Summary:

- Dell is integrating AI technology into its consumer products, such as laptops, to improve efficiency and productivity.

- The company’s financials show strengths in net income margin and cash flow, but weaker growth in EPS and revenue.

- The main concern for investors is Dell’s negative equity and high levels of debt, which may hinder its ability to finance long-term advancements in AI.

- Considering potentially no margin of safety in the current price, my analyst rating for Dell stock is a Hold.

NurPhoto/NurPhoto via Getty Images

Dell (NYSE:DELL) might be considered a good investment for exposure to consumer technology integrating AI, but I have concerns, particularly around its balance sheet, which prevent me from making an investment at this time, especially considering I estimate that the stock is trading at fair value.

Company Overview

For investors already acquainted with Dell, please skip ahead to the section ‘AI Operations.’

Dell was started by Michael Dell in his University of Texas dorm room in 1984. Since then, it has become a critical company in the technology industry, with offerings including hybrid cloud solutions and high-performance computing.

Dell Inc., a subsidiary of Dell Technologies, develops, sells, and repairs computers and products related to this. It is known for direct sales, and its acquisition of Perot Systems in 2009 marked Dell’s entry into the IT services market.

The company became publicly traded in December 2018, and Michael Dell is Chairman and CEO.

AI Operations

Dell is committed to integrating AI into its technology offerings, shown notably through its latest XPS lineup and its participation in CES 2024. Its XPS 16 and XPS 14 laptops have built-in AI features facilitated by its Intel Core Ultra processors that come equipped with a neural processing unit (‘NPU’). This integration allows AI acceleration on-device, improving performance without sole reliance on the central processing unit (‘CPU’) or graphics processing unit (‘GPU’). This particularly helps creators who are traveling, as it enables faster image editing while maintaining battery life for longer. Notably, XPS laptops also feature a built-in Copilot key, which gives easier access to AI companions in Windows 11. The net benefit to consumers from all of these advancements should be higher efficiency and productivity.

These features were showcased at CES 2024, and the XPS 16 stood out for its high-demand capabilities, armed with advanced processors and Nvidia GeForce RTX GPUs, providing up to 80W of sustained performance.

In 2024, the Dell Technologies World event will allow Dell to showcase its latest technology developments. It has this scheduled from May 20-23, 2024, at The Venetian in Las Vegas and will facilitate the discussion of continued advancements in AI.

Key Financials

While Dell’s adoption of AI makes it look well positioned to capitalize effectively on the growing trends in the technology markets, I think its present financials show considerable areas where investors might be wise to proceed with caution.

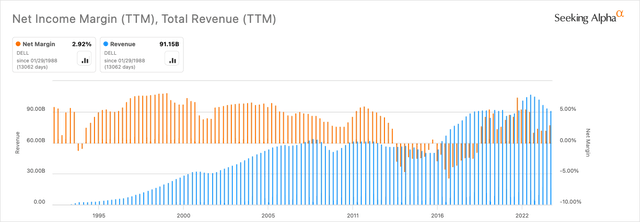

Starting with its strengths, Dell has a TTM net income margin of 2.92%, which is a 29.31% difference from the sector median of 2.26%. Additionally, its TTM cash flow from operations is $9.86 billion, an 11,961.89% difference from the sector median of $81.72 million, according to Seeking Alpha data. While this is likely due to smaller companies than Dell comprising the data set, we can also look at the forward price-to-cash-flow ratio, which is 7.87, a -66.03% difference from the sector median of 23.17, representing exceptional value.

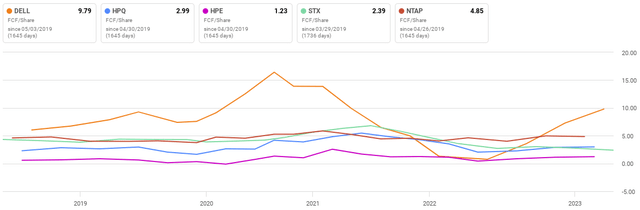

Compared to some companies that have a similar market cap to Dell, we can see it has an extremely competitive free cash flow per share over a long period, albeit with some volatility:

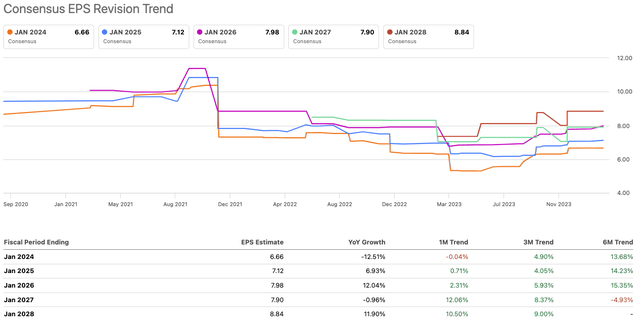

However, its growth is weaker, with forward EPS GAAP growth of -16.07% compared to the sector median of 5.97%. Its forward revenue growth of -2.91% is also significantly lower than the sector median of 6.59%.

