Summary:

- Data sovereignty concerns and potential platform restructuring costs of around $6 billion could impact Meta Platforms’ profitability and valuation, making its current valuation of 25 times forward earnings unjustifiable.

- If Meta is unable to find a solution to satisfy regulators, its profitability could descend to the same level as telcos, impacting its business model and reducing its agility.

- Barriers erected on a geographical basis could reduce Meta’s ability to capitalize on data to generate more sales, also pressuring its 6.5 times sales multiple.

- To substantiate my views, a comparison with TikTok which is under the scrutiny of U.S. authorities makes sense.

- Given Meta’s financial clout and cost reduction measures, it is also important to adopt some moderation.

Derick Hudson

I have authored several publications on ChatGPT’s Generative artificial intelligence to highlight opportunities, while also cautioning about the hype. More recently, I wrote about data privacy in the context of AI governance. Well, I am against big tech, as I surely appreciate the prospects offered by intelligent chatbots to improve labor productivity, but, it is important to be aware of the risk, namely, those posed by data sovereignty as more nations want to keep data about their citizens within their own jurisdictions.

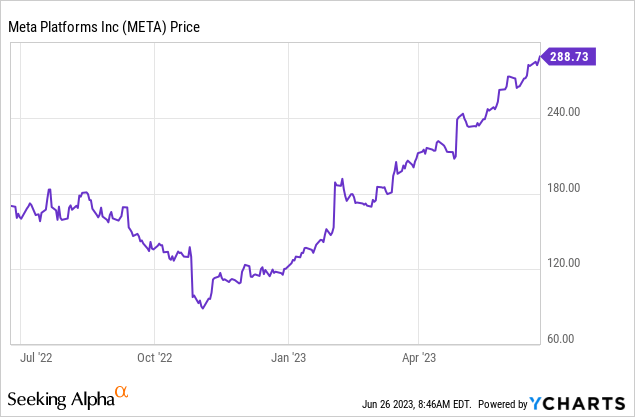

In this respect, Meta Platforms (NASDAQ:META) has seen its value rise by more than 125% since January as pictured below and even the record $1.9 billion fine imposed for violating data sovereignty in May failed to stir any concern among investors. Thus, my objective is to show how corporate profitability and valuations can be impacted.

For this purpose, I will draw from experience with how the U.S. authorities are handling TikTok as well as scan the company’s latest earnings transcript where the management has already raised concerns about the way data is handled may impact business operations.

First, I differentiate between data privacy and sovereignty as well as highlight some of the fines imposed on Meta, in order to make the investment community realize that things have become serious.

From Privacy to Sovereignty

Starting with data privacy, it is about protecting certain information pertaining to users like contact details so that they are not leaked away from social networking companies’ platforms and made available to the public. Such a breach was committed back in November 2022 when Meta was fined $275 million by the Irish DPC (Data Protection Commission) subsequent to the data about 500 million users being published online by a hacking website.

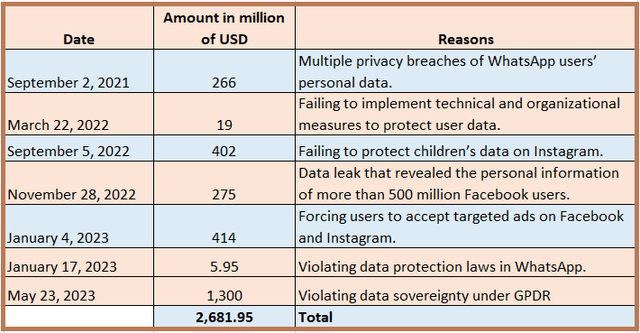

Well, this is not much as it constituted only 0.0002% of FY’22 total revenues, but, two months earlier, the company was fined $402 million for allowing teenagers to display their contact details (phone numbers and emails) online. If you add all the fines imposed just by the DPC, you quickly reach the $2.68 billion figure as illustrated below.

