Summary:

- In this article, we discuss one of my favorite dividend growth stocks, which makes up for a low yield by being a consistent source of outperforming total returns.

- The company has a stellar high-moat M&A-driven business model with strong pricing power and often anti-cyclical customers.

- While I expect the stock to remain rangebound, I am a consistent buyer, as I believe that DHR shares will continue to beat the market.

PM Images

Introduction

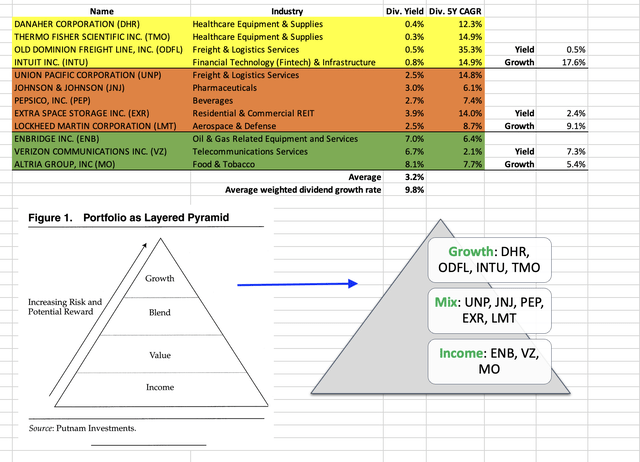

The other day, I wrote an article titled “The Dividend Pyramid: Potentially Beating The Market With This 12-Stock Portfolio”. The article aimed to provide investors with a theoretical analysis of two major diversification methods. One of them was the behavioral method, which I explained using the pyramid below. The behavioral method suggests that investors build a base of safe, income-generating investments while adding highly speculative investments at the top of the pyramid – to get rich quickly. However, when done correctly, investors can use safe, high-quality growth stocks to optimize the risk/reward of their portfolios. As we can see below, I included the Danaher Corporation (NYSE:DHR) in the growth category of the pyramid.

In this article, I will go into depth and explain why I am consistently adding to Danaher, which, despite its low yield, is one of my all-time favorite dividend growth stocks. It’s also one of the single best ways to beat the market with subdued volatility.

Low Dividend, High Total Return

Why buying Danaher makes sense for dividend growth investors, despite its low yield.

Danaher is a dividend growth stock. However, whenever I emphasize the dividend too much, some people tend to get very angry with me. I get that. After all, Danaher doesn’t pay a high yield.

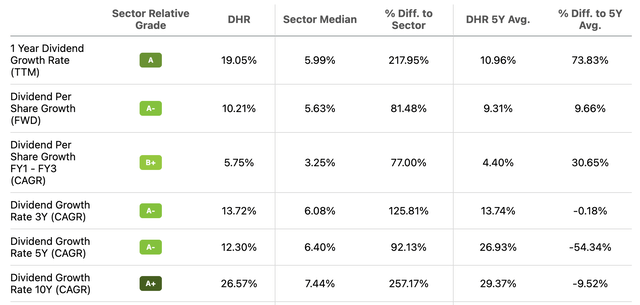

After hiking by 8.0% on February 22, 2023, the company now pays a $0.27 per share per quarter dividend. This implies a 0.4% dividend yield.

With regard to dividend growth, the company’s ten-year average annual compounding dividend growth rate is 26.7%. Over the past five years, that number has dropped to 12.3%.

Seeking Alpha – DHR Dividend Scorecard

Nonetheless, a $20,000 investment will end up paying just $80 in annual pre-tax dividends. So, yes, I get it when people are mildly frustrated when I call Danaher a dividend stock.

However, I will continue to call Danaher a dividend (growth) stock.

Why?

Because it is part of the reason why Danaher is a total return star. A company that has made people more money than almost all dividend stocks with “decent” yields.