Dell’s next earnings results are expected on the 29th of February, with an EPS GAAP estimate of $0.91 and an EPS normalized estimate of $1.72, 4.44% lower than the $1.8 reported in the same quarter last year. Dell’s financial year should close out strong, considering it has beaten expectations significantly in all previous quarters of the year.

Also consider the following chart, which shows generally upward revisions over the past six months for all future earnings estimates:

Balance Sheet Risk

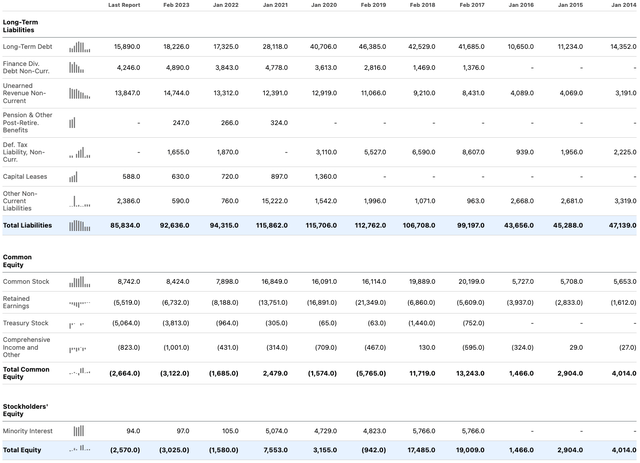

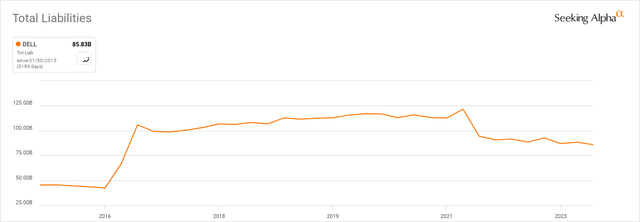

The largest risk with investing in Dell at this time in my opinion is its balance sheet. I think investors would be wise to consider that the company has negative equity on the books, with an equity-to-asset ratio of -0.03 at this time.

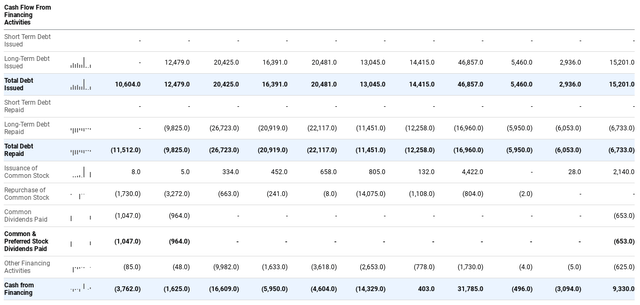

Debt is also issued every year by the firm but is paid down considerably each year, too, often at a rate higher than it is issued. While its total liabilities have been decreasing over the last few years, its liabilities level still remains high.

Seeking Alpha Author, Using Seeking Alpha

This creates a significant level of concern surrounding its ability to continue to finance long-term advancements in technology, specifically as AI is incredibly capital-intensive, and remaining competitive requires immense levels of free cash flow if building machine learning, LLMs, or assistant technology from scratch. The company seems to be stuck in a process of issuing and paying off debt to finance its expansions, and its relatively high free cash flow is useful in managing this. However, the company may find its debt repayments a priority if its net income depletes in the future. Simply, I think Dell is more positioned to collaborate and partner than to invest heavily in-house in advanced design related to AI, especially considering its relatively poor financial health. It may also look at acquisitions that could be inhibited by net income taken up by debt repayments in the future, not to mention low levels of debt financing capacity given its present negative equity-to-asset ratio. Nonetheless, I do not think Dell should be underestimated, and I think it may be able to find a strategic solution to this long-term, balancing decreases in its liabilities with effective investments in advanced technology trends.

Valuation

Dell also appears to be fairly valued at this time based on my discounted cash flow analysis, but it performs well in its price-to-earnings profile when compared against sector medians.

At the time of this writing, Dell has a forward P/E GAAP ratio of 22.14, which is a -19.34% difference from the sector median of 27.45. Its TTM P/E GAAP ratio is 23.32, a -18.95% difference from the sector median of 28.77.

For my discounted cash flow analysis, I considered the earnings estimates elucidated in my discussion of revisions above. I estimate, based on the above data and my own fairly optimistic outlook for Dell in an economy largely shifting toward higher digital usage over time, a 7.5% EPS without NRI growth rate as an annual average over the next 10 years. This also considers increases in efficiency as a result of the integration of automation within the business and the negative impacts of a weak balance sheet.

I also used a 4% terminal stage annual growth rate for 10 years following my 7.5% growth stage, an 11% discount rate, and a $6.26 EPS without NRI starting figure. My fair value came to $85, a 0.95% margin of safety on the present $84.21 stock price.

Conclusion

Investors will want to consider being careful that they do not buy into a company that is inhibited by its poor financial health at this time, primarily as a result of too many liabilities, in my opinion. While the valuation of the stock is compelling to some degree, I am certain that over the long term there are better technology investments out there. Short-term upside may be expected as a result of positive momentum and revisions, but beyond this, the future is less certain. My analyst rating for Dell stock is a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.