Summary:

- Nike, Inc. has historically offered good buy-on-the-dip opportunities and remains a high-quality business with potential for high returns on invested capital.

- Similar periods of weakness in Nike have been followed by strong outperformance, making it a recurring buy on the dip play.

- The current conditions, including margins, valuation multiples, and short-term trends, suggest that Nike may be at a great entry point for investment.

Thank you for your assistant

NIKE, Inc. (NYSE:NKE) is a blue chip that has often offered great buy-on-the-dip opportunities in conditions similar to what we see today in terms of margins, valuation multiples, and short-term trends. I think Nike remains a high-quality business that can compound at a high ROIC once the conditions for ramping up investments arise.

Analogies That I Like

It’s been a long time since I discussed Nike. Although I haven’t been involved in the stock for a few years, Nike has been a blue chip and recurring buy on the dip play that has never disappointed me.

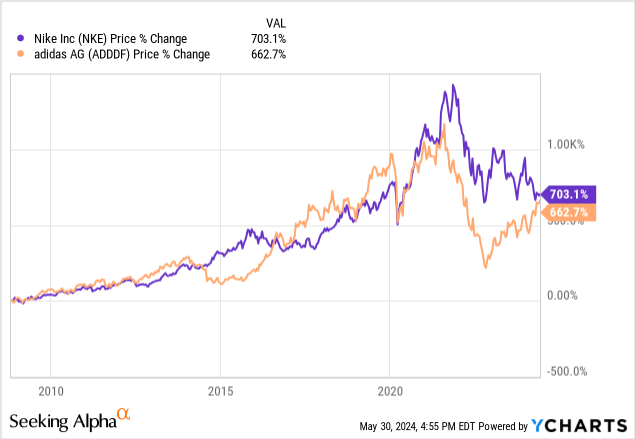

Excluding the major downturn that started at the end of the “everything” bubble in 2021, I don’t remember another price decline exceeding 25% for Nike shares that was not followed by a period of strong outperformance.

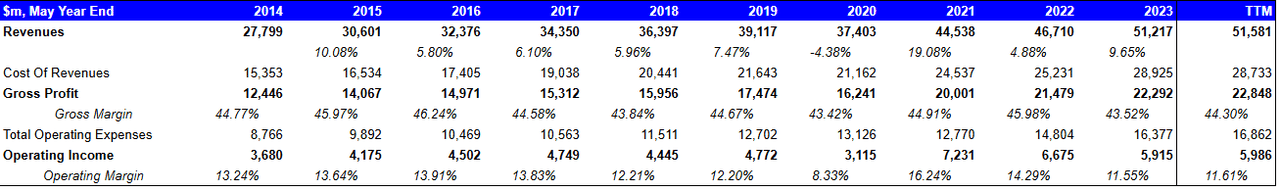

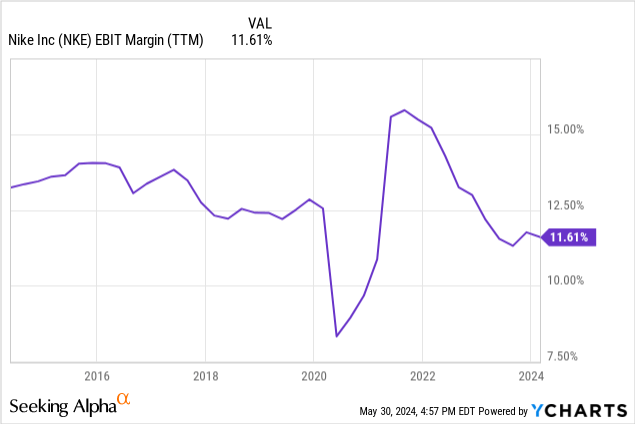

Don’t get me wrong, there are good fundamental reasons why the stock hasn’t recovered yet and is still underperforming the broader S&P 500 (SP500) two and a half years after reaching the top. Revenue has flattened, and a sharp margin contraction occurred, with operating margin going from 16%+ in 2021 to less than 12% in 2023.

I would say that periods of similar weakness with Nike happen cyclically, either because of customer attention temporarily withdrawn by competitors driving favorable fashion trends such as adidas AG (OTCQX:ADDYY), (OTCQX:ADDDF) or PUMA SE (OTCPK:PMMAF) (e.g., the 2016-2017 period), or because of macro weakness (2020).

I am old enough to remember how Nike had arguably lost the athleisure trend and was destined to succumb to the competition versus its German peers, which via a superior understanding of the market and sponsorships outside the sports world were poised to take the lead in the reformed sector of sportswear. It did not happen. Shares of Nike and Adidas have been in a constant tango, where a period of significant underperformance in one of the stocks has often created a great entry point.