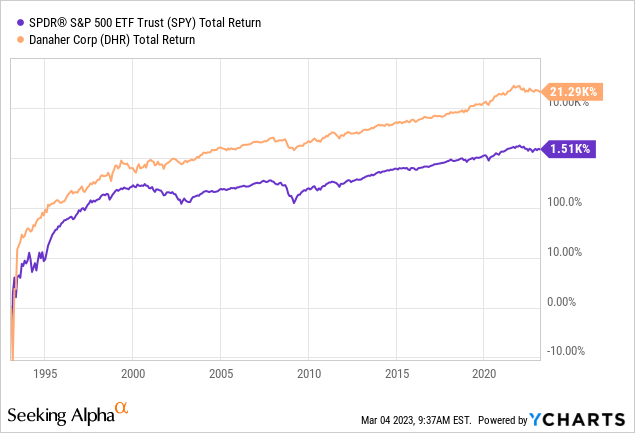

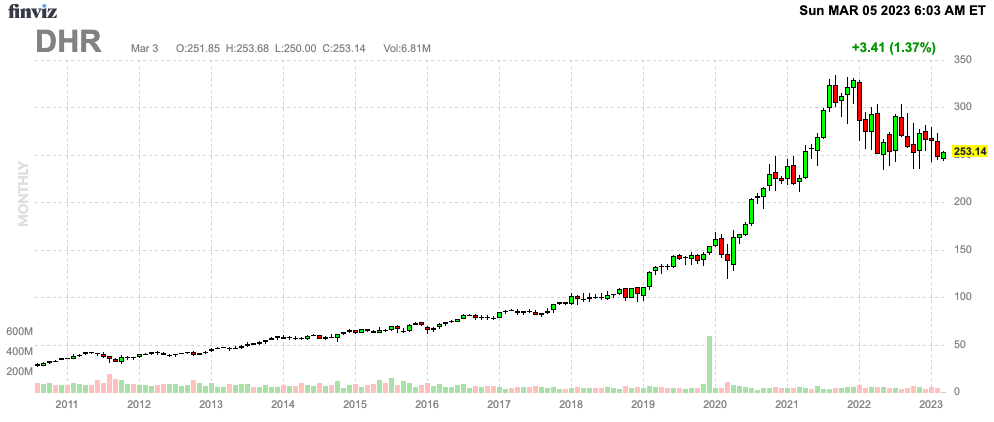

Going back to 1993, the S&P 500 has returned 1,510%, which is absolutely terrific. Danaher, however, has returned 21,290%, which is a mindblowing return.

At this point, one might think that this performance is mainly caused by a very good performance in the company’s early years.

That’s not correct.

The good news is that Danaher continued to be a terrific source of wealth. When looking at the numbers below (January 1988 – February 2023), we see that DHR has returned 20.3% per year. This performance has remained consistent. Over the past ten years, the stock has returned 20.3% per year. Over the past three and five years, the return has remained close to 20%.

Moreover, the company has done this with subdued volatility. Over the past five years, the annualized standard deviation was 23.8%. That’s slightly more than 500 basis points above the market’s standard deviation. That might sound lit a lot. However, that’s not the case. We’re comparing a single company to a well-diversified basket of 500 stocks.

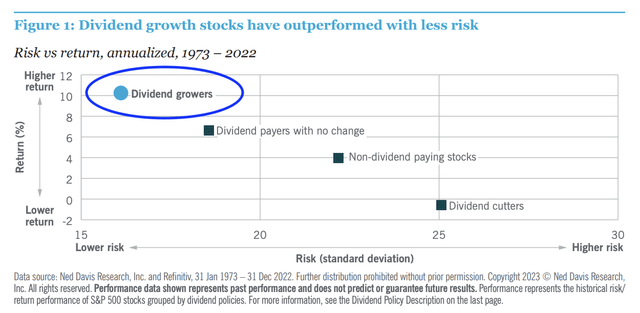

Investment company Nuveen wrote a paper that explains why stocks like Danaher are doing so well – I have used their findings in a number of articles.

As the chart above shows, dividend growth stocks tend to have lower risks and higher returns. In other words, they destroy the assumption that higher risks come with higher returns. On the stock market, that is not the case.

Here’s why (my summary of Nuveen’s findings):

- Dividend growth stocks are a type of stock that offer both earnings and cash flow growth potential, as well as sustainable dividend policies.

- These types of stocks have historically performed well during up markets and have provided a buffer during market downturns and volatile environments.

- Over the long term, companies that grow and initiate dividends have generated higher returns with less risk than companies that maintained their dividends, paid no dividends, or reduced/eliminated their dividends.

- While dividends are not guaranteed and may fluctuate, they have contributed significantly to equity total return over the decades. In fact, 41% of the annualized total return of the S&P 500 from 1930 to 2022 was derived from the payment and reinvestment of dividends, with capital appreciation contributing the rest.

- Market volatility can cause swings in the price return of a portfolio, but the performance of companies with healthy balance sheets and the financial strength necessary to support dividend growth can help mitigate volatility.

With that said, let’s dive further into Danaher.

