Summary:

- Danaher Corporation, with a focus on biotechnology and life sciences, exhibits strong long-term growth potential, supported by its diverse segments and innovation-driven approach.

- Danaher’s recent financial performance has faced challenges, particularly in biotechnology and life sciences segments, but the company’s strategy and focus on innovation position it well for future growth.

- Danaher’s outlook suggests resilience and long-term growth potential, making it an appealing investment choice for those with a long-term perspective despite recent short-term setbacks.

Dmytro Synelnychenko/iStock via Getty Images

(A Lengthy) Introduction

Over the past few months (and before that), we have discussed a wide range of healthcare companies, including biotechnology, major drug manufacturers, producers of devices, and so much more.

My favorite place to be in this sector, however, is companies that supply the hardware for research and development. These companies do not face the risks that their clients face, which include patent loss, competing drugs, FDA approval risks, and related.

The reason I’m bringing this up is because I’m not the only one who believes in the future of life sciences. Earlier this year, Bloomberg reported that Oaktree is betting big on this industry.

According to Bloomberg, Oaktree Capital Management has successfully secured over $2.3 billion for its inaugural private credit fund exclusively designed for life sciences enterprises.

The Oaktree Life Sciences Lending Fund is poised to offer direct financial support to biopharmaceutical and medical device companies worldwide. The primary focus will be on those firms possessing robust intellectual property and late-stage assets aimed at addressing challenging medical conditions.

With that in mind, two years ago, Oaktree wrote a paper on the future of this industry, which included some interesting insights that are still very valid (emphasis added):

We believe demand for healthcare innovation will long outlast this crisis and only intensify in the coming years, as populations age, the global middle class expands and U.S. medical expenditures outpace GDP growth. This advancement will require significant spending on technology, equipment and research and development, meaning this capital-intensive industry’s already hefty financing needs should – like the global population’s median age – just keep rising. – Oaktree Capital Management

This brings me to Danaher Corporation (NYSE:DHR), a company that I have been an aggressive buyer of after its post-pandemic decline has offered us a number of buying opportunities.

After spinning off Veralto (VLTO), which was its Environmental and Applied Solutions segment, the company is now a pure-play company focused on Biotechnology, Life Sciences, and Diagnostics.

This business model comes with:

- Strong pricing power.

- Secular growth tailwinds.

- Subdued competition, compared to the companies it sells to.

- The Danaher Business System (“DBS”).

DBS is the company’s philosophy to efficiently run its M&A-focused company.

According to the company:

DBS is not only the set of business processes and tools our operating companies use on a daily basis, but is more broadly our culture. As reflected in our logo, DBS features five core values (the “Core Values”):

1.The Best Team Wins

2.Customers Talk, We Listen

3.Kaizen is our Way of Life

4.Innovation Defines our Future

5.We Compete for Shareholders

Danaher Corporation

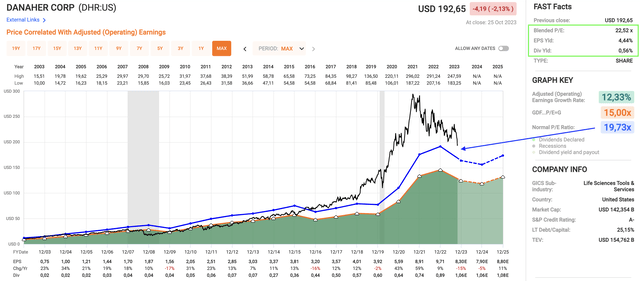

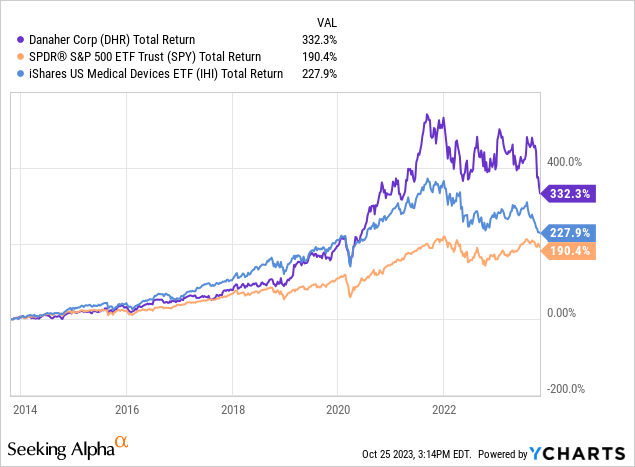

Thanks to all of these benefits, Danaher has been one of the best wealth compounders of the past ten years – and before that.

