Summary:

- Dell Technologies Inc.’s infrastructure segment grew 34% YoY, driven by AI and cloud demand, with exceptional growth in servers and promising storage business.

- Despite a 12% stock drop post-Q3 earnings, I see a massive overreaction and added to my position, targeting $140.

- Dell’s market leadership in AI infrastructure and storage, combined with margin expansion, positions it for significant growth in a $300B market by 2030.

- Near-term catalysts include Blackwell AI server production ramp-up and an enterprise PC refresh cycle, supported by strong financials and cash flow.

Erik Isakson

I first bought Dell Technologies Inc. (NYSE:DELL) at $90 back in August 2024. The stock looked cheap, and I was convinced that the boom in AI and data centers would drive serious growth in their infrastructure business. I started small, putting about 3% of my portfolio into the stock — enough to matter, but not enough to keep me up at night if I was wrong.

My timing wasn’t perfect. After Dell’s Q2 results, I saw mixed signals. Their infrastructure business was growing nicely thanks to strong cloud and AI demand, but their Client Solutions Group was struggling. So, I decided to be patient and wait for a better opportunity.

That opportunity arrived with Dell’s Q3 earnings. The stock dropped 12% after hours despite beating earnings estimates ($2.15 vs. $2.06 expected). Yes, they missed slightly on revenue, but in my view, the selloff is a huge overreaction.

Here’s what really excites me: Dell’s infrastructure segment grew 34% YoY. They’re executing extremely well in the fastest growing parts of the market. Their storage business looks particularly promising as AI drives massive demand for data infrastructure. We’re talking about a market expected to hit $300 billion by 2030 — and Dell is the clear leader.

I’m using this pullback to add to my position. So allow me to explain why I think Dell could hit $140, offering meaningful upside for investors willing to ignore the short-term noise and focus on the bigger picture.

Q3 Results: Looking Beyond the Headlines

Let me break down what I’m seeing in Dell’s Q3 results because I think the market’s reaction is missing the bigger picture. Yes, they missed revenue estimates by a bit ($24.37B vs. $24.59B expected) but I’m actually more impressed by what’s happening under the hood.

The headline numbers tell part of the story — revenue up 10% and earnings beating expectations at $2.15 per share. But what really catches my eye is their Infrastructure Solutions Group (ISG). This division absolutely crushed it with 34% YoY growth, hitting $11.4B in revenue. Their server business, in particular, jumped 58% YoY to $7.4B. That’s not just good — that’s exceptional growth for a hardware business.

This performance was driven by robust demand for both AI optimized and traditional servers. The storage business also showed signs of improvement, growing 4% to $4 billion, with PowerStore and PowerFlex solutions experiencing double-digit demand growth.

Operating income rose 12% to $2.2 billion, with operating margins expanding to 9% of revenue compared to 8.8% in the prior year. This margin improvement is particularly noteworthy given the significant mix shift toward AI servers, which typically carry lower initial margins. ISG operating margins showed even more impressive gains, improving 230 basis points sequentially to 13.3%, demonstrating Dell’s ability to capture value in high-growth segments.

The revenue shortfall was primarily attributed to two factors that I view as temporary. First, consumer PC sales declined 18% YoY, a broader market weakness in this segment. However, commercial PC revenue actually grew 3% to $10.1 billion, which shows that the enterprise demand remains healthy. The commercial segment represents over 83% of Client Solutions Group revenue, making the consumer weakness less impactful to overall results.

Second, the company experienced a strategic shift in AI server demand toward next-generation Blackwell architecture. Dell’s management noted that orders shifted dramatically toward Nvidia’s (NVDA) Blackwell-based systems during Q3, which affected near term shipments as these products ramp up production. This resulted in AI server revenue of $2.9 billion for the quarter, slightly below expectations but leading to a robust backlog of $4.5 billion.

