Summary:

- Elon Musk’s impressive innovations include SpaceX, valued at $210 billion, dominating commercial spaceflight and benefiting Starlink with over 3 million subscribers.

- Rocket Lab, a competitor to SpaceX, has seen a 71% revenue increase in 2Q24, with a strong backlog and strategic R&D investments for future growth.

- While Rocket Lab is not yet profitable, its success with the Electron rocket and upcoming Neutron project positions it well against competitors like SpaceX, showing significant potential for the future.

imaginima/E+ via Getty Images

Introduction

Tesla (TSLA), SpaceX, Hyperloop, Phone calls on the web, SolarCity, X.com/PayPal (PYPL), Zip2 – Digital city guides, Blastar game, Electric jet, Location-specific searches, Starlink, Tunneling machines, Tesla storage centers, Neuralink, X, X.ai.

This is a list of Elon Musk’s inventions/businesses as of this year, according to Pressfarm. Although some of these have turned into bigger successes than others, the Tesla founder has been the driver of a few very impressive innovations, including SpaceX.

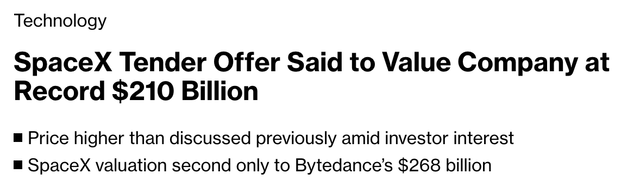

According to a recent Bloomberg article, SpaceX is now valued at roughly $210 billion. As the company will likely become part of the Aerospace & Defense industry, it would be roughly $30 billion bigger than GE Aerospace (GE), the current leader with a $180 billion market cap!

According to SpaceExplored, this is due to a number of reasons. I added emphasis to the quote below:

SpaceX has a de facto monopoly on commercial spaceflight with both India’s ISRO even stating they have rockets in storage but no customers, because of SpaceX’s lower prices. Even after a long belief that smaller dedicated rockets could succeed, in today’s market, if you aren’t competing with SpaceX, you aren’t succeeding.

And because of that dominate launch performance, Starlink benefited with now over 6,000 satellites in orbit, the service’s latency and reliability has greatly improved. The last update by SpaceX states that Starlink has over 3,000,000 subscribers worldwide and that is growing everyday.

It also needs to be said that Mr. Musk has figured out how to streamline the complex aerospace supply chain, building many products in-house to de-risk its supplier base.

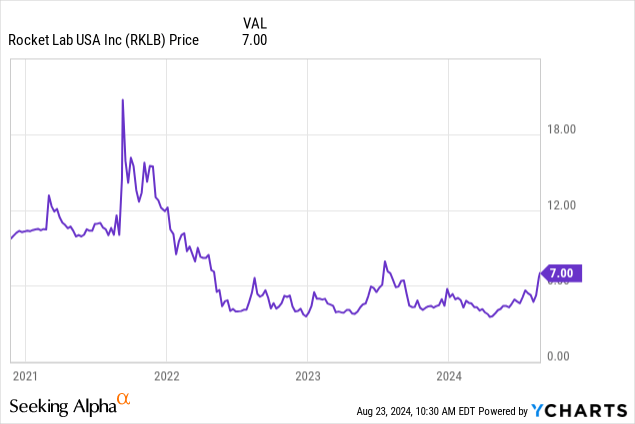

I’m bringing all of this up because any company that can take market share away from SpaceX will likely be in a very good spot. One of these companies is Rocket Lab USA (NASDAQ:RKLB), a company I started covering on June 19, 2024. Since then, shares have soared almost 40%, beating the 2% return of the S&P 500 by a wide margin.

After going public in an “overhyped” market in 2021, the stock price seems to be working its way to a new multi-year high, supported by very encouraging developments.

Although I usually prefer to cover long-term dividend investments, I believe RKLB is a fascinating disruptor.

Hence, in this article, we’ll take a detour from covering dividend investments as I’ll update my thesis using new developments and earnings.

So, as we have a lot to discuss, let’s get to it!

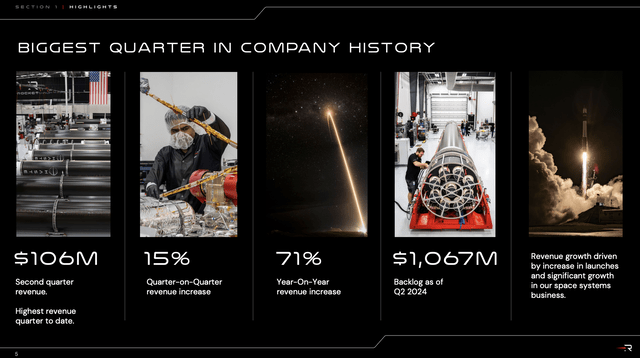

Biggest Quarter In Company History

I’m aware that this is a very strong sub-header. However, I did not come up with it. I used the company’s own words, as we can see in the presentation slide below.