What Makes Danaher So Powerful

From pricing power to free cash flow growth and balance sheet health.

I didn’t know what Danaher was until a person very close to me sold his business to a company owned by Danaher. That’s when I learned how efficient and goal-oriented its management creates value for its customers and shareholders.

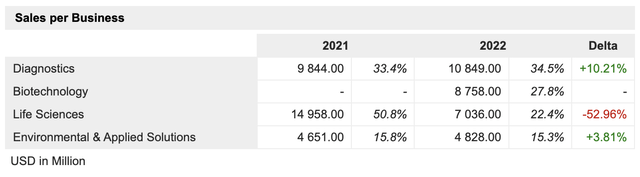

Founded in 1984, Danaher has grown into one of the world’s largest healthcare/industrial companies with a market cap of $184 billion. Based in Washington D.C., the company has four business segments: diagnostics, biotechnology, life sciences, and environmental & applied solutions.

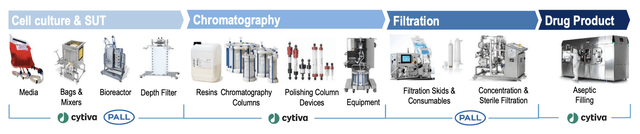

The biotechnology segment was established in 2022. It was formerly a part of life sciences. However, with the 2015 acquisition of Pall and the 2020 acquisition of Cytiva, the company thought it would make sense to start a new biotech-focused segment.

The biggest part of its business (everything except for environmental & applied sciences) is based on selling high-tech equipment and services to healthcare companies. This includes instruments to study DNA, vaccine equipment, gene editing hardware, and anything one can imagine.

At the end of this year, the company is likely to be entirely healthcare-focused as it is planning on spinning off its environmental & applied solutions segment. This company will be named Veralto and include some heavy hitters in the industry like Videojet, Esko, X-Rite Pantone, and Linx.

I am extremely excited to own this stock after the spin-off, as the company’s non-healthcare assets were a reason for me to buy DHR in the first place. However, we’ll cover this issue in depth as we get closer to the spin-off.

With that said, the company has a very international customer base. In 2022, only 43% of its sales were generated in the United States. This means that a weaker dollar is a tailwind for the company. A stronger dollar achieves the opposite. While companies like DHR hedge most of their planned foreign currency cash flows, it’s impossible to hedge revenues, as these cash flows are rather unpredictable.

Moreover, 16% of sales came from high-growth markets. This segment includes emerging markets (excluding China). China accounted for 13% of total revenues.

Danaher Corp.

Having said that, the company has several benefits that make it such a powerful company, some of which we already briefly discussed.

-

Strong brand reputation: Danaher has established itself as a reliable and trusted brand in the biotechnology, life sciences, diagnostics, environmental, and applied sectors.

-

Diversified product portfolio: Danaher has a wide range of products and services that are sold on a recurring basis, primarily through a direct sales model.

-

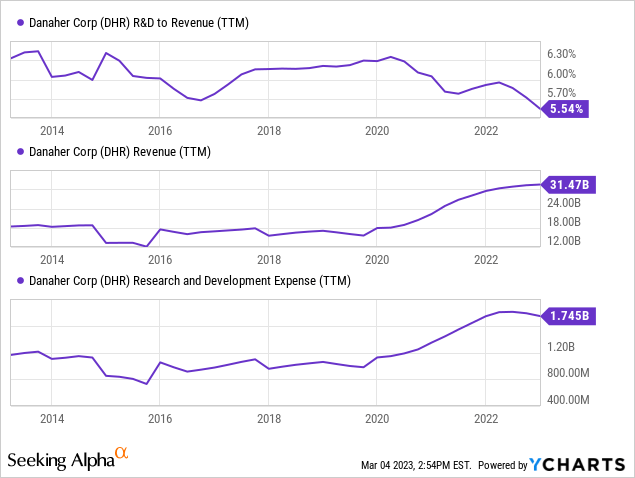

Emphasis on R&D: Danaher invests heavily in research and development to stay ahead of the competition and to develop new products and technologies. Please note that the only reason why the R&D/revenue ratio has hit a multi-year low is that revenue growth was so much stronger than R&D growth. There is no reason to believe that Danaher isn’t spending enough on R&D. Over the past twelve months, DHR spent more than $1.7 billion on R&D.