Since 2013, DHR has returned 332%, which beats the S&P 500 (SP500) and the iShares U.S. Medical Devices ETF (IHI) by a wide margin.

Now, the stock is down 34% after reporting somewhat weak Q3 earnings.

In the remainder of this article, we’ll discuss the company’s quarter and assess the risk/reward of buying DHR shares below $200.

So, let’s get to it!

A Temporary Setback & A Spinoff

The fact that DHR is still up 333% over the past ten years despite losing a third of its value since late 2021 shows just how strong the surge during the years leading up to and during the pandemic was.

We are not in a bad situation for life sciences. We’re mainly experiencing unwinding after the pandemic caused demand to explode.

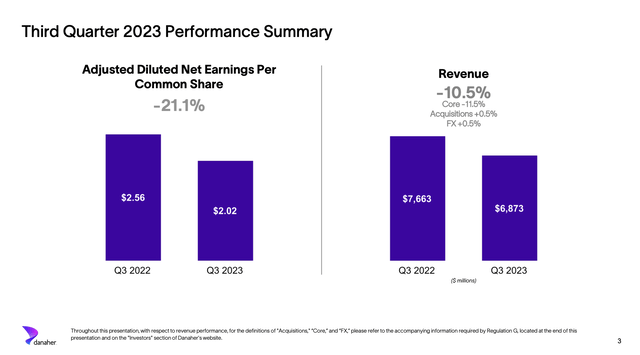

In the third quarter, Danaher reported sales of $6.9 billion, with a core revenue decline of 11.5%. Analyst expectations were $250 million lower.

Adjusted diluted net earnings per common share were $2.02, $0.14 higher than expected.

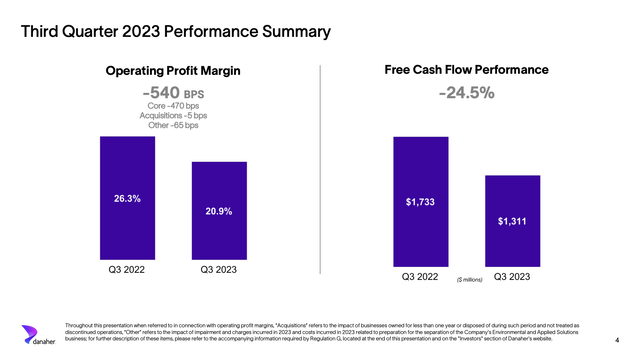

The gross profit margin was 58.2%, and the operating margin was 20.9%, which decreased primarily due to lower volume in the Biotechnology and Diagnostics segment and costs related to the separation of Veralto.

The separation is expected to create exceptional opportunities for both Danaher and Veralto to better serve their customers and create long-term shareholder value.

I agree with that and hope that Danaher will continue to focus on life sciences and related segments instead of adding diversified exposure in the future.

As part of this spin-off, Danaher rebranded its business, including a new logo.

Danaher – Via Creative Bloq

For what it’s worth, the new logo seems to be more focused on accelerating growth, a core strength of Danaher.

But the design is more calculated than might seem. Lippincott senior partner Dylan Stuart says the identity was built around the notion of an “acceleration curve” with “every component, from the logo and voice to illustration and motion, conveying dynamism and forward momentum.” – Creative Bloq.

With that in mind, let’s take a closer look at its quarterly performance.