That said, before we dive into its numbers, I want to highlight a few important things.

During its earnings call earlier this month, the company explained it is not just a launch provider. It has grown into a space system company with a wide range of services, including spacecraft manufacturing.

Because of these operations, the company controls a big part of the supply chain – similar to SpaceX. This also allows the company to lower supply risks, something that has become much more important since the pandemic.

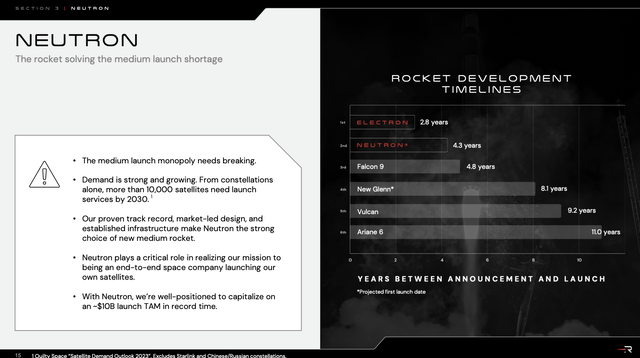

Moreover, with rockets like the Neutron rocket, the company aims to break the medium launch monopoly. This market is dominated by SpaceX, with new competition from Northrop Grumman (NOC), which is one of my defense investments.

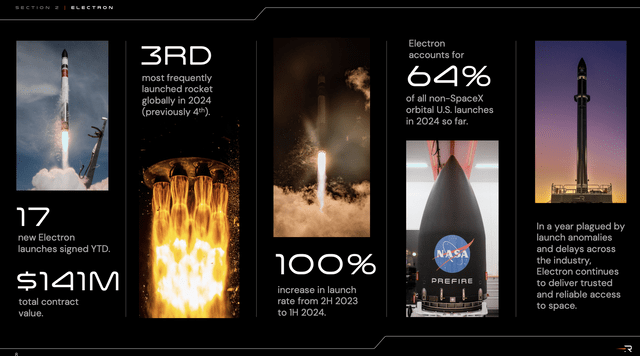

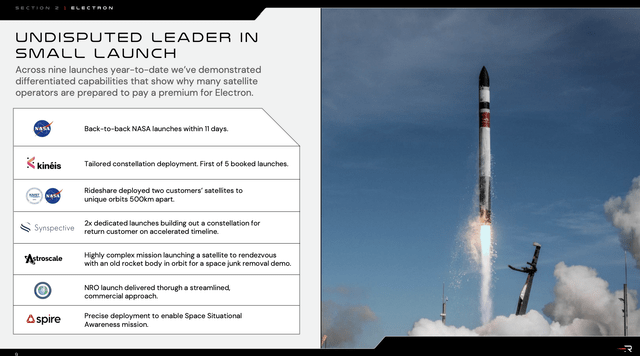

If history is any indication, the company should become a feared competitor, as it has turned its smaller Electron rocket (which is much smaller than the Neutron rocket) into the third most-used rocket in the world.

- The Electron accounts for 64% of all non-SpaceX orbital launches in the United States.

- It has increased launch rates by 100% since the second half of 2023.

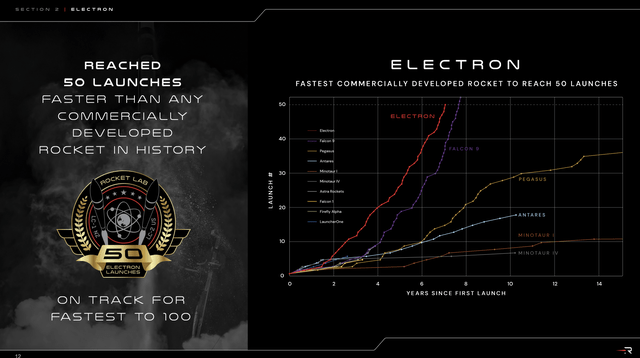

According to Rocket Lab, the Electron Rocket is the first commercially developed rocket that has reached 50 launches, beating even SpaceX’s Falcon 9.

