Summary:

- Norwegian Cruise Line delivers impressive guidance for 2024 and successfully refinances debt.

- New ships and increases in capacity and cruise prices make NCLH a potential buy.

- Risks include high debt levels, regulatory changes, and interest rate fluctuations, but current stock price is not expensive.

courtneyk

Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) recently delivered impressive guidance for 2024, and announced successful incoming refinancing of its debt. With new ships being added in the next four years, increases in the total amount of capacity, and successful increases in cruise prices, NCLH does look like a buy. There are several risks coming from the total amount of debt, changes in the regulatory framework in the United States and overseas, and changes in the interest rates. However, NCLH does not look expensive at the current price mark.

Norwegian Cruise Line Holdings

Norwegian Cruise Line currently reports 32 ships organized in three different brands, among which there were 66.5k berths for clients. Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises are the three brands, under which this company’s cruises operate, dedicated to tourism covering areas of European coasts, Oceania, and the Pacific, transfers from Norway to the United States, and inter-island trips in Hawaii and other destinations such as Africa and South America.

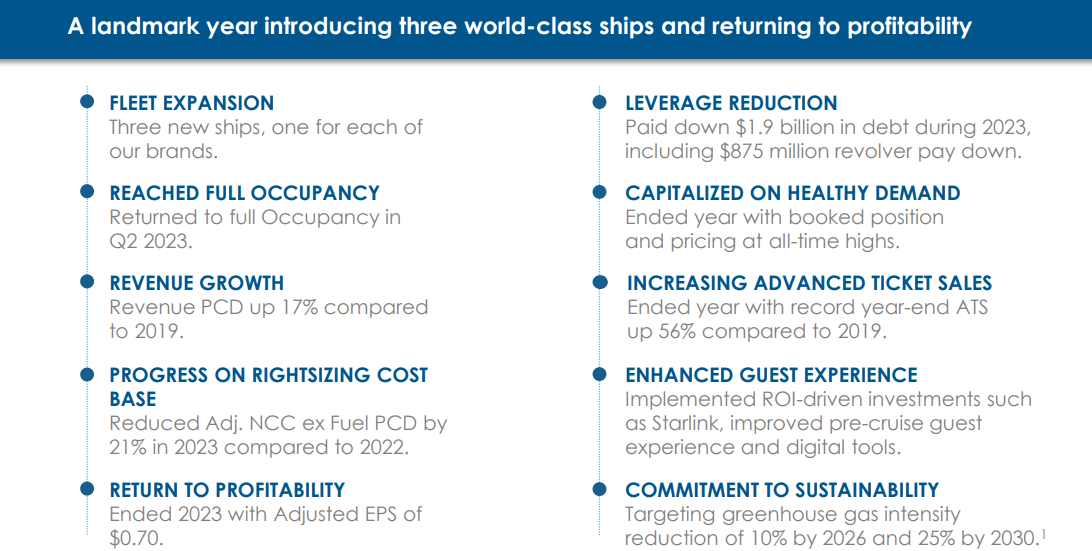

In my view, during 2023, Norwegian Cruise Line achieved extraordinary achievements in its historical records, and managed to complete the acquisition of a cruise ship for each of its lines, something that had not happened since its founding.

With around 2.9 million expected guests carried in 2024 and 5 ships on order, I believe that the future looks promising. In my view, it is worth having a look at the company right now.

Source: Investor Presentation

Given the efforts made in 2023 to reach profitability, I believe that many investors will have a look at the company from 2024. The company delivered PDC revenue up by 17% compared to that in 2019. Norwegian Cruise also noted full occupancy in 2023.

