Summary:

- Declining growth, increased competition, and uncertainty about the future of payments are all valid arguments against PayPal.

- However, the prominent digital payment player might appear as a compelling investment opportunity with a fair value below its current price.

- The article debunks the most common bullish and bearish arguments concentrating on what ultimately matters.

- Since an investor can easily overpay for a business, the key is to focus on the fundamentals of PayPal and its valuation.

chameleonseye

Introduction

PayPal (NASDAQ:PYPL) is currently a quite popular stock among retail investors, and for good reason. The company is a leader in the global payments industry, with over 400 million active accounts, has a strong track record of revenue growth and its business seems to be well-positioned to benefit from the continued growth of e-commerce. In addition, to many investors, PayPal became a value play once the stock hit multi-year lows and it’s trading 43.50% lower than five years ago.

However, there are reasons to believe that PayPal may not be as obvious of a long-term value investment as some investors think. It’s a broadly covered stock with Wall Street eyes analyzing it thoroughly. The company’s stock price has fallen significantly from its all-time high which can be attributed to several events over almost two years that fueled sharp sell-offs of PayPal shares. Yet, the stock price never recovered which could be a sign that the market is starting to lose faith in PayPal’s growth story.

Overall, PayPal appears to be a great business with solid financials and a history of strong performance. Yet, no matter how amazing the company is, there is always a question of how much it’s worth. Since an investor can easily overpay for a great business, the aim of this article is to focus on the fundamentals of PayPal and its valuation. Ultimately, an investment in a company is determined by today’s value of all future cash flows.

Wall Street as well as retail investors need a story to get hooked on, arguments in favor or against a stock, fancy statistics, a confident forecaster, individuals wearing suits and sounding smart, etc. These and some more are decisive factors in whether to buy, sell, or hold a stock. In fact, an investor requires insight into a company’s financials, conservative assumptions about the future of the business, common sense, and plenty of time.

That’s why the article debunks the most common bullish and bearish arguments. It doesn’t serve to express an actual author’s opinion but to show that one can make bullish or bearish views that make perfect sense and still be disapproved or put into question. Deciding which has a higher probability of occurrence is a fool’s game. What ultimately matters is recognizing a wonderful business, which PayPal seems to be, and performing a valuation based on conservative assumptions which is done in the last chapter.

Debunking a bullish case

The most common arguments being given by fund managers and retail investors favoring acquiring PayPal at the current level are:

1. Fallen stock price – PayPal stock price is down a whopping 82.0% compared to its all-time high from July 2021 where it hit $310.16. At first glance, it may look like the company fell too hard and the price should recover, especially after several quarters of no negative narratives.

However, it’s crucial to exercise caution when considering historical price action as a guide for stock investment decisions, especially in this case where the stock price was once significantly higher but has since plummeted. An investor can easily fall for something called a contrast bias. While the company may appear undervalued at present, this could be deceptive due to the comparison with the historical high. The current price might actually be a more accurate reflection of the underlying business’s true value, and the previous high might have been an unsustainable anomaly. Blindly following historical price trends can lead to misguided investment choices, as market conditions, economic factors, and the company’s fundamentals may have changed dramatically since the peak.

2. Network effect – A network effect in the case of PayPal is the phenomenon where the value of the company’s service increases as more people use it. This is because the more people who use a payment company, the more merchants that will accept it, and the more convenient it will be for users to pay for goods and services.

PayPal does possess a network effect. Yet, the economics of the payment-processing industry aren’t great. Although, the network effect is usually perceived as a meaningful competitive advantage, in PayPal’s case it turns out to be relatively mild. This is due to the company’s position as a smaller element within the broader electronic payment infrastructure. While the company is likely to maintain its status as a preferred partner in the online space owing to its platform’s relative ease and security, its market influence isn’t dominant enough to dictate terms to other competitors or significantly expand its market share.

3. Low valuation -PayPal stock is currently trading at around $57.48 per share, with a market capitalization of $64.31 billion. This gives the stock a forward price-to-earnings (P/E) ratio of 16.5 and a forward price-to-sales (P/S) ratio of 2.13. These ratios are both relatively low compared to PayPal’s historical averages and to those of its peers in the digital payments industry.

Again, an investor may fall easily into the trap of a contrast effect. The contrast effect is a cognitive bias that occurs when one judges something in comparison to something else, rather than judging it on its own merits. This can lead a person to overestimate or underestimate the target item, depending on the comparison item. In the case of PayPal’s valuation, an investor should value the company based on the current value of its future cash flows, and not based on the previous valuation.

Two years ago, when PayPal stock was in a free fall, analysts were still projecting a 19.91% earnings growth (CAGR – compound annual growth rate) for the next 3-5 years. In reality, PayPal recorded a 23.41% earnings decline (CAGR) over the last two fiscal years. Valuations based on such growth rates were hugely overextended and when the post-pandemic euphoria came to an end, the management and the analysts redid their growth estimates. The valuations came substantially down and the stock price followed.