I believe that what we are seeing now with Nike is similar to what the business experienced in 2016-2017, which ended up being a great entry point.

The secret to buying a blue chip like Nike in my view was always taking advantage of negative sentiment during periods of underperformance and letting the compounding power of the business and its dominant position in the market do the rest. I think that conditions are very similar to other great entry points of the past 10 years.

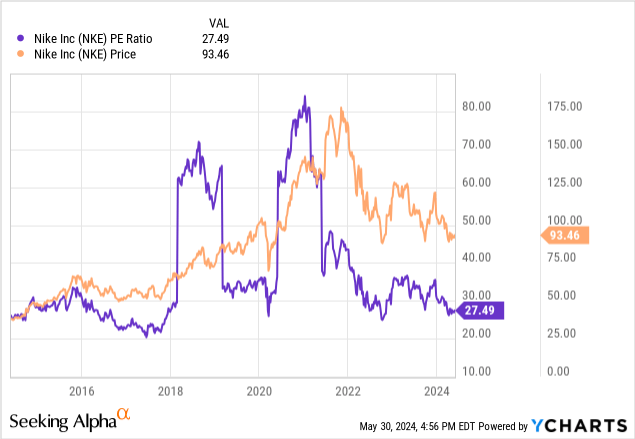

Starting from the basic P/E ratio, a multiple of 27x might scare the most fundamentalist value investors, yet it’s around the ratio where Nike has tended to find a bottom in previous corrections/declines, such as in 2017-18, 2020, and for a short time in 2022.

Trends in profitability suggest a similar situation as well. Gross Margin on a TTM basis is already recovering a bit, but on an operating margin basis, the current level of ~12% is around the level where the stock found a bottom in 2017. Abnormal conditions with lockdowns did lead to a much weaker operating margin of ~8% in 2020, but I believe it’s fair to assume we are not seeing imminent risks of a similar situation in the near future.

Short-Term Issues Look Much Improved

The problem of excess inventories, which has pressured revenue and margins, seems much more under control now. Inventories declined by 13% YoY in Q3 on flat sales, and are at around 62% of revenue in the quarter, or ~15.5% of annualized revenue.

In Q3 ’18, inventories of $5,366m amounted to ~60% of the quarter revenue, or ~15% of annualized revenue.

Normalized inventory levels should give some relief to pricing and alleviate margin pressure. Interestingly, gross margin already started to expand again in Q3 ’24 with a healthy 150bps increase.

Demand creation expenses, which is a fancy name for sales and marketing, were a bit elevated in Q3 at 8.13% of revenue compared to 7.45% in Q3 ’23. In my experience with consumer stocks, this is nothing crazy. It’s also something that for a high-quality business like Nike usually translates into some future demand growth and therefore some margin normalization in later quarters.

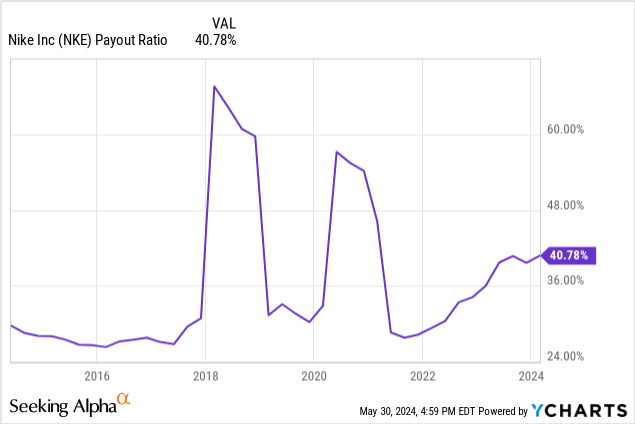

A difference I see with analogous corrections in the past is that the payout ratio is higher, while Nike has a history of generally finding a good balance between distributing dividends and reinvesting for growth.

The business is investing less in growth if we measure investments purely as capex. The Capex/revenue ratio is at least a third lower than 2016-2020 levels, and capex is mostly down in absolute terms as well. I do not blame the firm’s decision to take a cautious approach to expansion in new markets. After the disruption in Russia following the country’s war on Ukraine, and further geopolitical risks with China and Taiwan, I doubt that a cautious stance with a wait-and-see approach is inconsiderate at this time.

Yet, the business could suddenly quadruple its capex and compound with its 20%+ ROIC and would cause no strain on the firm’s cash flows, which are mostly going towards share repurchases anyway.

Conclusion

I think the current situation Nike is facing is very similar to previous conditions that underpinned great entry points for investment in the shares. With margins recovering, inventory issues under control, and a P/E ratio nearing historical buy zones, Nike appears poised for a rebound, in my view. As a lover of high-quality and dominating compounders, I will be chipping in at these levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NKE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.