The Impact Of Post-COVID Was Significant

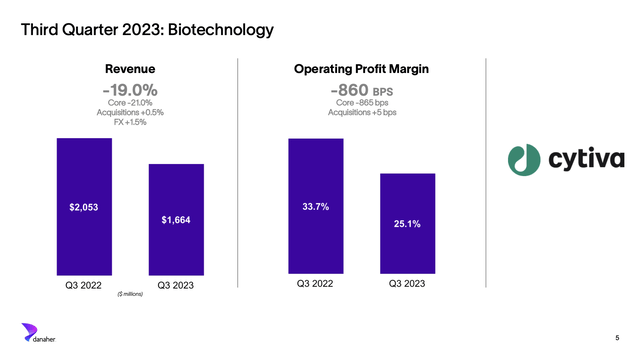

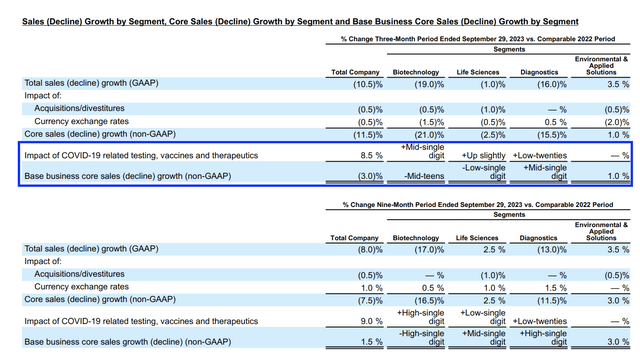

Reported revenue in the Biotechnology segment declined by 19%, with a core revenue drop of 21%. This was mainly due to a decline in bioprocessing core revenue, with base business core revenue down mid-teens.

The market conditions were consistent with expectations, with customers working through pandemic-related inventory and capital conservation.

China was notably down approximately 45% in the quarter.

Despite these challenges, there is confidence in the long-term growth outlook for the bioprocessing franchise, thanks to increasing demand for biologic medicines and FDA approvals.

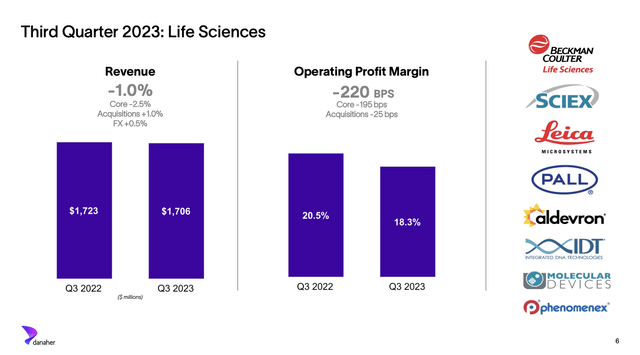

Reported revenue in the Life Sciences segment declined by 1%, with core revenue down 2.5%.

This decline was driven by China’s challenging funding environment and softness in pharma and biopharma customers, while life science research and applied markets remained stable.

The company is actively delivering innovative solutions, such as artificial intelligence-driven cell culture systems, and is planning strategic acquisitions like Abcam to enhance capabilities.

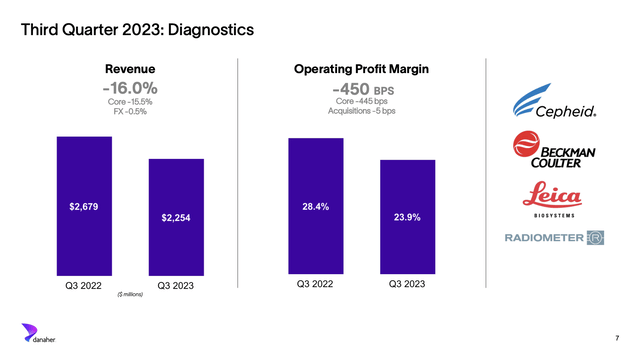

In the Diagnostic segment, reported revenue declined by 16%, with core revenue declining by 15.5%.

This decline was primarily due to lower COVID-related respiratory testing volumes at Cepheid.

However, clinical diagnostics businesses delivered mid-single-digit core revenue growth, with strong performance in instrumentation, clinical chemistry, and immunoassay products.

The company also reported over 20% core revenue growth in non-respiratory testing at Cepheid.

