Summary:

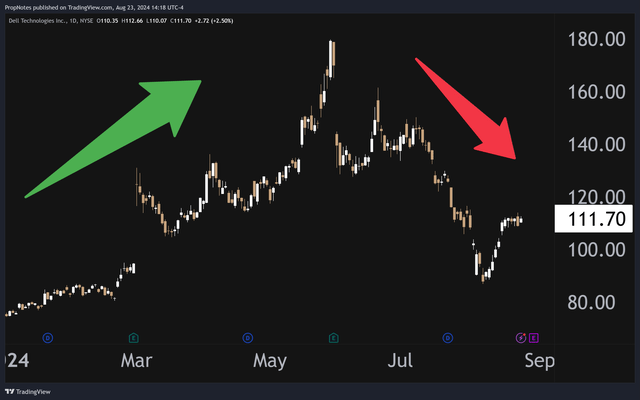

- Dell Technologies has had a volatile year, with a 140% rally followed by a 50% selloff in the stock. Where do things stand now?

- The AI server opportunity appears robust, but shares still appear a tad hot, and we’d like to own it from lower.

- We propose selling $90 strike put options. This would maximize returns while affording us the opportunity to buy it at a better entry point.

- Selling this put option could yield ~15.5% annualized (3.4% over the next 81 days).

- We rate DELL a ‘Hold’.

J Studios

Dell Technologies (NYSE:DELL) has had one hell of a year.

From the start of 2024 through mid-May, DELL’s stock skyrocketed roughly 140% from the mid $70’s to just shy of $180 per share, in one of the most epic runs of the year:

Since then, however, the stock has been cut in half from peak to trough, as investors have dumped the once-hot name.

What happened?

In short, speculation over AI’s impact on Dell’s business briefly sent shares roaring higher at a fever pitch, but Q1 earnings put a stop to that. Following the report, sentiment has cooled, and over the last four months we’ve been dealing with the hangover.

Looking ahead, DELL is set to report earnings again on Thursday, August 29th, and the market is bracing for more volatility.

While the results of that earnings report are anyone’s guess, we think there’s an easy-to-implement option trade that could optimize risk/reward in DELL for sharp traders, whether the stock goes up, down, or sideways over the next couple months.

Today, we’ll be diving into the company, explaining our view on the company’s trajectory and valuation, and positing a trade idea that could turn this high-flying AI stock into a tidy payday for investors.

Sound good?

Let’s dive in.

Dell’s Financials

DELL’s stock has been on a wild ride; how have the underlying financials fared?

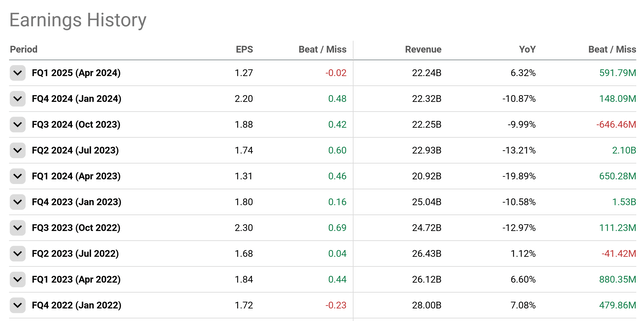

Over the last few quarters, DELL has performed well on the earnings front, although top line growth has been elusive since mid-2022:

In Q1, DELL missed on EPS, which is somewhat uncharacteristic for the company, but they did manage to beat on sales by nearly half a billion, which was a pleasant surprise.

YoY revenue growth also finally re-accelerated on the positive side, which is a good sign. Since mid-2022, the company has been dealing with slipping sales numbers in its top product and service categories, partially driven by a slowdown in client spending levels. Weak consumer results (laptops and consumer electronics) have also contributed to the drop.

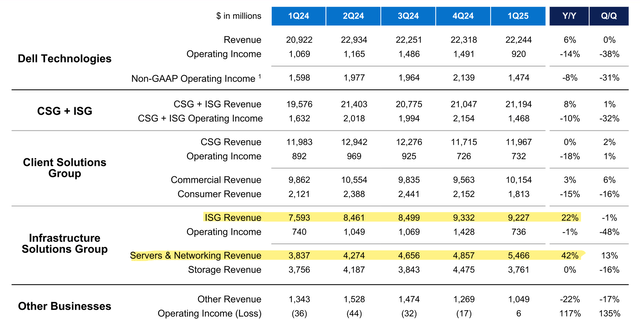

This recent rebound has largely been driven by AI demand for servers, which you can see in the financial results below:

Given that the company’s main growth engine now appears to be the server category, it has, to some degree, become the company’s ‘main’ narrative.

