Summary:

- Acadia Pharmaceuticals shows fiscal resilience with a shift to net positive income, buoyed by Daybue’s strong Q2 debut and increased Nuplazid sales.

- Daybue targets a high-need area in Rett syndrome, showing rapid market penetration and potential for substantial long-term revenue streams.

- Investment Recommendation: Shift stance to “Buy” as Daybue’s market promise and Acadia’s prudent capital allocation suggest a high-impact, sustainable investment opportunity.

K_E_N/iStock via Getty Images

At a Glance

Building on my prior analysis where I shifted from a “Sell” to a “Hold” on ACADIA Pharmaceuticals (NASDAQ:ACAD), the company continues to intrigue. Noteworthy is the robust $23.2M Q2 debut of Daybue in treating Rett syndrome—a market long starved for innovation. Coupled with an increase in Nuplazid sales and a drop in R&D costs, the firm’s pivot to a net positive income suggests prudent capital allocation. While the liquidity picture is strong, it is mitigated by a $246.9M liability load and heightened SG&A costs, mainly due to Daybue’s market entry. The noteworthy short interest of 9.22% warrants caution, even as Baker Bros’ investment provides a stabilizing counterbalance. As Daybue carves its niche and payer adoption rates soar, I am revising my stance to a “Buy.”

Earnings Report

To begin my analysis, looking at ACADIA’s most recent earnings report, there are several key indicators that demand attention. Net product sales of Nuplazid have shown a year-over-year increase of $7.4M for the quarter, driven by new patient starts and a higher average selling price. Importantly, Daybue, newly launched, contributed $23.2M in its first quarter, underscoring a successful market entry. On the flip side, R&D expenses have significantly dropped to $58.8M from $75.6M YoY, likely due to the completion of pre-approval manufacturing for Daybue. Selling, general, and administrative expenses surged to $96M, up $6.1M YoY, primarily attributed to Daybue’s commercialization costs. Net income turned positive to $1.1M compared to a net loss of $34M YoY. This transition from a net loss to net income, despite higher SG&A costs, implies efficient capital allocation and sets a more optimistic tone for future profitability.

Financial Health & Liquidity

Turning to ACADIA Pharmaceuticals’ balance sheet, the sum of ‘Cash and cash equivalents’, ‘Investment securities, available-for-sale’, totals $375.4M ($107.9M and $267.4M respectively). Over the last six months, the “Net cash used in operating activities” amounts to $9.7M, translating to a monthly cash burn rate of approximately $1.6M. Therefore, the estimated monthly cash runway for ACADIA Pharmaceuticals would be around 234 months, or approximately 19.5 years. However, caution should be exercised, as these values and estimates are based on past data and may not hold true for future performance.

The liquidity position of ACADIA Pharmaceuticals appears robust, considering its total liquid assets. However, ACADIA also bears a liability load of $246.9M, largely concentrated in accrued liabilities of $169.1M. While the company doesn’t have any disclosed debt, its strong liquidity could make it an attractive candidate for additional financing, either through debt or further equity issuance, if needed for its business activities. These are my personal observations, and other analysts might interpret the data differently.

Capital, Growth, Momentum, & Ownership

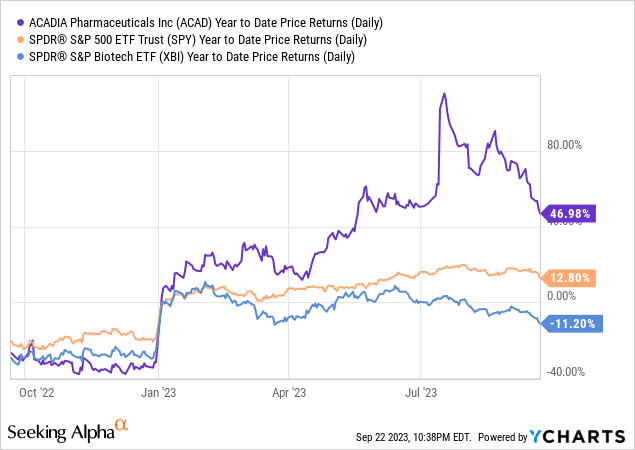

According to Seeking Alpha data, ACADIA Pharmaceuticals presents a compelling profile for investors on multiple fronts. The company’s liquidity position vis-à-vis its market cap of $3.83B mitigates concerns about its operational cash burn, while limited debt enhances leverage advantages. The projected sales figures suggest robust YoY growth, aligning with broader positive trends in earnings revisions and profitability. ACADIA’s stock outperforms SPY over most time frames, indicating strong stock momentum.

Institutional ownership sits at approximately 66%, with hedge fund managers accounting for an additional 32%, bringing sophisticated investor scrutiny and potential stability. Insider selling has been more prevalent lately, a concern, but balanced by sizeable purchases from Baker Bros. in May around $25/share. Short interest of 9.22% is noteworthy; it could lead to potential volatility but also offers a setup for a short squeeze scenario.

