Summary:

- Dell’s Q2 earnings exceeded expectations, driven by strong demand for AI-optimized servers.

- Dell’s server and networking revenue surged 80% Y/Y in Q2’25, driving top line performance.

- The IT hardware market raised its full-year guidance amid soaring growth in the Infrastructure Solutions Group.

- Dell’s valuation remains attractive, with a P/E ratio of 11.8X. I see upside and revaluation potential if server demand momentum continues.

- The main risk for Dell is a potential slowdown in its server business, which could impact overall profitability.

quantic69

Dell (NYSE:DELL) reported better than expected earnings for its second fiscal quarter last week that were driven by strong demand for AI-oriented servers. As a hardware maker, Dell benefits from increased demand for artificial intelligence-capable IT products, which has resulted in high-single digit top line growth in the last quarter. Dell also raised its guidance for FY 2025 amid strong business tailwinds, especially in the Infrastructure Solutions Group. In my opinion, Dell is a tech dinosaur with an attractive valuation. I also expect a new round of EPS upside revisions following the company’s second fiscal quarter earnings release last week.

Solid second-quarter results, robust demand for AI servers, raised guidance

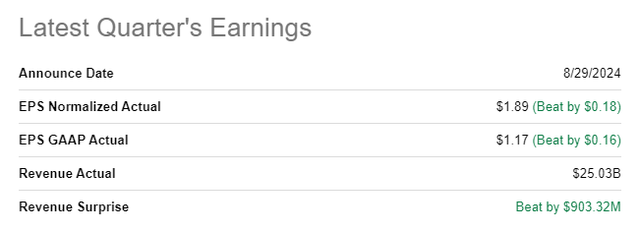

Dell reported higher than expected revenue and earnings in the second fiscal quarter on August 29, 2024: the hardware maker reported adjusted earnings of $1.89 adjusted, compared to an average prediction of $1.71 per-share. Revenues came in at $25.03B, beating the consensus projection by $903M.

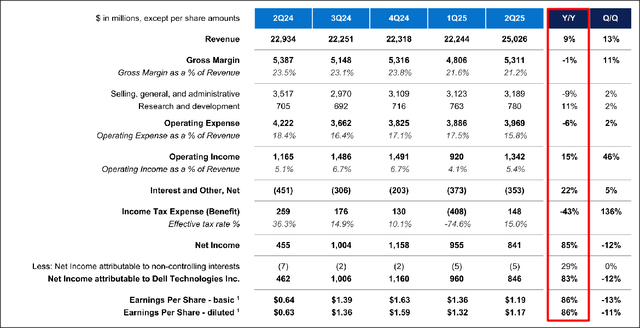

The main reason for Dell’s strong second-quarter earnings sheet as well as raised earnings/revenue guidance for FY 2025 was sizzling demand for its AI-optimized servers. Dell reported 9% year-over-year growth in its consolidated top line last week, as well as a significant (+85% Y/Y) surge in net income.

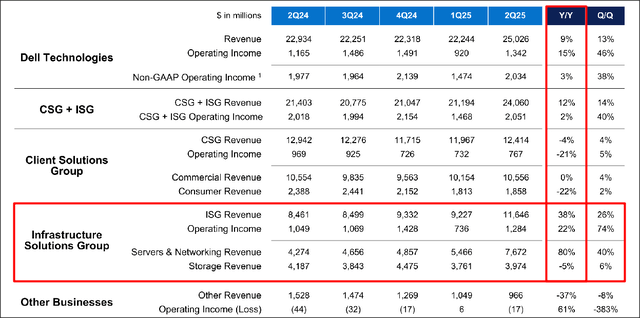

Dell’s business consists of two major business parts: the Client Solutions Group and the Infrastructure Solutions Group. The first deals with desktop PCs, notebooks, monitors, projectors and software products, while the second includes servers, storage and cyber technology products (essentially Dell’s Data Center business).

The real action for Dell happens in the Infrastructure Solutions Group, which is benefiting from all the momentum in the Data Center market. A key driver for growth here are servers that have been specifically optimized in order to handle AI workloads. As is the case with Super Micro Computer (SMCI), which is seeing surging demand for AI servers as well, the Data Center business is on fire. Dell’s Infrastructure Solutions Group crushed it in the second-quarter as server sales surged 80% year-over-year and reached $11.6B.

Infrastructure Solutions Group is now the second-largest segment for Dell in terms of revenue contribution. This segment generated 47% of consolidated revenue in Q2’25 compared against a top line share of 37% in the year-earlier period. Server orders are the single biggest revenue growth driver for Dell at the moment and with companies ramping up their spending, the IT hardware maker is set for a multi-year run-way in terms of top line growth in ISG.

Dell obviously benefits from the spending binge in the AI industry, especially in Data Centers where large corporations are spending billions of dollars to establish an infrastructure that can handle demanding AI workloads.

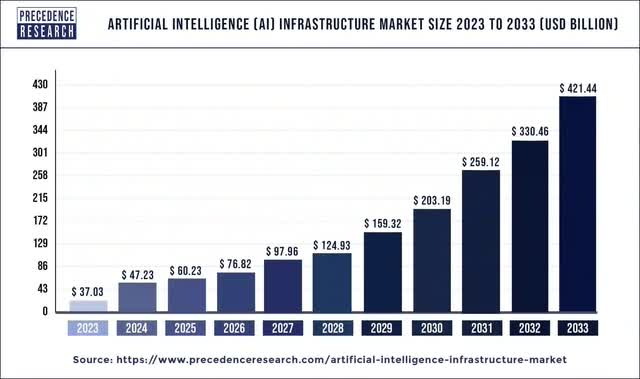

The AI infrastructure market is set for secular (not cyclical) growth in the coming years as companies need AI-optimized hardware and software to roll out artificial intelligence products ranging from digital assistants to their own, proprietary large language models. The AI infrastructure market is expected to grow from $47.2B in FY 2024 to $421.4B by the end of FY 2033, which calculates to a compound annual growth rate of 28%. In my opinion, Dell is well-positioned with its Infrastructure Solutions Group to take advantage of this expected, broad-based upgrading of the IT infrastructure base.