Source: Investor Presentation

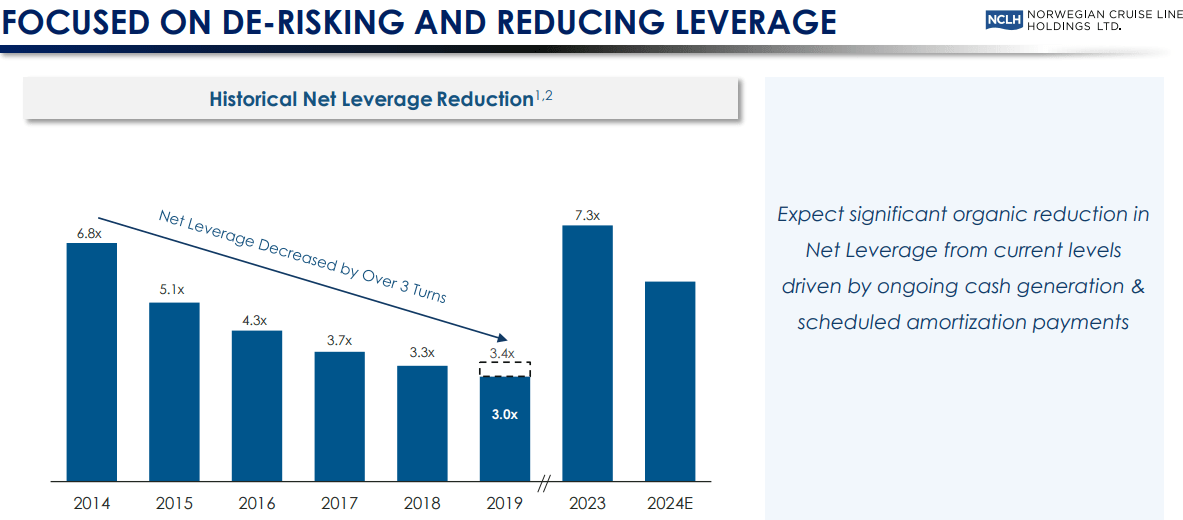

Management successfully reported leverage reduction after paying down $1.9 billion in debt, and expected to deliver significant organic reduction in net leverage due to ongoing cash generation and scheduled amortization payments. In my view, lower net leverage will most likely bring higher EV/FCF in the coming years.

Source: Investor Presentation

Each of the brands that make up Norwegian Cruise’s offering forms an autonomous reportable segment, leaving the company’s business organized into three segments that offer similar services and amenities. Similarly, operating margins and long-term considerations also run in parallel in the three segments, and the income received by each of these does not show major differences.

At a geographical level, we can highlight that the company’s activity is considerably greater in North America, where more than 60% of its revenue comes from, well above the activity in Europe and Asia/Pacific, which do not exceed 15% of the representation.

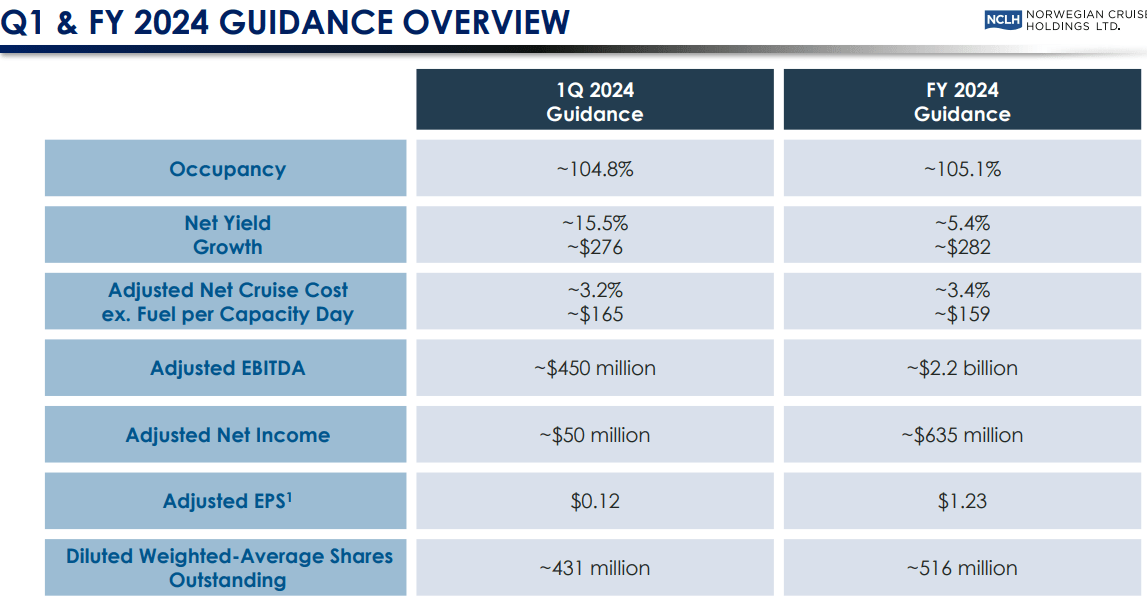

The guidance given for 2024 was also quite impressive. 2024 Adjusted EBITDA is expected to be $2.2 billion, while adjusted net income is forecasted at $635 million. Along with this, the company highlights that 2024 adjusted EPS could be around $1.23, 76% above the previous year.