-

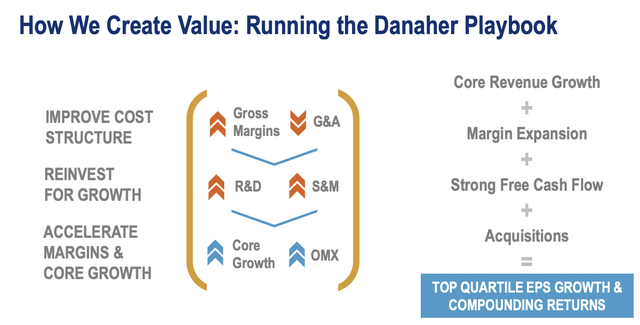

Lean manufacturing and operational efficiency: Danaher uses the Danaher Business System (“DBS”) to drive operational excellence and efficiency across all its businesses. This system emphasizes continuous improvement, waste reduction, and standardization to reduce costs and improve quality.

-

Pricing power: Danaher’s strong brand reputation, diversified product portfolio, and focus on customer needs have given the company pricing power. This means that the company can charge a premium for its products and services, as customers are willing to pay for the high quality and reliability that Danaher provides.

-

Customer health: It also needs to be said that healthcare customers are often anti-cyclical and benefit from strong secular growth like an aging population. While it’s hard to quantify, I believe that having strong customers is a huge benefit. It also adds to the aforementioned pricing power benefits.

The result is consistent and strong growth in revenue, EBITDA, and free cash flow.

These are the compounding annual growth rates between 2013 and 2015E:

- Revenue: +5.1%

- EBITDA: +9.2% (outperforming revenue growth thanks to an EBITDA margin surge from 22% to 35%)

- Free cash flow: +9.8%

With that said, while free cash flow growth has benefited dividend growth, the payout ratio is just 10%. The company has also been a net buyer of its own shares.

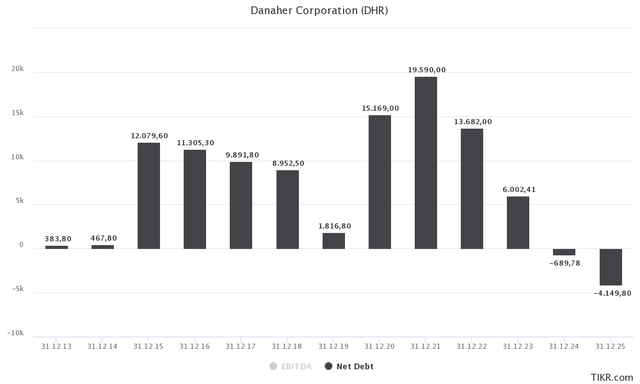

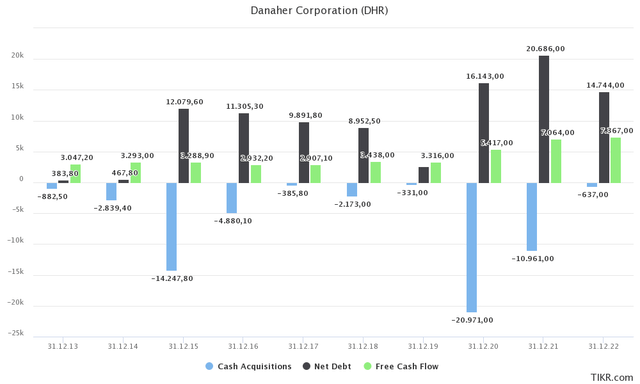

Danaher does things a bit differently. The company is a huge M&A player. It buys companies that either complement or expand its own portfolio. In the past ten years, the company had three deals worth more than $10 billion in cash. In 2020, the company bought General Electric’s Life Sciences division for $21.4 billion. These deals cause net debt to spike. However, synergies and the added value quickly cause free cash flow to rise, allowing the company to repay debt again.

Hence, if we exclude future acquisitions, net debt is expected to fall into negative territory in 2024. The company has an A3 credit rating.

Currently, the company is pursuing the acquisition of Catalent (CTLT) with an enterprise value close to $20 billion.

All of this is backed by the company’s aforementioned strengths.

Moreover, this model comes with rather frequent spin-offs.