Looking beyond these temporary headwinds, Dell’s competitive position continues to strengthen. The company’s AI server pipeline grew more than 50% sequentially, with broad-based growth across all customer types. These trends, combined with improving storage performance and an anticipated PC refresh cycle, create multiple vectors for future growth not fully reflected in current quarterly numbers.

AI Infrastructure Demand And Market Leadership in Critical Segments

The recent shift in orders toward next-generation Blackwell architecture further validates Dell’s competitive position, as customers are willing to wait for their latest technology solutions. The numbers tell a compelling story: they booked $3.6B in AI server orders this quarter, up 11% from last quarter. But what’s even more interesting is how broadly this growth is happening. They’ve signed up over 2,000 enterprise customers for their AI solutions, showing this isn’t just about selling to big tech companies anymore.

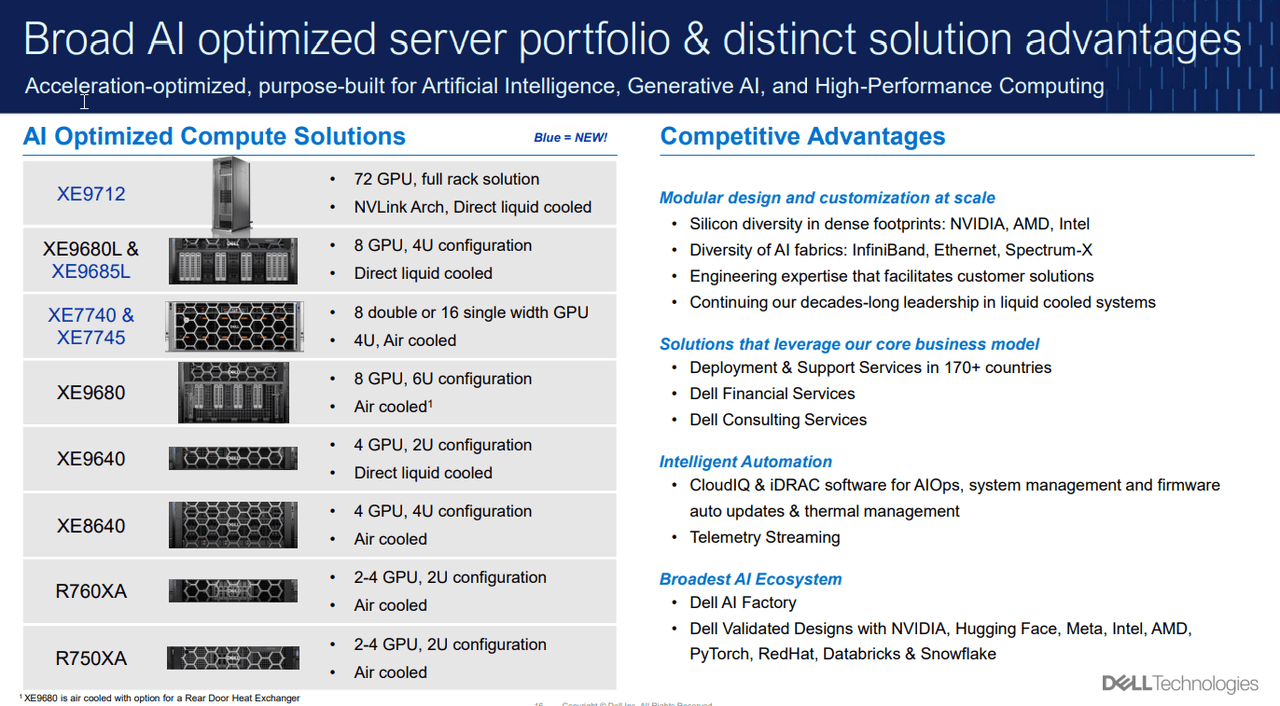

The company has recently launched several groundbreaking products including the PowerEdge XE9712 with direct liquid cooling capable of supporting up to 72 GPUs per rack. Their new 21-inch ORv3 Integrated Rack 7000 design supports up to 480 kilowatts per rack, demonstrating Dell’s engineering leadership in high density compute solutions. The IR5000 series offers up to 96 GPUs per rack in a traditional 19-inch design, providing flexibility for different customer requirements.