Source: Investor Presentation

On the other hand, in contrast to these data, it should be noted that an increase of 3.4% is expected in the adjusted costs of cruises without including fuel, which represents a considerable impact on the increase in days with dry docks. Beyond this data, the adjusted cost of cruises is expected to remain flat throughout the year.

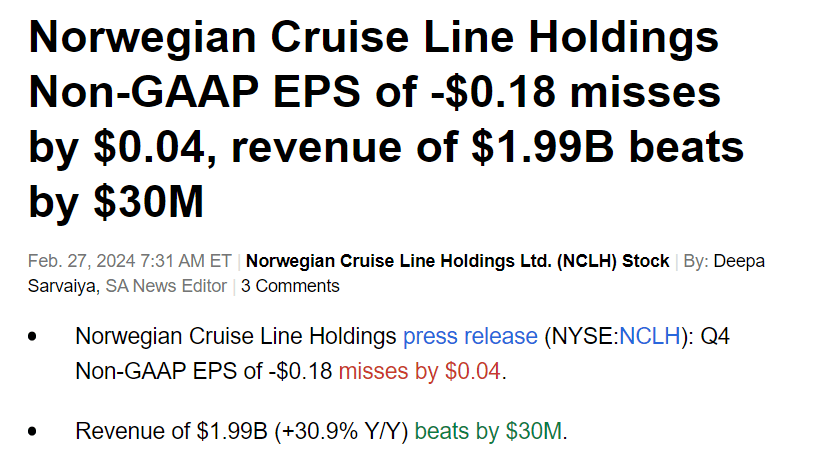

In the last quarterly report, Norwegian Cruise Line noted Non-GAAP EPS of -$0.18, which was lower than expected, and quarterly revenue of $30 million. I do not think that the market cares about the most recent results given the expectations given for the period from 2024 to 2028.

Source: Seeking Alpha

Balance Sheet: The Total Amount Of Debt Is Not Small

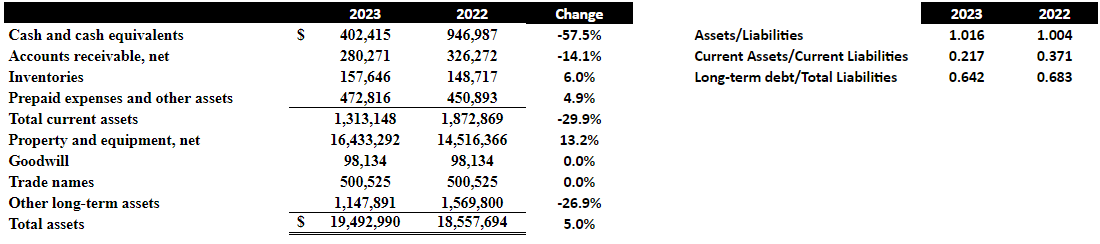

Norwegian Cruise Line Holdings reported a better balance sheet in 2023 than that in 2022. The ratio of assets/liabilities increased as well as the long-term debt/total liabilities ratio.

In 2023, the total amount of assets also increased a bit more than the total amount of liabilities. I dislike the fact that the ratio of current assets/current liabilities remains under one. However, I would not expect any liquidity issue out there. Given the total amount of property accumulated, bankers would most likely offer financing to continue its operations.

More in particular, the company noted cash and cash equivalents of $402 million, with accounts receivable worth $280 million, inventories of about $157 million, prepaid expenses and other assets close to $472 million, and total current assets of $1313 million. Besides, with property and equipment of about $16433 million, total assets stand at about $19492 million.

Source: Press Release

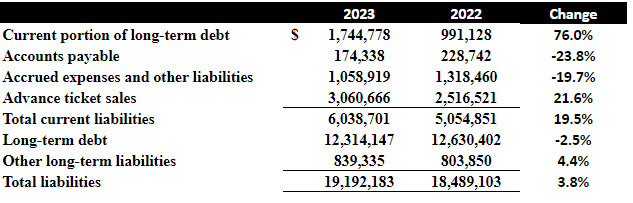

With regard to the list of liabilities, I think that investors may want to study carefully the current portion of long-term debt of $1744 million and long-term debt of close to $12314 million. In my view, further decline in the total amount of debt like we saw in 2023 will lead to higher EV/FCF or EV/EBITDA. Total liabilities stand at close to $19.192 million, so the asset/liability ratio remains over one.