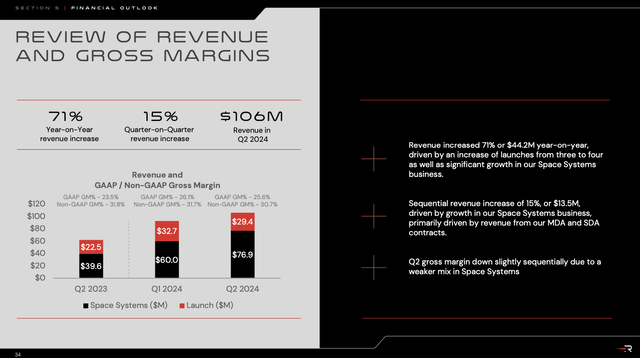

This also helped the company to generate $106 million in 2Q24 revenue, making this its best quarter ever. Year-over-year revenue growth was up 71%. Even on a sequential basis, revenue was up 15%.

As we can see in the overview above, these numbers were supported by 17 new Electron launch contracts on a year-to-date basis. These contracts have a value of $141 million.

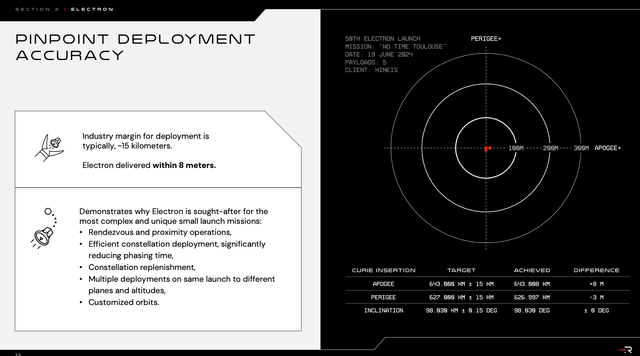

Moreover, the Electron rocket continues to see operating improvements, including its ability to launch within eight weeks from contract signing, with extreme payload placement precision – within eight meters of its target. After all, flying to space is just a part of the mission.

Getting payload to target is where it gets really tricky! “Ride-share” services simply cannot compete with Rocket Lab.

With that in mind, the Neutron project is progressing nicely, as the company has moved from the design to the production phase. The company expects to launch the first Neutron in mid-2025, which will be the first major step to disrupt what is estimated to be a $10 billion addressable market.

Although competition is fierce (it’s competing with SpaceX and Northrop – among others), the company notes by 2030, 10,000 satellite launches will need transportation.

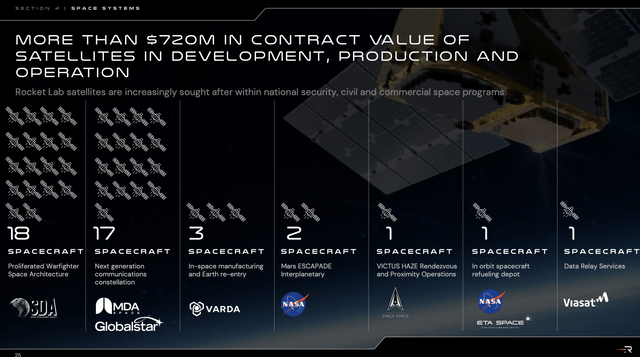

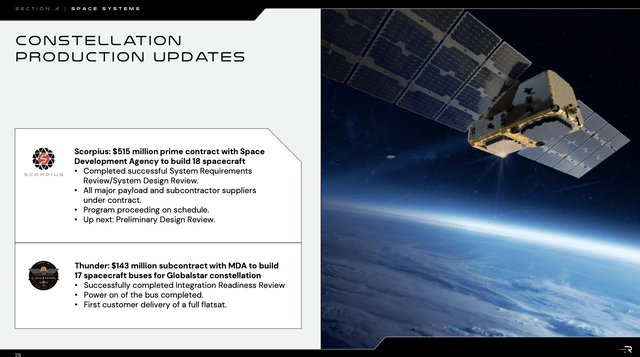

Beyond this, the company has a major footprint in the space systems market, with more than $720 million worth of spacecraft on contract and in development. This includes major contracts with NASA, the Department of Defense, and commercial customers.

In this case, the company sees another benefit from in-house development, as a lower-risk supply chain improves cost and quality control, which helps the company build better relationships with customers like NASA and the Department of Defense.

Now on to Constellation spacecraft and development at the moment. Recently, we completed a successful systems requirements review for our $500 million prime contract with the FDA to design and build 18 tranche 2 transport beta satellites. From here, we’ll move into a preliminary design review before hardware starts to take shape and clean rooms. This past craft are scheduled to launch in 2027. – RKLB 2Q24 Earnings Call

So, what does all of this mean for shareholders?