-

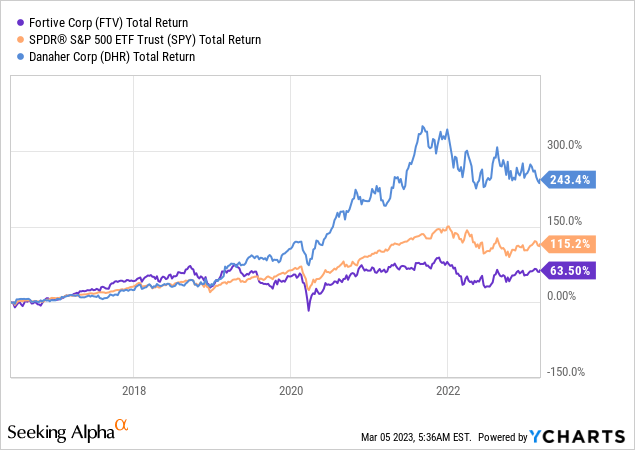

Fortive Corporation (FTV): In 2016, Danaher spun off its industrial technology businesses. This included businesses in the areas of testing and measurement, transportation, and sensing. Since its spin-off, FTV has underperformed both the market and Danaher.

-

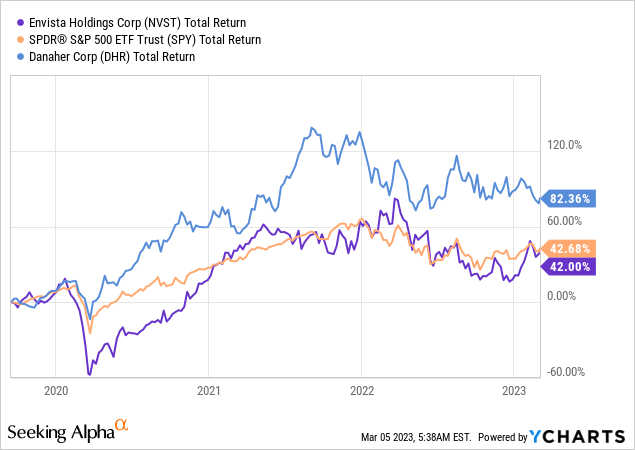

Envista Holdings Corporation (NVST): In 2019, Danaher spun off its dental business. This business included dental equipment and consumables, as well as imaging software and services. Since its spin-off, NVST has underperformed Danaher.

So, what about the valuation?

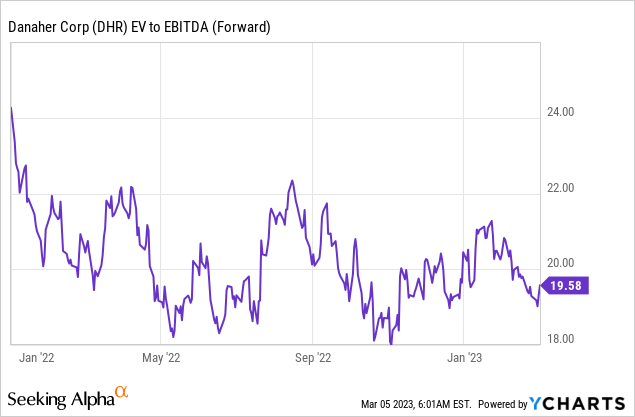

Valuation

Danaher has an implied 2024 enterprise value of $185.9 billion, based on its $184.4 billion market cap, $700 million in net cash (negative net debt), roughly $500 million in pension liabilities, and $1.7 billion in preferred convertible stock. That’s 16.7x 2024E EBITDA of $11.1 billion (excluding any future acquisitions).

The implied 2024 free cash flow yield is 4.6%.

The current average price target for DHR is $300, implying 19% upside.

Last week, I added to my position using dividends from other investments.

FINVIZ

I will likely buy aggressively once I believe that the market is bottoming. Given my view on the economy, I expect that to be close to 3,500 points.

Takeaway

In this article, we have explored Danaher, a dividend growth stock that captured my attention some years ago. Danaher has a robust business model that boasts competitive advantages leading to superior growth throughout business cycles. Its strategic focus on biotechnology, life sciences, diagnostics, environmental, and applied solutions sectors under the Danaher Business System (“DBS”) has allowed the company to maintain leadership positions in these areas.

Although Danaher’s dividend yield may be comparatively low, its consistent and high dividend growth coupled with strong total returns makes it a compelling investment choice. I anticipate that DHR shares will remain range-bound until the market reaches its bottom, but I am confident that they will outperform once a new sustainable bull market emerges.

While I prefer to maintain a balanced yield in my portfolio, I am bullish on Danaher’s prospects and continue to aggressively buy DHR shares. Overall, Danaher’s robust business model and competitive advantages position the company as a compelling choice for investors seeking growth-oriented dividend stocks.

Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice