Summary:

- Amazon Web Services could generate around $120B in annual revenues by 2025, and the advertising division could secure $50B in revenue by the same year.

- Amazon’s share price could rise to $200 due to growth in its cloud and AI services, advertising, and Prime subscription service. This would put Amazon’s market capitalization near the $2 trillion mark.

- Bear case has AWS growth falling short, leading to a reassessment of its valuation and a possible drop in Amazon’s share price to a range of $80-100/share.

- Despite this, I’m confident in AWS’s resilience and Amazon’s potential to generate $800B in revenues and trade around $200/share in three years.

4kodiak/iStock Unreleased via Getty Images

Priced at $200 per share, Amazon (NASDAQ:AMZN) would boast a market capitalization near the $2 trillion mark. While not the first to reach such a milestone, it would indeed join a select few in this elite league.

Needless to say, a rise to $200/share would spell significant gains for current investors. It’s seldom that we witness a corporate giant like Amazon, possessing the potential to nearly double its value over the forthcoming three years. Here, we have a prime example. In this piece, we delve into the reasons why.

AI and Cloud Growth

Giants like Amazon, Alphabet (GOOG), and Microsoft (MSFT) are positioned to reap profound benefits as compute needs swell due to increased AI demand.

Whether a firm is engrossed in developing its own extensive language model, endeavoring in generative image creation, or handling colossal data, the likelihood of conducting these operations solely on-premises is low. The clear winners? The hyperscalers.

Cloud Infrastructure market share (Statista)

According to Statista, AWS captures nearly one-third of the cloud infrastructure market. This share has remained roughly static, even as the market continues its steady ascension.

Moreover, the growth isn’t expected to lose steam. With generative AI and LLMs gaining traction, the need for computational power is escalating like never before, which is evident across a range of estimates.

- Fortune Business Insights projects the value of cloud computing at $2.4T by 2030

- MarketsAndMarkets envisions the market to be worth $1.2T in 2027, but it’s important to note that this report was published before the surge of generative AI

These are just two instances. Other forecasts echo similar growth trajectories of 14-20% CAGR over the decade, signifying robust growth from an already substantial market.

AWS revenue and expectations (Author sourced and compiled)

Growing AWS’s revenue at ~15% annually would accrue the company roughly $120B in annual revenues from this segment alone. 15% falls in line with the market’s expected 14-20%, and is conservative given the potential boost from generative AI, and Amazon’s already leading market position.

AWS, in my opinion, will retain its market position due to its incumbent status as the market leader. There are no newcomers that could topple the big three in this space given the need to invest billions of dollars (and we’ve left zero-interest rate times). This will be a three-horse race for dominance, and I’d argue that one of those horses, Google Cloud, is the only one that stands to lose given the company’s laissez-faire approach to customer support along with dropping products at the first sign of mid-tier margins.

AWS also benefits from “stickiness.” Moving from cloud provider to cloud provider is a monumental task. Even switching regions within AWS (a region is a datacenter location) can prove to be challenging for many companies, and a months-long event, so switching from AWS to GCP isn’t something existing users will subject themselves to without masses of reasoning.

Note, also, that upon searching for “best cloud provider 2023” or similar terms, the front pages of Google are loaded with opinion pieces that continue to point to AWS as the provider of choice. Point being, if this market is growing, there’s no better positioned company than Amazon to capture it.

AWS, with a focus on profitability, will be able to move from ~29% operating margin to around 32%. At this level, Amazon could generate an estimated $38.4B in operating income in FY2025 from this division alone.

Advertising Juggernaut

Advertising, a more recent endeavor by Amazon, promises to yield considerable returns in the future.

Amazon has established itself as a prime shopping destination, thereby engaging an audience with an exceptionally high purchase intent—arguably higher than what a Google search might attract. This high intent has spurred advertisers to invest billions into the platform, an investment that continues to exhibit robust growth.

Amazon advertising revenue and expectations (Author sourced and compiled)

A sluggish economy may potentially dampen advertising expenditure, yet giants like Amazon and Google are poised to continue capturing the lion’s share of online ads due to this high intent factor. Moreover, in an environment where companies such as Apple (AAPL) are limiting the data advertisers can access, those like Amazon, rich in first-party data, stand to benefit significantly.

I believe Amazon’s advertising division can sustain a growth of 10-15% CAGR over the next three years. This trajectory could catapult the company to secure $50B in advertising revenue by FY2025. Given a conservative operating margin of 30%, Amazon is set to generate $15B in operating income solely from advertising.

Prime

There’s already an abundance of discourse surrounding Prime, so there’s little need for me to elaborate extensively on its adhesive quality. However, it’s important to emphasize its high retention rate, especially as Amazon broadens its portfolio to include healthcare offerings and potentially cellular plans.

Prime exhibits substantial pricing power, and it’s reasonable to suggest that Amazon could implement a 3-5% annual price increase to cover growing costs without significant customer attrition. Price hikes might be infrequent, but when they occur, they are unlikely to deter current users.

At present, the global Prime membership exceeds 200 million across 22 countries. Amazon doesn’t segregate Prime revenue from its other subscription services (such as Kindle, Audible, Music, etc.), but it’s reasonable to assume it constitutes the majority of a segment that reported $35.2B in revenue in 2022.

Naturally, slower growth is anticipated here. Prime has already saturated the U.S. market, and the pool of potential subscribers who don’t already have it is dwindling. My projections indicate a slowdown in subscription revenue growth to 7% per annum (compared to 10% from 2021 to 2022). At this rate, subscription services would contribute $43B to Amazon’s revenue in 2025.

The 7% per annum is driven by user growth, albeit small, in the United States (and possibly a Netflix (NFLX) or Costco (COST) like membership sharing crackdown), along with user adoption across the EU. While the company still does offer same-day and free shipping to many European nations, Prime isn’t as beloved, and getting it there would require a lot of investment that Amazon is unlikely to undertake in the near-term. If Amazon were to find a “magic button” of sorts, we could see growth exceed 7%.

Amazon doesn’t disclose the operating costs of this segment, the expenditures related to offerings like Prime Video suggest that even with $43B in revenues, profitability might be a challenge. In essence, “Subscription Services” operates as a loss-leader for Amazon—and quite a substantial one at that.

Finally, Stores

We’ve examined over $50B in operating income and approximately $213B in revenues, yet the retail aspect remains untouched.

Amazon’s retail operations can be segmented into three categories:

- Physical Stores

- North American

- International

Let’s center our attention on North America as it represents the most significant portion of Amazon’s retail business (with physical stores accounting for around $20B in revenues and international remaining a constant challenge).

Amazon North America store revenue (Author sourced and compiled)

In FY ’22, North American revenues exhibited a growth of 12.8%, culminating in $315B. The first quarter of 2023 witnessed an 11% rise compared to 1Q ’22. This sustained growth, even when juxtaposed against COVID-era comparisons, is commendable. It reinforces the plausibility of assuming a realistic 7% CAGR over the subsequent three years.

With a 7% growth rate, Amazon’s North American segment could realize approximately $400B in revenue.

The 7% growth here will come from a combination of retail growth and eCommerce penetration. At just 21.2% eCommerce penetration in the United States, there’s still a lot of juice for Amazon to squeeze here.

Per Statista, eCommerce revenue will grow at a CAGR of 11.44% through 2027. Amazon, as the “everything store” will be on the tip of many user’s tongues as the place to spend those new digital dollars with the only contender, in my eyes, being D2C via Shopify (SHOP) which has a distribution problem it may need to figure out to be a true contender.

Amazon Prime Rivian EDV (Amazon)

However, it’s important to note that this is typically a low-margin operation—at around 1%. Amazon has made substantial investments in recent years to meet demand, and as such, any margin expansion would inevitably come from cost savings achieved through automation and the deployment of the Rivian EDV currently rolling out across the United States.

In summation, Amazon is poised to bolster its already dominant retail position, potentially seizing $400B of U.S. retail and a larger market share, likely generating around $8B in operating income in FY ’25.

The Path to $200

Breaking it down, we have $8B from North American retail, $35B from AWS, and $15B from advertising. Retail is poised to sustain its high single-digit growth, AWS could continue to harness double-digit growth, and advertising growth might hover around 10%.

Under these premises, Amazon could transform into a behemoth spanning various industries, generating upwards of $800B in revenue (including international, physical stores, and other businesses) and approximately $60B-70B in operating income, based on very conservative estimates. Even with these conservative projections, Amazon would only need a 2.5x sales multiple to trade north of $200/share, or a 30x operating income multiple to surpass the same threshold.

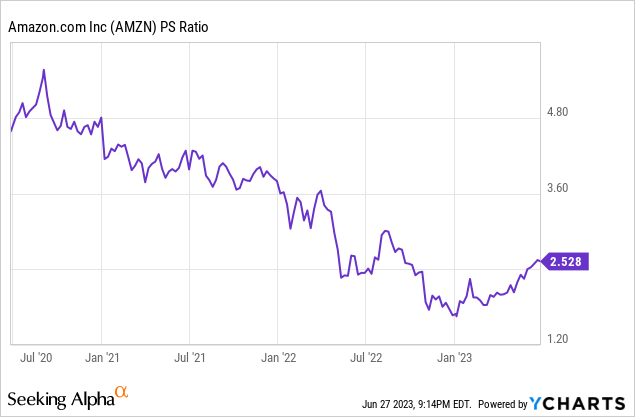

Observing Amazon’s P/S ratio over the past three years, it’s evident that it has declined considerably, stabilizing around 2.5x today. Given the continued growth expectations, it’s reasonable to anticipate that Amazon could maintain a 2.5x P/S ratio, even though retail often commands a lower ratio (tech infrastructure doesn’t).

With those $800B in revenues, Amazon, at a 2.5x sales multiple, would be valued at $2T, or roughly $200/share, providing a 57% return to investors who buy in today.

The Alternative

Numerous scenarios could unfold over the coming three years. A plausible alternative could see the generative AI boom not benefiting Amazon as much as its peers.

While we can reasonably anticipate growth in Amazon’s other business segments, any shortfall in AWS growth could be devastating for Amazon’s share price and its investors.

Should AWS grow at only 10% (lower than the industry average), it’s likely that investors would observe Microsoft and Google claiming a larger market share, leading to a reassessment of AWS’s valuation as a whole.

Even with a modest growth rate of 10% (or potentially less), we’re still looking at a business that generates over $700B in revenues. However, this scenario would likely be priced at 1-1.5x sales, rather than the bullish 2.5x multiple we explored earlier.

In terms of stock price, this would translate to a range of $80-100/share. Enduring a 20-30% loss over a three-year holding period is far from an ideal investment outcome.

Closing Thoughts

Despite the potential for various scenarios, AWS has proven its resilience against substantial competition over time. The stickiness of AWS is a key factor that should enable Amazon to retain a significant market share as we advance into a rapidly expanding future.

While I do anticipate Microsoft’s Azure gaining a larger piece of the cloud pie, I am confident that AWS will maintain its leadership position in the sector, rewarding Amazon’s investors in the process.

In a future article, I plan to explore the potential of a spinoff, which could unlock extraordinary value across all of Amazon’s businesses. For now, I am of the view that we will see the entire business generating $800B in revenues, becoming considerably more profitable, and trading around $200/share three years from now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.