Summary:

- Dell’s stock has tripled in the past year, driven by its AI hardware segment.

- While Q1 earnings fell slightly short of sky-high expectations, the 30% drop in its share price may be overdone.

- Dell appears undervalued with a low forward P/E valuation and has substantial AI potential.

Michael Vi

Dell Technologies (NYSE:DELL) experienced a significant surge in its stock price, appreciating by nearly 500% ($31 to $179) from the bear market bottom in 2022 to its recent peak. Over the past year, Dell’s stock has nearly tripled, with the primary driver of this stellar growth being Dell’s AI ‘hardware division.’ Despite a robust 42% YoY growth in its server and networking segment, Dell’s Q1 earnings fell short of the market’s ultra-high expectations. This dynamic led to a significant drop in Dell’s share price, approximately 30% from its recent peak.

Dell’s recent ‘drop’ appears to be an overreaction. Moreover, Dell seems undervalued, considering its sub-15 forward P/E multiple and other valuation metrics. The potential of Dell’s server/AI business could be far greater than the market anticipates. Dell’s substantial growth prospects, profitability potential, discounted stock price, low valuation, and other factors have created a solid and secure long-term buying opportunity in Dell’s stock. I recently went long Dell’s stock and may continue adding for the long term.

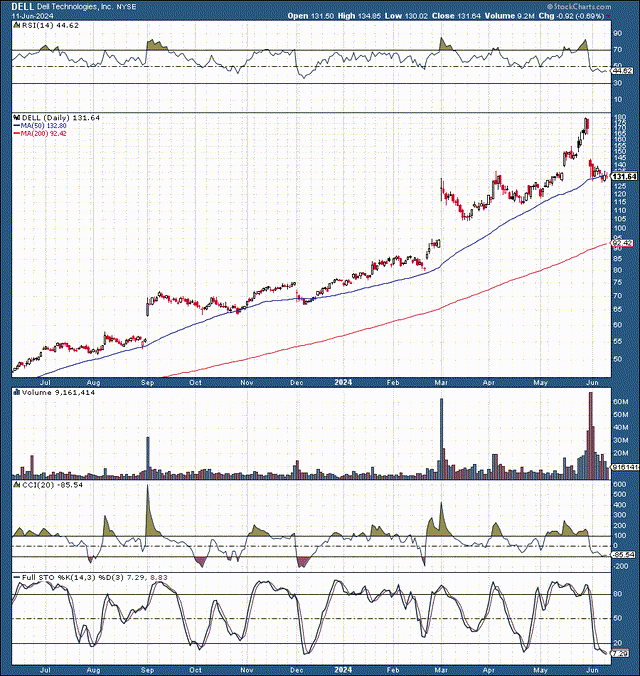

The Technical Image Remains Solid

DELL (stockcharts.com)

Dell’s stock has done an excellent job sticking around the 50-day MA, following a solid uptrend recently. Still, Dell’s stock more than tripled over the last year and became significantly overbought before the recent earnings announcement. Subsequently, we saw a considerable decline once Dell reported earnings and guided slightly lower than Wall Street expected.

The recent selloff was extreme, shaving nearly 30% off Dell’s stock price. We witnessed record volume, and the stock returned to the 50-day MA. Now, Dell’s stock is stabilizing, and the full stochastic is trending below eight here, suggesting there is a high probability for a positive shift in momentum that could drive Dell’s stock higher again soon.

Dell’s Q1 Earnings Overreaction

Dell announced a non-GAAP EPS of $1.27, which was a two-cent miss. Revenue came in at $22.2B, a $550M beat (6.2% YoY increase). Infrastructure Solutions Group revenue was $9.2 billion, up 22% YoY, with record servers and networking sales of $5.5 billion, up 42%. Diluted EPS was $1.32, up 67% YoY, and TTM cash flow from operations was $7.9B.

Despite the slight miss in EPS, Dell’s sales expanded more significantly than expected, indicating the company’s continued momentum. The 42% surge in services and networking revenue is a strong indicator of the growing demand for Dell’s AI solutions. This suggests that Dell’s AI sales have the potential to continue increasing, growing into a significant revenue stream in the future.