Debunking a bearish case

The most common bearish arguments concerning PayPal include:

1. Fierce competition – There are concerns that PayPal may not be able to maintain its dominant position in the digital payments market due to increasing competition, especially from new entrants and established financial institutions.

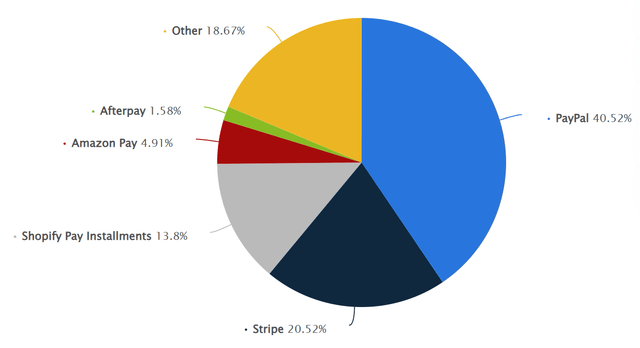

According to multiple sources, PayPal has 40.5% of the global market share in the payment service sector. Market share is calculated in this case based on either the number of customers or by taking the number of websites using technology and dividing it by the total websites using any technology in the same category.

Market share of online payment processing technologies worldwide as of July 2023 (Statista)

Besides that, PayPal is the most popular digital wallet in North America and Europe, accepted by 79% of the top 1,500 retailers. These statistics speak for the dominance of the California-based firm. Once such a scale is reached, it’s not an easy task for the competitors to disrupt the space and dethrone the leader.

2. Slow revenue growth and macroeconomic headwinds – PayPal is sensitive to the overall state of the economy because its revenue is directly tied to the revenue of its merchant customers.

The macroeconomic picture is an unknown for every company on the globe and PayPal is no exception. Yet, the company’s revenue streams are so diversified from a consumer and merchant standpoint that PayPal will most probably stay dominant in the digital payment space regardless of the condition of the global economy. Indeed, revenue growth has become sluggish, but the company has also become mature which means that the growth decelerates. Not a long time ago, PayPal’s addressable market was estimated to be $110 trillion and to generate $50 billion in revenue in FY 2025. The valuation was of course as exuberant as these assumptions. Revenue growth remains in the high single digits with the opportunities to improve margins and buy back shares, which will contribute to an even higher growth of earnings.

3. Failed acquisitions – PayPal has made a number of large acquisitions, and these acquisitions could destroy value if PayPal pays too much for them or is unable to integrate them effectively.

Since 2008, PayPal has made multiple acquisitions, some of which are paying off and keep gaining popularity.

| Date | Company | Price |

| Jan 28, 2008 | Fraud Sciences | $169M |

| Oct 6, 2008 | Bill Me Later | $945M |

| Apr 20, 2011 | Where.com – Wikipedia | $135M |

| Apr 28, 2011 | FigCard | – |

| Oct 15, 2011 | Zong | $240M |

| Jul 17, 2012 | Braintree Developer Documentation | – |

| Apr 11, 2013 | IronPearl | – |

| Sep 26, 2013 | Braintree | $800M |

| Sep 26, 2013 | Venmo | $26.2M |

| Dec 17, 2013 | StackMob | – |

| Mar 2, 2015 | Paydiant | $280M |

| Mar 5, 2015 | CyActive | $60M |

| Jul 2, 2015 | Xoom Corporation | $890M |

| Aug 19, 2015 | Modest Inc | – |

| Feb 14, 2017 | TIO Networks | $233M |

| Aug 10, 2017 | Swift Financial | – |

| May 29, 2018 | Jetlore | – |

| May 17, 2018 | iZettle | $2.2B |

| June 19, 2018 | Hyperwallet | $400M |

| June 22, 2018 | Simility | $120M |

| Sept 30, 2019 | GoPay | undisclosed (70% stake) |

| Nov 20, 2019 | Honey | $4B |

| Mar 8, 2021 | Curv | – |

| May 7, 2021 | Chargehound | – |

| May 13, 2021 | Happy Returns | – |

| Sep 8, 2021 | Paidy | $2.7B |

PayPal’s acquisitions (Wikipedia)

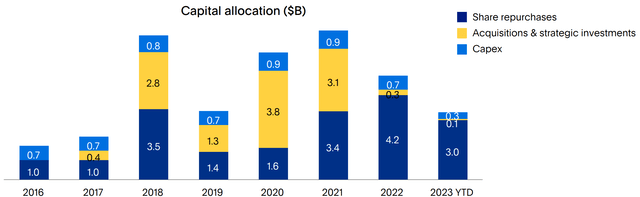

Of course, there will be acquisitions that will turn out to be mistakes, but it’s unavoidable when making investments. PayPal allocates capital in a balanced manner and it seems that the management doesn’t throw money into random businesses for the mere purpose of making an acquisition. Venmo, Braintree, iZettle, and Xoom are examples of great investments that are driving the company’s revenue growth.

