Summary:

- Dell Technologies’ stock has rebounded from its recent low, driven by strong earnings and AI enterprise growth, making it a solid investment.

- Dell’s re-entry into the S&P 500 and robust sales growth position it for multiple expansion and a higher stock price.

- Dell’s forward P/E ratio is undervalued at below 12, with the potential to reach 15-17, implying a stock price of $150-$170.

- Wall Street’s average 12-month price target for Dell is $148, with potential upside to $220, highlighting a favorable risk/reward profile.

Hispanolistic

We discussed buying Dell Technologies (NYSE:DELL) stock in early August, as its stock dropped below $90 during the late summer growth scare. While the stock has remained volatile, Dell has made a solid comeback, appreciating by approximately 35% from its recent low. Dell recently reported earnings, delivering better-than-expected results and illustrating that the AI revolution is alive and well in the hardware enterprise segment.

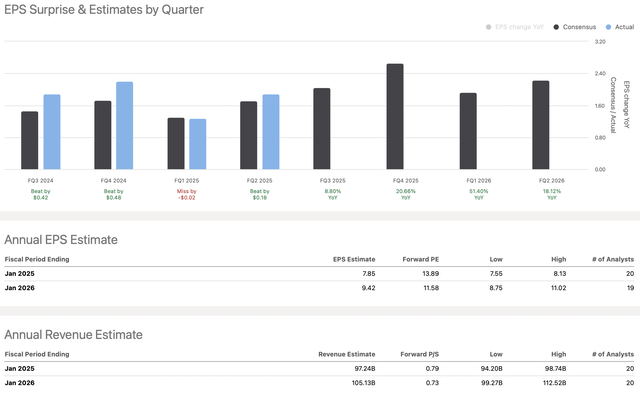

Moreover, Super Micro Computer “SMCI” (SMCI), one of Dell’s primary AI enterprise competitors, faces issues, a dynamic that may benefit Dell in the long run. Additionally, Dell was recently added to the S&P 500, a positive catalyst moving forward. Dell also has a robust sales and profitability growth momentum. Dell’s consensus EPS estimate for next year is about $9.50, illustrating its forward P/E ratio is below 12, which is exceptionally cheap for a company in Dell’s position.

Furthermore, Dell has become accustomed to surpassing consensus forecasts and could outperform estimates as we advance. Due to its advantageous market-leading position, Dell will likely continue expanding revenues, leading to better profitability, multiple expansion, and a considerably higher stock price in the coming years.

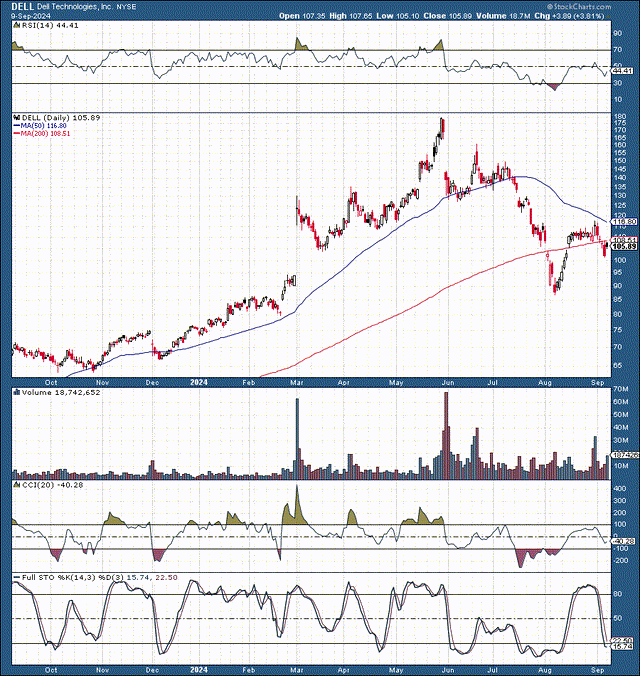

Dell’s Improving Technical Image

Dell’s stock experienced an extensive correction. In fact, its 52% peak-to-trough decline can be considered a crash, but primarily, the steep decline accounts for the hot air that was in the stock when it went vertical around mid-year. After stabilizing, Dell’s stock had a robust recovery and is now consolidating around the crucial $100-$115 range. Despite the recent volatility, Dell’s valuation appears cheap here. Therefore, the downside may be limited, and the stock likely won’t remain at these depressed levels for long.