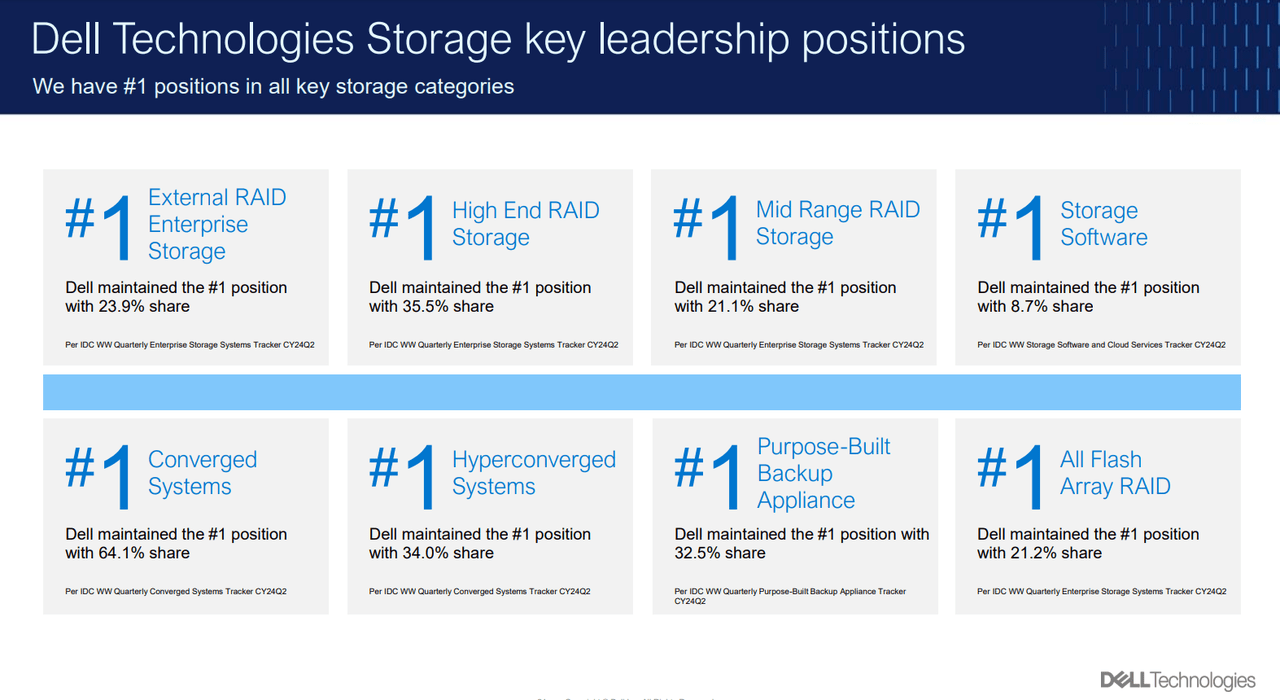

Dell’s market leadership extends across critical infrastructure segments, with dominant positions that provide a strong foundation for future growth. The company maintains a 23.9% share in external enterprise storage, significantly ahead of competitors. Their 35.5% share in mid-range RAID storage and 21.1% share in high-end RAID storage shows their ability to serve diverse customer needs across the storage spectrum. In hyperconverged systems, Dell leads with a 34.0% share, while their 14.6% revenue share in x86 servers positions them as the top provider in mainstream computing infrastructure.