Fines imposed by DPC, Table Built Using Data from (qz.com)

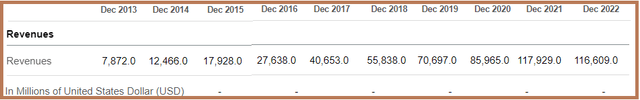

There were earlier violations that led to other fines, but investors failed to react probably because they pale when compared to the company’s annual revenues amounting to billions of dollars. Also, these fines do not automatically translate into outflows of money from Meta’s income statement as the company is used to making appeals signifying that it can take years for a final decision to be made as to the amount to be disbursed.

Annual Revenues (www.seekingalpha.com)

However, to be more specific, in addition to touching upon the domains of privacy due to the transfer of data about EU citizens in the U.S., the latest fine of $1.3 billion (fines table) also has a data sovereignty dimension to it. Well, you would think that since most Western European countries are U.S. allies, there would be no such scrutiny, but the reality is different.

Looking at the past, there was a previous EU-U.S. legal framework to process data, for example for a German citizen in America, but this was invalidated in 2020. Furthermore, with the advent of GPDR (General Data Protection Regulation) “the toughest privacy and security law in the world”, things have become more complicated. Now complications often rise with additional costs, in turn adversely impacting profitability.

Potential Profit Impact, Learning from TikTok

Looking at the operational aspect, it is not easy to segregate such large quantities of users’ data on a geographical basis. To this end, Meta’s community which includes Facebook, WhatsApp, and Instagram now boasts more than 3 billion people worldwide with about 4 petabytes of data generated daily. Furthermore, people constantly move from one country to another which means that the associated data (for the same person) has to be stored in several locations, implying additional complications. Thus, as I further elaborate below, the economics may become unjustifiable if each country wants to have its own storage facility protected by a network firewall.

Noteworthily, in probable anticipation of IDPC’s $1.3 billion fine, Susan Li, Meta’s CFO talking during the FQ1-’23 earnings call on April 26 said that “We will also evaluate whether and to what extent the IDPC decision could otherwise impact our data processing operations even after a new data privacy framework is in force.”

Now, by the new data privacy framework, she means a bridge being worked out for the transfer of data between the U.S. and the EU under certain conditions like transparency, but, according to the latest update on May 11, members of the European Parliament voted against it. Tellingly, one of the arguments for rejecting the framework was U.S. foreign intelligence agencies collecting data in bulk.

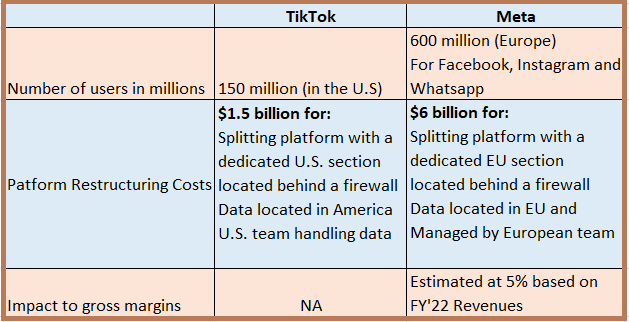

Here, a parallel can be drawn with TikTok owned by the Chinese group ByteDance but used by around 150 million Americans. As such, it is regularly criticized by American elected officials on the basis that its data is used by Chinese authorities to spy on and manipulate users and, in May, Montana became the first U.S. state to ban the app starting January 1, 2024.

To avoid such an extreme step, U.S. authorities had previously encouraged the video-sharing app company to withdraw from ByteDance, with more recent discussions centered around a $1.5 billion restructuring exercise involving TikTok’s data being handled by an American team and partnering with Oracle (ORCL) for hosting the platform on the database giant’s OCI cloud.

Now, think of Meta being impacted in the same way in order to ensure that European data are not processed by American servers.

The cost of revenues may go up in case the company has to host different platforms each with its own management teams in Europe or other big countries like India where the Information Technology Rules, have been targeting social media companies since February 2021 over privacy fears and accountability for fake news.

