the most out of its main peers.

As such, that metric confirms what we found in our previous metric (RFA): Danaher is the company that is the most efficient in terms of CAPEX and fixed asset management and has better free cash flow (FCF) margins. Nevertheless, even when Danaher is the company with the higher efficiency and better FCF margins, it is not the company that has delivered the highest stock capital appreciation in the last 10 years, as is shown by the last column in the table.

It’s possible that its lower ROE and ROIC compared to those of its peers were the factors that slowed down the stock appreciation; this might seem the opposite of what we’ve found about the company’s efficiency, but it’s not. Apparently, this is the result of Danaher’s business model with respect to its M&A strategy, which is one of its core pillars of value creation.

Indeed, Danaher encompasses 16 different subsidiaries after decades of acquisitions, divestments, and consolidations. Taking only the acquisitions, Danaher has made 47 acquisitions in its entire history; Thermo Fisher has bought 49 subsidiaries in its overall history; and Sartorius has only bought 17 subsidiaries in its history. Thermo Fisher and Danaher have a similar strategy in terms of frequency of acquisitions, and there is a connection between that frequency and their relatively lower ROIC and ROE compared to Sartorius.

Looking into the balance sheet of Thermo Fisher and Danaher, there is a common pattern: their goodwill represents almost 50% of their total assets, while all that goodwill is the result of past acquisitions that were paid mostly in cash. Then, there is no surprise that their equity is inflated, more so in Danaher’s case since Thermo Fisher’s equity is significantly reduced by its share buybacks program, as we know that repurchases are accounted for as negative within the equity, which ends up boosting the ROE and ROIC. Indeed, in the first column in the table above, we see that Thermo Fisher has allocated an average of 29% of its FCF for repurchases in the last 5 years.

Apparently, it’s not Danaher’s strategy to deploy its excess liquidity in share buybacks, and one result of that is lower ROE and ROIC but, at the same time, lower financial leverage compared to those of Sartorius and Thermo Fisher, as we can see in the fifth column: total debt/FCF. This is understandable as Danaher prefers to park liquidity for future acquisitions to be paid mostly in cash rather than using it for share buybacks, so its requirements for debt are considerably reduced.

We cannot say that Danaher’s strategy is better than that of Thermo Fisher; in the end, it depends on the available future opportunities to acquire businesses to fit with their own requirements. Danaher can buy more high-quality companies, and they are not necessarily cheap, but that strategy ends up reducing the ROE and ROIC, particularly if the company is not interested in deploying capital for share buybacks.

Sartorius does not make frequent acquisitions and does not make share buybacks since it mostly invests in its own subsidiaries. In the end, these three companies have found their own way to deliver long-term capital appreciation to their shareholders.

Something interesting to point out is that Danaher’s ROIC has been increasing in the last 5 years; we think that the compensation package, in which one of its components is to achieve certain levels of ROIC, is pushing up this metric over the years, as the ROIC in 2018 was 5.75% and that of 2022 was 9.63%, so we expect that the management’s incentives combined with Danaher’s culture through its DBS might keep boosting this metric in the next few years.

With respect to Merck (MRK), we notice that it is more focused on developing and launching medical drugs, despite the fact that there is certain overlap with the other three companies aforementioned in some business lines. That’s why its R&D/gross margin is significantly higher than those of Danaher, Thermo Fisher, and Sartorius. We prefer these three businesses as they belong to a sector that is not involved in all the risk associated with the research and launch of medical drugs but in providing support to the biopharmaceutical companies by supplying them with tools, equipment, and software to help them launch those medical drugs with more efficiency and efficacy, regardless of their success or failures in developing those medications and treatments.

Investors in Danaher and Thermo Fisher might not be the same as investors in Sartorius.

Let us be clear: these three companies are excellent long-term bets, but the type of investor in each of them might be different. For instance, even when Sartorius stock can offer a better long-term capital appreciation to its shareholders, the stock is way more volatile in the short term than Danaher’s and Thermo Fisher’s, given that the stock is less liquid and the company is less diversified in terms of business lines while being more focused on the biopharma segment.

That can be an issue for some investors, so they could focus on Danaher and Thermo Fisher, which offer very good long-term capital appreciation with significantly lower stock price volatility than Sartorius’. Conversely, there are other investors who feel more comfortable with the short-term volatility of the stock price, combining it with a long-term horizon, so Sartorius would fit very well in their investment criteria.

Guidance and prospects

In the last call for Q2 2023 results, Danaher CEO Rainer Blair said the following:

So now let’s briefly look ahead at expectations for the third quarter and the full year. In the third quarter, we expect core revenue in our base business to be down low single digits year-over-year. We also expect total core revenue to decline in the low to mid-teens percent range primarily as a result of lower demand for COVID-19 testing, vaccines and therapeutics.

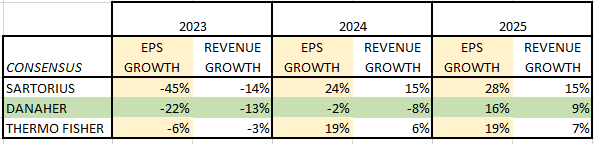

The management did not want to assure anything, but apparently they are expecting that this lower demand for Danaher’s products will reach its bottom in Q4 2023, so a recovery might happen in 2024. We collected the data for Danaher, Thermo Fisher, and Sartorius according to consensus:

Author, MarketScreener

The table above indicates that not only Danaher is being affected by the lower demand in the biopharma segment in a scenario where COVID-19 has receded and Danaher’s clients need to destock all the inventories accumulated during the pandemic. However, according to that consensus, the three companies might recover gradually in 2024.