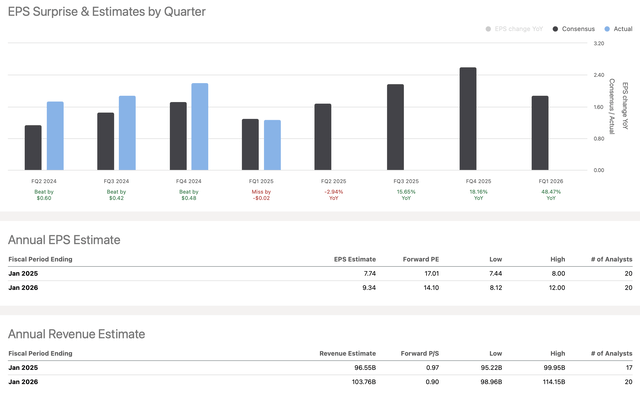

Dell’s EPS Likely To Expand

EPS vs. estimates (seekingalpha.com )

This year’s EPS should be around $7.75, and next year’s consensus estimate is for EPS of about $9-10. Moreover, higher-end estimates range up to $10-12. Dell delivered $7.09 in EPS over the TTM period, while the consensus estimate was $5.51, illustrating an excellent 29% outperformance rate.

The fiscal 2025 consensus EPS estimate is $7.74, but if Dell beats by a modest 15%, it could earn around $8.90 this year. Moreover, if Dell beats by a similar margin in fiscal 2026, it could earn around $10.75 next year. This dynamic implies that Dell may trade around 12-13 times next year’s earnings, which is relatively cheap for a company in Dell’s position.

Dell’s AI Advantage

Dell is an AI innovator who has looked ahead and embedded AI in many of its products to improve them. Moreover, Dell is a significant provider of IT infrastructure, and its early adoption of AI technologies places Dell in a prime position to capitalize on the stellar growth in the lucrative AI/enterprise/server segments.

Dell has partnered with Intel (INTC), Nvidia (NVDA), and many other market-leading companies, enabling it to diversify its AI solutions and deliver them to a broad range of customers globally.

Dell’s precision workstations have the power to deploy and manage comprehensive AI platforms, including machine learning, generative AI, and computer vision. Dell’s AI solutions help provide efficiencies, innovation, and faster outcomes for customers globally.

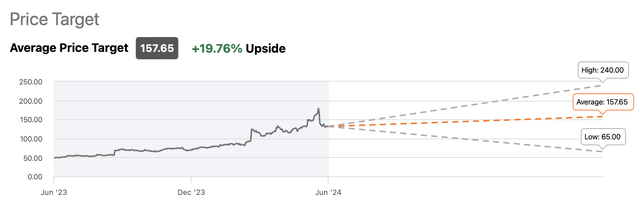

What Wall Street Thinks

Price targets (seekingalpha.com)

The average price target on Wall Street is around $158, roughly 20% above its current stock price. Moreover, higher-end estimates go up to $240, representing an upside potential for approximately 85% gain in the next 12 months. While $240 may be aggressive, there is a solid probability that Dell could reach approximately $200 by year-end (in my view).

Where Dell’s Stock Could Be In Future Years

| Year | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $98 | $112 | $122 | $133 | $144 | $155 |

| Revenue growth | 11% | 14% | 9% | 9% | 8% | 8% |

| EPS | $8 | $10.50 | $13 | $15 | $17 | $19 |

| EPS growth | 12% | 31% | 24% | 15% | 14% | 12% |

| Forward P/E | 17 | 18 | 19 | 20 | 19 | 18 |

| Stock price | $180 | $234 | $285 | $340 | $370 | $400 |

Source: The Financial Prophet

Due to the strong demand for Dell’s AI/server market solutions and other products and services, we could see solid sales growth in the future. Moreover, Dell should become more efficient and profitable due to increased AI-related sales and general optimization improvements due to AI advancements. Therefore, sales and EPS could increase more than expected, leading to considerable multiple expansion and a higher stock price in future years.

Dell Has Risks

Despite my bullish assessment, Dell has risks. Dell is primarily a hardware company and faces a challenging landscape with competition and relatively low margins. Moreover, there are risks on the macroeconomic side. A slowdown in the economy could negatively impact demand for Dell products. Also, a tighter-than-expected monetary environment could negatively affect Dell’s bottom line. Dell could also face margin pressure in its AI/enterprise segment, leading to worse-than-anticipated profitability and other detrimental factors. Investors should consider these and other risks before investing in Dell.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!