Source: Press Release

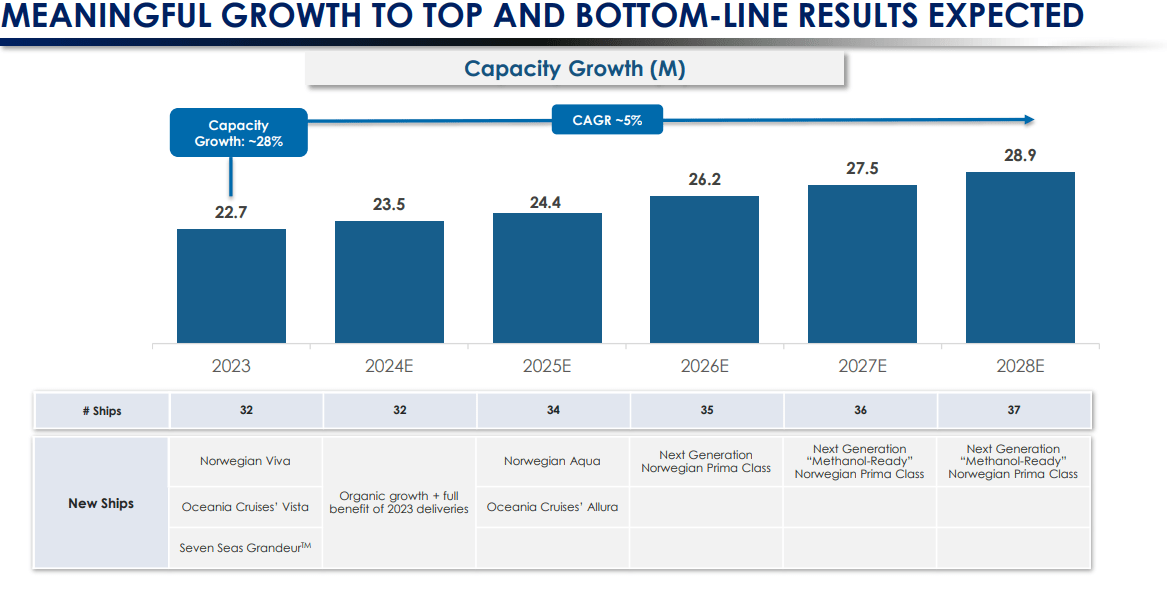

New Ships In 2025-2028 May Bring Net Sales Catalysts

The ships that the company expects are forecasted to be delivered between 2025 and 2028, adding to each of its brands and increasing the total passenger capacity to about 82k berths.

In this regard, I believe that the most impressive is the guidance given for the next four years. Capacity growth is expected to increase at close to 5% CAGR thanks to the addition of new ships. As a result, I would be expecting more clients and net sales growth.

Source: Investor Presentation

Pricing Growth Could Bring Significant Net Sales Growth

I believe that Norwegian Cruise could also benefit significantly from recent price increases. In my view, management successfully raised the price of cruises, and clients did not pose any problem in this regard. In my opinion, new price increases as a result of inflation, labor costs, or general costs could bring new net sales growth acceleration.

Pricing growth in the fourth quarter was also strong with total revenue per Passenger Cruise Day up approximately 21%, with capacity growth of 17% compared to 2019. Total revenue was up approximately 34% in the fourth quarter. Source: Press Release

Successful Refinancing Efforts

In the last quarterly report, Norwegian Cruise Line noted that it expects to repay $250 million of the 9.75% senior secured notes due 2028. Besides, management noted that it is expecting refinancing of the $650 million backstop commitment. In my opinion, debt holders seem to appreciate the business model. As soon as shareholders recognize that debt holders would continue to finance future operations, I believe that demand for the stock will most likely trend higher.

Expected refinancing of our $650 million backstop commitment from a secured to unsecured commitment. Additionally, as part of this refinancing, expected repayment of our $250 million 9.75% senior secured notes due 2028, our highest interest rate debt. Source: Press Release

My Expectations Under My Base Case Scenario

Under this scenario, I assumed net income close to $1.617 billion, with the following adjustments to reconcile net loss to net cash provided by operating activities. Note that in order to design future cash flow figures, I took a look at previous cash flow statements and my own assessments.