Capital allocation ($B) (PayPal)

The worst investment you can make is no investment at all.

– Warren Buffett

Valuation

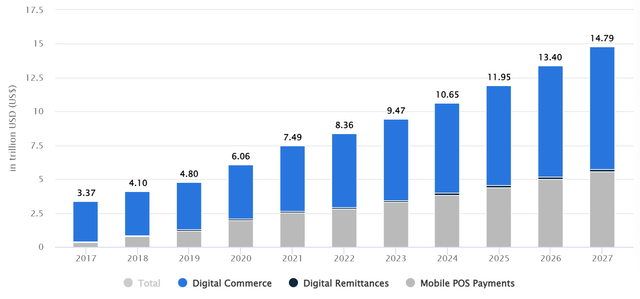

The valuation model was based on the forecast of the total volume of digital payments globally until 2027.

Digital Payments Worldwide – Transaction Value (Statista)

Moreover, it was assumed, that PayPal’s market share remains the same for the analyzed period. Eventually, results derived from the Total Payment Volume (TPV) and the company’s share of it include:

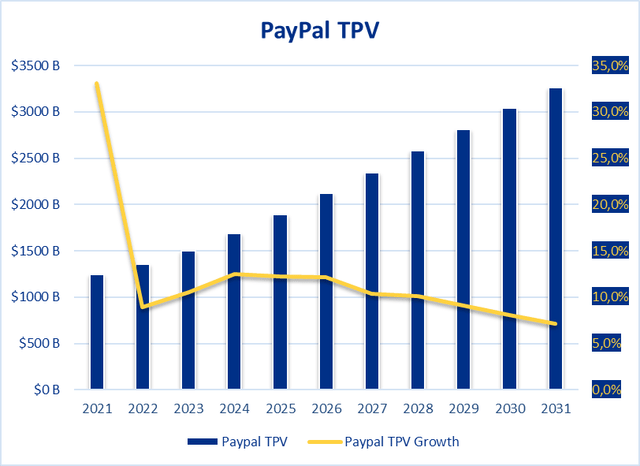

1. PayPal’s TPV: Its growth decelerates from 2024 until the end of the analyzed period.

PayPal’s Estimated Total Payment Volume (Author)

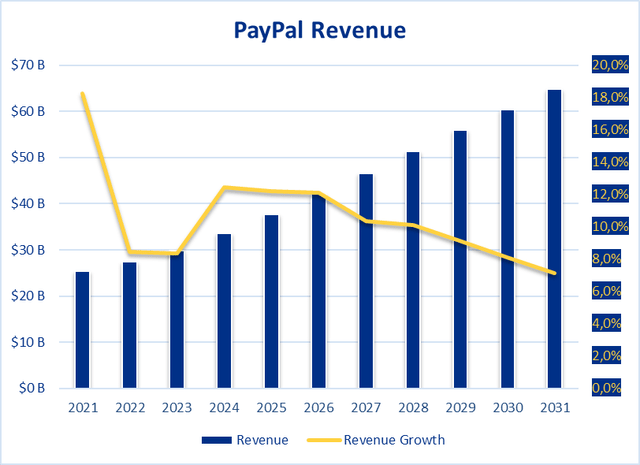

2. Revenues: Sales grow and hit $65.0 billion in 2031. The growth rate slows down on an annual basis reaching a 7.1% increase in the same year.

PayPal’s Estimated Revenues (Author)

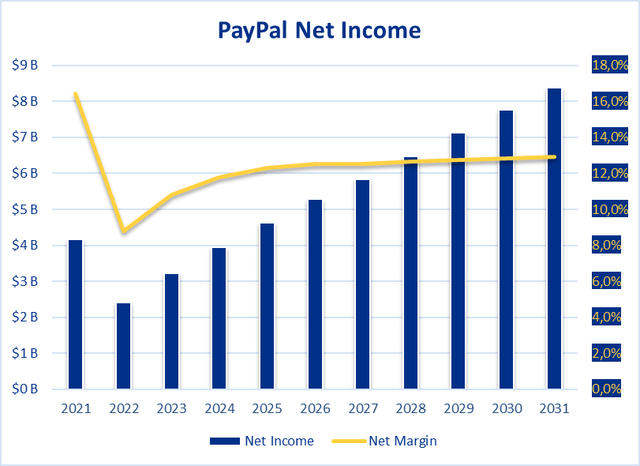

3. Net Income and Net Margin: Profits experience steady growth boosted by the improving net margin.

PayPal’s Estimated Net Income and Profit Margins (Author)