Even better, Danaher now expects approximately $1.6 billion of respiratory testing revenue for the full year, higher than the previous expectation of $1.2 billion. The increase is attributed to customer preference for Danaher’s testing systems and assays during the pandemic.

According to Danaher, Cepheid’s success in the testing market is attributed to the company’s strategic approach to placing systems, resulting in a significant increase in its installed base and revenue since 2019.

Danaher believes Cepheid is well-positioned to gain market share and expand its installed base in the current endemic environment.

The overview below shows the impact of COVID-19, which is essentially a summary of what we just discussed. Note the significant strength in Diagnostics.

Overall, the company saw a 3% decline in its core business, which isn’t too bad in this environment of elevated funding requirements.

This brings me to the outlook.

Outlook & Valuation

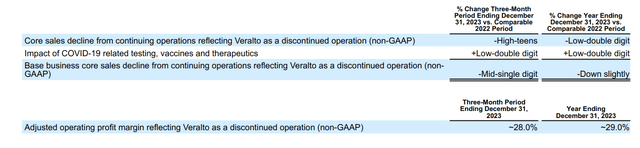

Looking ahead to the fourth quarter of 2023, Danaher anticipates several key points.

- Core revenue in the base business is expected to decline by a mid-single-digit percentage compared to the previous year.

- Total core revenue is expected to decrease significantly in the high teens percentage range.

- This decrease is primarily attributed to lower demand for COVID-19 testing, vaccines, and therapeutics.

- The company also expects an adjusted operating profit margin of approximately 28% for the fourth quarter. This margin includes additional productivity initiatives to adjust the cost structure further.

For the full year 2023, Danaher expects core revenues in the base business to decrease slightly.

Similarly, total core revenue for the year is projected to decline by a low double-digit percentage, again due to lower demand for COVID-19-related products and services.

The full-year adjusted operating profit margin is expected to be approximately 29%.

Going forward, the company expects to benefit from DBS-driven execution, a more focused approach after spinning off Veralto, and longer-term secular tailwinds.

[…] we’re pleased with our third quarter results and believe the combination of our team’s DBS-driven execution and differentiated portfolio enabled Danaher to outperform on a relative basis. With the successful spinoff of Veralto, we are now a more focused company committed to deploying leading-edge science and technology to improve human health. Danaher is purpose built to help customers solve some of the most important health challenges impacting patients around the world. Our proven ability to innovate is enabling faster, more accurate diagnoses and helping customers reduce the time and cost needed to sustainably develop and deliver life-changing therapies. – DHR 3Q23 Earnings Call.

Valuation-wise, we’re dealing with a company that trades at a blended P/E of 22.5x. The company’s long-term normalized P/E ratio is 19.7x, which means that DHR is trading at a “premium.”

Next year, analysts expect EPS to decline by 5%, followed by an 11% surge in 2025, which could mark the start of a new long-term uptrend – five years after the start of the pandemic.

DHR shares are currently down 19% as investors continue to price in an environment that could see higher rates and higher inflation on a prolonged basis, on top of the aforementioned post-COVID demand weakness.

The current consensus price target is $254, which is 34% above the current price.

Although it seems that DHR is currently trading close to its fair value, I agree that DHR should be trading between $250 and $290.

While 2024 may be another weak year, Danaher’s growth potential is stunning, and long-term secular tailwinds should pave the way for long-term double-digit annual earnings growth.

I’m currently down 20% on my DHR investment (excluding dividends).

Now, I’m looking to buy more, making it Danaher stock one of my biggest holdings.

Takeaway

Despite a recent setback, Danaher Corporation remains a strong player in the life sciences sector, offering promising long-term growth potential.

The company’s focus on biotechnology, life sciences, and diagnostics, coupled with its robust business model, has made it a wealth compounder over the past decade.

While the post-COVID unwinding has impacted its recent performance, Danaher’s strategic spinoff and commitment to innovation bode well for its future.

With its diverse product offerings and a well-established Danaher Business System, the company is poised to navigate challenges and seize opportunities in the healthcare industry.

Although short-term fluctuations have affected the Danaher Corporation stock price, patient investors may find potential in Danaher’s growth story, supported by long-term secular trends.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.