We ignore the assumptions behind these projections, particularly in Danaher’s estimations for 2024, but we are more optimistic about them than consensus, so we will take this into account in our estimations of the intrinsic value.

Aside from all the long-term tailwinds we’ve mentioned, such as a growing world population and an increase in age-related diseases in industrialized countries, there is a serious threat to the biopharma sector as there will be a patent cliff throughout this decade, which means that many patents will expire. That would mean that biosimilars will take advantage of that opportunity, and companies like Danaher will be prepared to support those small and medium-sized companies in the development of those biosimilars.

Valuation

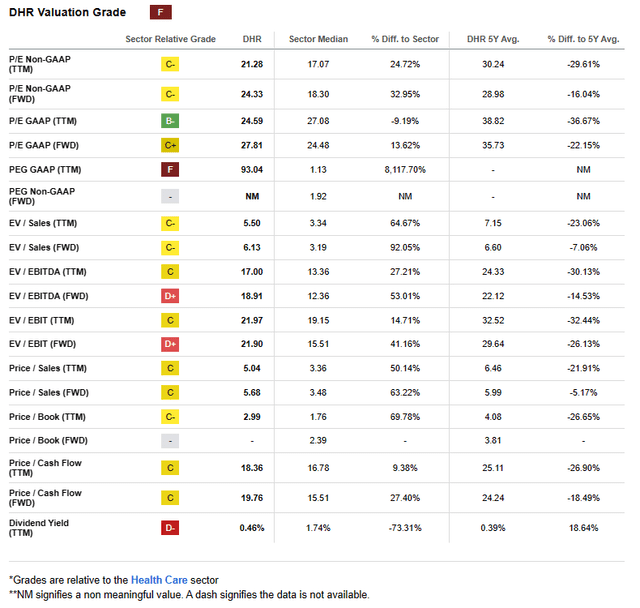

According to Seeking Alpha, most of the multiples indicate that Danaher is expensive.

SA

However, we need to take into account that the comparables taken by SA are related to the healthcare sector, which may include sectors outside the niche segment where Danaher operates. We will use the discounted free cash flow method to calculate Danaher’s intrinsic value.

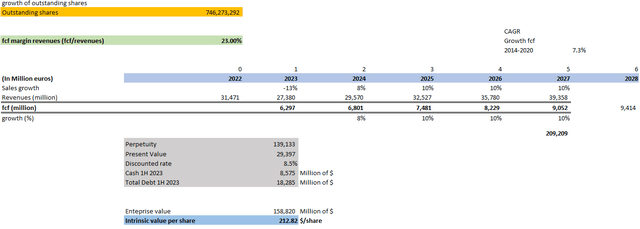

Assumptions

- Outstanding shares: 746,273,292

- Total debt as of the first half of 2023: $18,285 million

- Cash as of the first half of 2023: $8,575 million

- FCF margins: 23% (the average of the last five years was 22%)

- Revenue growth beyond 2023: 8% for 2024 and 10% beyond 2023 (more optimistic than the consensus)

- Discounted rate: 8.5% (I assumed 9% for Sartorius in our previous article).

- FCF growth in perpetuity: 4% CAGR (FCF growth 2014–2020 was 7.3% CAGR)

Author

To find the perpetuity, we used the formula:

Perpetuity = FCF 2028/(discounted rate – g)

where g = FCF growth in perpetuity, which was assumed to be 4% CAGR

With perpetuity, we calculate the present value of all the FCFs beyond 2027. Then, we calculate the enterprise value using the following:

Enterprise Value = Present Value of FCF (from 2023 to 2027) + Perpetuity + Cash – Total Debt

Finally, the intrinsic value is calculated by taking the enterprise value and dividing it by the outstanding number of shares. In this way, we could get $212.82 per share under the assumptions presented.

Here, we need to consider that we’ve assumed more optimistic revenue growth than that assumed by the consensus. We considered a discounted rate of 8.5%, lower than our discounted rate used in our Sartorius’ assessment. The FCF margin of 23% is a bit higher than the average of the last 5 years of 22%. Our FCF growth in perpetuity of 4% is not so conservative, as Danaher reached a FCF growth of 7.3% from 2014 to 2020, considering the first year of COVID-19, when the demand for Danaher’s products was growing significantly.

With all these optimistic assumptions, we get a target price of $212.82 per share, which is close to the current price of around $211. In fact, we’ve put those assumptions to approximate, which are the assumptions made by the market to reach that $211. Apparently, there is trust in the management and in Danaher’s culture to deliver value that the market is not punishing the stock right now.

Anyway, we would wait for a further decline in the stock price, and there is a chance that might happen as we will need to wait for new information from the management about the destocking situation until the end of the final quarter of 2023.

Risks

The main risk is if the destocking effect experienced by Danaher’s clients takes longer than expected. It would affect not only Danaher but also the rest of the players in the industry in the short term and middle term. Here, the important thing is to be aware of the long-term tailwinds of these companies, and at some point, there will be a recovery in the demand for Danaher’s products in the biotech and life science segments.

Final Thoughts

Danaher is a high-quality business that should be on our radar as it is in a very profitable industry while enjoying strong competitive advantages, particularly in the biotechnology and life sciences business lines, which jointly represent around 50% of its total revenues.

We think that Danaher’s business model, through the application of the DBS in each subsidiary, contributes to making the company very resilient, particularly in very hard scenarios. Given that our vision is to hold high-quality companies for the long term, we consider the destocking effect, which is generating uncertainty about the visibility for the next quarters in Danaher’s industry, to be a temporary effect.

We hope that this uncertainty causes further declines in the stock price to buy shares of this excellent company for our long-term portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I hold Sartorius, a Danaher's competitor

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.