Many have drawn parallels to SMCI, which has done incredibly well this year on the whole (despite a recent drawdown), but we’re not quite convinced it’s at that level.

Sure, DELL does have the size and capability to execute on this opportunity, but it also has a more complex operating plan and less bottom-line exposure to the trend, which means that we see less overall upside in the stock.

Right now, only a quarter of the company’s net income, roughly, is generated from server revenue at all.

SMCI, conversely, is a much purer play.

That said, DELL has a solid balance sheet, ample cash, minimal debt, strong industry relationships, and other advantages that make us think that it will be able to capitalize over the long term on this opportunity.

For Q2, we’re expecting a few things. Mainly, we’re going to be looking at server growth numbers, but we also want to see how much of a lift this server revenue growth is going to provide for the company as a whole.

If YoY sales numbers are negative, then that’s a huge red flag.

If server & networking revenue comes in above $6 billion, then we’d see that as highly bullish.

We’ll also be keen to hear what management has to say about consumer devices. It’s only a $1.8 billion / quarter business, but a rebound here would staunch a good portion of the sales headwinds, and the stock might pop if there’s exciting news here.

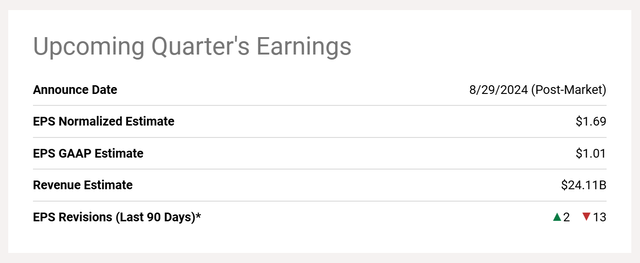

Analysts have been revising EPS expectations lower as of late, but we’re not as dour on the company:

We see EPS coming in at around $1.80, but we wouldn’t consider it a miss unless it came in under $1.70, around where analysts have the quarter pegged.

Our bullishness stems from DELL’s current position where they have a lot of room to build on AI server momentum in the short and medium term.

Net of everything we’ve talked about so far, we’d call DELL a high-quality beneficiary of the advancing tech landscape.

We expect growth will return, and, pending a laptop refresh with new chips & AI capabilities, revenues in all four segments should head up and to the right over the medium term.

Dell’s Valuation

So – DELL is a relatively high-quality stock.

But what is the company worth?

Right now, DELL is trading at roughly 19x GAAP P/E. Given DELL is expected to rake in more than $4 billion in net income over the next twelve months, DELL’s resulting market cap stands around ~$77 billion.

To us, this seems a bit expensive.

Sure, the company’s growth should tick up strongly on the back of AI server demand, but as a low gross-margin company, DELL needs to sell a LOT of servers to really boost profits.

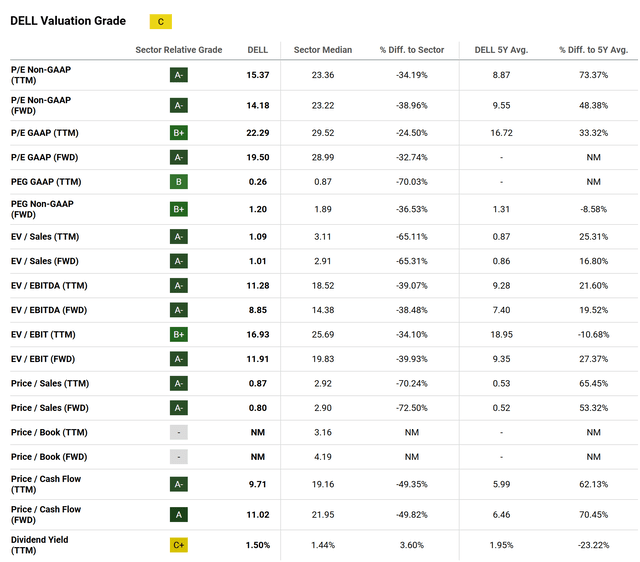

Seeking Alpha marks DELL as a ‘C’ on the valuation front, which, we think, is a tad generous:

Sure, the multiples are lower than peers in the tech industry, but the company is on the lower margin side of things and doesn’t have a lot of room to charge higher prices, given the competition with SMCI and others.

