Summary:

- Dell Technologies’ 11% post-earnings sell-off is an overreaction, presenting a strong buying opportunity.

- The company’s ISG segment is thriving, driven by AI server demand, with a 34% revenue increase and 41% operating income growth.

- Dell’s forward P/E ratio and DCF model indicate significant undervaluation, with a fair share price 24% higher than the current market price.

- Despite competitive pressures, Dell’s robust fundamentals and strategic AI initiatives position it well to capitalize on the AI megatrend.

Lina Moiseienko

Introduction

Dell Technologies (NYSE:DELL) has just released its FQ3 2025 earnings, and the market reacted with an 11% post-market sell-off. This was unfair in my opinion because there are multiple robust indications that the company is fundamentally strong and is able to capitalize on secular AI tailwinds. DELL stock is 24% undervalued after the post-earnings sell-off, making it an apparent ‘Strong buy’.

Fundamental analysis

It is the first time I am covering DELL, so I have to start with a short introduction to the company’s business. DELL is a global technology company operating through its two main business lines: the Infrastructure Solutions Group (‘ISG’) and Client Solutions Group (‘CSG’). The ISG segment includes enterprise servers, storage, and networking solutions. The CSG segment offers the market PCs and peripherals.

CSG is the company’s legacy business and is the largest from a revenue perspective. On the other hand, the gap between DELL’s two business lines is closing rapidly due to the ongoing AI revolution. The ISG segment capitalizes on the AI megatrend by offering AI servers for data centers.

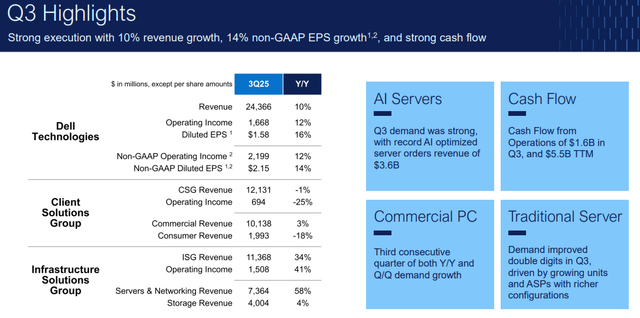

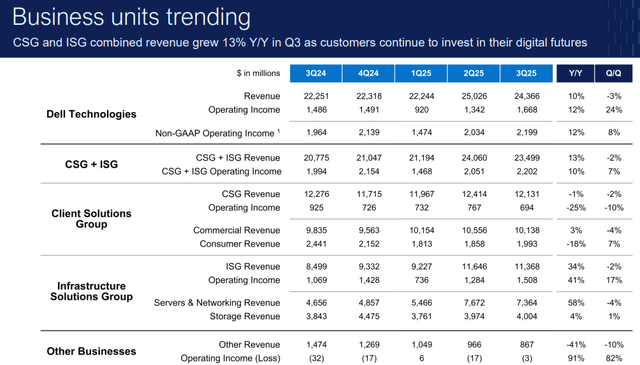

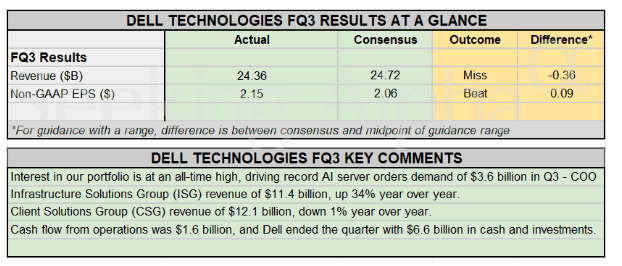

The Q3 FY2025 earnings release is fresh, just posted yesterday. During the quarter, the ISG revenue soared by 34% while the CSG slipped by 1%. On a consolidated level, FQ3’s $24.4 billion revenue was 10% higher on a year-over-year basis but fell short of the consensus estimates of around $24.7 billion. I think that the revenue miss together with the CSG segment’s relative weakness were two primary reasons why the stock plunged by around 11% after earnings.

SA

I think that the market overreacted, let me explain this. A $36 million revenue miss looks like nothing for a company that generates $24.4 billion in quarterly revenue, a 0.14% deviation. For long-term investors like me, the ability to deliver operating leverage is far more important than just a one-off subtle revenue miss.

DELL delivered a notable non-GAAP EPS improvement on a year-over-year basis, from $1.88 to $2.15. And this was achieved not due to some extraordinary events, but thanks to the operating leverage. The company’s consolidated operating income grew 200 basis points faster on a year-over-year basis, compared to a 10% revenue growth. What is even more important is that the thriving ISG segment’s operating income is soaring far ahead of revenue, with a 41% year-over-year growth. This compares to the segment’s 34% year-over-year revenue growth.

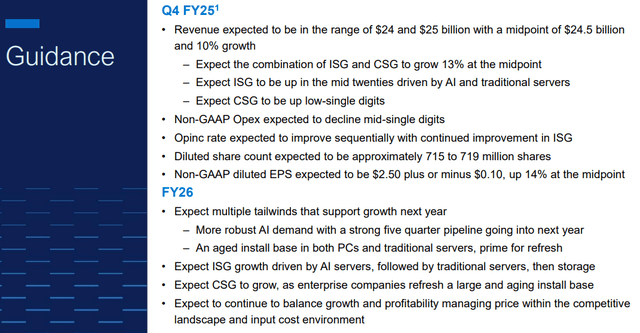

I share the management’s optimism demonstrated in the solid FQ4 2025 and FY2026 guidance. The demand for AI servers is robust, and there are no indications that the aggressive data center spending by mega caps is cooling. When I state by bullishness about the AI server demand, I rely on Citi’s forecast that data center capex will grow by at least 40% in 2025.

