Summary:

- Dell Technologies Inc. is experiencing a sequential improvement in their ISG and CSG segments, with a growing backlog driven by demand for AI infrastructure.

- Management remains optimistic about the demand for AI-enabling infrastructure as enterprises seek to enhance their own data centers for AI applications.

- I anticipate storage, networking, and device sales to follow improving server growth as enterprises seek to optimize and debottleneck their IT infrastructure.

Justin Sullivan

Dell Technologies Inc. (NYSE:DELL) reported a sequential improvement across their ISG and CSG segments, with AI infrastructure building backlog. In tandem with other IT infrastructure manufacturers, Dell is experiencing a challenging networking equipment market as CIOs focus on cost-savings initiatives across their respective IT departments. I believe this can lead to a strong tailwind in the back-half of eFY25 through eFY26 as CIOs will seek to implement AI/ML applications for performance optimization, leading to the need for more storage capacity and higher networking speeds. Given my growth expectations, I provide DELL shares a BUY recommendation with a price target of $134.82/share.

Do note that DELL shares are undergoing a retracement wave pattern on a tactical basis and may offer an opportunity to buy in at a better price. Please read my technical analysis at the end of this report for more information relating to the trade.

Operations

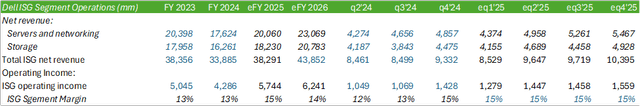

Dell Technologies ended FY24 flatfooted with total revenue down -14% y/y with some signs of a turnaround across their segments. With the advent of AI-enabling infrastructure coming into play, management voiced headwinds to revenue growth in the face of GPU supply bottlenecks that have already been voiced across the server and infrastructure building and integrations industry. This has led to Dell reporting a growing backlog that has ballooned to $2.9b, driven by customer demand for the Nvidia (NVDA) H100, H200, H800, and the Advanced Micro Devices (AMD) MI300X. This can be viewed as an optimistic sign for Nvidia and Taiwan Semiconductor (TSM) shareholders alike.

We are also seeing strong interest in orders for AI-optimized servers equipped with the next generation of AI GPUs, including the H200 and the MI300X.

Jeff Clarke, Dell COO.

Management remained optimistic about demand for AI-enabling infrastructure as more enterprises will seek to develop and utilize their own data on their own infrastructure for AI applications. I believe that the majority of enterprises will leverage their private data centers as managing these large data sets can be costlier when hosted and utilized in the public cloud. That being said, there may be some near-term challenges that might drive more firms to leverage public cloud infrastructure.

Given the server industry’s challenges in sourcing enough GPUs to meet the market demand, an enterprise may opt to jump-start their AI training and development through a public cloud platform rather than wait for these next-gen servers to become available. A point worth mentioning that I discuss in my report covering Nvidia is that Taiwan Semiconductor is doubling their CoWoS capacity to cater to the heightened demand for accelerator chips. The downside is that this capacity isn’t expected to come online until late CY24.

It’s where the data is. 83% of all data is on-prem. We think AI moves to the data. More data will be created outside of the data center going forward than inside the data center today. That’s going to happen at the edge of the network. A smart factory, an oil derrick or platform, a deep up mine, all variations of this. We believe AI will ultimately get deployed next to where the data is created driven by latency.

Jeff Clarke.

This presumption is shared with Patrick Gelsinger, CEO of Intel (INTC) who is designing their own next-generation AI-enabling chips. I believe that there will inevitably be a modest split between on-prem and cloud-hosted AI applications in development as enterprises will seek to both keep data secure and provide the convenience of mobility through the public cloud. By association, hyperscalers such as Oracle (ORCL) and Microsoft (MSFT) are constructing a large array of regional data centers for hosting these massive data sets to cater to both corporate and sovereign governments. As management at both Dell and Oracle has pointed out, sovereign government bodies are an untapped market with a large interest in developing and utilizing AI applications.

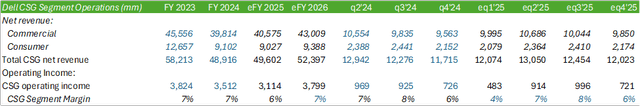

Aside from AI infrastructure, Dell’s operations fell to the same fate as Hewlett Packard Enterprise (HPE) as legacy server, storage, and networking equipment remained in inventory as companies have exhibited less urgency in initiating new projects. I believe that there may be more pain across these segments as enterprises are prioritizing cost-saving projects, which may lead to deferment of new devices and legacy data center equipment. Gartner’s 2024 forecast for IT spend was relatively mixed with strong growth across software, IT services, and data center systems, and anticipated slow growth for communications and devices. The research firm suggests that there will be very little IT spending towards GenAI in 2024; however, they do anticipate organizations to invest in AI and automation to enhance operational efficiencies. Gartner anticipates spending towards GenAI to begin taking part in IT budgets beginning in 2025 with 2024 laying out the foundational work.