Shareholder Value

As I briefly mentioned, in 2Q24, revenue increased by 71%. Unsurprisingly, after everything we discussed, this was supported by strong growth in both launch and space system operations.

What’s even more important is the backlog. The company ended the second quarter with more than $1 billion in backlog, a 5% sequential increase. To put things in perspective, 44% of this backlog can be turned into sales within 12 months.

Moreover, in order to be better prepared for long-term growth, the company is significantly increasing its R&D spending. This includes a 48% increase in R&D headcount.

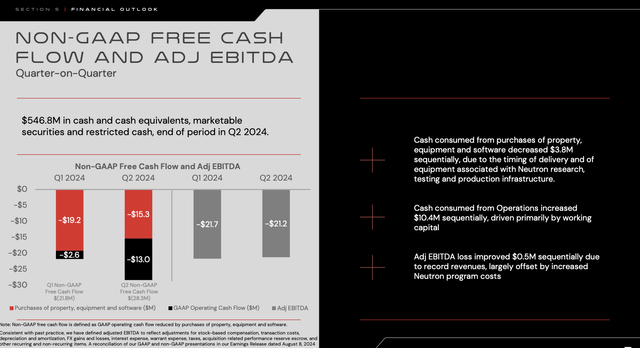

This also means that free cash flow and adjusted EBITDA are still negative, which is very normal for a company in the early stages of competing for a large addressable market. It also helps that the company has close to $550 million in cash and equivalents.

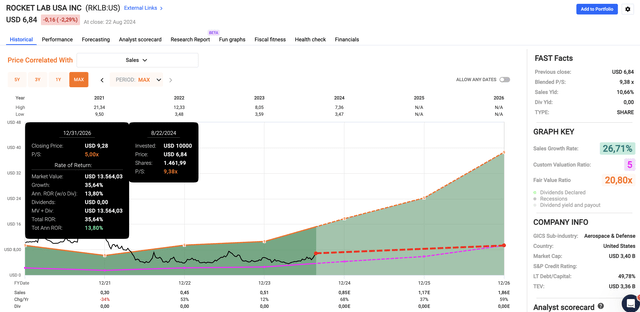

Valuation-wise, we’re dealing with a company that is expected to be profitable in 2026. By then, analysts believe it can generate $0.07 in EPS.

For now, however, that number is meaningless. When I wrote my prior article, the company was expected to generate $0.14 in 2026 EPS. While that number dropped by 50%, its stock price soared by almost 50%.

For now, what matters is sales.

This year, per-share revenue is expected to increase by 68%, potentially followed by 37% and 59% growth in 2025 and 2026, respectively.

If we apply a 5x multiple, we get a fair stock price of roughly $9.30, 37% above the current price. It’s also unchanged compared to the target I gave in my prior article.

As such, I remain bullish on the company and will continue to follow this fascinating growth story.

The only reason why I do not own RKTL is my focus on larger, dividend-paying, defense companies. These have close to 20% exposure in my portfolio. RKLB is the only company on my radar I value on a price/sales basis.

Takeaway

Rocket Lab is quickly proving itself as a serious contender in the space industry, showing strong growth with a 71% year-over-year revenue increase in 2Q24.

The company’s increasingly important role in space systems, combined with its successful Electron rocket and upcoming Neutron program, put it in a great position against competitors like SpaceX.

While RKLB isn’t yet profitable and is a very small player compared to its larger peers, its current success, backlog, and strategic R&D investments suggest significant future potential.

Pros & Cons

Pros:

- Strong Revenue Growth: With a 71% year-over-year revenue increase in 2Q24, Rocket Lab continues to prove its growth potential.

- Market Share Growth: The Electron rocket’s success and the upcoming Neutron project position RKLB to challenge major players like SpaceX.

- Strategic R&D Investments: The company is heavily investing in R&D, which should fuel future growth and innovation.

- Robust Backlog: Over $1 billion in backlog and strong demand put the company in a great spot to accelerate revenue.

Cons (unchanged compared to my prior article):

- Financial Challenges: Rocket Lab continues to operate at a loss and relies heavily on external funding. Meanwhile, high stock-based compensation causes shareholder dilution.

- High Volatility: As a young company in an emerging industry, RKLB’s stock price is subject to significant volatility.

- Uncertain Valuation: Valuing RKLB is complex due to its non-profitability and volatile revenue growth.

- Competitive Industry: The space sector is increasingly competitive. Consistent innovation to stay ahead is key.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NOC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.