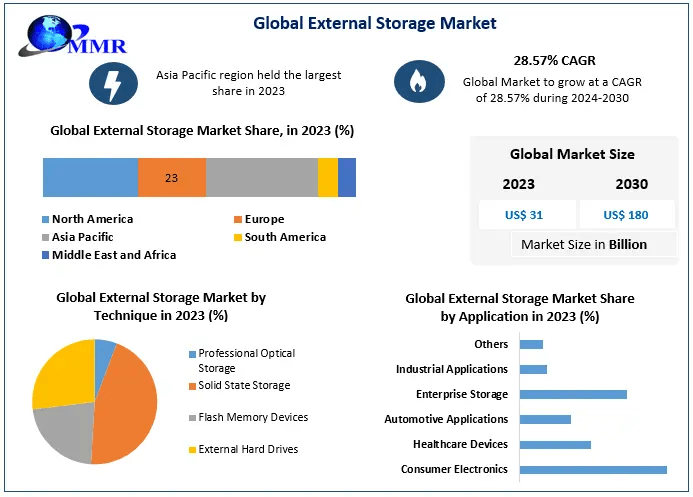

MMR

The enterprise storage market is currently valued at approximately $31 billion and projected to grow at an impressive 28.6% CAGR, potentially reaching $180 billion by 2030. The hyperconverged infrastructure market shows similar promise, with a 23.5% CAGR expected to drive the market to $205.8 billion by 2037.

The total addressable market for these combined segments is expected to exceed $300 billion by 2030, providing Dell with a substantial runway for growth. This market expansion is being driven by several secular trends, including the proliferation of AI workloads, increased data generation and storage needs and the ongoing modernization of enterprise IT infrastructure. Dell’s comprehensive product portfolio and strong customer relationships position them to capture a significant share of this growing market.

Margin Expansion Story

In Q3 FY25, the Infrastructure Solutions Group (ISG) demonstrated remarkable margin improvement, with operating margins expanding 230 basis points sequentially to reach 13.3%. This improvement is particularly significant as it represents a 530 basis point recovery since Q1, showcasing Dell’s ability to execute on its margin expansion initiatives even while scaling its AI infrastructure business.

The margin expansion story is multifaceted, driven by numerous structural improvements in Dell’s business model. First, the company’s AI infrastructure solutions, while initially margin rate dilutive, are proving to be significantly margin dollar accretive. Management noted during the earnings call that traditional server demand improved double-digits in Q3, marking the fourth consecutive quarter of YoY growth. These servers are being configured with denser core counts, more memory and increased storage per unit, driving higher average selling prices and improved profitability.

The company’s success in attaching additional products and services to its AI server sales is creating a powerful margin multiplier effect. Beyond the core compute infrastructure, Dell is capturing revenue from power management and distribution systems, cooling solutions, network switches, storage, deployment services, maintenance contracts and financial services. This comprehensive solution approach allows Dell to capture a larger share of wallets while delivering higher value solutions to customers.

Near-Term Catalysts

Looking ahead, I see several powerful catalysts that could drive both revenue growth and continued margin expansion. The most immediate catalyst is the ramp up of Blackwell-based AI server production. Dell noted a significant shift in Q3 orders toward these next-generation systems, building a robust backlog that should begin converting to revenue as production scales. The company is already shipping the industry’s first enterprise-ready GB200 NVL72 server racks.

A major catalyst looming on the horizon is the enterprise PC refresh cycle. With Windows 10 reaching end-of-life in 46 weeks, organizations will need to upgrade their systems. Dell’s management noted that customers are already aligning their upgrade cycles with new AI PCs expected in the first half of next year. This timing could create a powerful replacement cycle as enterprises seek to future-proof their purchases with AI capable systems.