Daybue’s Daybreak: ACADIA’s Early Triumph in Rett Syndrome

Rett syndrome is a rare, severe neurological disorder primarily affecting females, characterized by developmental regression, loss of purposeful hand skills, and the onset of repetitive hand movements. The disorder has significant unmet medical needs, both in symptom management and in disease-modifying therapies. Current treatment options largely focus on symptom relief through antipsychotics, antiepileptic drugs, and various non-pharmacological interventions, which underscores the innovative nature of Daybue as a targeted therapy.

ACADIA’s management, in their recent earnings call, emphasized Daybue’s rapid market penetration in just 15 weeks post-launch. They reported that over 400 healthcare providers have written prescriptions and pointed out a solid 70% conversion rate from prescriptions to paid therapy in Q2 alone. Coupled with the compelling testimonials from caregivers, these metrics suggest Daybue is carving out a substantial niche in a high-need therapeutic area.

Based on ACADIA’s population estimates, the total addressable patient population for Daybue is between 11,000 and 17,000 when factoring in prevalence in Europe, the UK, and Japan. At a conservative 30% market penetration and an annual net realized cost of $375,000 per patient, Daybue’s peak annual revenue is estimated to fall between $1.238 billion and $1.913 billion.

In addition to patient numbers and costs, the company noted quicker-than-anticipated formal policy adoptions by payers, already covering one-third of the Rett syndrome patient population. This metric, in conjunction with ACADIA’s comprehensive One ACADIA support strategy, suggests a favorable environment for sustained market penetration and revenue growth. Therefore, Daybue’s early performance and the existing market dynamics indicate a promising, albeit conservative, peak revenue outlook in a therapeutic area that has been long underserved.

My Analysis & Recommendation

In wrapping up, Daybue’s market introduction sends an unequivocal signal—this drug has the makings of a blockbuster in the treatment of Rett syndrome, a condition screaming for effective therapies. This is not just a win for ACADIA’s revenue; it’s a milestone in clinical care.

Investors should concentrate on three critical metrics in the forthcoming quarters:

-

Conversion Rate from Prescription to Paid Therapy: The initial 70% is promising but warrants ongoing attention to assess whether this rate will hold or improve as the market gains greater exposure to the drug.

-

Payer Policy Adoption: The swift embrace by one-third of payers is extraordinary. Any uptick in this number could be a catalyst for accelerated revenue growth.

-

International Reach: Given the patient populations in Europe, the UK, and Japan, ACADIA’s moves to tap these markets could significantly amplify Daybue’s revenue projections.

From a financial perspective, the company’s transition from a net loss of $34M to a net income of $1.1M YoY is an essential indicator. This positive shift in net income—achieved even while grappling with increased SG&A costs due to Daybue’s commercialization—shows prudent capital allocation and sets a bullish undertone for future profitability.

Given these dynamics, especially Daybue’s robust early market performance and the company’s fiscal resilience exemplified by the shift to net income, I am revising my recommendation to “Buy.” ACADIA Pharmaceuticals, with Daybue potentially being the linchpin, seems poised for a future that combines financial sustainability with clinical impact. Consequently, this isn’t an investment opportunity to be overlooked any longer.

Risks to Thesis

In re-evaluating my “Buy” recommendation for ACADIA Pharmaceuticals, several counterpoints emerge that could temper optimism:

-

Regulatory Risk: Despite Daybue’s promise, regulatory approval is never guaranteed. A failure in Canada might spark investor doubts.

-

Pricing Pressure: Daybue’s high annual cost per patient could attract scrutiny, leading to pricing adjustments that negatively impact projected peak revenue.

-

Competition: Other companies may introduce targeted therapies for Rett syndrome, eroding Daybue’s market share faster than anticipated.

-

Market Saturation & Safety Concerns: My projection of a 30% market penetration may be overly optimistic due to the safety concern of diarrhea associated with Daybue. Such side effects could restrict widespread adoption and force prescribers to consider alternative treatments, especially if long-term usage exacerbates gastrointestinal issues in Rett syndrome patients. This, in turn, could limit Daybue’s ability to capture the anticipated market share, thereby affecting projected revenue streams.

-

Insider Selling: This typically suggests insiders expect the stock price to not appreciate significantly, contradicting the strong institutional backing.

-

R&D Expenditure Drop: The decrease in R&D expenses could be a double-edged sword, signaling lack of investment in future pipelines.

-

Short Interest: At 9.22%, a negative catalyst could trigger a sharp sell-off, rather than the envisaged short squeeze.

-

Operational Cash Burn: Positive net income notwithstanding, the company is still burning cash in operations. A prolonged scenario may require additional financing, diluting existing shares.

-

Patent Expiry for Nuplazid: Nuplazid’s Composition of Matter patent is set to expire in 2027. This opens the door for generic competition, which could significantly erode its market share and revenue contribution. Loss of exclusivity might compel ACADIA to offset this revenue decline through other means, putting extra pressure on Daybue and other pipeline assets to perform exceptionally well. Investors should closely monitor ACADIA’s strategy to mitigate this looming risk.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.