Raised guidance for FY 2025

Due to favorable business tailwinds in the Infrastructure Solutions Group, Dell raised its outlook for FY 2025 revenue and earnings: the hardware maker increased its revenue guidance to a range of $95.5-98.5B compared to $93.5-97.5B in Q1’24. The non-GAAP earnings guidance for FY 2025 now is $7.80 +/- $0.25, showing a raise of $0.15/share Q/Q.

Dell’s valuation

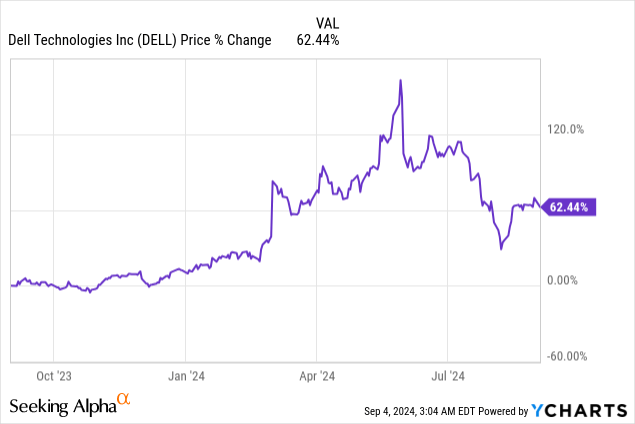

Dell has made a name for itself in the competitive PC market, and the company has gradually ventured out over time and moved into the server market. Shares, however, are not excessively valued, in my opinion, which means Dell has an opportunity for multiplier expansion if it continues to execute well in the server market.

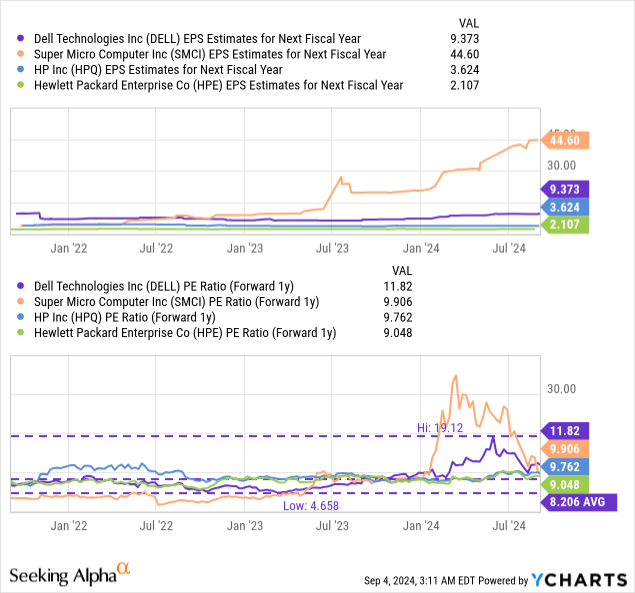

Dell is currently valued at a forward price-to-earnings ratio of 12X, which is almost a pitiful multiplier given the company’s 80% increase in server revenues in the second-quarter. In the market for computers and AI servers, Dell competes against companies like Super Micro Computer (SMCI) as well as Hewlett Packard Enterprise (HPE).

Dell is currently trading at a forward (FY 2026) P/E ratio of 11.8X, implying an earnings yield of 8.5%. This ratio is 44% above the company’s three-year average P/E ratio, but the technology company’s shares are still very reasonably valued here. Given the strong Q2’25 earnings report last week, I expect a number of EPS upside revisions going forward.

Super Micro Computer, which is dealing with the fall-out from a recent short-seller report (a buying opportunity, in my opinion), is trading at a 10.0X P/E ratio, but shares have been considerably more expensive earlier this year. The average P/E ratio for SMCI in the last year was 17.0X. In the context of the latest Hindenburg Research report for SMCI, I see Dell as a lower-risk alternative to Super Micro Computer.

In my opinion, Dell could easily trade at a 15X P/E ratio if the momentum in the server and networking business proves to be sustainable… which I believe to be the case given the considerable ramp in AI spending that we are seeing right now. Long-term projections also indicate that growth in AI spending, in the hardware and software markets, is of a secular nature, and is not cyclical. A 15X P/E ratio implies a fair value of ~$141 per-share (based off of a consensus EPS estimate of $9.37 for Dell’s next fiscal year).

Risks with Dell

The biggest opportunity, but also the greatest risk for Dell, is the company’s burgeoning server business. Here, Dell is seeing the most significant growth burst and the biggest spending tailwinds. Therefore, what would change my mind about Dell is if the hardware maker were to see a decrease in server and networking orders and if the server segment were to contribute a lower share of revenues going forward.

Final thoughts

Dell may not grow as quickly as Nvidia (NVDA) or AMD (AMD), but the company is seeing escalating demand for its AI-oriented servers, nonetheless, and the company has real growth potential here. Dell’s biggest advantage is that the potential for accelerating server revenue growth is not priced into the company’s shares yet, in my opinion. With an 11.8X P/E ratio, based off of FY 2026 earnings, I don’t believe investors are paying an outrageous multiplier here. Dell also raised its forecast for revenue and earnings, indicating that spending on AI products in the hardware market is going to remain high. As a result, I see an attractive risk profile for shares of AI and consider Dell to be an alternative to Super Micro Computer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL, SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.