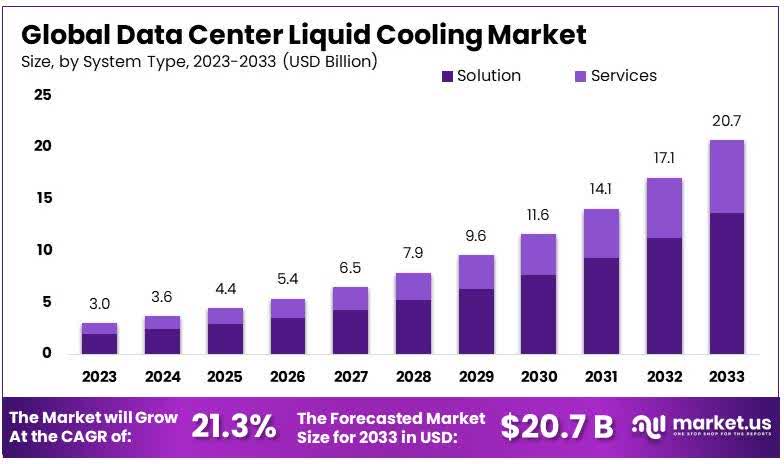

Market.US

These catalysts are underpinned by broader market trends, including the projected growth of the data center liquid cooling market at a 21.3% CAGR through 2033 and the expansion of the global cloud infrastructure market to $837.97 billion by 2034. Dell’s strong market positions and comprehensive solution portfolio position it well to capture a significant share of this growth while maintaining its margin expansion trajectory.

$140 Price Target

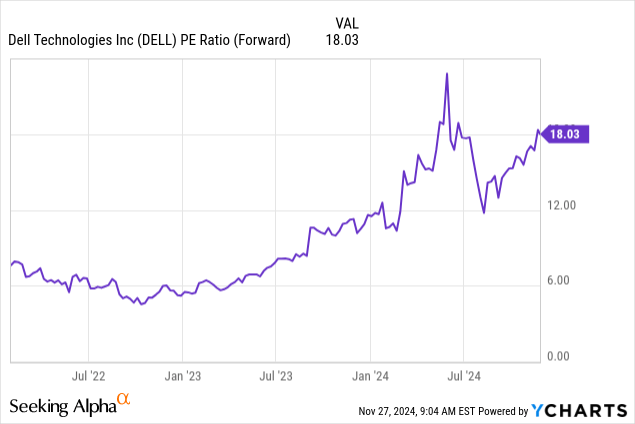

The valuation case for Dell is particularly compelling when considering the company’s growth trajectory and market leadership position. Currently trading at approximately 18x forward earnings, Dell presents an attractive entry point that I believe significantly undervalues the company’s potential, especially given its growing exposure to high-growth AI infrastructure markets.

My $140 price target is derived from multiple valuation approaches, with the primary framework based on a 20x multiple applied to FY26 earnings per share estimate of $9.41. This target multiple represents a modest premium to Dell’s current forward P/E of 18x, but remains well below the broader technology sector’s median P/E of 25.49x. I believe this multiple expansion is justified given Dell’s improving growth profile and margin trajectory. The company’s Q3 results demonstrated strong execution, with non-GAAP EPS growing 14% YoY to $2.15, outpacing revenue growth of 10%.