To come up with concrete figures as to an eventual profit impact, I consider that for Europe, there were around 255 million and 250 million Facebook and Instagram users as of February 17, plus around 116 million using WhatsApp in Germany, Italy, and Spain alone. These numbers total more than 600 million (255 + 250 + 116) users and, based on TikTok’s 150 million requiring a restructuring cost of $1.5 billion, one can envisage about $6 billion (1.5 x 4) for Meta. This is in case it has to segregate its platform for European operations and, this figure represents about 5% of FY’2022 revenues as illustrated below.

Potential Restructuring Costs in case part of the platform has to be dedicated to Europe (www.seekingalpha.com)

Too Highly Valued in View of Risks

Add to these fines amassed in the U.S., notably the 2019 record of $5 billion for the Cambridge Analytica data breach and others in the U.K, and you easily see how gross margins, which, by the way, are revenues minus cost of sales, are likely to be impacted if Meta is not able to find a solution which satisfies regulators.

Now, the company has indeed issued a communique after the DPC fine, saying that it “will appeal the ruling, including the unjustified and unnecessary fine, and seek a stay of the orders through the courts”. However, this seems a rather “soft” response in view of the rather “hard” European Parliament instance as I touched upon earlier. In this case, one would expect Meta to provide insights as to how it would adjust its operations and provide services if its very ability to transfer data between the EU and the US in an as-usual mode is interrupted.

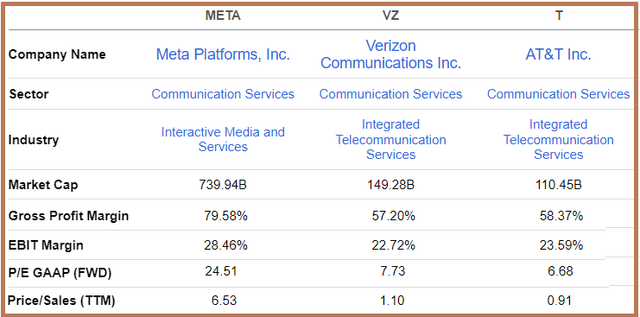

Thus, unless Meta is able to come up with an appropriate formula, I see its profitability as forming part of the Communications Services sector descending to the same level as telcos as tabled below. Consequently, its higher valuation of 24.5x to forward earnings, which is more than three times telco peers, is not justifiable in my opinion.

Comparing META, VZ, and T (seekingalpha.com)

To further justify my pessimism, it is precisely its platform approach as an interactive and media services play that makes it possible to add new features rapidly on a global basis while using fewer manhours for operational tasks which accounts for Meta’s higher margins. Now, rolling back on this platform approach would amount to a more telco-like less integrated IT infrastructure entailing relatively higher expenses.

Going a step further, without the ability to transfer data seamlessly across borders, Meta’s platform risks being divided into regional silos, impacting its very business model as it leaves users in one location unable to access many of the shared features they have been accustomed to. Also, operating behind a firewall as is the case for segregated network architectures reduces agility.

Moderating Slightly and the Generative AI Paradigm

In conclusion, by quantizing the probable margin headwinds, this thesis has shown that Meta risks seeing its value dwindle by as much as a third in case it is subject to the same EU measures that TikTok may face in the U.S., and has to restructure its European operations.

However, moderating slightly, the company now employs only 77K people, after reducing its workforce by 11% which is something unprecedented with the full effect of the cost reduction still to impact its margins. Also, this is a company with $37.4 billion of cash in the balance sheet, meaning financial strength. Also, unlike TikTok, Meta may be given more time since the U.S. and Europe remain allies. Therefore, it would be better to obtain an update as to the company’s data processing strategy when the company’s second-quarter results are released next month, for investment purposes.

Finally, coming back to Generative AI, for all its nimbleness in helping Facebook to promote engagement, it also involves a lot of data crunching which requires parallelized processors supplied by Nvidia (NVDA). As such, its algorithms feed on vast amounts of information pertaining to browsing habits, and, consequently, more barriers being erected on a geographical basis can only reduce Meta’s ability to capitalize on data to generate more revenues. This can in turn pressure it’s 6.5 times sales multiple in case it has to break up its platform.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.