I believe this roadmap aligns with the verbiage management at Dell laid out in their q4’24 earnings call as enterprises are seeking to source the infrastructure necessary to develop these applications. Dell experienced 40% sequential growth in AI-optimized server sales driven by the ramp-up of their new PowerEdge XE9680 server, powered by the AMD MI300X. Due to the heightened demand for their higher capacity servers and the headwinds in GPU sourcing, this heightened demand nearly doubled Dell’s backlog. This level of interest suggests that enterprise customers are laying out the foundation for their push towards AI/ML applications that will play into other infrastructure and services offered at Dell. In terms of market breadth, management anticipates AI infrastructure to reach a total addressable market, or TAM, of $152b by 2027, up from $72b in 2023.

Management alluded to the fact that as enterprises develop their AI capabilities, more storage will be required for these larger, unstructured data sets. I believe that this may also drive networking equipment sales for higher gig-rate routers as older legacy routers may create data congestion and latency as larger data sets will be in transit. In terms of financial modeling, I anticipate CIO’s spending to cascade over time and not be all at once. What I mean by this is that they will fulfill their needs for server capacity, storage space, and finally networking equipment as latency may need to be experienced to justify the upgrade.

On the PC side, I do not believe AI PCs will take off this year as a growth driver. I believe that with the high inflation rate consumers are faced with throughout their daily lives, PC refreshes may be delayed or pushed out to next year. I believe corporate devices will also experience headwinds as CIOs are seeking to manage costs across the department and may not consider an edge device as an urgent need, especially if their inhouse AI features are not expected to be built out until 2025 at the earliest.

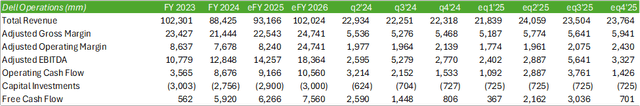

Modeling out the financials, I anticipate margins to face some headwinds as management had alluded to on their FY24 earnings call with a recovery in e2h25 and a further tailwind in eFY26. I believe that as the semiconductor manufacturing process debottlenecks and more capacity comes online, Dell will be able to fulfill their backlog and convert it to revenue. I also anticipate the demand for networking and storage infrastructure to follow suit as CIOs gain more line-of-sight for their departments, assuming economic conditions turn positive. Lastly, I further anticipate the consumer PC market to shift towards the end of CY24 or early CY25 as consumers face an inflationary market relating to the daily cost of living.

Valuation & Shareholder Value

DELL offers substantial shareholder benefits in the form of buybacks and dividends. In q4’24, the firm repurchased 11.2mm shares and paid out $0.37/share in dividends. Management announced a 20% increase to the quarterly dividend for an annualized rate of $1.70/share. Management outlined their plan to return 80%+ of adjusted free cash flow to shareholders through dividends and buybacks as part of their long-term strategy. I believe that as the firm experiences longer-term tailwinds resulting from AI infrastructure adoption, Dell will continue to increase the dividend to retain shareholder interest as well as increase their buybacks.

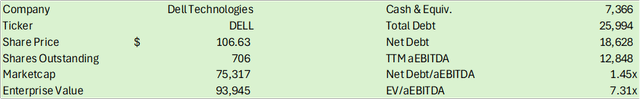

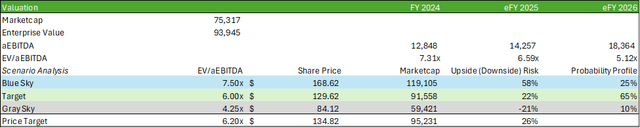

Though I anticipate eFY25 to be a mixed bag in terms of management’s value drivers, I do expect the near-term headwinds to be resolved in either the latter part of CY24 or early CY25. Considering my expectations for strong growth and margin expansion in eFY26, I believe Dell’s valuation will reflect the firm’s operational excellence. I provide DELL shares a BUY recommendation with a price target of $134.82/share.

For the blue-sky scenario to occur, I believe Dell will need to experience significant tailwinds in the consumer AI-enabled PC space as well as faster-than-expected debottlenecking of GPU capacity. The gray-sky scenario would suggest a softer-than-anticipated PC market paired with further economic headwinds and IT projects being further pushed out.

Looking at DELL shares from a tactical perspective, the stock appears to be forming a retracement trend since their strong returns at the beginning of March post-earnings release. Using Elliot Wave Analysis, I believe shares will trend down to ~$95/share before reaching their inflection point to reach $134.82/share. I believe this downtrend will be an opportune time for those that have not yet built a position. Assuming shares reach that $95/share point prior to my price target, we can see an upside risk of 42%, holding all else equal.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.