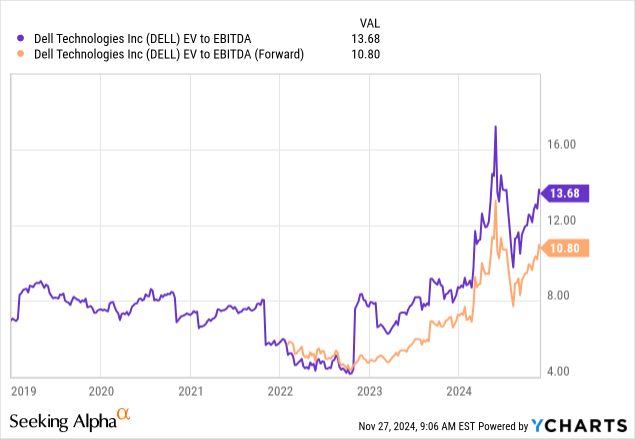

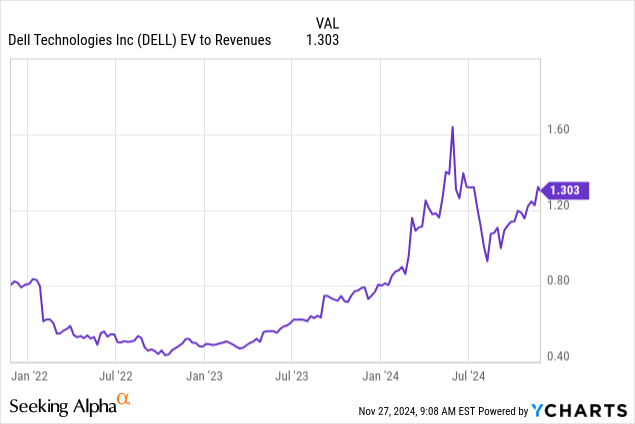

Dell’s enterprise value metrics also suggest room for multiple expansion. The company’s EV/EBITDA ratio of 10.8x forward and 13.68x trailing remains well below the sector median of 15.43x and 19.64x respectively. This discount appears unwarranted given Dell’s market leadership and growth potential. The company’s EV/Sales ratio of 1.31x is similarly discounted compared to the sector median of 3.37x, providing additional upside potential as Dell continues to improve its margin profile.

The company’s financial strength further supports the valuation case. Dell generated $1.6 billion in operating cash flow during Q3 and maintains $6.6 billion in cash and investments. The core leverage ratio of 1.4x provides financial flexibility while maintaining investment grade ratings.

Looking at growth metrics, Dell’s forward PEG ratio of 1.49 suggests the stock is undervalued relative to its growth potential, especially considering the projected expansion of its key markets. The data center liquid cooling market is expected to grow at a 21.3% CAGR through 2033, while the broader cloud infrastructure market is projected to reach $837.97 billion by 2034, providing a substantial runway for Dell’s continued expansion.

What Could Go Wrong

The most immediate concern centers on supply chain dynamics, particularly regarding AI component availability. Dell’s Q3 results highlighted this challenge as the company’s AI server revenue of $2.9 billion was constrained by component supply, despite robust demand evidenced by their $4.5 billion backlog. The company’s inventory levels have already increased to $6.7 billion, which are elevated compared to historical levels due to AI server business and order linearity.

Macroeconomic conditions present another significant risk factor. Dell’s Q3 results showed some signs of cautious enterprise spending, with storage demand continuing to lag traditional servers. Management noted during the earnings call that “enterprise and large customers are being more mindful of their PC and Storage IT spend in the short-term.” This conservative spending environment could impact Dell’s growth trajectory, particularly in their storage business, which grew only 4% YoY to $4 billion in Q3, despite new product launches and AI-driven demand tailwinds.

The persistent weakness in Dell’s consumer PC segment remains a concern, though I view it as a manageable risk given the company’s broader portfolio. Consumer revenue declined 18% YoY to $2 billion in Q3, with both demand and profitability remaining challenged. While consumer PCs represent only about 8% of total revenue, continued weakness in this segment could offset some growth momentum from AI infrastructure and enterprise solutions.

That said, I’m not losing sleep over these risks. Dell has $6.6B in cash and generated another $1.6B in operating cash flow last quarter. Their leverage is conservative at 1.4x. Most importantly, they’ve got multiple growth drivers lined up for 2026 — continued AI momentum, an aging PC base that needs refreshing and their storage business poised for acceleration.

To Sum Up,

In my view, the recent Dell Technologies Inc. stock pullback presents an exceptional entry point for long-term investors. Dell’s dominant market position, accelerating AI momentum and margin expansion potential create a compelling risk-reward profile. That is why I’m initiating a Strong Buy rating with a $140 price target.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.