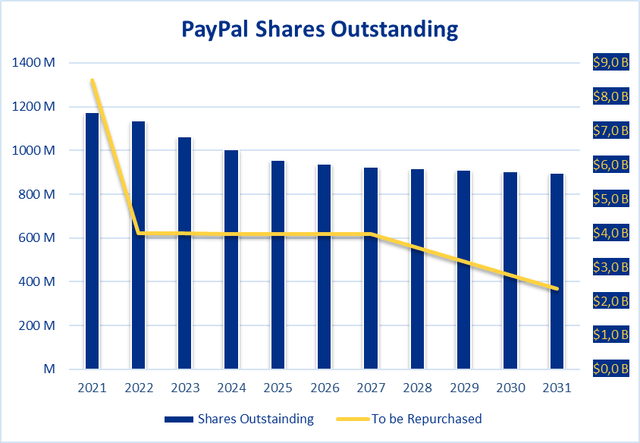

4. Shares Outstanding: Buybacks should boost earnings growth, especially when the stock price continues to stay at current or lower levels. It takes into account the current buyback program until 2027 and an assumed amount of capital spent on stock repurchases afterward.

PayPal’s Estimated Shares Outstanding (Author)

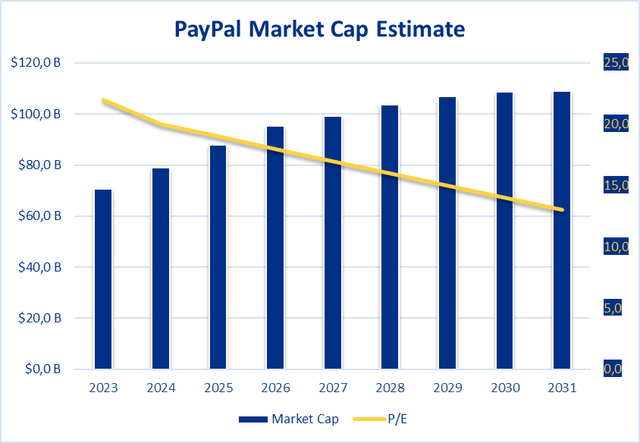

5. Market Cap and the P/E ratio: The company’s market capitalization will likely grow at a slow pace as its revenues and earnings don’t show the growth they once did. Simultaneously, the P/E ratio will likely fall as well with investors not being willing to pay for the company as much as when it showed its former expansion.

PayPal’s Estimated Market Capitalization and The Corresponding P/E Ratio (Author)

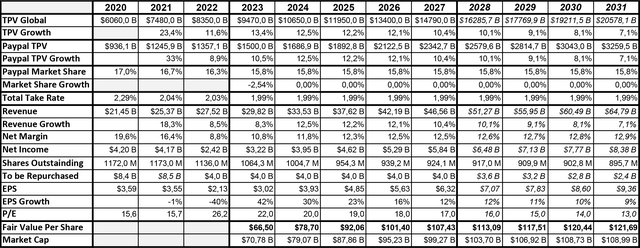

The table below represents the valuation model and summarizes the numbers used in the calculation.

Valuation Model Based on the Estimated Transaction Value in Digital Payments (Author)

Assuming the estimates are realistic, a fair value of PayPal equals $66.5 per share, which represents a 19.15% discount to the current price. Besides that, PayPal would likely be a $103.70 billion company by 2028, which would correspond to a share price of $113.09. This would make a PayPal investment a potential double in 5 years constituting an ample return.

If you buy a company at a good price, you don’t need to worry about the market. If you buy a company at a bad price, you need to worry about the market and the company.

– Warren Buffett

Conclusion

Declining growth, increased competition, or uncertainty about the future of payments are all valid arguments. However, to every gloomy argument, there can be presented a positive view and it’s extremely difficult for a human to quantify and weigh multiple combinations of dozens of scenarios to make an investment decision. A simplified approach is to decide if the company possesses characteristics of a great business such as a moat, healthy financials, honest management, sustainable growth, an edge against competitors, etc. Once it’s established that the company is exceptional, the valuation should tell the investor how much to pay for it.

PayPal, a prominent player in the digital payments landscape, stands as a compelling investment opportunity with its fair value estimated at $66.5, signaling its current undervaluation. At the forefront of innovation, PayPal is continually diversifying its portfolio, investing strategically in emerging growth prospects like cross-border payments and e-commerce. Its prowess in adapting to evolving market trends and leveraging technology bolsters its position as a clear industry leader. This visionary approach not only ensures resilience in a rapidly evolving digital economy but also promises sustained growth and a secure position within the highly competitive payment sector. Thus, PayPal stands as an attractive investment option for those seeking long-term value and potential returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.