Summary:

- Dell posted another strong quarter of profits in August.

- Shares remain a bargain given healthy out-year EPS estimates.

- I outline key price levels to monitor ahead of the Q3 2025 earnings report and take a look at what the options market suggests.

JHVEPhoto

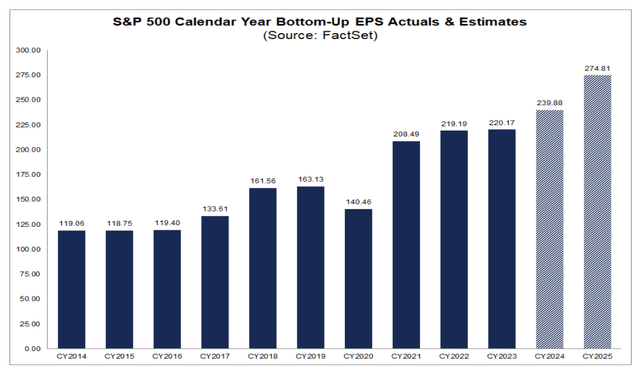

With the bulk of the Q3 earnings period in the books, we are getting a firmer feel for what FY 2024 S&P 500 EPS will be. The number is about $240, with out-year consensus forecasts targeting nearly $275 of non-GAAP per-share earnings.

Much of the profit gain will come from the high-margin, high-growth Information Technology sector, though the year-on-year increase from the tech space could be a bit lighter compared to strong trends in the past handful of quarters.

One firm poised to step on the EPS gas is Dell Technologies Inc. (NYSE:DELL). I reiterate a buy rating on this GARP stock, but note that shares are closer to fair value today compared to when I last looked at the Texas-based company last summer. I will also dig into the upcoming earnings report and provide a refresher on DELL’s technicals.

S&P 500 Bottom-Up EPS Estimates: Current & Historical

Back in August, DELL reported a solid set of quarterly results. Q2 non-GAAP EPS of $1.89 topped the Wall Street consensus target of $1.71 while revenue of $25.0 billion, up 9% from the same period a year earlier, was a large $910 million beat.

DELL recorded record sales from its Infrastructure Solutions Group ($11.6 billion), noting a massive 38% year-on-year jump in that segment. Networking revenue was even better at a +80% Y/Y increase to $7.7 billion. A blemish was its Client Solutions Group sales of $12.4 billion, which was down 4% from Q2 of its FY 2024. In net, DELL’s diluted EPS of $1.17 was +86% from the previous year.

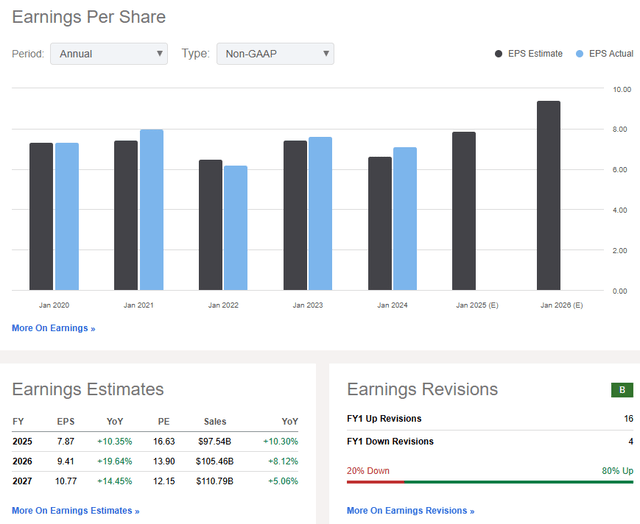

Shares rallied by 4.3% in the session that followed, and it marked the 9th out of the last 10 beats on the bottom line. Looking out to the Q3 report, Seeking Alpha shows a consensus operating EPS estimate of $2.04 of non-GAAP EPS which would be a 9% annual increase while revenue of $24.7 billion would mark an 11% Y/Y advance.

As it stands, the options market prices are in a high 9.1% earnings-related stock price swing between now and when DELL reports later this month – that’s above the historical implied move of 7.4%, according to data from Option Research & Technology Services (ORATS).

On the earnings outlook, analysts expect DELL’s EPS to rise 10% this year with a very strong 20% profit climb in the out year. By its FY 2027, the sell-side projects more than $10 of operating per-share earnings. Revenue growth is also stout – better than 10% this year, then gradually dipping into the mid-single digits by FY 2027.

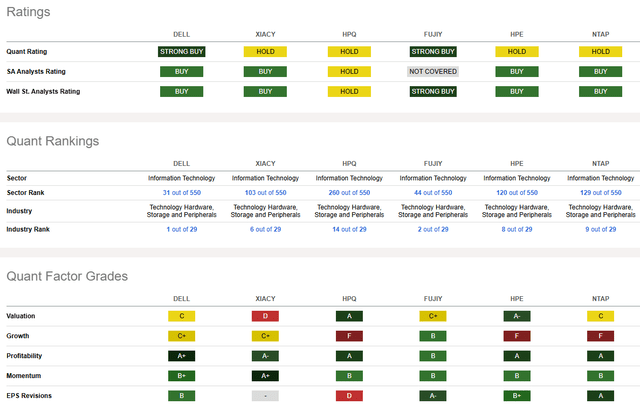

I also like how Wall Street analysts have become more sanguine on DELL’s EPS trajectory – there have been a high 16 earnings upgrades in the past 90 days compared to just four downgrades. With hearty profitability trends, underscored by $4.72 of free cash flow per share over the past 12 months, DELL is now ranked No. 1 out of 29 in its industry, per Seeking Alpha’s quantitative scoring system.