Dell’s Earnings Tell A Compelling Tale

EPS vs. estimates (seekingalpha.com )

Dell reported EPS of $1.89, beating by 18 cents (roughly 11%). Dell’s sales growth shined, as the company reported revenues of $25.03B, a $910M beat (4%), which is quite significant and impressive. Dell’s Infrastructure Solutions Group provided revenue of $11.6 billion, up 38% year over year, with record servers and networking revenue of $7.7 billion (enterprise AI), up 80% YoY.

Dell has also done a solid job surpassing most earnings estimates recently. For instance, Dell’s TTM consensus EPS estimate was $6.18, but Dell earned $7.24 instead, a considerable 17.5% outperformance. Due to the bullish dynamic, Dell could continue outperforming, and a modest 10-15% outperformance rate implies Dell could earn around $10-40-$10.80 next year, potentially pointing to a sub-10 forward P/E multiple for Dell.

SMCI’s Pain May Be Dell’s Gain

SMCI, Dell’s primary competitor in the AI enterprise hardware space, faces issues. A short report recently dented confidence in SMCI’s stock, which was exacerbated by the company’s statement that it will miss its 10K filing deadline. These events have put considerable pressure on SMCI’s stock and could have broader, longer-term implications. Due to the uncertainty surrounding SMCI, Dell may gain customers as clients move away from the SMCI volatile experience to a more predictable and stable Dell atmosphere. Dell’s stock could benefit as more investors pick Dell for exposure in the lucrative AI enterprise hardware space.

Induction Into The S&P 500

On September 23, Dell will replace Etsy (ETSY) in the S&P 500 index. After many years of being included in the index, Dell lost its place in the S&P 500 when it went private, but it’s finally regaining its spot in the coveted stock index. Being in the S&P 500 is highly favorable for Dell, as fund managers who require a stock to be in the S&P 500 will now invest in Dell. This dynamic should enable Dell’s P/E ratio and other multiples to expand, leading to a higher stock price in the coming years.

Dell’s forward P/E ratio could expand to about 15-17 from the current depressed 10-12 ratio. Given that Dell could earn around $10 next year, a 15-17 forward P/E ratio implies that Dell should trade around the $150-$170 range. Currently, Dell is around $100 and has a roughly 50-70% upside potential to achieve its higher multiple range.

Wall Street Ratings – Dell Is A Strong Buy

Price targets (seekingalpha.com )

Incidentally, the average 12-month price target on Wall Street is around $148, roughly 50% above Dell’s current price. Also, the lowest price targets are around Dell’s depressed current prices, suggesting that the downside is likely minimal now. On the upside, we see higher-end price targets going up to $220, implying the potential for a more than 100% return in the next twelve months in a bullish case outcome. Therefore, based on Wall Street’s price estimates and other factors, Dell has a highly favorable risk/reward profile.

Where Dell’s stock could be in the future:

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $98.5 | $110 | $119 | $128 | $139 | $148 |

| Revenue growth | 11% | 12% | 8% | 9% | 8% | 7% |

| EPS | $8 | $10.20 | $12.20 | $14.40 | $16.85 | $19.20 |

| EPS growth | 12% | 28% | 20% | 18% | 17% | 14% |

| Forward P/E | 15 | 16 | 17 | 17 | 16 | 15 |

| Stock price | $153 | $195 | $245 | $287 | $308 | $325 |

Source: The Financial Prophet

Due to Dell’s growth in the AI enterprise space, a likely constructive cycle in its computer business, and other favorable factors, we could see solid sales growth in future years. Additionally, Dell’s AI segment continues to improve its general profitability. Dell will also likely benefit from future efficiency increases. Therefore, Dell could go through a period of considerable EPS growth. This dynamic could lead to multiple expansion, as Dell’s forward P/E ratio could grow into the 15-17 range or higher, resulting in a substantially higher stock price in future years.

Risks to Dell

Dell faces risks due to macroeconomic factors, competition, and other elements. A slower-than-anticipated economy could harm Dell’s legacy computer business and AI segment. Worsening growth in the AI space could impact Dell’s stock very negatively. Moreover, Dell faces competition from SMCI and other competitors in the enterprise AI space. The higher interest rates for longer policy can also hurt sales and cause growth to decrease. Investors should examine these and other risks before investing in Dell.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!