Summary:

- Dell stock has outperformed Super Micro stock recently, closing the valuation bifurcation between them.

- Dell’s diversified ISG portfolio potentially helps to mitigate margin pressure in AI-optimized servers, underscoring its diversification.

- Dell benefits from core server refresh cycles and increased AI adoption, bolstering investor sentiments about its growth prospects.

- I explain why DELL’s improved AI thesis should lift the market’s confidence in its ability to gain more market share against its rivals. Read on to find out more.

Brandon Bell

Dell: Buyers Have Returned With Conviction

Dell Technologies Inc. (NYSE:DELL) investors have avoided a further battering as DELL’s August 2024 lows held firmly. As a result, dip-buyers have returned to lift the stock’s buying momentum, even as arch-rival Super Micro (SMCI) stock suffers to gain traction. Therefore, the valuation between SMCI and DELL has closed markedly, narrowing the previous valuation bifurcation between the leading competitors in the AI server infrastructure market. Coupled with Super Micro’s recent 10K filing delays, DELL’s relative outperformance against SMCI has been nothing short of breathtaking.

In my previous bullish update on Dell, I indicated why the company’s AI growth inflection looks promising. I also highlighted that the company is well-positioned in the AI server market, following the strong read from Super Micro’s earnings release.

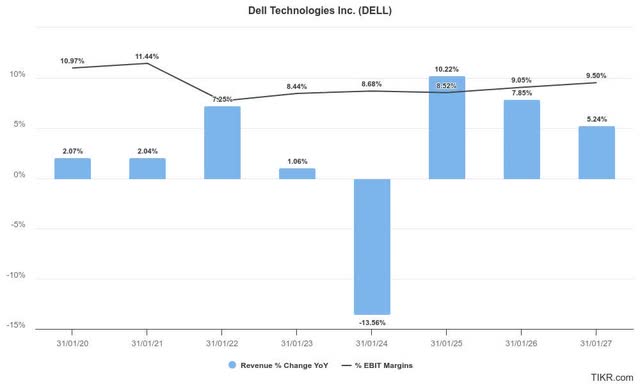

As a result, DELL has outperformed SMCI since February 2024, although its valuation is still assessed to be relatively attractive. Moreover, its well-diversified ISG portfolio has helped to mitigate the margin pressure it faces in the increasingly competitive AI-optimized servers business.

Accordingly, Dell has continued to gain market share as it seeks to outmaneuver its rivals in the enterprise and SMB space. In addition, Dell has also been making solid progress with tier-2 cloud service providers, underscoring its competitiveness. As a result, Dell has been able to mitigate the near-term profitability impact in its ISG business as it scales, bolstered further by its core “traditional” server business. Accordingly, Dell indicated that the company has observed a growth inflection in enterprise demand in its core server business, suggesting the weakness in enterprise demand has likely reached a nadir. Moreover, the continued strength in Dell’s nascent AI business should underpin the company’s ability to sustain its profitability growth inflection, potentially avoiding the significant profitability impact observed in SMCI’s thesis.

Dell’s AI Growth Supported By Its Core Server Business

I assess that I have understated Dell’s bullish proposition in its core server business. I was concerned whether the maturing opportunities in its “traditional” business could hamper a potentially more robust growth cadence in its AI server business. Notwithstanding my caution, Dell demonstrated its ability to deliver a growing backlog that reached $3.8B in its fiscal second quarter. Moreover, management emphasized that it recorded $3.2B in AI server orders “driven by tier-2 CSPs.” Hence, I assess that despite the unanticipated delays in the shipment of Nvidia’s (NVDA) Blackwell chips, Dell’s more robust enterprise base has proved its mettle.

Moreover, management is confident that the growing adoption in its enterprise base is still in the early stages. Therefore, despite the growth rates for hyperscaler demand potentially slowing through 2026, Dell’s ability to transition its current enterprise customers to its AI-optimized portfolio shouldn’t be understated. As a result, the company should demonstrate its ability to lift its AI-related margins as it faces off with Super Micro in the AI business.

Moreover, investors shouldn’t ignore Dell’s opportunities to target the “aging installed base” of its core server business. The need to drive higher efficiencies as enterprise customers invest in AI has spurred an impetus to initiate earlier hardware refresh cycles. Therefore, Dell is well-primed to benefit from the refresh cycles in core server infrastructure while positioning itself to gain more share against SMCI in AI server opportunities.

Dell’s Margins Are Expected To Remain Solid

I assess that the market seems increasingly confident in Dell’s capabilities to overcome its past tepid growth rates as it capitalizes on the core server refresh and growing AI backlog.

In addition, Dell’s ability to pay a forward dividend yield above its sector median underscores management’s confidence in its capital allocation strategies. Given its more well-diversified portfolio, this should underpin the market’s confidence that Dell could experience less profitability volatility than SMCI posted.

Wall Street’s estimates on Dell have also been lifted, boosting the company’s bullish proposition and potentially improving buying sentiments.

Is DELL Stock A Buy, Sell, Or Hold?

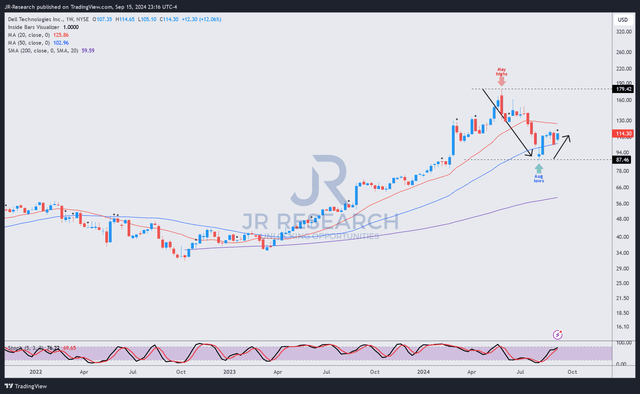

DELL price chart (weekly, medium-term, adjusted for dividends) (TradingView)

DELL’s price action suggests dip-buyers returned aggressively to help the stock bottom out in August. Its “B+” momentum grade corroborates my confidence in its ability to regain its uptrend bias, suggesting its August lows should hold decisively.

Moreover, its relatively attractive valuation suggests the stock isn’t overvalued. DELL’s forward adjusted PEG ratio of 1.17 is more than 35% below its sector median. Hence, I assess that the market has already reflected significant execution risks in its AI growth prospects as the company seeks to unhinge SMCI’s market leadership.

In addition, the market could also be worried about Dell’s transition risks from its core server business, potentially diluting its profitability margins further. Notwithstanding my caution, I have determined that the risk/reward on DELL still seems favorable.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI. NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!