The earnings call also provides some quite useful insights about DELL’s prospects in AI. The company launched several new AI-optimized products, which mostly include server racks. There is an ‘AI Factory’ initiative that aims to accelerate AI innovation and adoption. The AI Factory focuses on supporting both enterprise and SMB customers by providing comprehensive AI solutions from large-scale data centers to AI PCs.

DELL demonstrates its strong ability to generate benefits from strong AI tailwinds, which underscores the company’s technological edge. The management realizes that DELL cannot afford this strong industry momentum slip, and strong Q3 AI servers revenue growth together with the management’s initiatives around AI make me very bullish. Strong operating leverage demonstrated by the ISG segment is another solid reason to be bullish.

Valuation analysis

Based on my fundamental analysis, DELL looks like a compelling investment opportunity. On the other hand, taking into account valuation before making a sound investment decision is vital. The stock dropped by 11.3% post-market after the earnings release, and I want to compare how this plunge looks against the fair value.

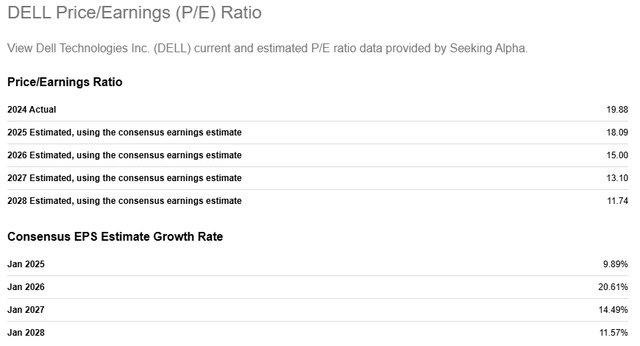

The forward P/E ratio dynamic looks quite good from the valuation perspective. The company is expected by consensus to drive solid EPS growth, which will lead to a notable P/E ratio compression over the next few years. Moreover, the starting point looks quite conservative as well, with an actual 2024 P/E ratio of around 20.

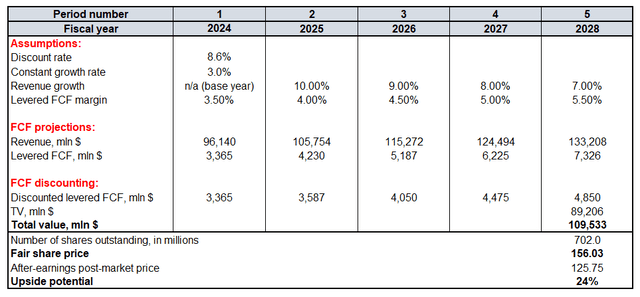

The DCF model is a useful tool to project a stock’s fair value. DELL’s WACC is 8.6%, and this one will be used to discount future cash flows. For FY2025 revenue assumption, I have actual FQ1-FQ3 revenue of $71.64 billion plus the management’s FQ4 $24.50 billion guidance mentioned before. This gives me FY2025 revenue forecast at $96.14 billion. Since data center tailwinds are expected to remain strong in calendar 2025, I project the same 10% consolidated revenue growth in FY2026. I am a conservative investor, and incorporating a 100-basis points revenue growth rate decrease looks prudent. The TTM levered FCF margin is 3.5%. The above table suggests that a solid EPS growth is projected, which will highly likely help to drive FCF margin growth as well. Therefore, projecting a 50-basis point yearly improvement is fairly conservative.

Despite AI tailwinds, I apply a conservative 3% constant growth rate because the legacy CSG revenue still represents around half of consolidated sales. According to Seeking Alpha, there are 702 million outstanding DELL shares.

The recommended fair share price is $156. The fair share price is 24% higher compared to the November 26 post-market DELL price, meaning that the after-earnings sell-off represents a solid buying opportunity from the valuation perspective.

Mitigating factors

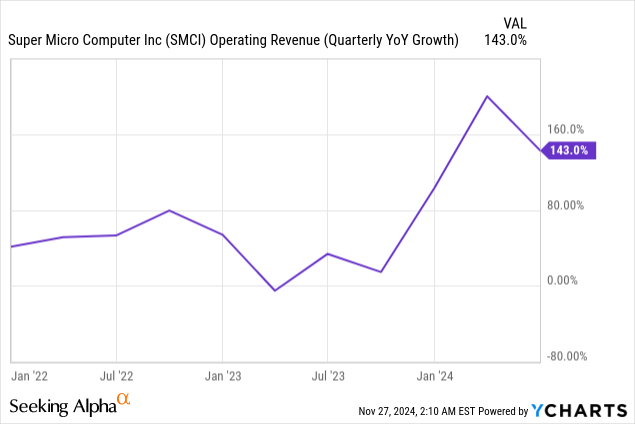

The AI servers’ market is competitive. There is another remarkable player in the game, Super Micro Computer (SMCI). This company is laser focused on AI servers only, which is DELL’s competitive weakness in this case as the management has to diffuse its focus between two segments. SMCI’s revenues have been soaring since the AI started booming from early 2023, meaning that it is a really tough competitor.

SMCI is not the only player as there are several other AI server manufacturers. This competition puts pressure on profitability, which we see from DELL’s quite thin 3.5% TTM FCF margin. Any adverse developments in the supply chain might diminish this thin margin closer to zero, which will significantly undermine DELL’s valuation. Moreover, the market’s after-earnings disappointment might last until the next earnings.

Conclusion

DELL is one of the large AI beneficiaries, and the stock is very attractively valued after the post-earnings sell-off. I believe that the market overreacted, as DELL is a fundamentally strong company and demonstrates solid ability to capitalize on the AI megatrend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DELL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.