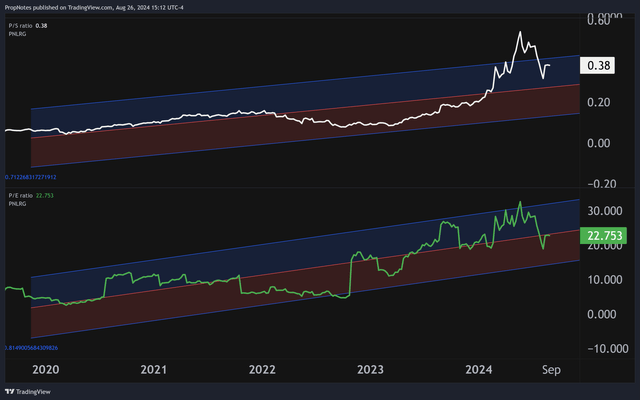

If you look at DELL’s historical multiples, you can see that there’s downside to the mean on the sales front, but there’s some upside on the P/E front, especially considering that each of these metrics are slated to grow over the coming year:

Add this up, and we’d estimate that DELL’s Fair Value at the present moment is probably around $95 – $100, which should grow over the next year to around $115-$120.

While there is upside here over the next year, we’d argue that the stock is perhaps a little out over its skis in the short term.

The Trade

So – DELL is a quality stock but the shares, in our view, aren’t exactly a ‘deal’ right now. What’s the best way to play it?

We’re fans of selling put options in a scenario like this.

When you sell a put option, you’re agreeing to buy a stock if it drops in price. In return, you get an up-front payment.

If the stock goes up or sideways, you get to keep the payment. If the stock goes down and beneath the agreed upon price, then you need to buy the stock, but you still get to keep your payment.

So, the net/net of selling a put option is that you get paid, and you might need to buy the stock if it drops. Not a bad proposition, huh?

In our view, we’d like to own DELL, but at a more attractive price.

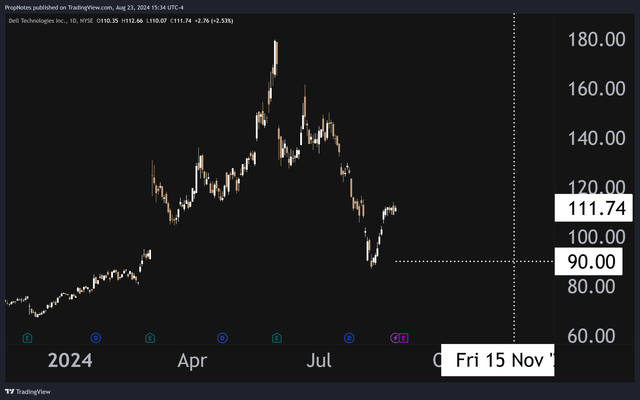

Thus, selling the November 15th, $90 strike put options for $3.00 per contract appears optimal:

Strike & Expiration (TradingView)

$3.00 represents roughly a 3.44% return over the next 81 days, which annualizes to a 15.5% annualized return on capital invested.

In this case, we picked $90 because it seemed like the best balance of return and risk on a trade like this. A ~20% discount to the current price should protect an investor against a lot of volatility, but the return is still in the mid-teens range, which is compelling.

Also, it’s below our Fair Value estimate of $95 – $100, so the trade includes some fundamental margin of error baked in.

Thus:

- If DELL stays above $90 by expiry, then the cash return is kept in your account free and clear.

- If DELL drops below $90 by expiry, then you’d need to purchase 100 shares at $90, per contract. Depending on the price, this could put you at an unrealized loss immediately. However, you’d still get to keep the return laid out above in cash to your account, while keeping the shares as a position for the longer term.

For a chance to either keep the money or keep the money and get to buy a 20% dip in the stock, it seems like a strong win-win proposition to us.

Risks

We’re fans of selling puts on DELL at the present moment, but there are some risks to consider:

- Earnings are coming up, and a negative result could send the shares violently lower. This put option provides a 20% price buffer for investors, so it’s de-risked vs. holding the stock, but there are still earnings risk to be aware of here.

- We don’t see the multiple compressing much over the next 3 months given the AI valuation premium, but the stock could draw down as a result of the technical strength up to this point. We’ve seen some argue that it’s now oversold, but on a weekly timeframe or higher it’s still a technically hot stock.

- The company, as always, has execution issues to contend with. If they can’t execute their strategy, then shareholders will get hurt. We’re fans of how this AI server opportunity has been capitalized on so far, but negative news here could prove materially negative for the stock.

Summary

All in all, there are some risks to bidding for DELL stock at this point in time, but we ultimately think that selling puts and taking advantage of recent volatility is the best risk/reward way to play the name before earnings.

Shares may not be the most attractive at their current price, but selling far OTM put options with a 20% price buffer could be a great opportunity to make money while getting a chance to buy this one lower.

Consequently, we’re rating DELL a ‘Hold’ for the time being. Good luck to all!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DELL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.