DELL: Revenue & Earnings Outlooks, EPS Revision Trends

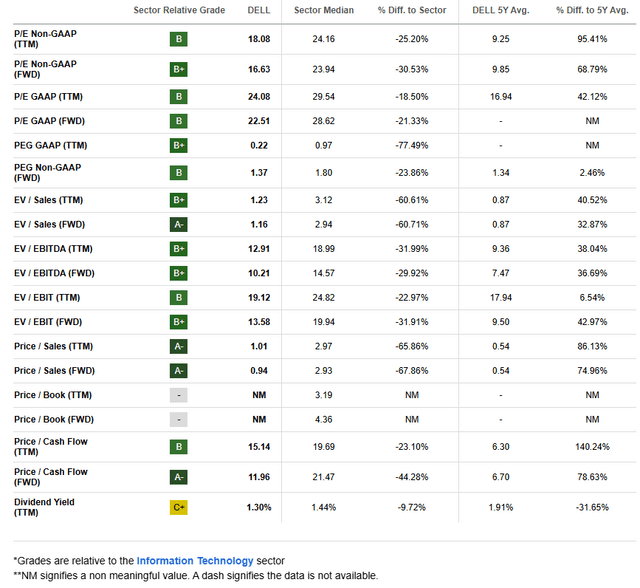

On valuation, not too much has changed since my summer analysis, but the period shift results in a higher assumed operating EPS amount over the coming 12 months. If we assume $9.10 of per-share earnings and apply the same 16x multiple (which I assert may be conservative given the EPS trend), then shares should trade near $146, which is a $10 bump up from my previous assessment.

For grins, a 16x multiple of $10.77 of FY 2027 EPS yields a price objective as of the end of next year of $172. The point being, shares have added upside potential. DELL also trades cheaply on a price-to-sales basis.

DELL: Attractive Valuation Multiples

Key risks include a weaker enterprise spending environment if we see a macro slowdown. The same risk applies to the consumer, which is key to DELL’s PC business. Rising competition in the Technology Hardware, Storage, and Peripherals industry could also pressure margins, which would threaten the stock’s P/E multiple. Finally, uncertainty regarding how the AI theme plays out in the year ahead is a risk.

Competitor Analysis

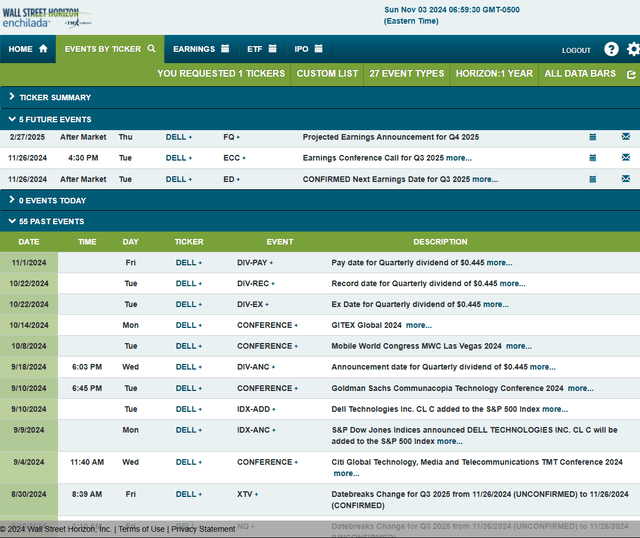

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2025 earnings date of Tuesday, November 26 after market close with a conference call immediately after the results cross the wires. There are no other volatility catalysts on the calendar.

Corporate Event Risk Calendar

The Technical Take

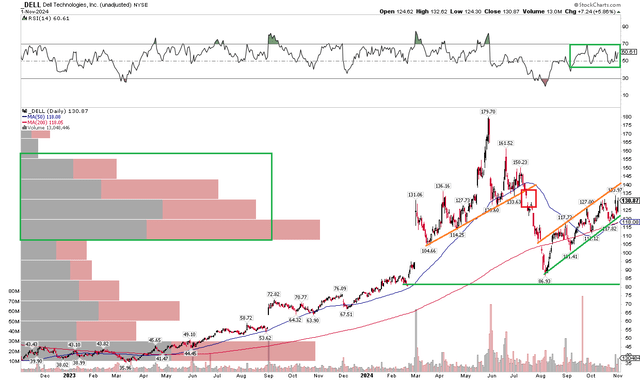

With shares undervalued and high earnings growth expected next year, DELL’s technical situation is mixed. Notice in the chart below that the stock held the $80 mark that I noted last time, and we’ve seen a steady climb since August. Today, the long-term 200-day moving average remains upward-sloping while the RSI momentum oscillator at the top of the graph ranges in a bullish zone above 40.

I pointed out in August that an upside gap of $135 was a potential target. Shares just about filled that gap with precision – the October high was $133.97, and DELL closed last week not too far under that mark. Now, with a high amount of volume by price in the current area, the onus is on the bulls to continue the trend of higher highs and higher lows. Both the 200dma and rising 50dma might act as support for around $118, while $136 and $150 are possible resistance points to monitor.

DELL: Near-Term Uptrend, $135 Gap Looms, Rising 200dma

The Bottom Line

I have a buy rating on DELL. I see the stock as undervalued with strong EPS growth over the coming periods. Its chart remains attractive ahead of earnings later this month.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.