I included 2028 depreciation and amortization expense close to $1036 million, with loss on derivatives worth $96 million and 2028 share-based compensation expense of close to $109 million.

In addition, with accounts receivable worth $4665 million, changes in inventories of close to -$143 million, prepaid expenses and other assets worth -$2472 million, and changes in accounts payable of about -$156 million, I obtained 2028 CFO of about $6.926 billion. Finally, with 2028 additions to property and equipment of close to -$4852 million, 2028 FCF would be $2075 million.

Source: My Expectations

Peers of Norwegian Cruise Line report a median EV/EBITDA of close to 9x-10x. With these figures, I assumed a terminal EV/EBITDA of close to 12x and 7.5x, which I believe is conservative.

Source: Seeking Alpha

Assuming an exit multiple of 12x and a WACC of 8.9%, adding cash in hand, and subtracting debt, I obtained an implied equity valuation close to $11 billion and a fair price close to $26 per share.

Source: My DCF Model

Competitors

In broad terms, competition comes from the different offers of tourist alternatives within the United States and internationally, among which there are many that go outside of the cruise activity. Particularly within the tourist boat and cruise market, where the company undoubtedly enjoys a leadership position, the main competitors are some of the historical participants such as Carnival (CCL) and Royal Caribbean (RCL), to which are added other smaller businesses that offer wide price ranges, among which MSC Cruises, Viking Ocean Cruises, and Virgin Voyages stand out.

Risks

I believe that shareholders of Norwegian Cruise Line need to study carefully the total amount of debt. If the company does not successfully decrease its debt, certain investors may sell their stakes, which may lead to a decline in the stock price. In addition, further increases in the interest rates could lead to increases in the interest expenses. As a result, we may see a decrease in the net income.

Of course, the appearance of an international problem such as the 2020 pandemic, strong destruction in international financial markets, or economic crisis situations that prevent access to the purchase and reservation of tickets could eventually translate into a significant reduction in margins or even the total paralysis of the company’s activity.

Beyond these extraordinary facts, we must consider that the data on the increase in the maintenance costs of each cruise that we indicated above does not take into account the costs related to fuel, and a significant increase in the prices could translate into an increase in the total costs of the cruise vehicle maintenance. In addition, there are the risks associated with the regulations on the markets in which the company participates.

My Bearish Case Scenario Using Previous Risks

Under my bearish case scenario, I included 2028 net loss of about $1.398 billion, with 2028 depreciation and amortization expense close to $833 million, losses on derivatives of about $82 million, and 2028 share-based compensation expense of close to $86 million.

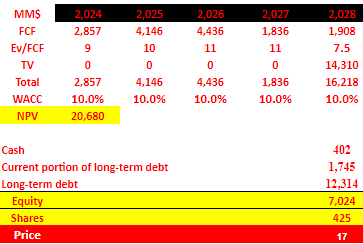

In addition, if we take into account 2028 changes in accounts receivable worth $3.971 billion, changes in inventories of close to -$120 million, changes in repaid expenses and other assets worth -$2.086 billion, and advance ticket sales worth $856 million, 2028 CFO would be $5.996 billion. Now, assuming 2028 additions to property and equipment of -$4089 million, 2028 FCF would be $1.907 billion.

Source: My Expectations

Using the FCF from 2024 to 2028, a WACC of 10%, and an exit multiple of 7.5x, the implied enterprise value would be close to $21 billion. If we add cash in hand and subtract debt, the implied equity valuation would be $7 billion, and the fair price would be $17 per share.

Source: My DCF Model

Conclusion

With recent reduction in the total amount of debt and beneficial guidance for 2024, Norwegian Cruise Line seemed to receive significant attention from investors. In addition, I believe that further increases in the total amount of capacity, new ships, and successful refinancing efforts will most likely bring the attention of new investors. With all this in mind, I believe that the company is a buy. There is a list of risks coming from changes in the regulatory framework not only in the United States, but also in other jurisdictions, changes in interest rate, and failed reduction in the total amount of debt. However, I believe that Norwegian Cruise Line does not look expensive at the current stock price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NCLH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.